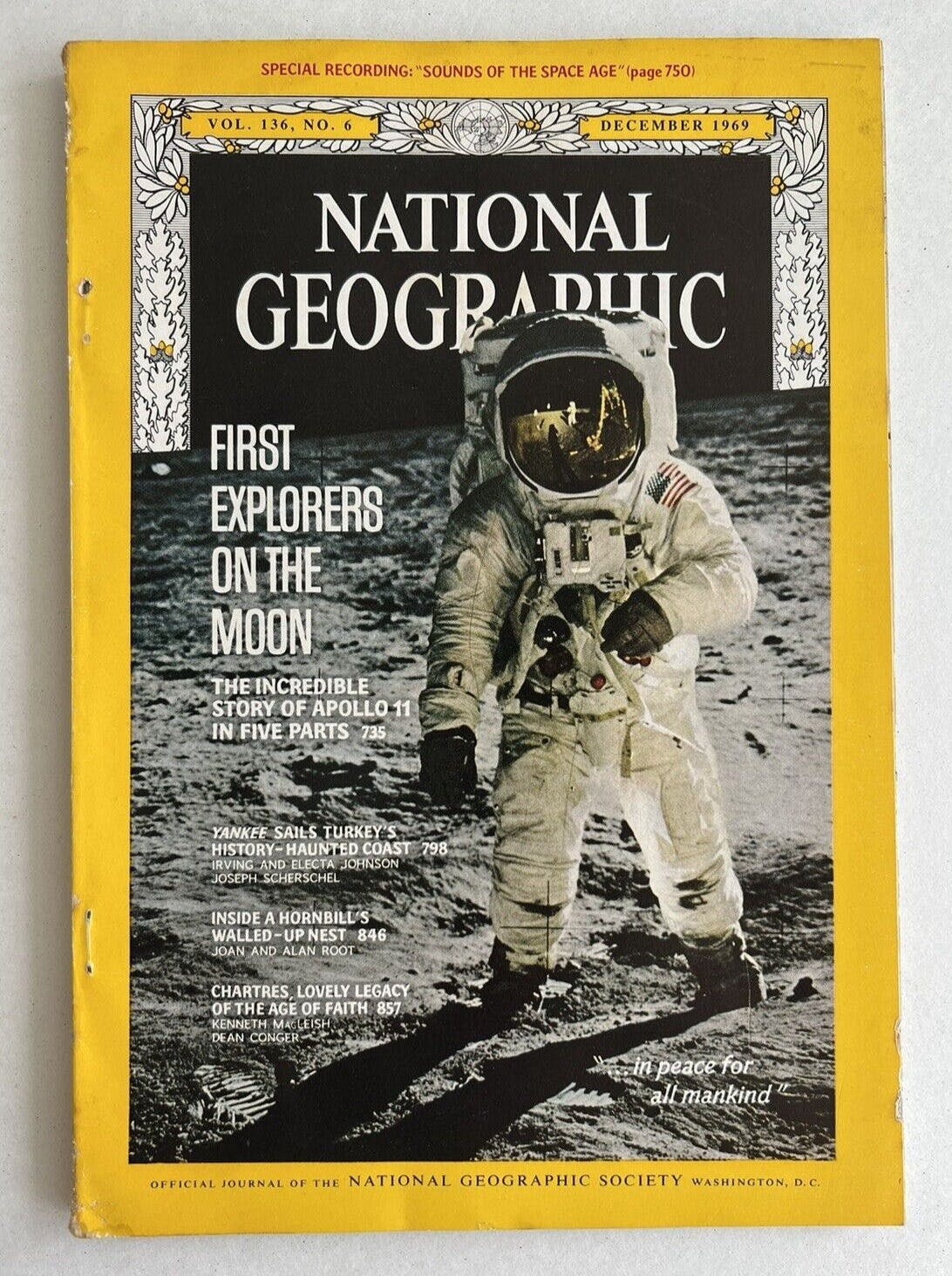

Vintage magazines

We explore the market for vintage magazines, as Stefan shares anecdotes from collecting old issues of National Geographic.

Investing in rare books can be a fascinating and potentially lucrative venture. Rare books possess a unique allure as they represent a convergence of literature, history, and art.

By acquiring books that are scarce, in high demand, or have historical significance, investors can benefit from their appreciation in value over time. Rarity, condition, authorship, and historical importance are key factors that influence the value of rare books.

Conducting thorough research, consulting with experts, and keeping a pulse on market trends are essential for making informed investment decisions.

Additionally, investing in rare books can provide intellectual satisfaction as one explores the depths of literary treasures while enjoying the potential financial rewards they offer.

We research and write about opportunities from time to time. Follow this asset if you’re interested. We’ll send occasional updates.

We explore the market for vintage magazines, as Stefan shares anecdotes from collecting old issues of National Geographic.

Still, no bottom in sight for rare books fractional markets. Today we look into rare books performances, what’s at auctions offers, and the two new assets dropping in the marketplaces.

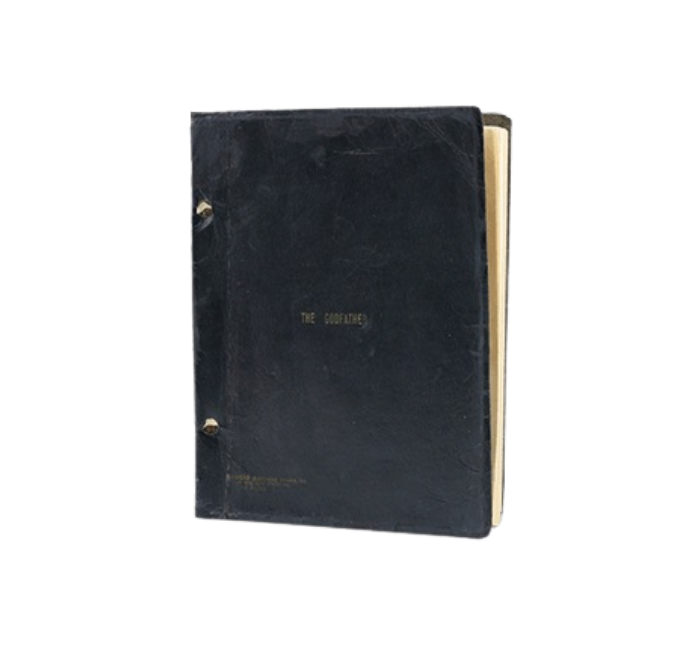

-’71 THE GODFATHER SCREENPLAY

-HELLEN KELLER 1892 BOOK (INSCRIBED TO FRANCES CLEVELAND)

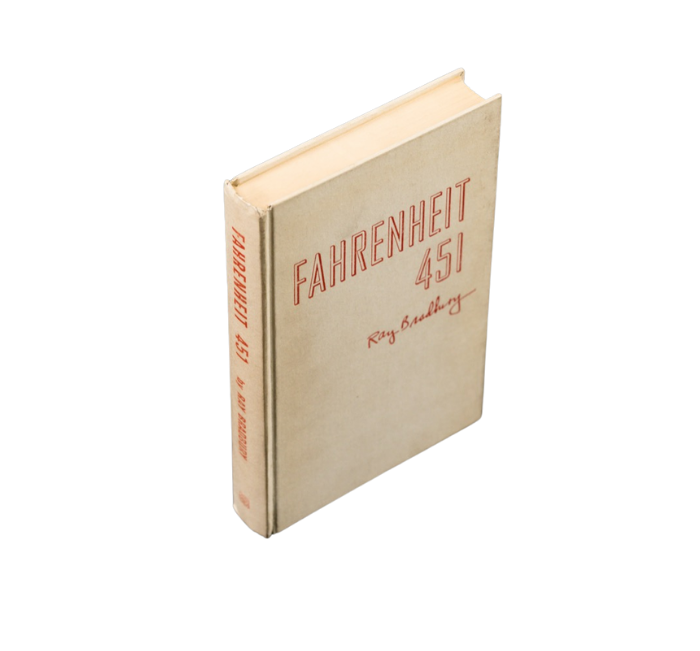

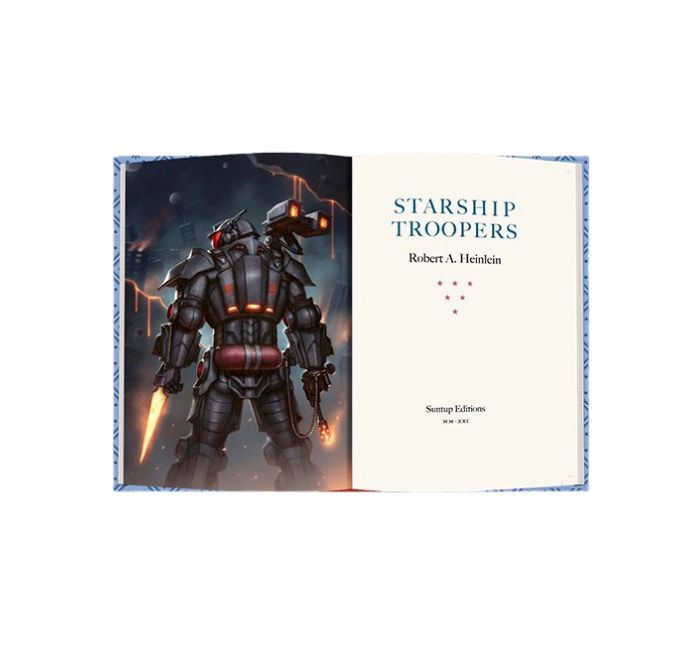

Time to go book shopping? Today we analyze rare books fractional markets, limited edition books, and what’s IPOing this week and next week.

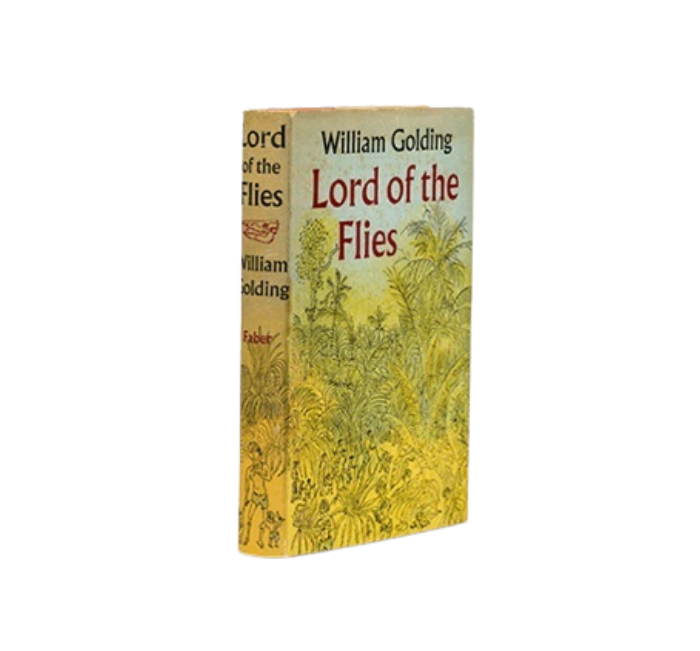

-William Golding’s Lord of the Flies

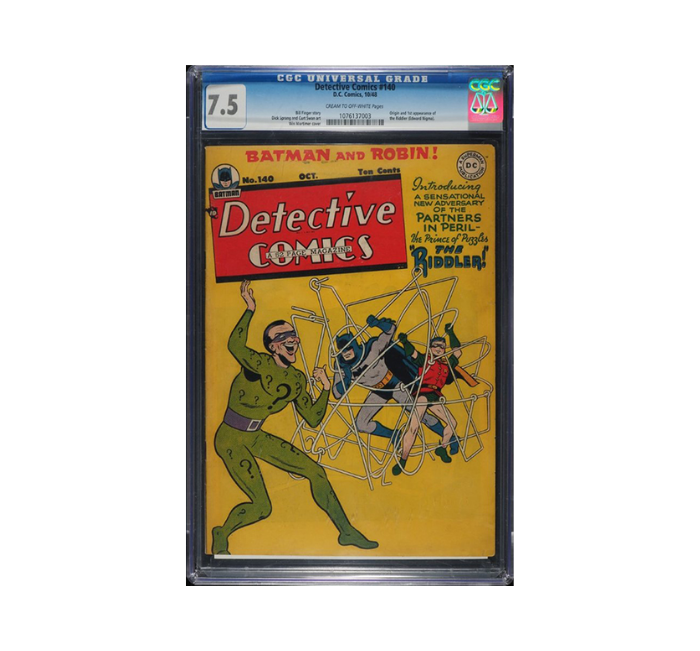

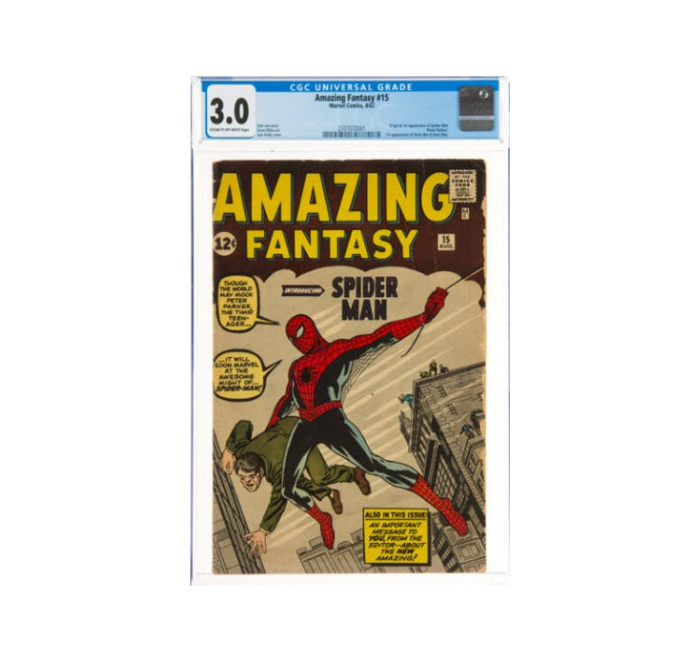

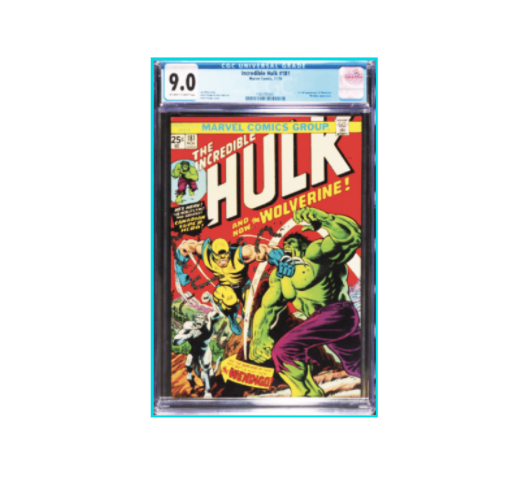

More losers than winners last week as more assets dropped into negative territory. The biggest loser was Batman #5 on Rally, which dropped 41%. Here’s what’s in store for you at auctions, comic books dropping this week, secondary markets, and more.

Lots of things going on this week in Comic books. Here’s a scoop into what’s dropping, auctions that are still open, and what’s fresh in the industry.

Today let’s look into interesting books in auctions, fractional secondary markets, and fractional market IPOs.

-Ray Bradbury’s Fahrenheit 451 – Signed First Edition

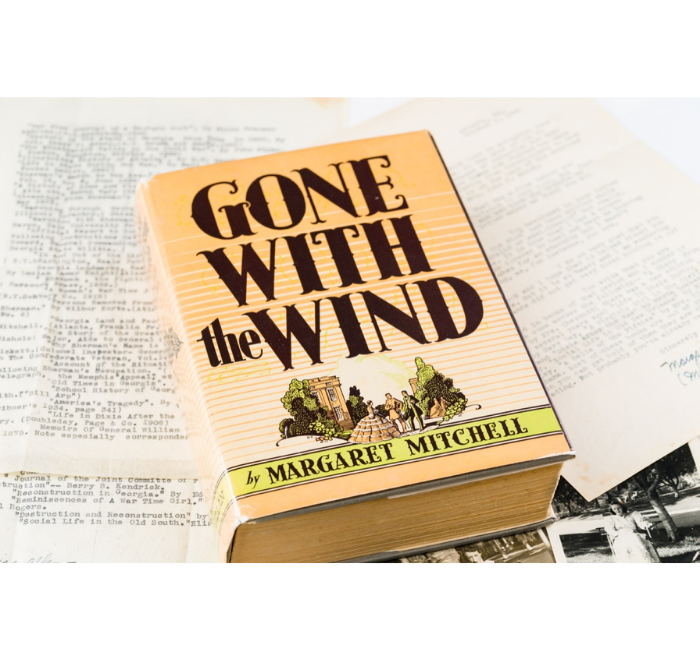

Rally brings us Margaret Mitchell’s Gone with the Wind this week. Let’s not waste any more time and dive into rare books, fractional secondary markets, auctions, limited edition books, and so much more.

The Brattle Book Shop has been in the family business since 1949 and has become a Boston landmark ever since.

Most comics were up last week, led by Spiderman #129 and Hulk #181 on Otis. Here is a good look into comic books fractional markets, secondary markets, auctions, and interesting IPO you might like.

-Incredible Hulk #181 CGC 9.0

No IPO this week, but today here’s a good look at the five fractional secondary markets starting to trade this week on rally, what’s at auction for books fractional assets, and lots more.

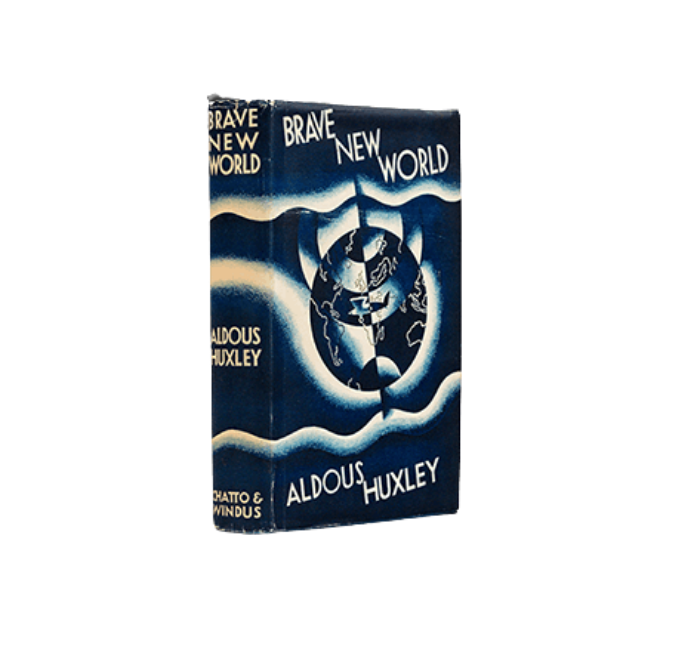

It’s been a tough couple of weeks to kick-off 2022. Today we dig into rare books fractional market. auctions, fractional market IPOS.

-Aldous Huxley Brave New World 1st Ed

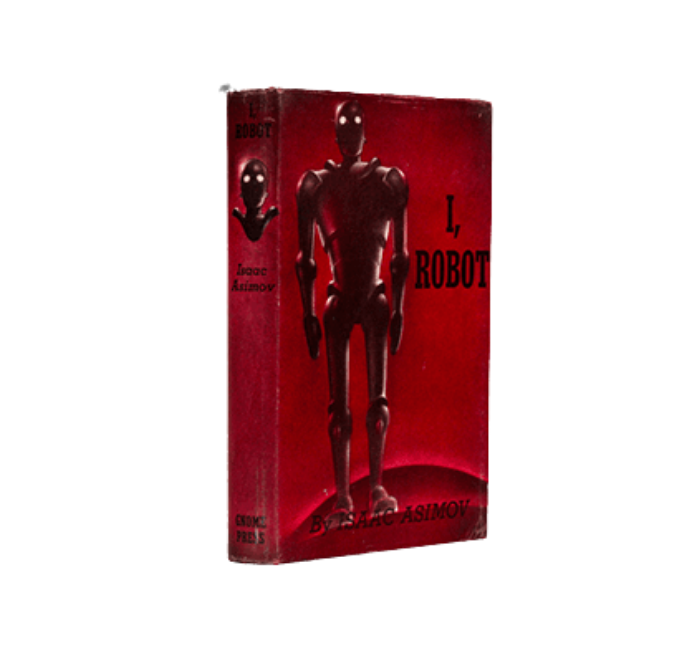

Rare books dipped into negative territory in the first week of 2022 after finishing 2021 slightly up. Today we dig into rare books performance, fractional secondary markets, auctions, and upcoming market IPOS;

-I, Robot Isaac Asimov (1st Ed)

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |