Introducing the ALTS1 Fund

ALTS 1

We are a ground-breaking, first-of-its-kind alternative investment community.

With the ALTS 1 fund, you’ll stay one step ahead of the market and get exposure to exotic alternatives larger funds don’t provide.

Download the prospectus to read all about it.

This ain’t your grandpa’s fund.

ALTS 1 is designed to provide exposure to modern, eclectic alternatives.

Backed by our superior research and analysis

Since Feb 2021, we have analyzed 800+ deals across fractional platforms. We choose assets designed to diversify your portfolio and protect against inflation.

Uncorrelated to equity markets

An opportunity to invest in a broad basket of alternatives uncorrelated to public equities.

Available to US and international investors

This is a groundbreaking, actively-managed Reg D Fund for investors anywhere in the world. If you are located in the US, you must be accredited, and will be required to show proof.

What do we invest in?

Meticulously-chosen and refined, the ALTS 1 Fund is packed with unique alternative investments across 10 asset classes.

Fine Artwork

Historic returns average 14%

5%

Art has always been a strong store of wealth, and it’s historically outpaced most equity markets. Our blended approach, investing in both Masters and Contempories, generates alpha returns while providing portfolio stability.

Wine & Spirits

Historic returns average 30%

5%

Both wine and spirits made record returns over the last two years and whisky consumption will outpace vodka for the first time in 2022. We’re digging deep to find the next Karuizawa and unearth the most daring Bordeaux.

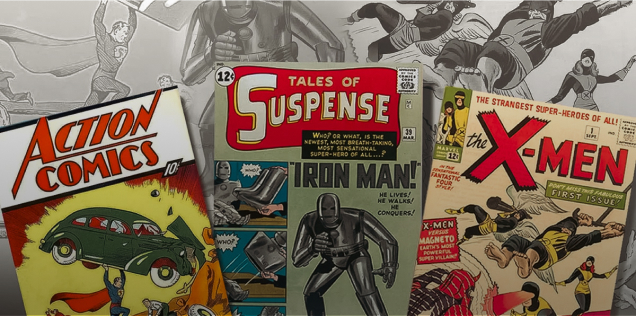

Collectibles & Culture

Historic returns average 24%

35%

Nostalgia is real. That’s why investors and collectors alike are flooding into these assets. From sports cards to vinyl, an entire generation wants to get involved. Our proprietary methodology ensures that we see trends develop before anyone else.

Crypto & NFT’s

Historic returns average 30%

5%

Both wine and spirits made record returns over the last two years and whisky consumption will outpace vodka for the first time in 2022. We’re digging deep to find the next Karuizawa and unearth the most daring Bordeaux.

Music Rights

Historic returns average 12%

5%

One of the most exciting and underrated alternative asset classes out there, music rights yield immediate and consistent cashflow. We work with industry experts to make the best, most portfolio-stabilising investments.

Specialty Real Estate

Historic returns average 8%

5%

There’s an entire world of real estate beyond multi-family homes and office buildings, and we’re here for it. We’ll take positions on assets such as holiday homes, farmland, and alternative dwelling units.

Sneakers

Historic returns average 60%

3%

Die-hard sneakerheads generate returns well above equity markets, and we’re working with the best. The ultimate diminishing asset, sneakers are only deadstock for so long.

Fund offering and strategy

Actively-managed, low fees

Actively managed funds are the best way to address the volatility, immaturity, and rapidly-changing nature of alternative assets.

Management fees start at just 1% and go down from there.

A data-driven approach

In fragmented markets, returns follow data and analysis. We have proprietary indices and strong analysts.

Our portfolio team takes a long-term approach, as the vast majority of returns accrue to the top 1% of assets.

A solid track record

Returns across this basket of asset classes historically beat benchmarks like the S&P 500.

Read our latest quarterly investor update.