International Private Credit

Most private debt discussion is focused on the US. But a majority of the world’s private credit assets are invested outside America! So we’re exploring the intersection of international investing and private credit.

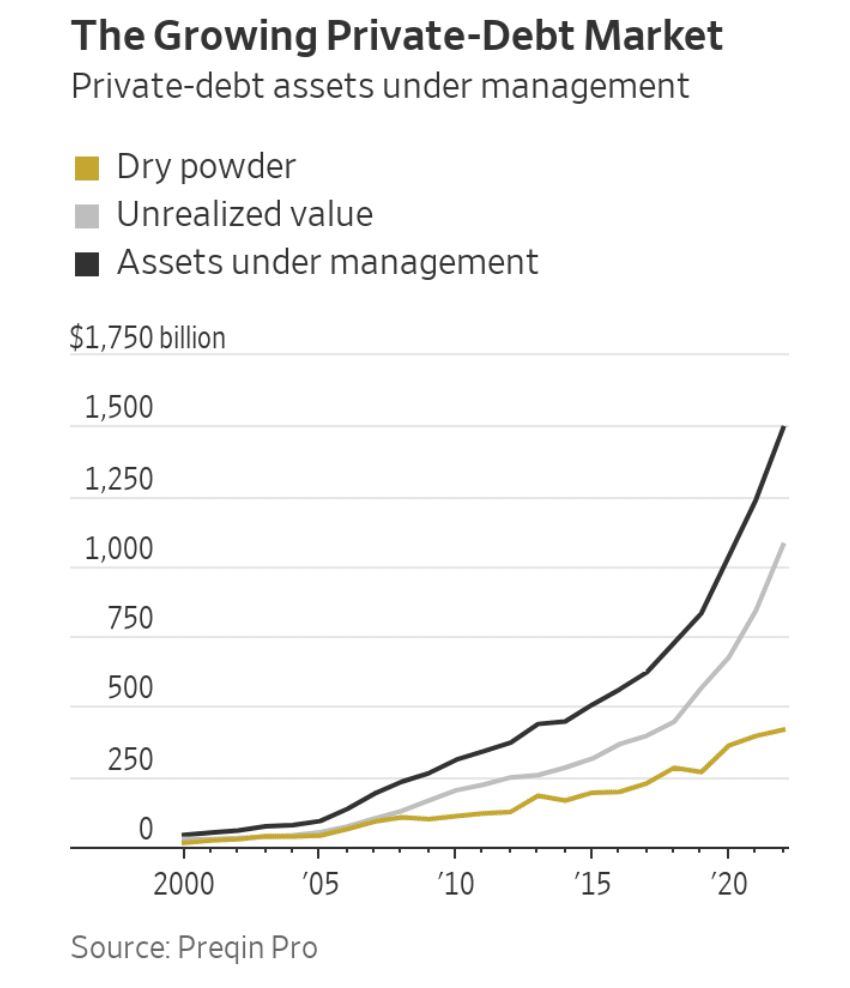

Debt financing (also known as Private Credit) is one of the “OG” alternative investments — a $1.2 trillion alternative investment market that is top of mind for institutions around the world. Common uses include equipment financing, inventory financing, and acquisition financing.

As an investor, you can help provide secured and unsecured loans. Firms use your capital to finance equipment and pay you back with interest.

We research and write about opportunities from time to time. Follow this asset if you’re interested. We’ll send occasional updates.

Most private debt discussion is focused on the US. But a majority of the world’s private credit assets are invested outside America! So we’re exploring the intersection of international investing and private credit.

A comprehensive recap of our very first alternative investor retreat: A unique tequila-themed journey to the heart of Mexico.

Today we’re looking at Finlete, which lets you invest in the future of up-and-coming athletes, earning a cut of their on-field earnings if they make it big.

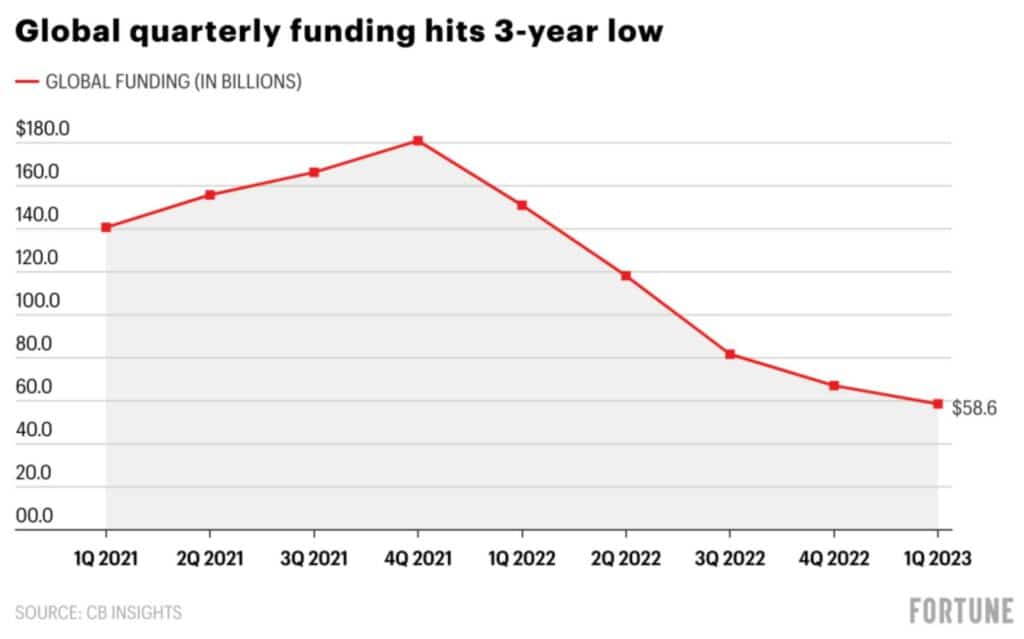

In this piece, we’re breaking down five charts that best explain the state of private credit today. Read this and become a pro.

Most of Americans’ wealth is tied up their homes. A niche industry is emerging to help American homeowners understand and tap into their home equity: The Home Equity Management industry.

Most investors are just starting to wrap their heads around the idea of financing court cases. But Fenchurch Legal discovered a way to get paid the exact same amount on each case — win or lose.

US GDP growth blew past estimates, Canada is the lone bright spot for North American real estate, Private credit continues to moon & More.

Litigation finance can feel like a form of highly educated betting. But it’s a necessary, $39 billion dollar industry, with some smart companies carving out niches.

We break down the different categories of private lending, talk about the risks and rewards of each type, and explain how it all works.

Private credit has gone from non-existent in the 1970s, to a $1.3 trillion market today. But are the risks rising along with yields?

Today, we’ll show why private credit is so valuable to businesses and investors, through the lens of a company called Quiq Capital.

Today we’ve got a short spotlight on a unique company called Levenue.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |