Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite

Table of Contents

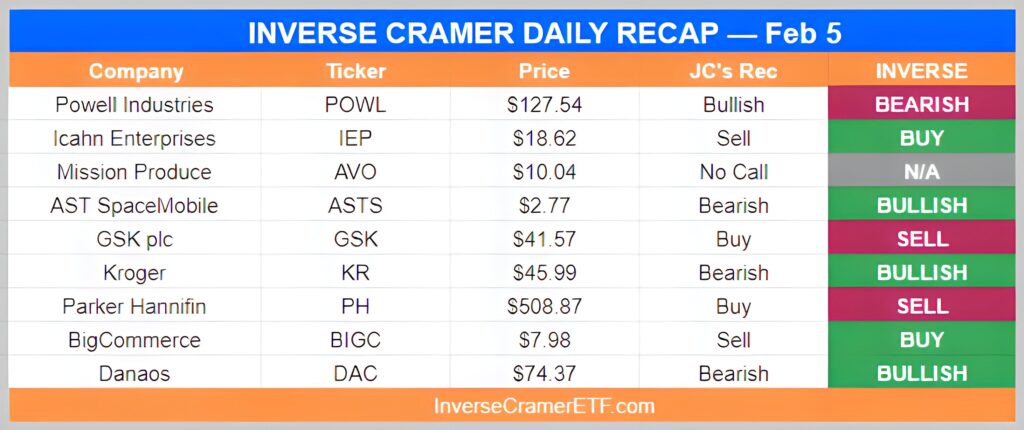

Monday, Feb 5

I have no idea what it owns. I’ll not recommend stocks in Mad Money where I do not know what they really own.

-On Icahn Enterprises ($IEP)

These guys gotta make money. And I don’t see any way shape or form of them making money so I’m gonna hold off on that one.

-AST SpaceMobile ($ASTS)

We’re fine with Kroger but the CFO just quit. I’ve got to find out what the heck is going on. They’re CFO is really good, but so it happens. We’re gonna hold off right now for Kroger.

-On Kroger ($KR)

No. We had Amazon. We’re Amazon people.

-On BigCommerce ($BIGC)

I'm just gonna start a thread here …

— Alex Monahan (@AlexMonahan100) January 30, 2023

Feel free to ask me anything about sports betting & I will answer publicly

Example of a good question: "How did you make $91,113.75 off DraftKings in 2021?"

😎😎😎 pic.twitter.com/vu6Ml7ukd7

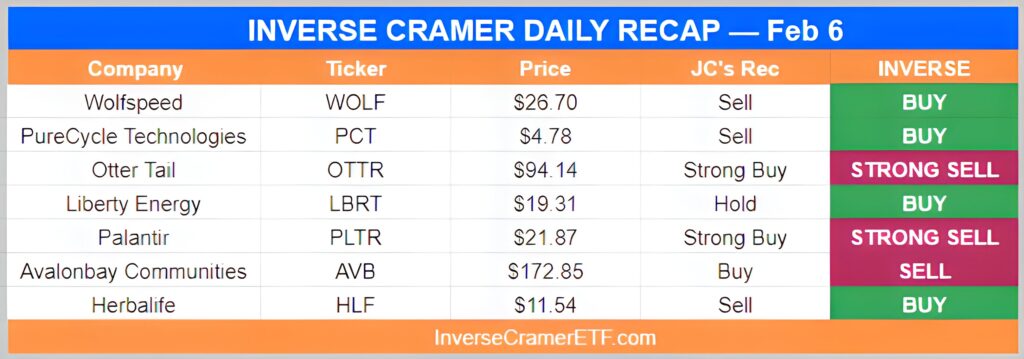

Tuesday, Feb 6

Nah, losing too much money. Second rate player. C’mon, we’re stepping up the game. We are Palo Alto Network fans.

-On Wolfspeed ($WOLF)

I mean Otter Tail, utility, look at this thing, it’s unbelievable. I say Buy, Buy, Buy.

-On Otter Tail ($OTTR)

(Buy, Buy, Buy) Listen to me, Karp hates me, I really don’t care. I like what he did. I don’t understand exactly but kind of self-fulfillment but it wasn’t really that. I like his bombastic nature. I am calling him officially, right here right now, the Dave Portnoy of cybersecurity.

-On Palantir ($PLTR)

You’ve got to step up your game. Not good enough. We don’t want. We want high quality.

-On Herbalife ($HLF)

Congress member = legal

— Insider Tracker (@TrackInsiders_) February 6, 2024

Anyone else = jail pic.twitter.com/NvHOebmf5B

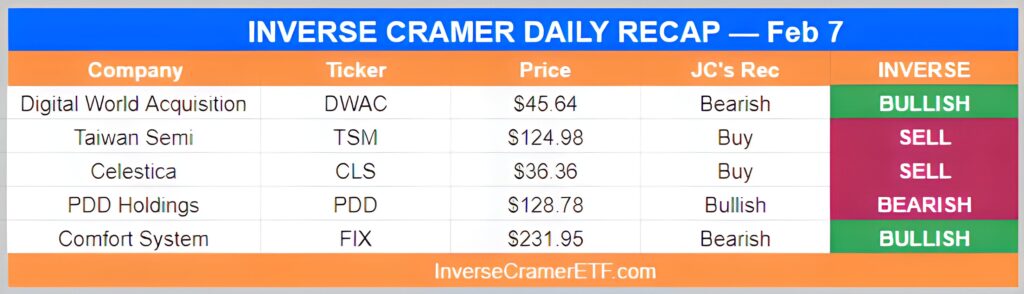

Wednesday, Feb 7

I think the reason why it sells on a lower multiple on all the stock is the geopolitical risk. Which I think is overstated at the moment, given the fact that China seems a little less inclined to take offensive action. It is a great company, what can I say.

-On Taiwan Semi ($TSM)

That’s a contract manufacturer. These companies are doing very well. I like them. They kind of have this unknown cohort that used to be very much talked about. You’ve got a good one there.

-On Celestica ($CLS)

I don’t want to use the term invest, I think you can trade this. I believe that the PRC is desperate to move the stock market up including PDD. I was surprised that Alibaba reversed today, I know the government wants that stock higher.

-On PDD Holdings ($PDD)

Remember NFTs? pic.twitter.com/Vumye660is

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 7, 2024

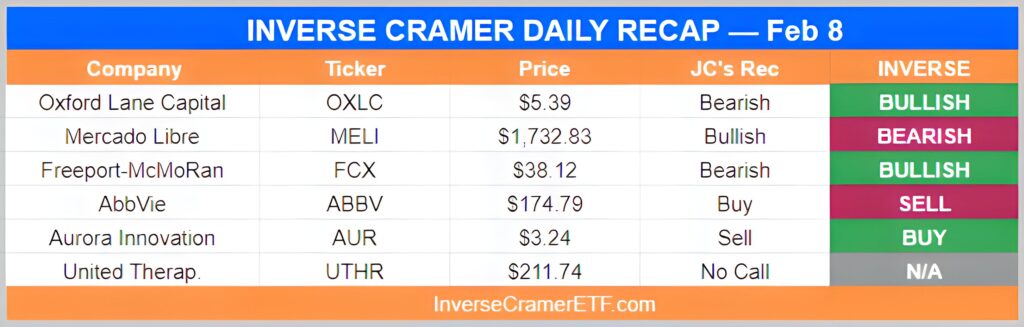

Thursday, Feb 8

The problem is we don’t know whether they’re any good at credit. We also don’t know what they own. I like the concept but in that sense, I think I’ll be looking at Blackstone because they know how to do it.

-On Oxford Lane Capital ($OXLC)

I think it could go up a couple of points once the Chinese start to manipulate their market higher, but that’s all that you’re gonna get. We want high quality.

-On Freeport-McMoRan ($FCX)

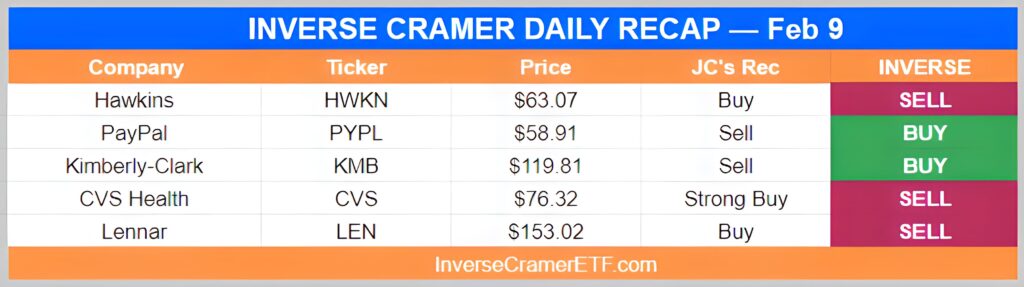

Friday, Feb 9

Yes, buy more Hawkins. The water chemical business had a tough time last year, I don’t think it will repeat itself. I think the stock is a buy.

-On Hawkins ($HWKN)

You should be worried. The CEO, basically, laid out a tail. The stock just jumped 3 bucks, you have a chance to sell. Do it for half of your position.

-On PayPal ($PYPL)

No, but Karen is executing a turn. It’s a very big turn, I think it’s gonna work, but not overnight. I am a believer.

-On CVS Health ($CVS)

Lennar is so good. It goes higher.

-On Lennar ($LEN)

The initial declines in both Affirm and Pinterest show that the fear of a decline-and getting ahead of it–dies hard. Those panicked sells told you a great deal about the real mindset of this market

— Jim Cramer (@jimcramer) February 9, 2024

Cramer Classic

Bitcoin is up 20% since, legend😂 pic.twitter.com/uQwGrs1gVN

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 10, 2024

Weekend Bonus

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) January 10, 2024

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by DraftKings

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.