Social media creator economics

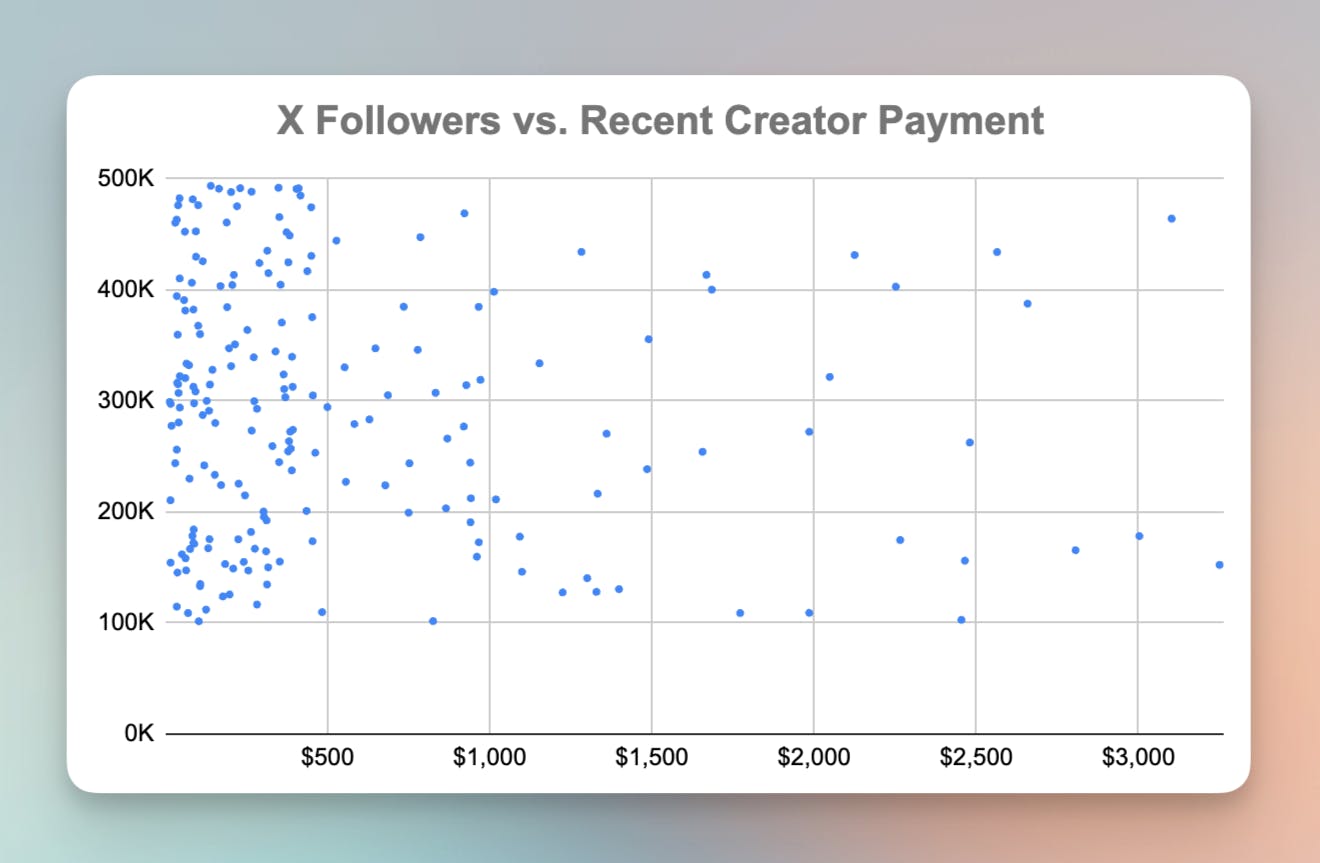

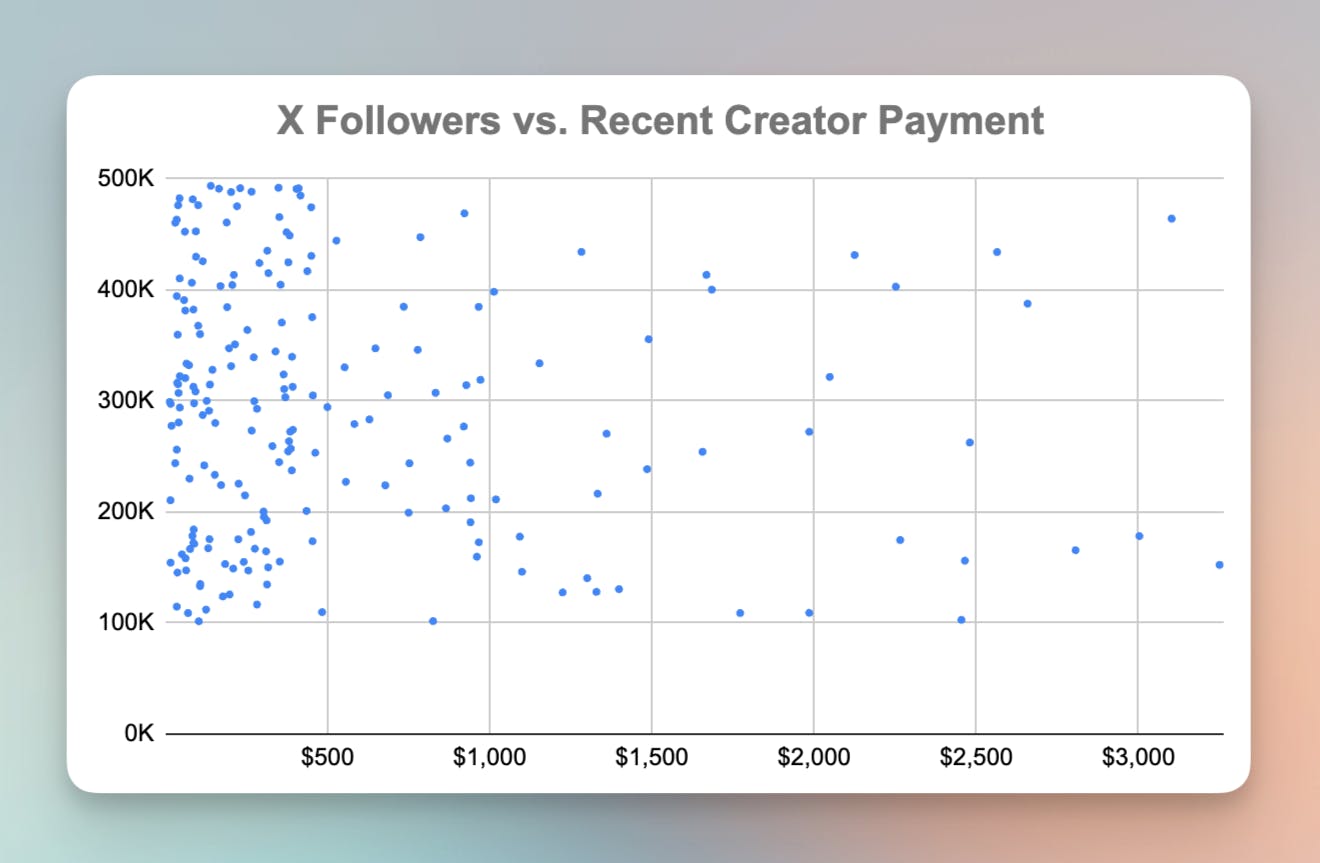

We explore the economics of social media creators in this special post by Keaton Inglis. Includes results from the world’s largest survey of X creators.

Social media accounts are certainly alternative assets. Instagram, YouTube, and TikTok accounts have fans, followers, and eyeballs. Digital traffic. And traffic means revenue.

While platforms such as Fameswap and Trustiu serve the market, pricing confusion and information asymmetry means many people don’t know how they should price their accounts. You can find crazy-good deals.

We explore the economics of social media creators in this special post by Keaton Inglis. Includes results from the world’s largest survey of X creators.

An in-depth analysis of creator earnings and sale prices across YouTube, Instagram, and TikTok.

Today we have an Instagram account worth considering in the pets niche, along with a special new feature for Insiders.

This week we have a Tik-Tok VR girl with an underpriced account, a Mexican YouTube channel, and one of the top 10 horse-related accounts on Instagram.

Social accounts: instagram.com/americanartt, youtube.com/dragicars, tiktok.com/llsqw

Here are the highest ranking & best buying opportunities across Instagram, YouTube, and TikTok over the past few weeks.

Facebook has a troubled history with video. But it’s been building bridges to lure creators back to the platform.

This week’s issue explores the buying and selling of something that we all have — social media accounts.. The market is certainly there. The legality is another story.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |