Welcome to Sports Cards Insider – Free version

Today we have a deep dive into two baseball cards:

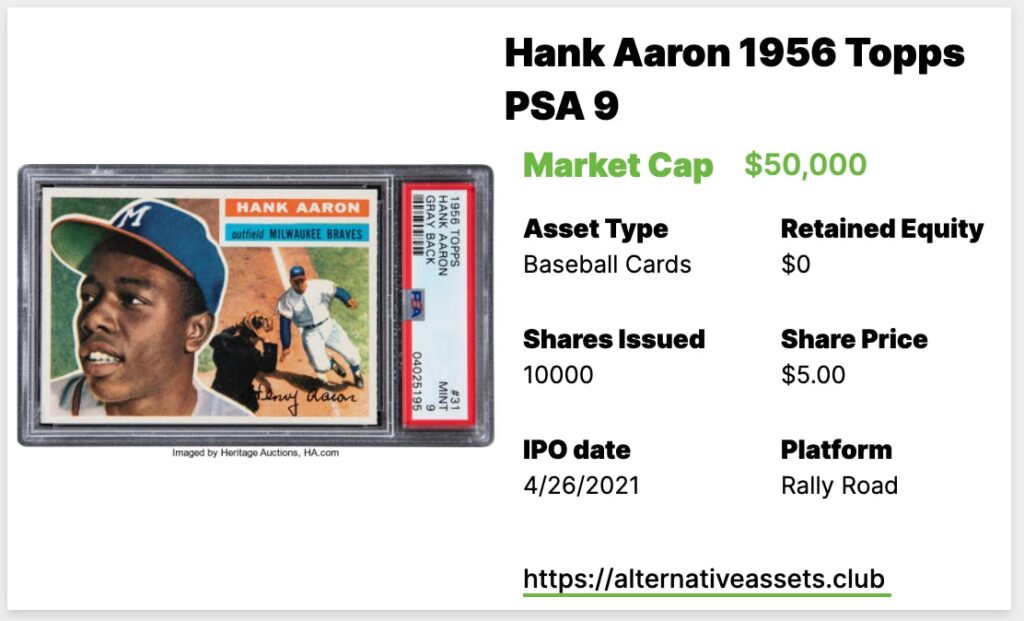

- Hank Aaron 1956 Topps PSA 9 – IPOs Monday 26th April on Rally at noon EST.

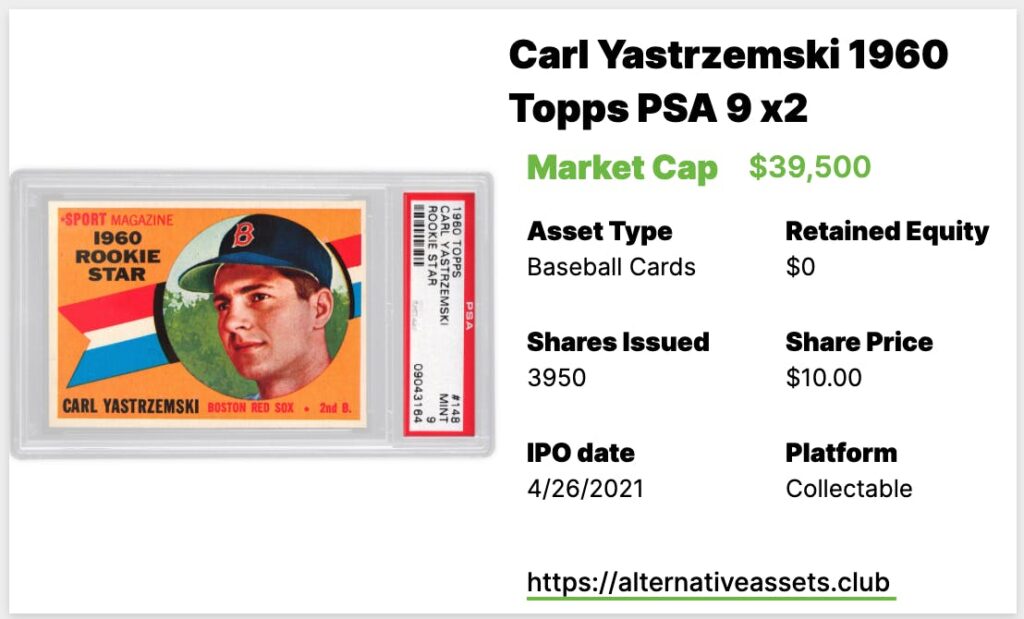

- Carl Yastrzemski 1960 Topps PSA 9 x2 – IPOs Monday 26th April on Collectable at 8pm EST.

Table of Contents

What is the Hank Aaron 1956 Topps PSA 9?

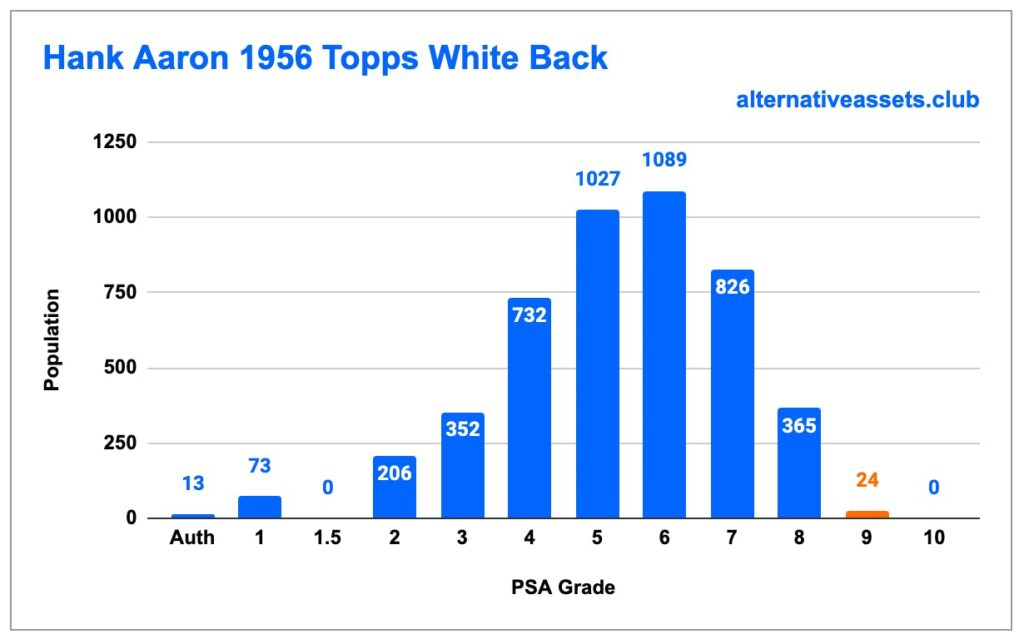

This is a PSA 9 graded Hank Aaron card from 1956. There are two versions of this card – the grey back and white back. This is the more plentiful white back version. Graded PSA 9, there are no known higher versions of this card, though there are a few PSA 9s in the gray back version.

1956 was Aaron’s prime, when he won the first of two batting titles and was named the Sporting News NL player of the year.

It IPOs for $50k on Rally at noon EST 26th April 2021 with no retained equity.

Add IPO to calendar

Cultural Relevance

We’ve covered Hammerin’ Hank before. Have a read if you’d like. Points – 6/10

Inferred Value

Looking through historic sales, the Grey back version tends to command around a 30% premium to the White back counterpart — this makes sense given the relative populations. So it’s important to exclude those from comps. The most recent sale of a PSA 9 White back was 28th February 2021 for $40,800. That was Rally’s purchase of this card. Since then, his 1956 cards have appreciated around 7% on average. Adjusting for the Fractional Premium, that gives us an inferred value today of

$40,800 x .9 x 1.07 = $39,290.

If we use the growth rate of his base 1954 rookie card, inferred valuation of this comp is $36,720.

Prior to that, Goldin sold one for $14,760 on 24th August 2020, and there were a few other sales in 2018 and 2019 around the $10k mark. Since August 2020, his 1956 cards have appreciated around 90%, which puts inferred value today around $28,044.

Again, using his base rookie card, inferred value is $23,763.

Finally, double checking against those sales from 2018 and 2019, his base rookie has appreciated 175% since then, which puts inferred value at around $28k.

So our four data points:

- $39k

- $37k

- $28k

- $24k

- $28k

The Rally purchase seems like an outlier, but we’ll give them the benefit of the doubt and average all five scores – $31k.

Inferred Value ~$31k.

Points 1/10

Category Strength

The Sports Cards category had a 60% ROI in Q1 2021.

Points 10/10

Subcategory Strength

The Baseball Cards subcategory had a 40% ROI in Q1 2021.

Points 9/10

Risk Profile

The Baseball Cards subcategory had a 111% standard deviation in Q1 2021. Lower is better.

Points 1/10

Asset Growth TTM

This card has appreciated around 100% in the last year.

Points 10/10

Growth Outlook and Future Catalysts

Aaron’s rookie card has dipped off its highs, but his other cards are holding up better in the last few months. Generally speaking, though, his rookie (1954) is likely to hold value better, even if it’s more volatile.

Points 7/10

Asset Liquidity

This will have a roughly 90 day lockup period then will trade quarterly.

Points 5/10

Platform Risk

Rally is mostly transparent.

Points 8/10

Intangibles

This is a nice looking card from a really nice set. Other than that, not much to note.

Points 7/10

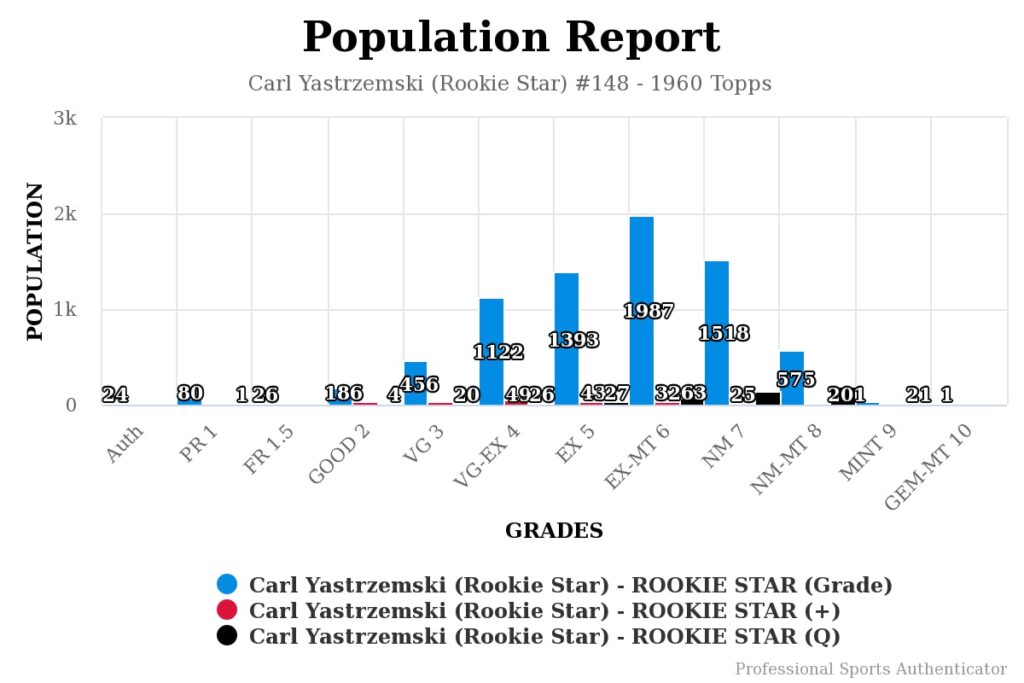

What is the Carl Yastrzemski basket?

This is a pair of 1960 Carl Yastrzemski rookie cards each graded PSA 9.

The 1960 set was colourful and contains two key cards: Yastrzemski and Willie McCovey.

It IPOs for $39,500 on Collectable at 8pm EST 26th April 2021 with no retained equity.

Add IPO to calendar

Cultural Relevance

Most known for his famously challenging surname, Yastrzemski spent his whole career with the Red Sox, winning the Triple Crown in 1967.

He won the MVP that year and featured in the All-Star game 18 times. He was also an excellent fielder, winning the Gold Glove seven times.

He and Johnny Bench were elected to the Hall of Fame in 1989, each on their first try. Yastrzemski received 94.6% of the vote.

His cultural relevance is undoubtedly hurt by a lack of rings (23 years with the Red Sox will do that) despite a long and impressive career. Oddly, I think he’s also a bit overshadowed by his name — he’s almost known more for that than his very impressive career.

A couple interesting notes from his career:

- No one spent more time with one team (23 years)

- He’s second all time in games played (3,308) and first with one team.

- He’s one of the few Hall of Famers to directly succeed another HOF’er at his position (Ted Williams)

- In 1999, he was ranked 72nd on the Sporting News list of the 100 Greatest Baseball Players.

Yaz was a great baseball player in his day, but ultimately his lack of rings and above average but not amazing stats hurt him. Maybe his name a bit too. Points – 1/10

Inferred Value

This one seems pretty straightforward – there have been two recent sales at $34k and $35k. We’ll use the latter as our comp and say inferred value is $70k.

This one feels ripe for a quick Collectable buyout.

Inferred Value $70k.

Points 9/10

Category Strength

The Sports Cards category had a 60% ROI in Q1 2021.

Points 10/10

Subcategory Strength

The Baseball Cards subcategory had a 40% ROI in Q1 2021.

Points 9/10

Risk Profile

The Baseball Cards subcategory had a 111% standard deviation in Q1 2021. Lower is better.

Points 1/10

Asset Growth TTM

This card has appreciated around 150% in the last year.

Points 10/10

Growth Outlook and Future Catalysts

Yaz won’t be doing much in the near future, and his card has already seen a decent jump. There may be more room to run if investors start putting more value on slightly lesser known HOF’ers. That said, his cards already trade at a premium to other comparable players like Willie McCovey and Johnny Bench.

Points 5/10

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Points 8/10

Platform Risk

Collectable is moderately transparent.

Points 7/10

Intangibles

Once while running the basepaths, Yastrzemski found a new way to induce a throwing error. Thrown out at second base, he continued rounding the bases while the other team made a protracted attempt at tagging out another runner in a rundown.

During the rundown, the fielders, confused, saw a Red Sox player (Yaz) rounding third and heading for home. A panicked throw to the catcher far missed the mark, which allowed the runner behind him to advance.

Points 7/10

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and runs Flippa’s Due Diligence program, and can offer the same service to you.