Hello and welcome to Alts Cafe

[Remember, I’m off on holiday the next couple weeks, so you’ll be treated to two special issues of Alts Cafe while I’m away.]

This is a quickfire look at what’s driving your alts week.

TLDR:

- Consumers keep consuming

- The US residential property market has ground to a halt

- IPOs are back, but they’re tanking

- A way to bet against armageddon

- Is Worldcoin a scam?

Table of Contents

Macro View

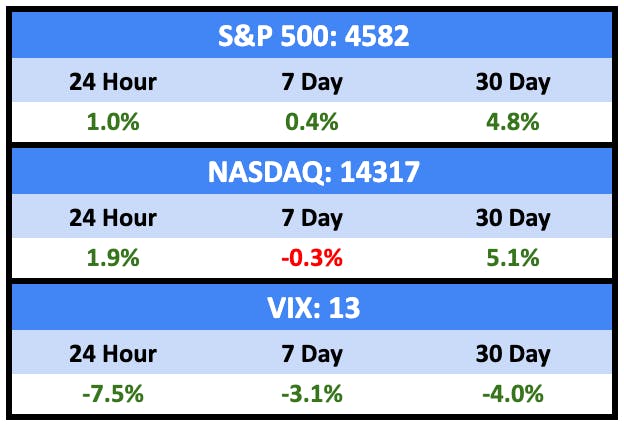

The market was mixed last week despite a record run by the Dow Jones.

Bullish News

- Equities continue to pump despite lots of signs pointing to a recession.

- US GDP grew 2.4% on the quarter, beating estimates.

- U.S. consumer confidence increased to a two-year high in July.

- MasterCard quarterly earnings showed consumers continue to spend. LikewiseVisa’s.

- But equities investors are dumping stocks with significant exposure to consumer spending.

- More people are entering the jobs market, which should bring unemployment up — which could bring rates down.

- The US Dow Jones index was up 13 days in a row, the longest streak since 1987.

Bearish News

- As expected the Fed hiked rates 25bps.

- U.S. business activity slowed to a five-month low in July.

- US junk bond downgrades hit their highest level since Covid.

- The UK is running the highest debt interest bill in the developed world.

What are we doing?

ALTS 1 Fund news:

Nothing here

Real Estate

Bullish News

- Austin, Texas has cut the minimum lot size for single family homes in half.

- US home prices are now just 0.9% below their peak.

- There are forecasted to be 3,600 distressed CRE deals to be had over the next two years.

- There are plenty of buyers for them.

- Around 13% of commercial loans come due between now and 2027. That’s either bullish if it’s fewer than you expected, or bearish if it’s more.

- Office demand in SF is up 10% (from a very small base) thanks to the AI boom.

- The US government is giving $8.5 billion in rebates to companies and home owners that improve energy efficiency. Qualifying categories include insulation, heat pumps, and efficient appliances.

Bearish News

- Evergrande, China’s hugely indebted property developer, lost $81 billion over the last two years.

- Yields on commercial mortgage bonds are approaching 11%.

- REIT redemptions were $4.5 billion in Q2 (291% of fundraising).

- Existing home sales in the US fell to a fourteen-year low.

- And the luxury market is no longer immune.

- Looking to avoid high rates, some home buyers are getting loans from the property sellers.

How to invest in real estate right now:

Who wants to invest in a fund that buys old homes, puts in insulation, heat pumps, and efficient appliances and flips them?

Startups

Bullish News

- Crunchbase thinks tech layoffs may have peaked.

- UK app developers have brought a $1 billion lawsuit against Apple to reduce app store fees.

- US IPOs continue to tick up and are set to beat 2022 numbers.

Bearish News

- Following Uber’s lead (three years later), lyft is trying to offload its e-bikes division.

- Sequoia fired some more people.

- Startup M&A activity is the lowest it’s been for a decade.

- Sequoia is slashing two funds, including its crypto fund.

How to invest in startups right now:

Semi-conductors, baby.

Crypto & NFTs

Here’s what you need to know:

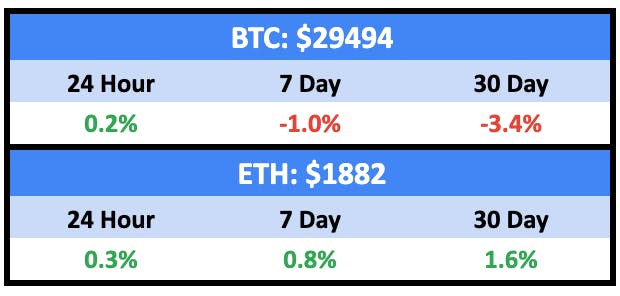

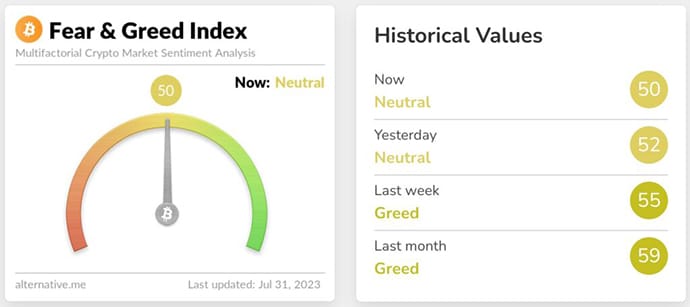

A mixed week.

Bang average.

Holding steady

Bullish News

- Worldcoin, the eye-scanning blockchain project co-founded by OpenAI CEO Sam Altman, launched its cryptocurrency on Monday. Users queued up by the thousand.

- But there were allegations many of those in the queue were paid actors

- But the UK is already investigating on privacy concerns

- Indonesia has launched a national crypto asset bourse.

- Binance is expanding into Japan.

- An NFT project featuring legendary comic-maker Stan Lee sold out immediately.

- The American Congress is trying to pass a bill to regulate stablecoins

Bearish News

- The SEC may appeal the recent Ripple ruling, which would send alt coins in particular into a tailspin.

- Binance, like Sideshow Bob in a field full of rakes, withdrew its application for a crypto license in Germany.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at VantagePoint and Kalshi.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.