Why Onfolio stopped buying Content sites (and pivoted to digital agencies)

It’s more than just AI: Google is becoming unreliable, and making content sites impossible to value.

Investing in private equity offers investors the opportunity to participate in the growth and success of private companies, typically not available through public markets.

Private equity involves investing in companies that are not publicly traded, often at different stages of their development, with the aim of generating significant returns over the long term. Private equity investments can take various forms, such as venture capital, growth equity, or buyouts.

These investments are typically made by private equity firms or institutional investors. Private equity investors often bring more than just capital to the table; they also provide strategic guidance, operational expertise, and industry connections to help the invested companies thrive.

This hands-on approach distinguishes private equity from other investment vehicles. However, it’s important to note that private equity investments tend to have a longer investment horizon, with limited liquidity compared to public markets.

Thorough due diligence, evaluating the track record and expertise of the private equity firm, and understanding the investment thesis and exit strategy are crucial when considering private equity investments. When successful, private equity investments can deliver substantial returns, but they also come with higher risk levels.

It is important for investors to have a long-term perspective and a well-diversified portfolio when considering private equity as an investment avenue.

It’s more than just AI: Google is becoming unreliable, and making content sites impossible to value.

The World Cup is here, so it’s time to understand rugby. Why it’s undervalued, why private equity got involved, and how you can invest in the sport too.

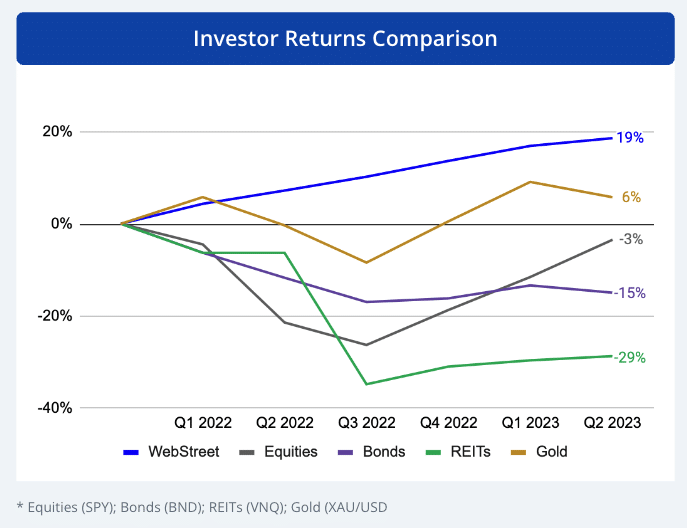

I love under-the radar companies that are spinning off cash. WebStreet buys these companies, optimizes them, and buckets them together as an investment. It’s like micro-PE.

PE is coming for your local sportsball team, Can weed save Texas, Wealthy Americans building their own cities, and More.

We explore Onfolio, a Nasdaq-listed holding company that acquires and operates profitable, cashflowing online businesses.

Most Americans have never watched a game of cricket. But Major League Cricket is debuting in the US while PE dollars are flowing into the sport.

PE firms are starting to realize that in many ways, owning a sports team is the ultimate alternative asset.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |