Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite 🙃

Table of Contents

Monday, Feb 19

No show (President’s Day)

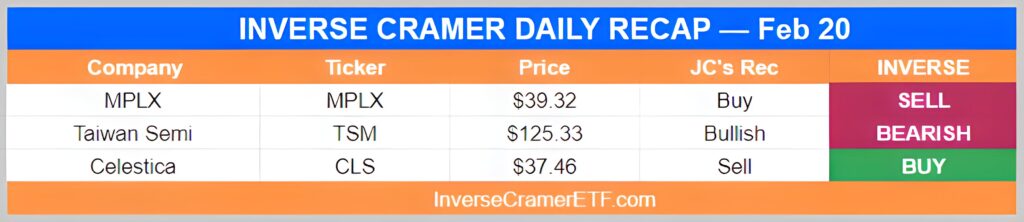

Tuesday, Feb 20

I like it very much. I like the pipeline. That’s like a fixed-income bond. It’s a very good situation.

-On MPLX ($MPLX)

We’re gonna let these stocks come in a little here. We’re seeing what’s happening – they’re rolling over. We’ll have to let them come down, and get great prices. We cannot be so eager to buy the first dip.

-On Taiwan Semi ($TSM)

You know what you gonna do there? Ring the register. Sell one-third of it. Celestica is in a very dicey situation, and it’s a contract manufacturing.

-On Celestica ($CLS)

Oh dear💀 pic.twitter.com/H3XCux3dfc

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 21, 2024

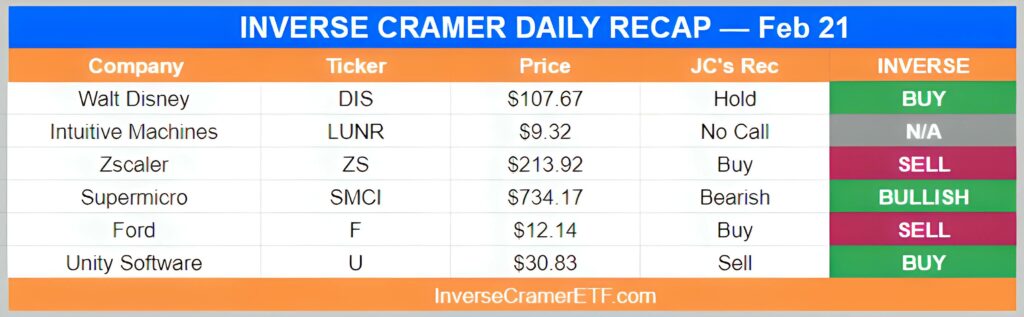

Wednesday, Feb 21

Right now all I’ve got to say is we own the stock for the capital trust and stay tuned.

-On Walt Disney ($DIS)

They’re the best. It’s a good one to buy. It’s down now from $259 to $213. Dave once again brings a level of wisdom and patience to the product and I think his right.

-On Zscaler ($ZS)

This one is too hard. I’m now willing to say that this one is make or break. This one is too hard for me.

-On Supermicro ($SMCI)

Ford stalled. All I can come up with is it’s stalled.

-On Ford ($F)

Mankind lives to see another day pic.twitter.com/Nmlpoucm8C

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 21, 2024

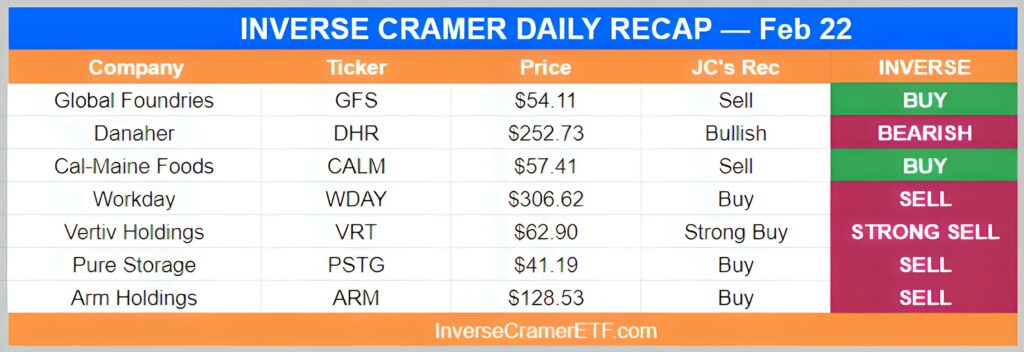

Thursday, Feb 22

It’s an interesting stock. I’m not a big foundry guy unless it’s Taiwan Semi.

-On Global Foundries ($GFS)

What a comeback that Danaher has made. That thing has been a rocketship ever since the IPO market started falling. It could go higher.

-On Danaher ($DHR)

Unnecessary stock to own, frankly. Ineffectual, and not there for me, I do like Tyson on an evaluation discount.

-On Cal-Maine Foods ($CALM)

Workday, Salesforce, and ServiceNow are the three that have the models I like. They are true platform companies. We are behind them all the way. You’ve got three winners there.

-On Workday ($WDAY)

You play with a house of money. You’re in great shape. That quarter is magnificent. They have a fantastic management. They’re the guts of data centres. Stay long, and congratulations, great work.

-On Vertiv Holdings ($VRT)

They’ve gotten their act together. This has been an inconsistent company that is now an enterprise. They really do have it together. It’s a good one that I would not let go. It should have a higher multiple given its consistency.

-On Pure Storage ($PSTG)

$NVDA market cap: $2 trillion

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 23, 2024

Entire crypto market cap: $2 trillion

Choose your fighter

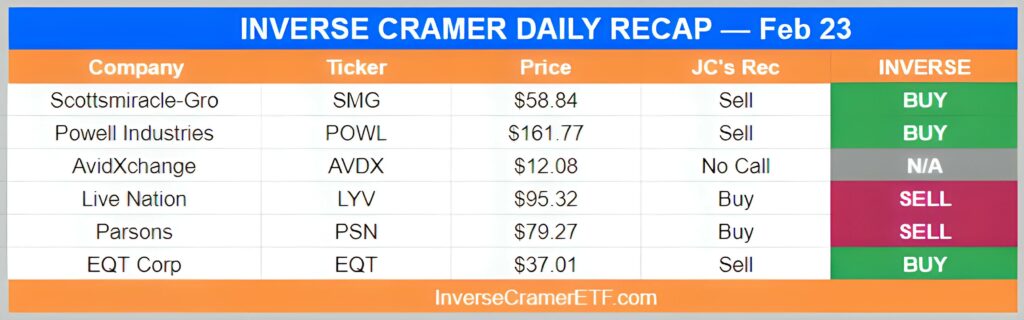

Friday, Feb 23

I used their product. I’m a big gardener. Here’s my concern. If the weather is not good Scotts Miracle can go down and not do well enough, therefore I cannot recommend the stock.

-On Scotts Miracle-Gro ($SMG)

This will be another great year for them. They’re so well ahead of plan.

-On Live Nation ($LYV)

Parsons is one of a couple of infrastructure stocks that I look at myself and think why did I not have it? I’ve been the biggest bull in infrastructure. This is a great company. I actually know this company from the 50s. Anyway, I miss it, my bad, I think it can go higher.

-On Parsons ($PSN)

Babe wake up Nvidia's market cap just crossed $2T pic.twitter.com/6UaUSX5xoC

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 23, 2024

Cramer Classic

Look at him, that's my quant.

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 23, 2024

My quantitative. My math specialist.

Look at him, you notice anything different about him?

Look at his face.

Look at his eyes.

I'll give you a hint.

His name is Jimmy Chill. pic.twitter.com/7buCWuUwSU

Weekend Bonus

Nancy Pelosi is now up nearly 85% over the past year

— Insider Tracker (@TrackInsiders_) February 22, 2024

Her $5M worth of $NVDA call options are up 50% in the past 60 days alone

Greatest to ever do it pic.twitter.com/qIKvfEmwlI

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by Tuttle Capital

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.