Investing in Mexico: A recap of our investor field trip to Jalisco

A comprehensive recap of our very first alternative investor retreat: A unique tequila-themed journey to the heart of Mexico.

Impact investing is a relatively modern approach to finance that has gained significant traction. It seeks to deploy capital with the intention of generating positive and measurable social or environmental impacts, while also aiming for financial returns.

It includes Socially Responsible Investing, Sustainable Investing, Ethical Investing, Mission-Driven Investing, ESG Investing, and Philanthropy Investing. A great example of impact investing in action is through companies like Climatize.

Traditional investing often prioritizes financial gains alone, but impact investing broadens the scope of investment considerations to encompass social and environmental factors.

The primary objective of impact investing is to address pressing global challenges, such as climate change, poverty, gender inequality, access to education and healthcare, and other social or environmental issues.

It operates on the belief that businesses and projects that actively contribute to solving these challenges can also be financially successful in the long run. In this way, impact investing bridges the gap between profit-driven motives and positive societal outcomes.

As impact investing continues to gain popularity, it has the potential to shape the future of finance, encouraging businesses and investors alike to prioritize sustainability and societal well-being.

A comprehensive recap of our very first alternative investor retreat: A unique tequila-themed journey to the heart of Mexico.

We examine ESG through an impartial lens: Why its intentions are good, what the problems are, and how it turned into a Frankenstein. We’ll also talk about real solutions.

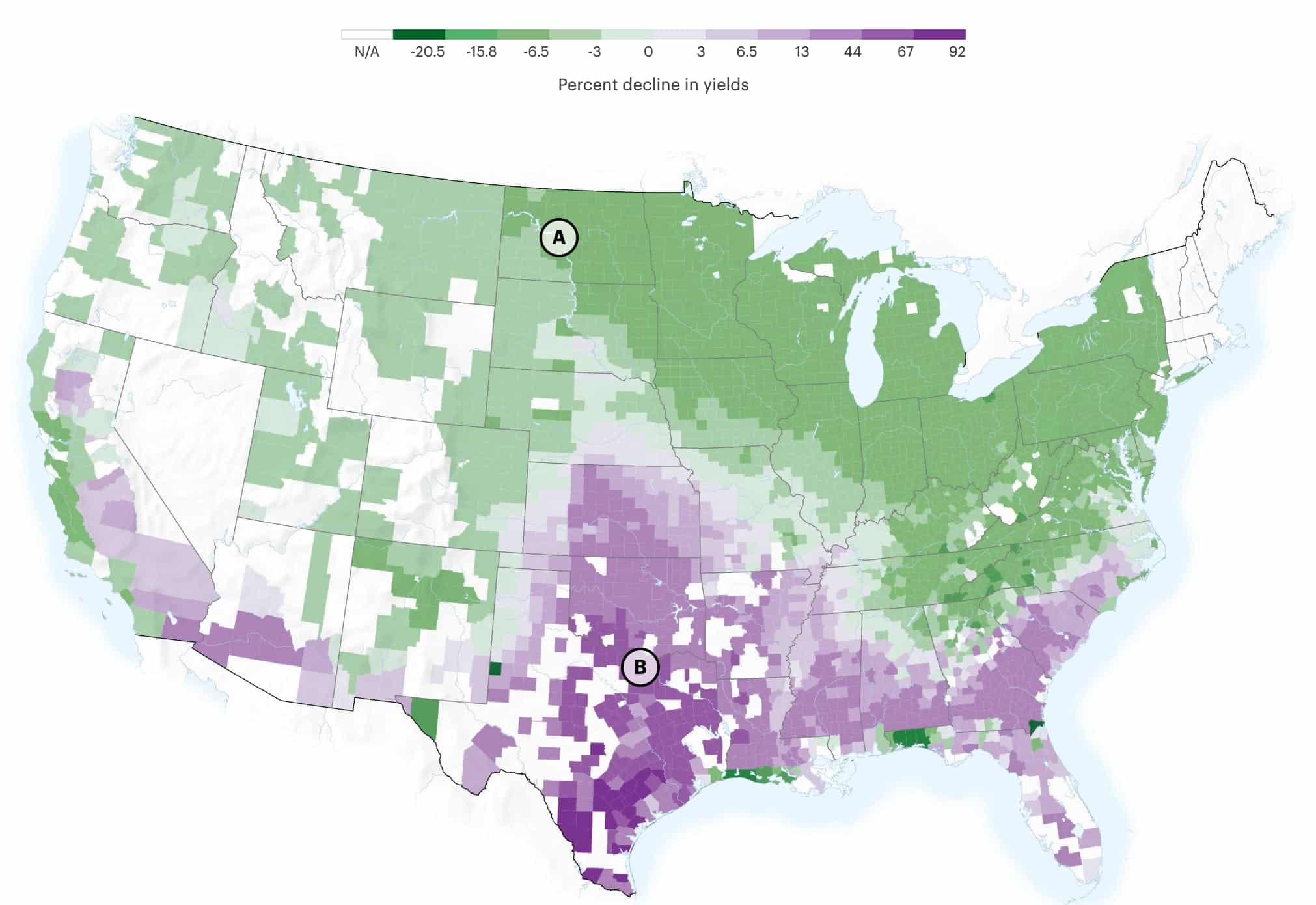

Today, we’re looking at which American residential real estate markets will benefit most (and least) from climate change.

In honor of World Bee Day, we explore how bee farms make money, what the costs & profits look like, and explore a few interesting bee-related startups.

What exactly are carbon credits? How are they traded? Do they actually help the environment? And who can invest in them?

Women generally outperform men in investing. So why are they under-invested in financial markets? We explain the phenomenon and highlight interesting women-led startups.

A look at investing in farms & farming operations, this post also explores some interesting things you can do with rural land.

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |