Invest in mental health (again!)

This is a company we’ve talked about before, and they’re back for another round.

This is a company we’ve talked about before, and they’re back for another round.

This month, we’re looking at Contractor+, which helps tradesmen bid, schedule jobs, and get paid. The platform already has 35k+ members and is doing more than $360k per year in revenue.

After a raft of holiday calamities, Boeing is at risk of becoming a meme stock only taken seriously by the Wall St Bets crew lurking on Reddit.

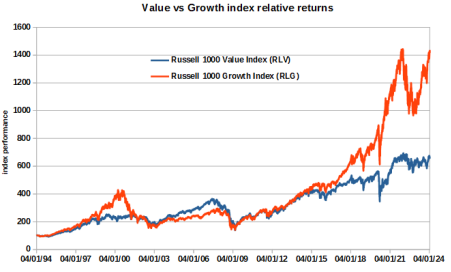

Today, we’re looking at options (get it) to hedge against a market correction in 2024.

We’ve got a strategy to play on two different theses that might become reality in 2024. If either thesis hits, we win. If they both hit, we win big.

This month, we’re looking at Oberit, an early-stage HealthTech company that’s advancing the mental health and addiction recovery category with AI-powered, incentive-based behavioral change.

This month, we’re looking at a company making parents’ lives easier by taking the hassle out of travelling with little ones.

Today, we’re looking at something completely different – it’s an FMCG brand called selfmade, and they’re pioneering the field of psychodermatology.

Today’s version of the Big Deal features two opportunities, but they’re only available to accredited investors and qualified purchasers.

This month, we’re looking at something completely different – it’s an FMCG brand called AKUA, and they’re introducing the west to something the east has known about for centuries — kelp-based food.

This month, we’re looking at something completely different – it’s an investment platform called WebStreet focussing on flipping digital properties like Amazon stores, content sites, and more.

This month, we’re going industrial with a deep dive into LiquidPiston, a company reimagining a much-maligned piece of tech that’s largely unchanged since the 1800s — the internal combustion engine (ICE).

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |