Inverse Cramer Weekly Update — Apr 21

I like Uber here. I think Uber is well below. It’s high. I think you buy some now, and you buy some a little bit lower, and that’ll do it -On Uber ($UBER)

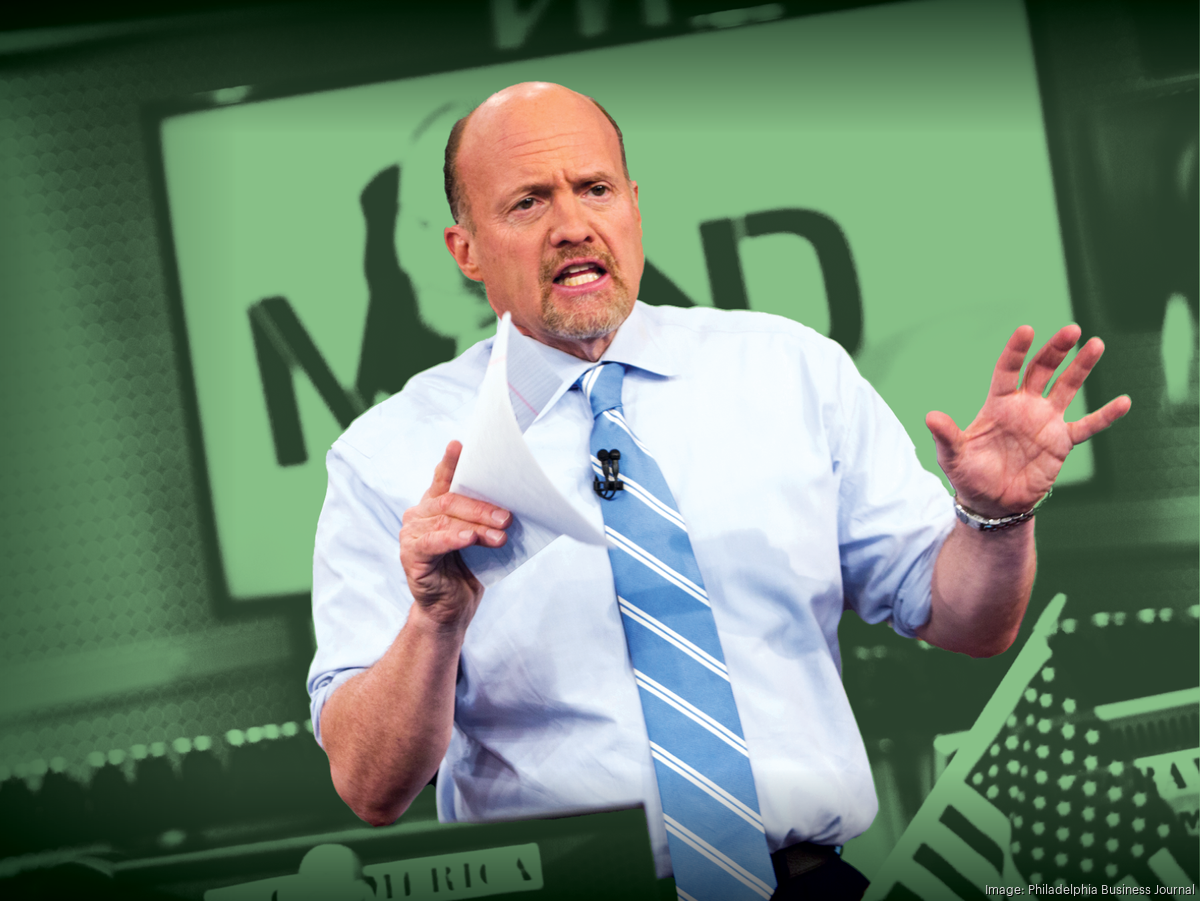

Tracking Jim Cramer’s stock picks so you can do the opposite.

Read past issues of the Inverse Cramer Newsletter below:

I like Uber here. I think Uber is well below. It’s high. I think you buy some now, and you buy some a little bit lower, and that’ll do it -On Uber ($UBER)

If you have to own one, it’s gonna be Alibaba. That is the one that has the most American-like financials. I’m not a fan of Chinese stocks but BABA is the one to own if you want to go there -On Alibaba ($BABA)

If you have to own one, it’s gonna be Alibaba. That is the one that has the most American-like financials. I’m not a fan of Chinese stocks but BABA is the one to own if you want to go there -On Alibaba ($BABA)

I like Visa very much here. I like that settlement that was announced today. It’s gonna clear their heads a little bit. Visa is too close to its all-time high. If it comes a little, I’ll be a buyer -On Visa ($V)

I like AMD here. I think it has been in the penalty box long enough that I’m in the Nvidia land but I haven’t lost sight that Lisa Su is one of the greatest managers of all time. It’s time for me to think can I own both for my capital trust, Nvidia and AMD? I think I can.

-On Advanced Micro ($AMD)

It’s going higher. Blackrock is the distinguishing event. It is the great financial repository for our nation, and you should own it. It is still inexpensive, great call by you -On Blackrock ($BLK)

Workday, Salesforce, and ServiceNow are the three that have the models I like. They are true platform companies. We are behind them all the way. You’ve got three winners there -On Workday ($WDAY)

My stepson works at Zoom. It’s such a great company. Eric Yuan is such a fabulous CEO. But I don’t know how it keeps on going, and it drives me crazy. Sometimes you want the good guys to really win, and I can’t think of a thesis to have it happen -On Zoom Video ($ZM)

I think the reason why it sells on a lower multiple on all the stock is the geopolitical risk. Which I think is overstated at the moment, given the fact that China seems a little less inclined to take offensive action. It is a great company, what can I say -On Taiwan Semi ($TSM)

You’re not doing well at all. We don’t want AMC, it’s not doing well. We want stocks that go higher. Let’s understand that the consumers are not going the the movies like they used to. Why don’t you go buy Netflix? -On AMC Entertainment ($AMC)

I don’t trust it I’ve got to tell you. I checked in with Larry William again, now he has been saying, you’ve got to get out of Bitcoin. He’s been so right. I’ve called him and ask are we done going down, he goes ‘No, stay away.’ -On Riot Platforms ($RIOT)

I think you should pick up the stock. It’s a reverse head and shoulders pattern btw. It yields 3.5%, it’s very inexpensive, and people buy it at Home Depot. You should be buying Stanley Black & Decker -On Stanley Black & Decker ($SWK)

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |