Short Jim Cramer ETF (SJIM)

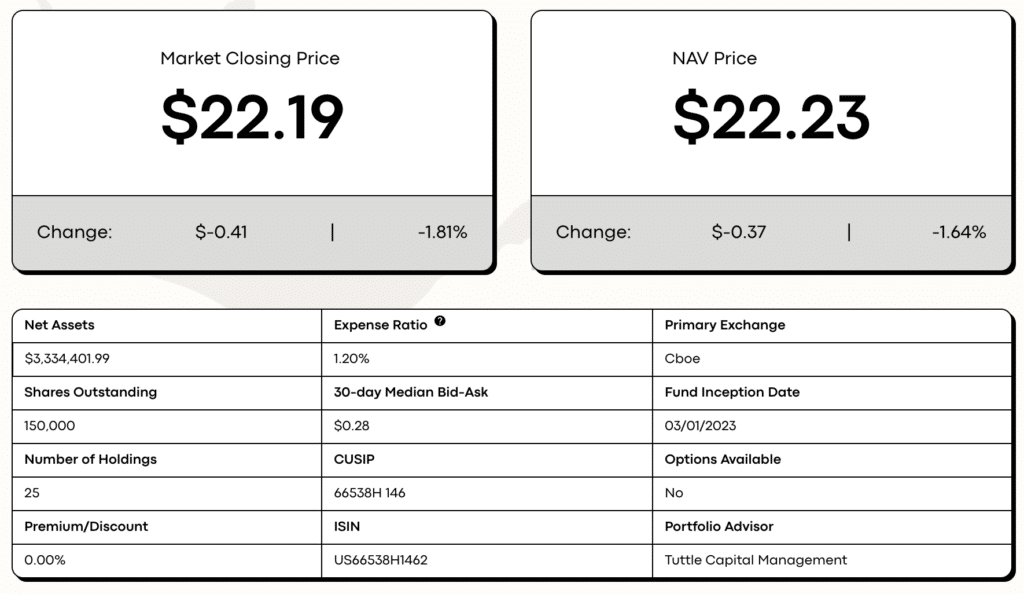

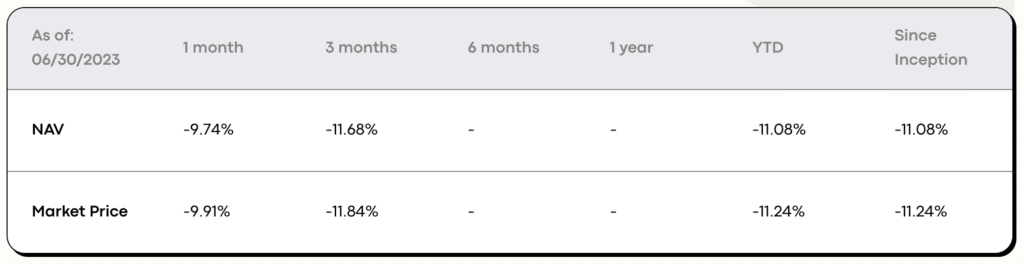

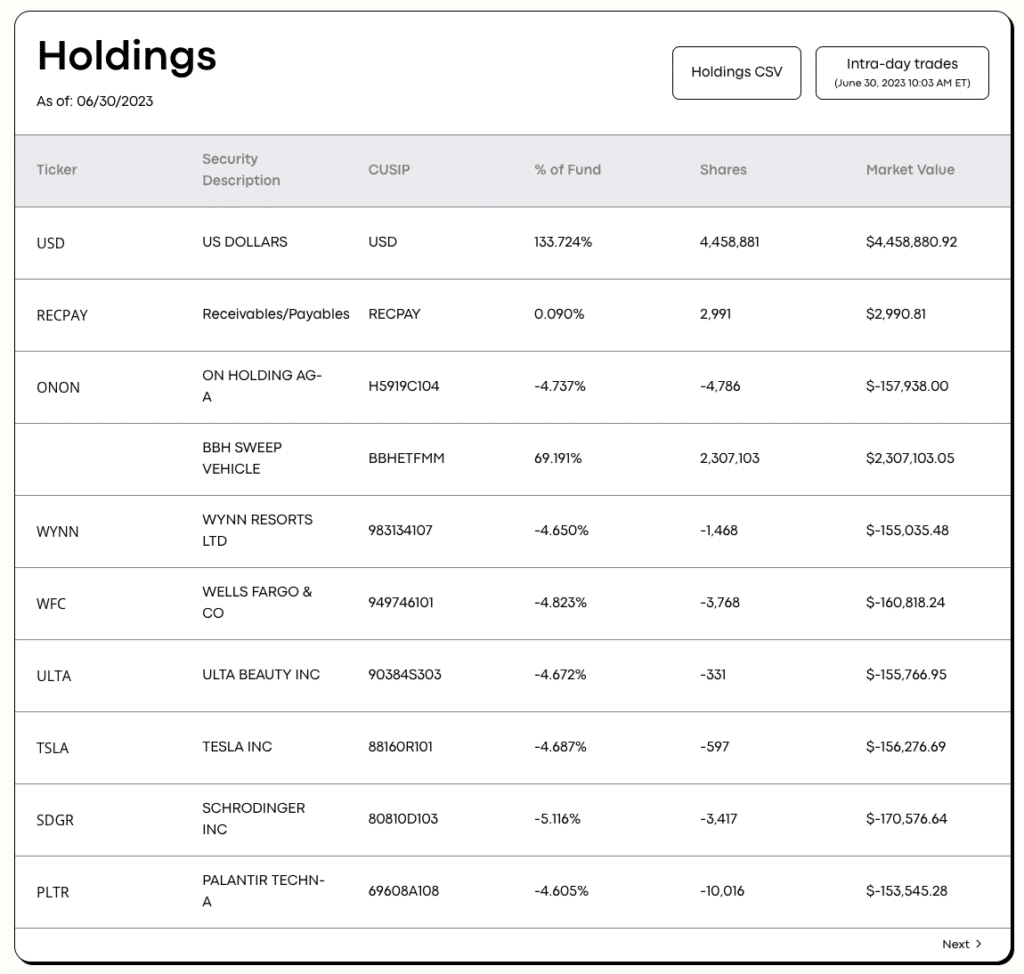

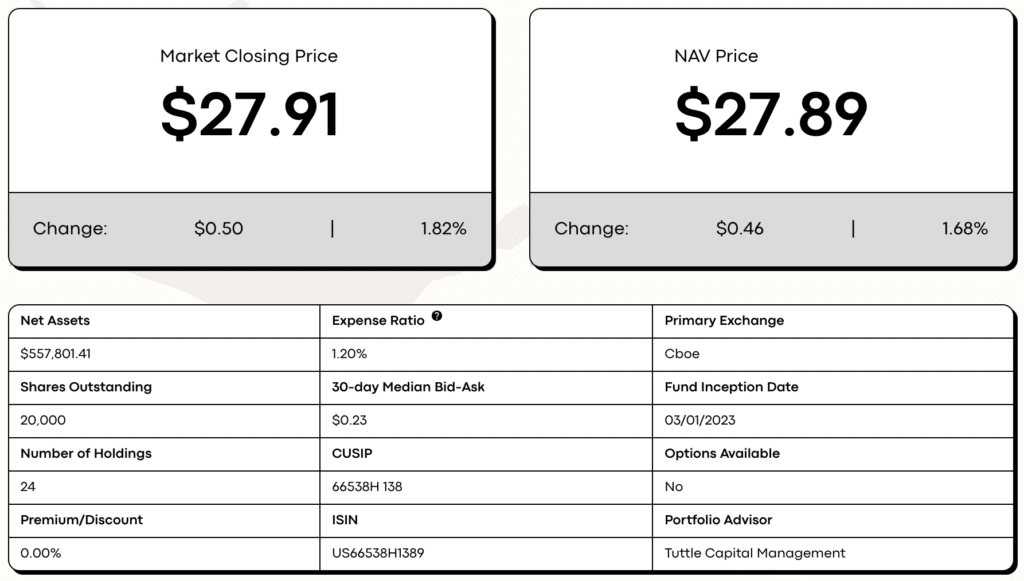

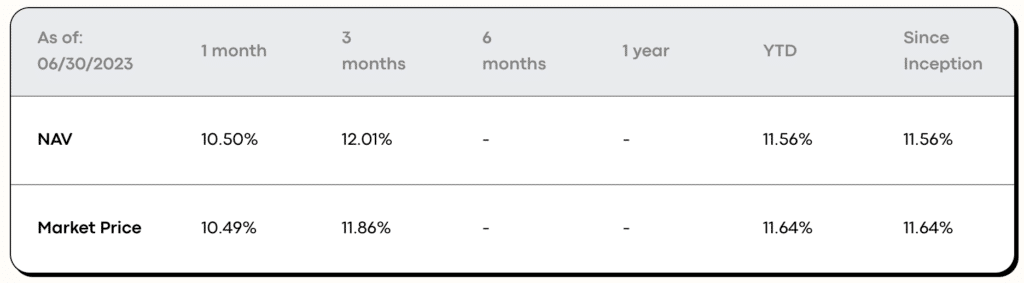

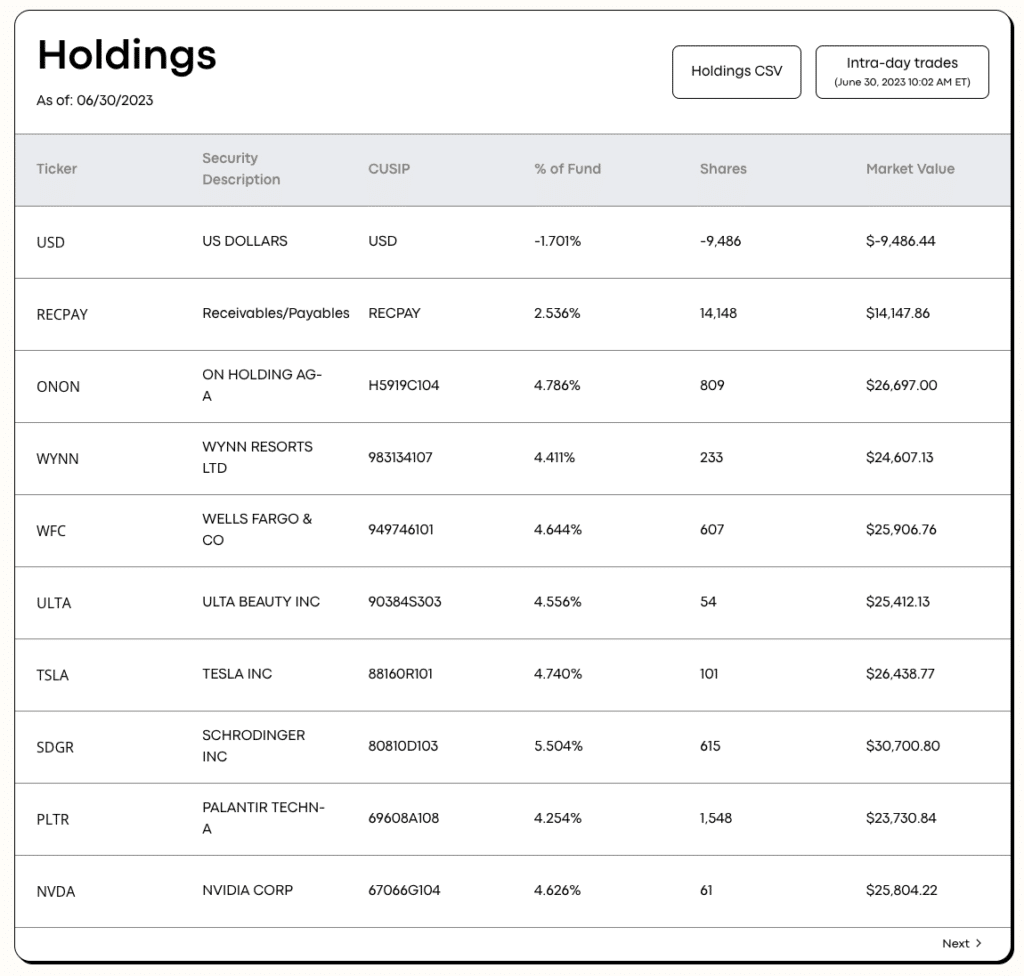

The Inverse Cramer Tracker ETF (SJIM) seeks to provide investments results that are approximately the opposite of, before fees and expenses, the results of the investments recommended by television personality Jim Cramer.

Long Jim Cramer ETF (LJIM)

The Long Cramer Tracker ETF (LJIM) seeks to provide investments results that generally track, before fees and expenses, the results of the investments recommended by television personality Jim Cramer.

About Alts.co

Founded in 2020 as the combination of two Substack newsletters, Alts.co is now home to the world’s largest community of alternative investors.

In addition to running the Inverse Cramer Newsletter, we cover the world of exotic, esoteric asset classes. Collectibles, Crypto & NFTs, Wine & Spirits, Artwork, P2P Lending, Farmland, Music Rights, Startups, Real Estate, Debt Financing, and more.

Our audience is comprised of critical thinkers, finance & technology workers, and retail & institutional investors looking to understand alternative investing markets.

There’s no newsletter quite like Alts.

Disclosures

The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing, and is intended to serve solely as research, not financial advice. Alt Assets, Inc is not affiliated with Jim Cramer, CNBC, Mad Money, or the Inverse Cramer ETF (LJIM and SJIM). For entertainment purposes only. Not investment advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several, or all of the alternative asset classes that Alt Assets, Inc. publishes content about on its site. Any of the Fund’s investments that have positive designations on the Alt Assets, Inc. site are purely coincidental, as the Fund is actively managed and guided by its own investment parameters, as summarized in the relevant private placement memorandum. The newsletter may contain affiliate links, meaning that Alts.co and its associated entities may receive compensation for referring customers to the noted companies.