A three-part framework for investing in prefab housing startups

Prefabricated housing can address the construction industry’s supply challenges. But prefab startups aren’t created equal. Here’s a 3-part framework for evaluating their effectiveness.

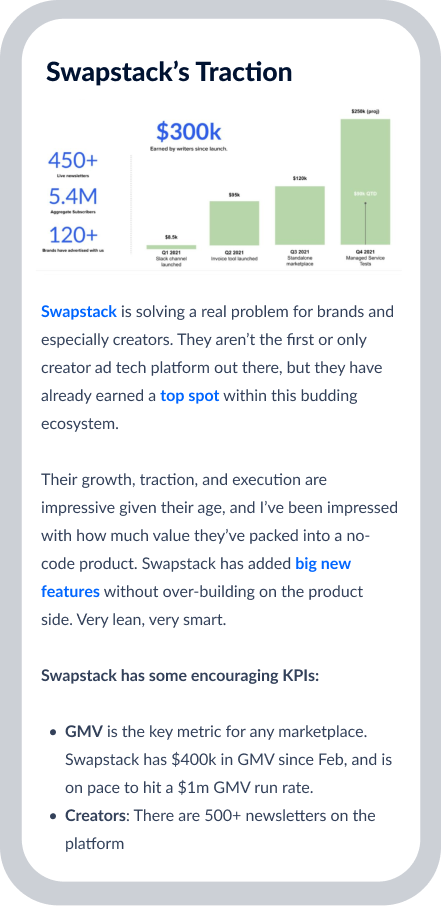

Previously, getting access to private companies was reserved for the wealthy. Not anymore.

Between Republic, WeFunder, StartEngine, AngelList, SeedInvest, and a dozen other crowdfunding platforms, there is certainly no shortage of deals out there.

For those startups close to going public, there’s Sandhill Markets, which lets you buy secondary shares in pre-IPO startups (i.e., “secondaries”)

Investing in startups is very risky, and the quality between startups varies tremendously. But despite all of the junk on these platforms (and there is certainly lots of junk), there are also some potential gems hidden in the mix.

Follow this asset if you’re interested. Our goal is to uncover these gems, bring them to you, and give you our unbiased analysis & recommendation.

Prefabricated housing can address the construction industry’s supply challenges. But prefab startups aren’t created equal. Here’s a 3-part framework for evaluating their effectiveness.

The continued innovation is further driving the popularity of EVs. Does that mean it’s the ideal time to invest in EV stocks?

A comprehensive recap of our very first alternative investor retreat: A unique tequila-themed journey to the heart of Mexico.

The Sonic Power Scrubber became a viral sensation, translating into a ton of sales for the company behind it, Sonic Power. But this was no lucky accident.

DXYZ will be the first public, exchange-listed portfolio of hand-picked venture-backed private technology companies. That’s a very big deal.

Today, we explore Brightline: The only privately-owned and operated intercity railroad in the USA. (Think of it like America’s biggest transit startup.)

The secondary market looks nothing like it did a year ago — or at any point in its history. These five charts paint a good picture of what’s happening today.

We explore how admin work has changed, why the pendulum swung away from admin assistants, and why companies should consider swinging it back.

Today, we’re looking at In-Q-Tel, the secretive firm funding some of America’s leading tech companies, operated by none other than the CIA.

Most of Americans’ wealth is tied up their homes. A niche industry is emerging to help American homeowners understand and tap into their home equity: The Home Equity Management industry.

We dig deeper into strategic metals: The subset of metals that are key to national economic prosperity and military security.

Today we’re exploring music royalties, through the lens of a company called JKBX.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |