Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you ↓

Table of Contents

Billions In Insider Selling Activity… Time To Panic?

Recent headlines have spotlighted high-profile executives and company insiders selling off billions in stock, stirring fears of an impending financial disaster.

However, a deeper look reveals that most of these sales were pre-planned, only a small fraction of these individual’s holdings were sold, and in the context of record-high prices, these sales might not be so worrisome.

The Rising Political Divide: Homeownership vs. Renting

The gap between homeowners and renters in the U.S. is not just economic, but increasingly political.

New data reveals the growing polarization: homeowners are more likely to identify as Republican, while renters lean Democrat. This divide has intensified since 2004, with homeowners twice as likely to be strong Republicans compared to renters.

20 Lessons From 20 Years In The Trenches

via A Wealth of Common Sense

Veteran wealth manager Ben Carlson celebrated his “20 years in the business” milestone with a value-packed recap of his top lessons.

Some of my favorites:

- Why intelligence doesn’t guarantee investment success

- The paradox of “set-it-and-forget-it”

- The paradox of “overthinking”

- The difference between experience and expertise

Skip the 20 years of painful learning, and read the full post.

Mexico’s Economic Renaissance

Mexico is experiencing an impressive economic transformation, with real nonresidential construction up 50% above pre-pandemic levels and Mexico surpassing China as America’s top source of imports.

How did Mexico break its long streak of GDP stagnation? More from Joseph Politano.

Spending A Trillion Dollars in 100 Days—How Long Can It Last?

The U.S. national debt continues to balloon to unprecedented levels.

In light of a shocking increase of $1 trillion in just 100 days and a projection of $54 trillion in a decade, Peter Schiff questions the sustainability of this debt growth.

Could this be the tipping point for a major economic reset?

The Uncertain Future of Car Manufacturing

Drawing parallels with the demise of horse-drawn carriages and Nokia’s fall from grace, Vitaliy delves into the precarious position of traditional car manufacturers amidst the electric vehicle (EV) revolution.

While the past success of the manufacturers has been undeniable, the rapid shifts in both technology and consumer demand may make for an uncertain future.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

The latest news, tools, and step-by-step tutorials of all the latest in AI.

A 2-minute rundown of an exciting startup every Monday morning.

The most important tech news and insights. Join 80,000+ early adopters staying ahead of the curve, for free.

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

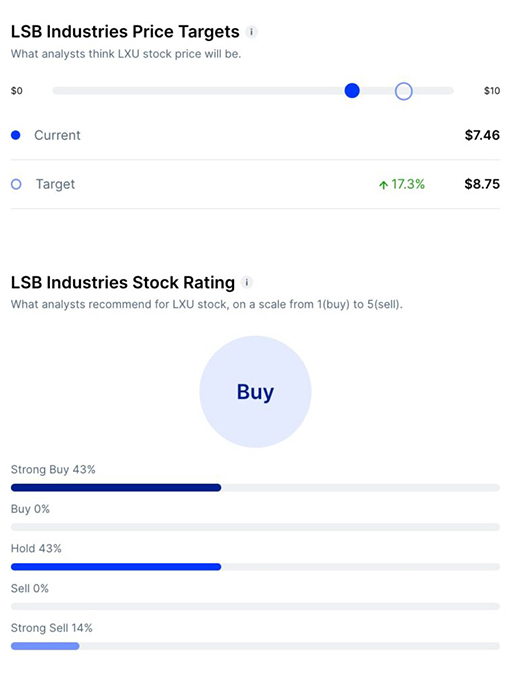

LSB Industries ($LXU)

Bull Case:

- Emerging Markets: LSB is poised for growth in emerging markets like maritime shipping and hydrogen transport.

- Strategic Partnerships: Collaborations on large-scale, low-carbon ammonia projects highlight LSB’s potential for growth.

Bear Case:

- Earnings Volatility: LSB’s fluctuating earnings and recent drop in EBITDA suggest potential risk.

- Financial Concerns: The company’s debt-to-equity ratio and forward P/E ratio raise questions about its debt management

- Industry Risks: LSB faces risks from raw material price fluctuations and regulatory changes.

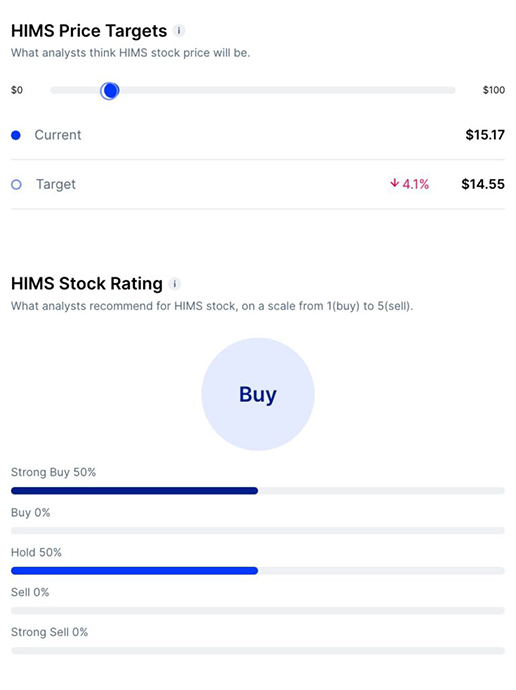

Hims & Hers Health, Inc ($HIMS)

Bull Case:

- Growth Projections: Analysts predict substantial increases in HIMS’ revenue, with growth estimates for fiscal years 2024 and 2025 reaching 24% and 40%.

- Long-Term Targets: HIMS aims for adjusted EBITDA margins between 20%-30% long-term.

- Undervalued Stock: HIMS trades at significant discounts compared to its historical levels and peer averages.

Bear Case:

- Market Pressures: HIMS faces intense competition in the evolving telehealth and direct-to-consumer healthcare markets.

- Stock Price Volatility: The company’s stock has shown significant volatility, such as its increase from $8.90 to $14.61 in 2024.

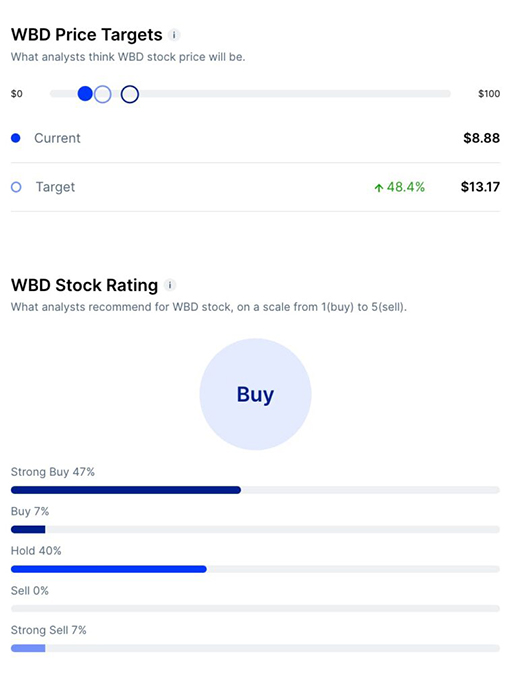

Warner Bros. Discover ($WBD)

Bull Case:

- Subscriber Growth: WBD’s venture into sports streaming, alongside Disney and Fox, is expected to attract 5 million subscribers within five years.

- Diverse Portfolio: The company’s broad range of content, brands, and franchises across television, film, streaming, and gaming, combined with a significant global presence, offers a solid foundation.

Bear Case:

- Earnings Challenges: WBD has experienced significant EPS declines, with recent quarters missing expectations and shifting from profit to loss compared to the previous year.

- Market Pressures: Intense competition in media and entertainment, along with fluctuations in consumer preferences pose significant risks.

- Merger Talks Halt: The halting of merger talks with Paramount indicates potential strategic limitations.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.