Let’s Nuke AI

The AI nuclear option, Chess makes me a better investor, Introducing Books from the WC, and More.

The AI nuclear option, Chess makes me a better investor, Introducing Books from the WC, and More.

Wells Fargo upgraded US economy outlook, Denver ranked hottest housing market, Ramp raised another $150 million, Global PE exit value sank, and More.

Live deals wrapping up, two new real estate opportunities this week, and music-themed investing adventure to Music City, USA.

The American Car Insurance Crisis, Goldman Sachs Bets Big on Luxury and Beauty, California’s Shrinking Share of the US Tech Industry, and More.

California Forever is Never, Fundraising is hopelessly outdated, You can buy used Iranian missiles, and More.

This is a company we’ve talked about before, and they’re back for another round.

Unemployment claims last week fell by 11,000, Blackstone’s apartment REIT goes private, The space economy is on the rise, Q1 saw an uptick in leveraged buyouts, and More.

Buy and hold 50+ barrels of 100% agave tequila, time to invest in a unique piece by legendary artist Frank Auerbach, and two new deals coming in hot this week.

The Fading Allure of Macro Hedge Funds, Brazil: The Future of Fintech, How to Work Successfully with Gen Z, The Big Four’s Ironclad Grip on S&P 500 Audits, and More.

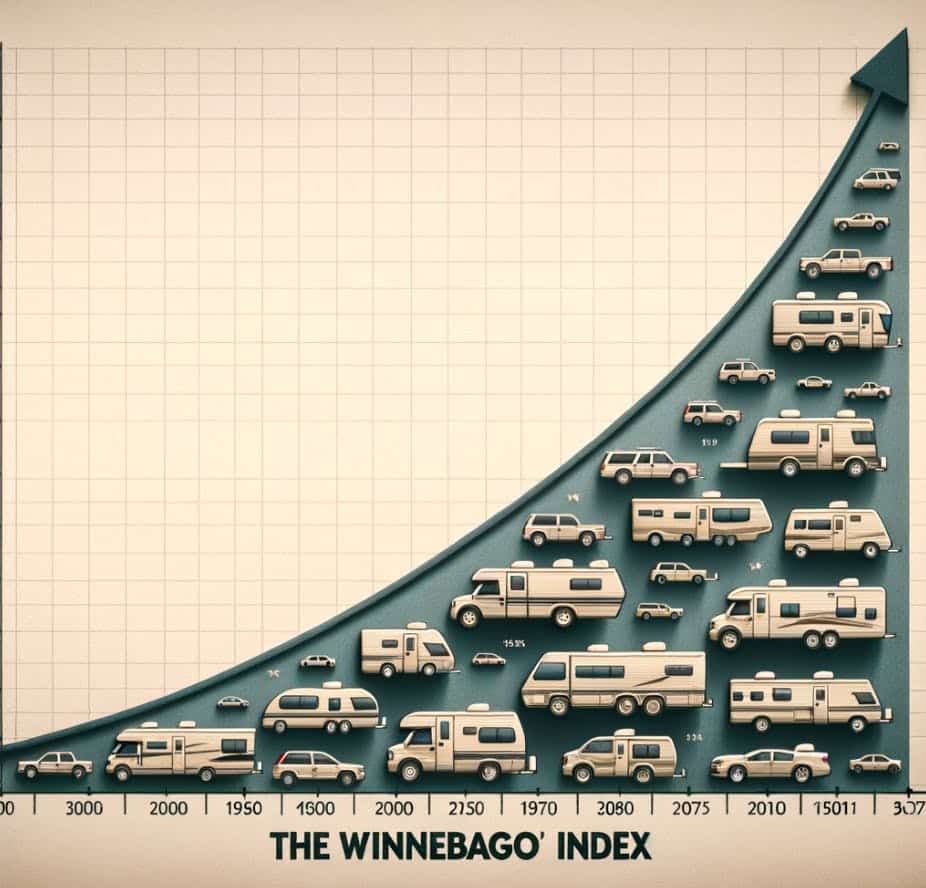

Does the Winnebago Index work, Caitlin Clark is already dominating the WNBA, SMEs are flocking to Dubai, and More.

Macro: US added 303,000 jobs in March, Real Estate: Detroit’s housing market beat Miami’s, Startups: Nvidia chips are up for rent, and thirteen more insights on different asset classes.

The ETF That Lets You Buy Privately Held Companies, How VC Has Changed Since The SVB Fallout, Are Bear Market Funds Worthwhile, and More.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |