The benefits and pitfalls of tokenization

We team up with crypto expert John Belitsky to demystify tokenization: One of the most practical, yet least-understood use cases for blockchain technology.

Our index shows that NFTs are diverging from crypto, and not in a good way.

Crypto is recovering from the winter, while NFTs remain north of the wall.

We team up with crypto expert John Belitsky to demystify tokenization: One of the most practical, yet least-understood use cases for blockchain technology.

Ready to make the most of your crypto holdings? Then DeFi yields may be the answer you’re looking for.

I’m mining in public, L1s to watch this crypto summer, and which L2s are poised to blow up?

Meta, Verse, Metaverse… Can somebody explain why I should participate in the Metaverse? Today we’ll look into what is the Metaverse and Digital Real Estate

This week I sat on a panel discussing price and value in web3. Here’s what I didn’t say during the panel.

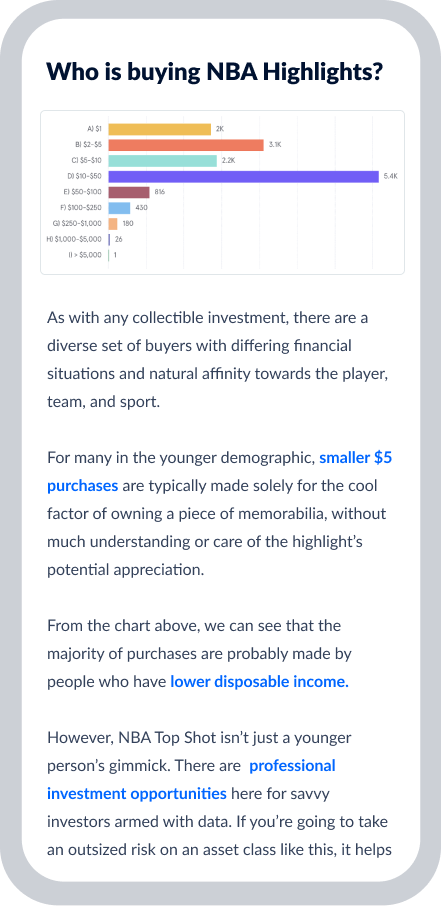

It’s no secret that NFTs have been in the doghouse lately. Let’s see where you can still make money.

Today we’re jumping into the world of crypto funds and exploring a newer player in the industry – Ember.

Colin doesn’t pull in punches evaluating just WTF happened with Celsius.

Today’s NFT insider highlights the NFT meltdown, Biggie’s own NFT, FOMO in Moonrunners, and Beeple’s probably uses a lot of drugs.

It’s a different flavour of Colin Ma this week as he gives us a boots on the ground view of NFT NY.

Today in the NFT Insider highlights our Blue Chip NFT Index, Chromie Squiggles, BAYC bottle, and Doodles.

Today we look at NFT fractional markets coming full circle, squiggles & bored ape on fractional markets, NFTS in opensea, and projects to follow this week.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |