Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite.

Table of Contents

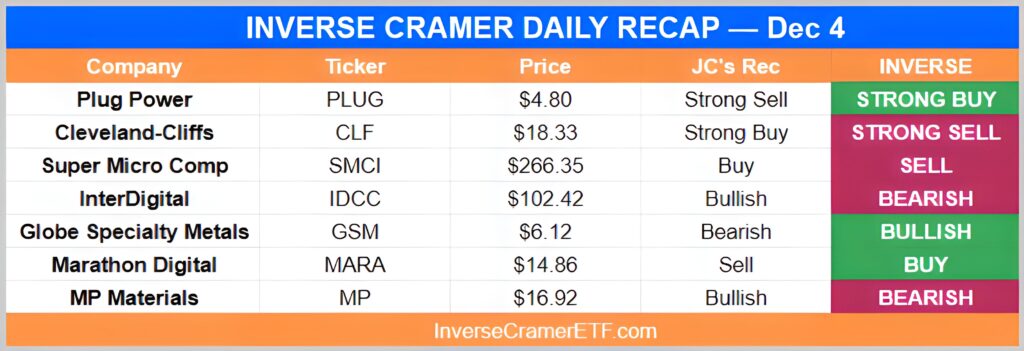

Monday, Dec 4

No, I’m pulling the plug on plug (Sell, Sell, Sell). They keep on missing the quarters. No go for me.

-On Plug Power ($PLUG)

It’s a derivative of Nvidia, frankly. Kind of one more company that’s involved in supercomputing, I like it.

-On Super Micro Comp ($SMCI)

You wanna own Bitcoin, own Bitcoin.

-On Marathon Digital ($MARA)

Jim missing Coinbase both ways is the most Jim thing ever$COIN now +173% since he went bearish😂 pic.twitter.com/WLqg9MZ7pA

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) December 5, 2023

Tuesday, Dec 5

I like Take-Two. I’ve watched the trailer of Grand Theft Auto, I thought it was amazing. I’ve got to tell you, a lot of people expected that this season would be rushed, it is not. You own a stock because it’s a multi-year growth. I’d buy it.

-On Take-Two Interactive ($TTWO)

Hold on to it. It had a very big spike. By far the best in the group and a good yield.

-On Stellantis NV ($STLA)

No, too dicey. I would actually prefer Deckers to Crocs. I feel a little more convinced that Deckers would have a better holiday season.

-On Crocs ($CROX)

Ever wondered how expensive medical care is in the US?

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) December 5, 2023

Zuckerberg tore his ACL and moments after surgery sold his first $META shares in two years pic.twitter.com/SF8pJS8jiR

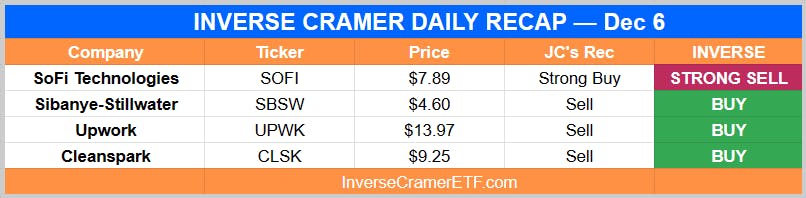

Wednesday, Dec 6

When we’re going down there, we’re just going to buy GOLD because we can’t fool around with bad operators.

-On Sibanye-Stillwater ($SBSW)

No, I don’t wanna buy an online recruiter right now. We are going to have a slowdown in jobs. If we get a Friday number that’s weaker, we gonna say why do we own that stock.

-On Upwork ($UPWK)

When we wanna buy cryptocurrency, what we do is buy cryptocurrency. Just go right in there and we buy Bitcoin. Simple as that.

-On Cleanspark ($CLSK)

Jim Cramer on Bitcoin at $24k…"I would sell my Bitcoin right into this Rally"

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) December 6, 2023

Oops pic.twitter.com/MTQYxJ7jFg

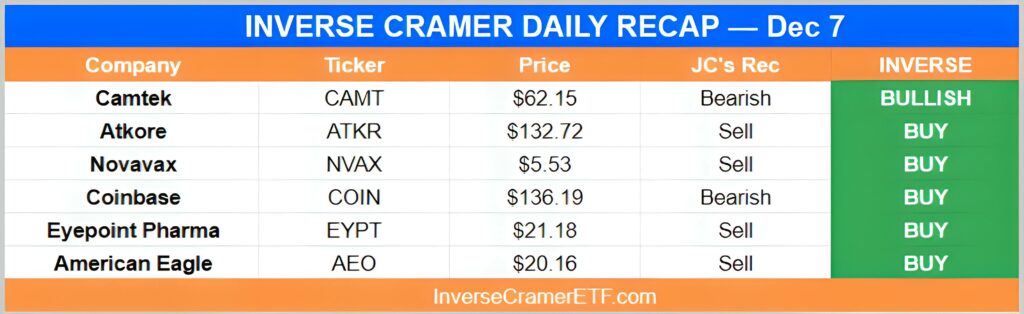

Thursday, Dec 7

I just dislike the company entirely. I’ve done so for very very long time, even when it’s much much higher. Nothing good to say about it.

-On Novavax ($NVAX)

The stock has doubled. I’m worried about that the stock is too expensive. Let it come down.

-On Coinbase ($COIN)

The stock has been straight up so therefore the easy money is made here. You’ve got to find something else

-On Eyepoint Pharma ($EYPT)

“Yeah you know Wolf of Wall Street right? Yeah so that’s basically what I do” pic.twitter.com/uyP0QbFxVT

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) December 7, 2023

Friday, Dec 8

I think the government is going to block that merger. They like to stop anything that would actually help some consumers because it might lower prices.

-On Kroger ($KR)

They’re doing such a great job. The stock is breaking out. The Brazilian market is crushing it in Mexico. Buy SAN.

-On Banco Santander ($SAN)

Weekend Bonus

GET OFF THAT PLANE https://t.co/MqYX0qpquN

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) December 8, 2023

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by our friends at Alto and Stocks & Income

- The ALTS 1 Fund has any holdings in any companies mentioned in this issue

- I am long $SOFI and $UPWK

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.