Hello and welcome to Alts Cafe

This is your weekly quick-fire analysis on all thing Alts investing. We delayed sending til today due to the holiday in the US yesterday.

TLDR:

- The poor are getting poorer

- Commercial real estate continues to implode

- AI companies are smashing it

Like these posts? Please give us a shout on your socials, we’d appreciate it.

Wyatt

Table of Contents

Macro View

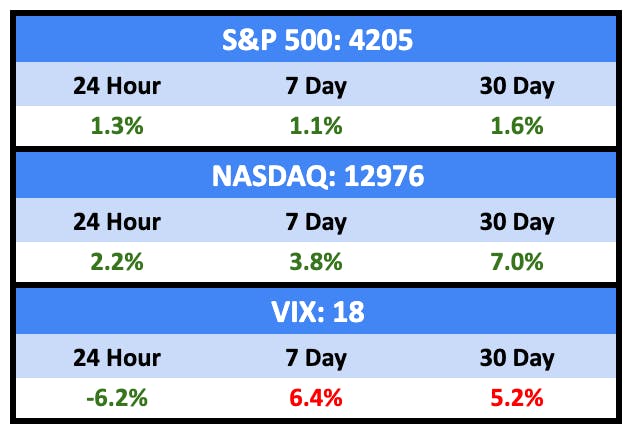

Everyone was playing wait and see last week.

Bullish News

- It looks like the White House and Congress have made a deal to lift the debt ceiling.

- US economic activity rose in May to the highest pace in 13 months.

Bearish News

- A record share of Americans — 35% — say they’re worse off financially than they were a year earlier.

- Auto loan delinquencies are approaching 2008 levels in the US.

- The American Fed hasn’t got a clue what it’s going to do about rate hikes.

- For the first time ever, the number of Americans who say they could cover a $400 emergency has fallen year over year.

- Poorer American consumers have slowed down purchases of expensive gadgets and minor splurges, but the 1% continue to spend spend spend.

- Germany is in a recession. Scheisse.

What are we doing?

ALTS 1 fund news:

We’re looking into an investment in the Deathcare space 🪦 👀

Real Estate

Bullish News

- US housing starts increased in April.

- Nationwide, one and two bedroom rents were flat month over month in the US for April.

- Single American women are 70% more likely to purchase a home than single men.

- Bucking the trend, Nashville, Charlotte, Miami, and Dallas saw office space vacancies decrease in Q1.

- Betting against remote work, a rich guy is

lighting $1 billion on firespending $1 billion to redevelop San Francisco’s Transamerica Pyramid.

Bearish News

- There are more realtors in the US than there are single-family homes available for sale.

- Brookfield, which defaulted on a $787 million office building in February, missed payments of $275 million on another property in Los Angeles.

- Nationwide, office space vacancies climbed 50bps to 17.8% in Q1.

- Over 80% of maturing office loans will struggle to refinance.

- Remote work could wipe out 44% of office values in NYC.

- Mortgage applications last week were down 30% YoY.

- China’s got a $23 trillion real estate debt mess.

- Florida has banned Chinese citizens from buying land. The ACLU is suing.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

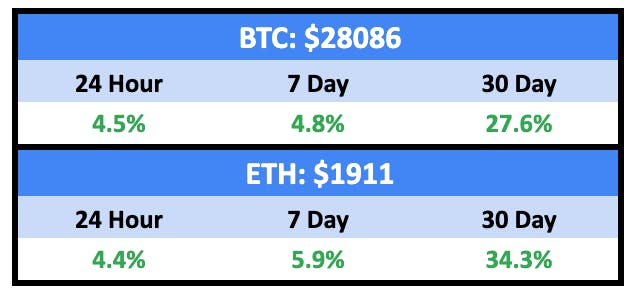

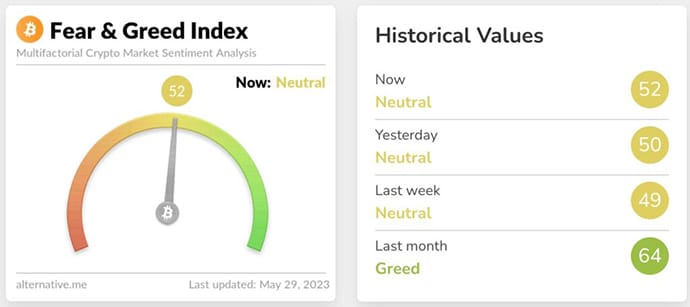

Pretty good week; markets climbed as news of a debt ceiling deal looked imminent.

Not much change here.

NFTs pumped this week.

Bullish News

- Michael Lewis, author of “Moneyball” and “The Big Short,” has nearly finished his book about SBF.

- The ECB says a digital euro may only be a few years away.

- Bitcoin payments app Strike is expanding from three countries to 65.

- Sort-of American Presidential candidate RFJ Jr will accept donations in Bitcoin.

- Do Kwon’s bail was revoked.

Bearish News

- Binance can’t stop doing shady stuff.

- According to America’s Commodity Futures Trading Commission, there is no way to police all cryptocurrency fraud because there is so much.

- Crypto was used to buy $38 million worth of fentanyl.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- OpenAI closed a $175m startup fund to invest in companies using its LLM model.

- There are now 13 generative AI unicorns.

- India’s Ola Electric, a scooter company, is aiming to IPO by the end of 2023.

- China is building a Starlink competitor.

- The Tesla Model Y was the world’s best-selling car in Q1.

Bearish News

- VCs are facing pressure to divest from China.

- Emerging managers are struggling to raise funds.

- Crypto venture capital firm Paradigm, one of the most established and active players in the space, has pivoted to AI. Cue the AI collapse.

- The EU fined Meta $1.3 billion for breaking a law that’s impossible to comply with.

- Peloton is trying to rebrand / pivot.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our very clever friends at sliceNote and Otherweb.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- We are investigating an opportunity in the Deathcare space, and will report as soon as there’s something to report.