Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- The Fed’s not done with you

- Mortgage defaults are on the rise

- Startup investment is down >50% YoY in most markets

- Private credit is set to double to $3 trillion

- Most NFTs are now worthless

Table of Contents

Macro View

It was an awful one as the Fed ruined everyone’s week.

Bullish News

- Nothing here, I’m afraid.

Bearish News

- The Fed says interest rates will stay higher through 2026. [via ShortSqueez]

- And one more rate hike in 2023 is likely. There’s a 75% chance the Fed hikes in November.

- And 10-year yields hit a 16 year high

- The global corporate default tally jumped to 107 as of Aug. 31, 2023, with 16 defaults in August, the highest August monthly tally since 2009.

- And media and entertainment defaults are six times higher than at this point in 2022.

- Fannie Mae thinks the US will face a mild recession.

Forecasts 🎰

Get $25 to play around with invest on Kalshi using this link.

📈 75%

Chance of Fed hikes rates in November

📈77%

Chance mortgage defaults will rise in Q3

📉2.32%

National average house price increase in 2023

The market is betting on the Fed doing what it says it’s going to do in November, and the chance of mortgage defaults has increased 7% since last week.

What are we doing?

ALTS 1 Fund news:

No change

Real Estate

Bullish News

- Marathon Asset Management is bidding on $33 billion worth of distressed CRE.

Bearish News

- U.S. existing home sales unexpectedly fell in August

- But persistently tight supply boosted prices.

- And this is affecting both retail and institutional buyers.

- Partly because an alarming number of buyers backed out of deals.

- Housing starts were also off.

- Apartment rental growth in the US has flatlined.

- Chinese offices are even emptier than America’s.

- CRE transactions are off 50% YoY.

- And lending standards are getting even tighter.

How to invest in real estate right now:

avoid

Startups

Bullish News

- Blockchain Capital closed two new crypto VC funds for a total of $580 million.

- Several Southeast Asian companies are considering IPO’ing in the US.

Bearish News

- Everything is not awesome

- Startup M&A is way off this year too.

- Expect to see a number of high profile startups fail in 2025.

How to invest in startups right now:

avoid secondaries

PE & Private Credit

Bullish News

- Ares Management boss Mike Arougheti sees the $1.5 trillion private credit market doubling to $3 trillion within five years.

- Meanwhile, Ares gave Chelsea FC $500 million to light on fire.

- Goldman Sachs raised $14.2 billion for private-equity secondaries deals.

Bearish News

- The FTC sued PE firm Welsh Carson Anderson & Stowe, accusing it of price fixing. This could be a body blow to roll-up firms. [via ShortSqueez]

- PE firms are suing Morgan Stanley for $750 million, alleging fraud.

- It’s a tough market, and PE firms are consolidating.

How to invest in PE and Private Credit right now:

Wait, probably.

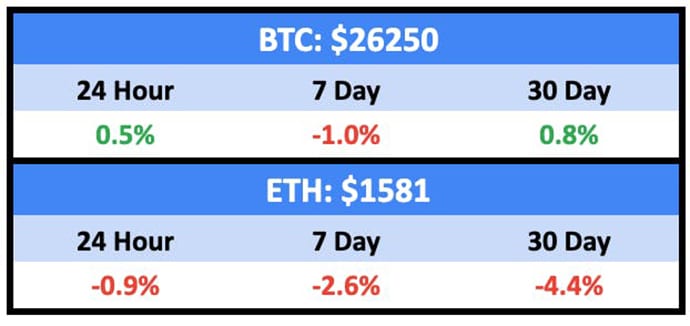

Crypto & NFTs 🪙

Here’s what you need to know:

Crypto sang to its own tune last week.

With investors mostly treading water.

But NFTs had a tough go of it.

Bullish News

- In Japan, startups will be allowed to offer cryptocurrencies instead of stocks when receiving investment from investment funds.

- Grayscale has applied to launch an ETH ETF.

- Tim Draper has launched a crypto accelerator.

- eToro has secured crypto registration in Europe for the first time.

Bearish News

- Crypto funds have seen $500 million outflows over the last two months.

- The SEC is coming after more exchanges and DeFi.

- 95% of NFT collections are worthless

- But isn’t that what everyone expected to happen?

- Australia’s corporate regulator is suing Bit Trade for failing to comply with design and distribution obligations.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick Hits

Music Rights

Second big music rights announcement in as many weeks. Katy Perry has sold her music rights to Litmus Music for $225 million. Litmus is back by Carlyle and the deal includes the master recordings and publishing rights five albums she released between 2008 and 2020: “One of the Boys,” “Teenage Dream”, “Prism,” “Witness” and “Smile.” Universal Music Group continues to own the masters to those albums.

Check out Stefan’s primer on music rights investing to understand exactly what Litmus has got itself into.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at CalTier.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.