Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite

You are subscribed to receive Weekly updates.

We are now doing Daily updates too. You can add Daily updates here.

Quick links:

Well folks, we have another failed bank!

Yesterday morning, the FDIC was preparing to take First Republic Bank into receivership.

Of course, last month, Jim tweeted that First Republic is a “very good bank.”

It’s truly incredible. Like clockwork.

Jimmy spent much of the the week talking about lithium, and making vague, bold calls on Twitter.

Table of Contents

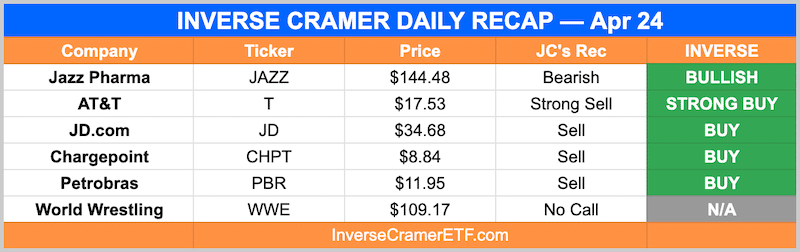

Monday Apr 24

The company told me they weren’t going to cut the dividend before they cut it last time. I think based on trustworthy nature alone, I’d say you go with T-Mobile. And that’s all I have to say about them. – On AT&T ($T)

The only Chinese stock I think is good to own is Alibaba. It’s just too hard to own the rest of it, especially JD. – On JD.com ($JD)

After what Chile did yesterday with the Lithium, I’m not messing with the Brazilian companies, it’s too hard. – On Petrobras ($PBR)

Cramer is referring to Chile’s plans to nationalize the lithium industry.

An all-time great call. Legendary. pic.twitter.com/g6T3hSxbUd

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 28, 2023

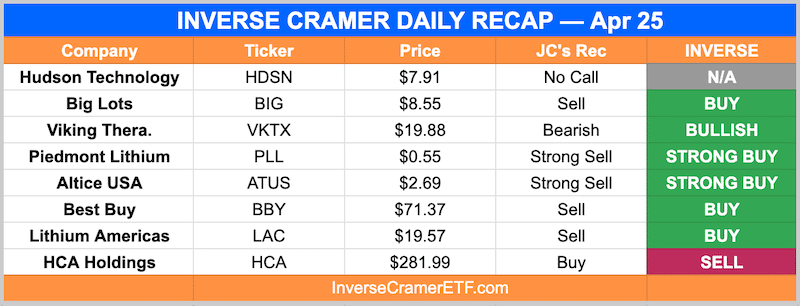

Tuesday Apr 25

After going bearish on Petrobras yesterday, Cramer got two more callers asking about lithium companies.

After listening to Elon Musk over and over again say ‘more companies should go into this business’ (lithium) I am worried he’s going to stir up more competition. Don’t buy. – On Piedmont Lithium ($PLL)

Again, these lithium stocks, I keep coming back to the great Elon Musk says: There’s going to be a way to get around lithium, because he doesn’t like the pricing. I’m not messing with him. – On Lithium Americas ($LAC)

BREAKING: In a day of media mashup, CNBC to keep Cramer, execs stating “we are making a lot of money doing the opposite of Jim” pic.twitter.com/lrjRZrrNGb

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 24, 2023

Wednesday Apr 26

Cramer no show

Thursday Apr 27

I like it. I just profiled it a couple days ago. I think it’s a great buy. I suggest that you do some buying. Get a better average.– On New Fortress Energy ($NFE)

Yea, this is office properties. Real Estate investment trusts. I’ve said stay away.– On Peakstone Realty ($PKST)

hard pass pic.twitter.com/ksiW0ldAwt

— Jim Cramer (@jimcramer) April 29, 2023

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 27, 2023

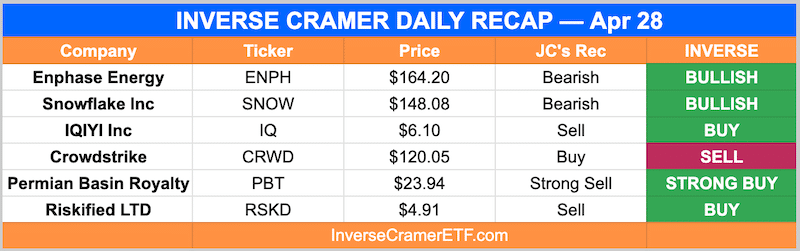

Friday Apr 28

I’m not recommending any Chinese stocks. If you put a gun to my head I’d say, ‘Please take away the gun.’

– On IQIYI Inc ($IQ)

own it pic.twitter.com/MCphE4pwbT

— Jim Cramer (@jimcramer) April 29, 2023

sell sell sell pic.twitter.com/h9cOI8vpeg

— Jim Cramer (@jimcramer) April 29, 2023

Weekend Bonus

The key to never being wrong is to be as vague as possible:

Amazon, taking other side of the trade

— Jim Cramer (@jimcramer) April 28, 2023

What trade? What trade are you talking about?

So much – i disagree with market on this one

— Jim Cramer (@jimcramer) April 27, 2023

On what? What do you disagree with??

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by Tuttle Capital and Cult Wines.

- I have no personal holdings in any companies mentioned in this issue.

- We have no ALTS 1 investments in any companies mentioned in this issue