Sneakers Investing – Sep 20, 2021

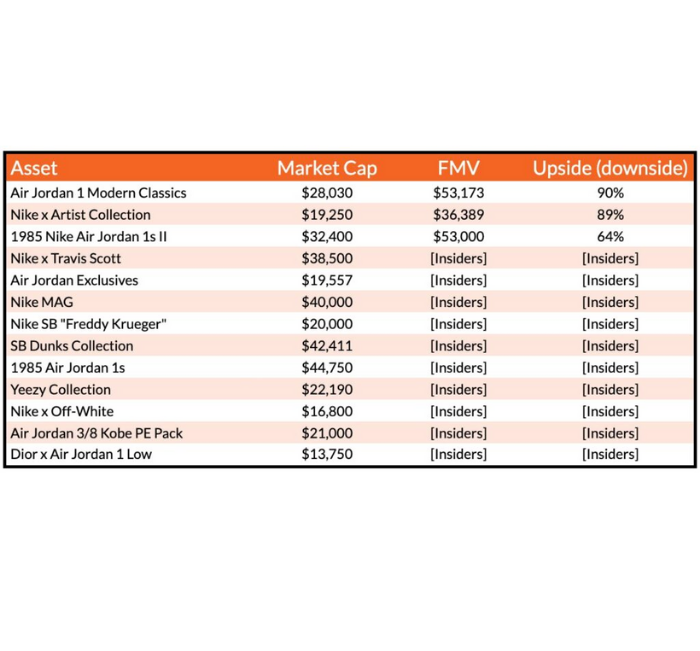

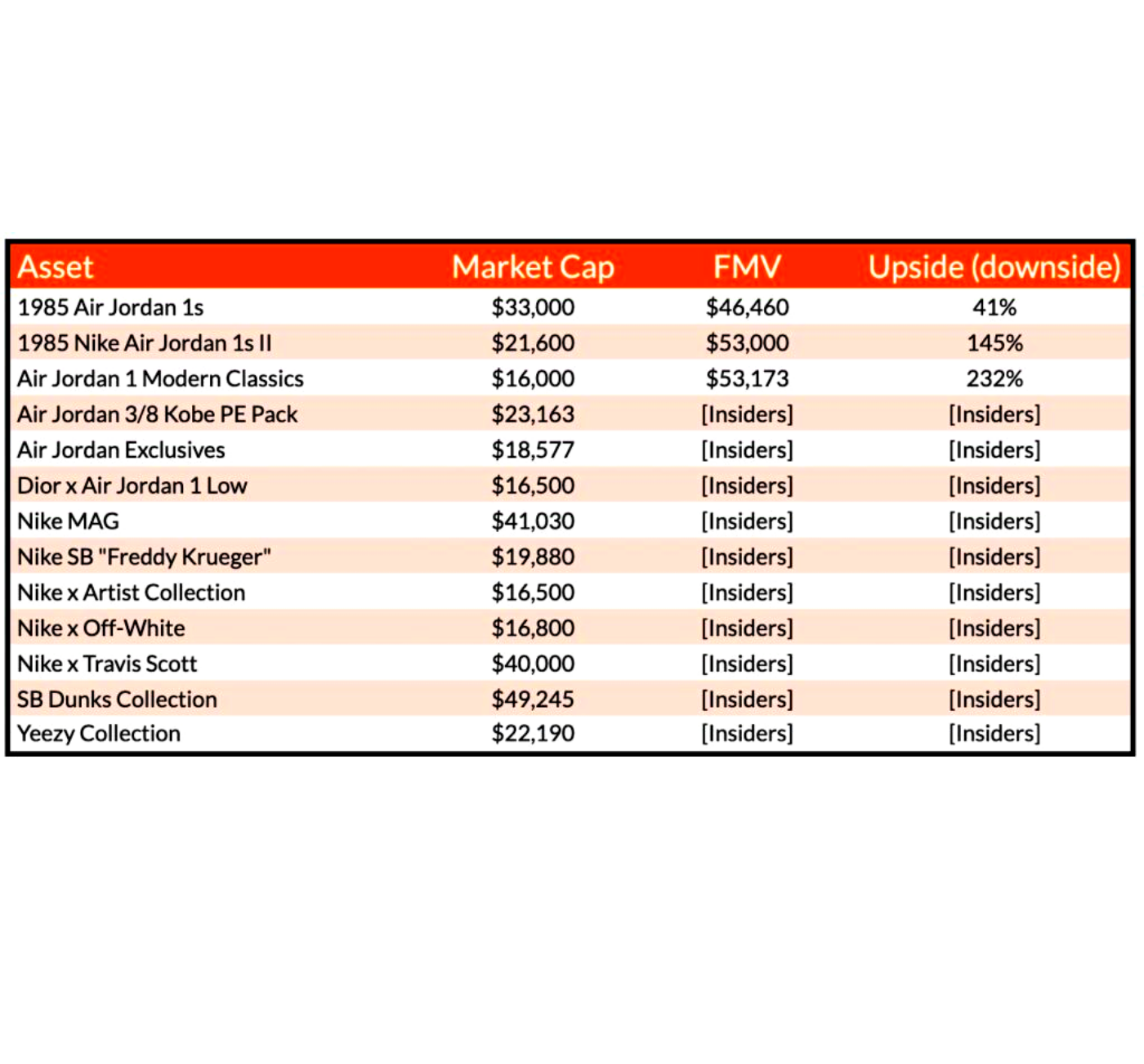

Every Monday, we compare the market cap for sneakers to the inferred value based on recent sales on sneaker trading platform StockX.

If luxury collectibles are the “gateway drug” to modern alternative assets, then sneakers are the gateway drug to luxury collectibles.

Sneaker collecting and reselling has gained significant popularity in recent years. It has evolved from everyday footwear to highly sought-after fashion with a global appeal; often associated with limited editions, collaborations, and iconic brands.

Investing in sneakers involves acquiring and holding sneakers with the expectation that their value will appreciate over time. Factors that influence the value of sneakers include rarity, brand reputation, celebrity endorsements, historical significance, and overall demand in the market.

Building a collection of coveted sneakers requires staying informed about trends, understanding the sneaker market, and being aware of releases and collaborations. Sneaker enthusiasts often leverage online marketplaces, social media communities, and specialized sneaker reselling platforms to buy and sell sneakers for potential profit.

Sneakers are a fairly liquid market with supportive ecosystem. You can even insure your sneakers.

However, it’s important to note that investing in sneakers comes with risks, including fluctuations in demand, market saturation, and counterfeit products. Proper authentication, buying from reputable sources, and understanding the condition of the sneakers are crucial aspects to consider. Investing in sneakers can be an exciting and potentially profitable venture for those with a passion for fashion and an understanding of the market dynamics.

Every Monday, we compare the market cap for sneakers to the inferred value based on recent sales on sneaker trading platform StockX.

Every Monday, we compare the market cap for sneakers to the inferred value based on recent sales on sneaker trading platform StockX.

We use Moneyball tactics to discover sneaker arbitrage opportunities across the fractional platforms. Note: Sneaker markets trade thinly and there typically aren’t any catalysts to cause the share price to snap to fair market value. So: (a) the assets could stay mispriced for a long time, (b) there may not be sufficient trading volume to sell all the shares you want to when you want to.

Every Monday morning, we compare the market cap for all trading sneakers on Rares and Otis to the inferred value based on recent sales on sneaker trading platform Stockx.

Every Monday morning, we compare the market cap for all trading sneakers on Rares and Otis to the inferred value based on recent sales on sneaker trading platform Stockx.

Every Monday morning, we compare the market cap for all trading sneakers on Rares and Otis to the inferred value based on recent sales on sneaker trading platform Stockx.

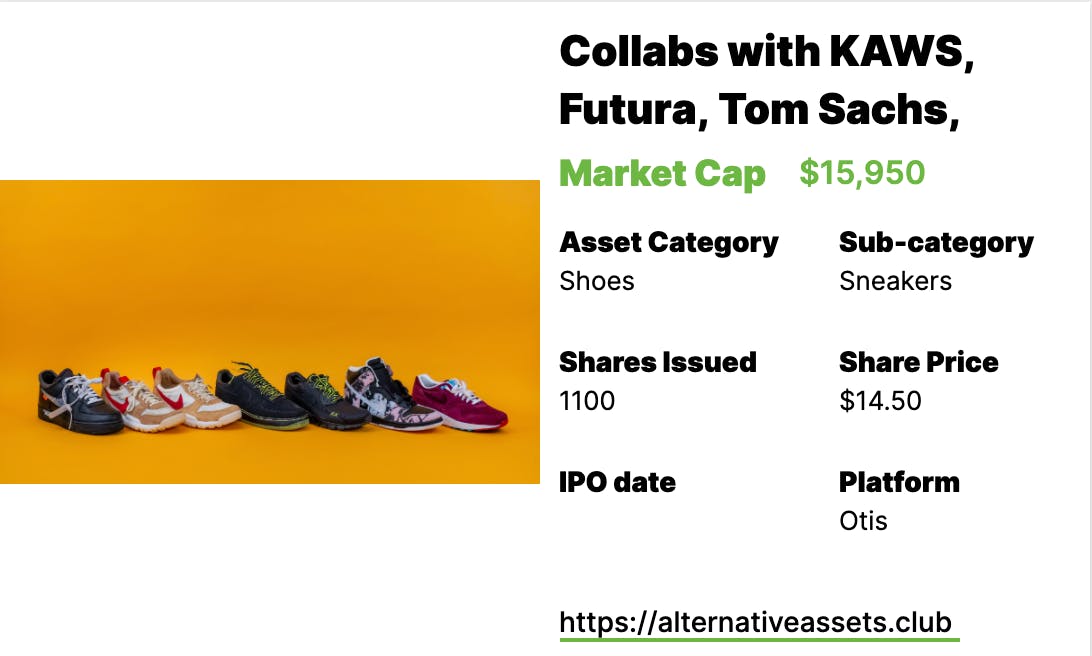

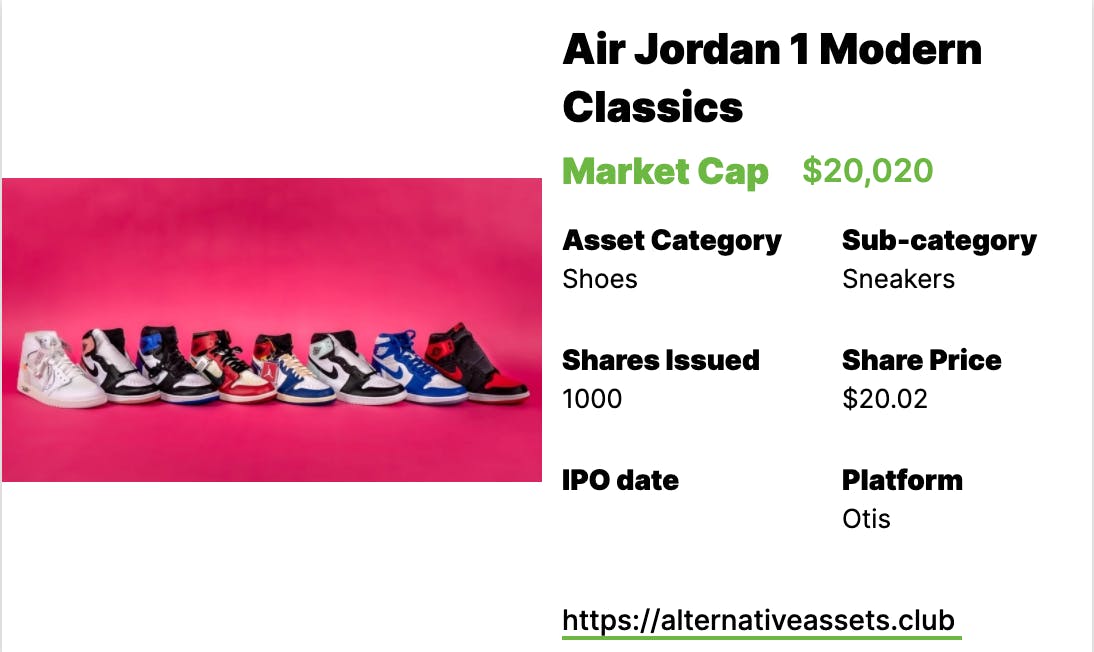

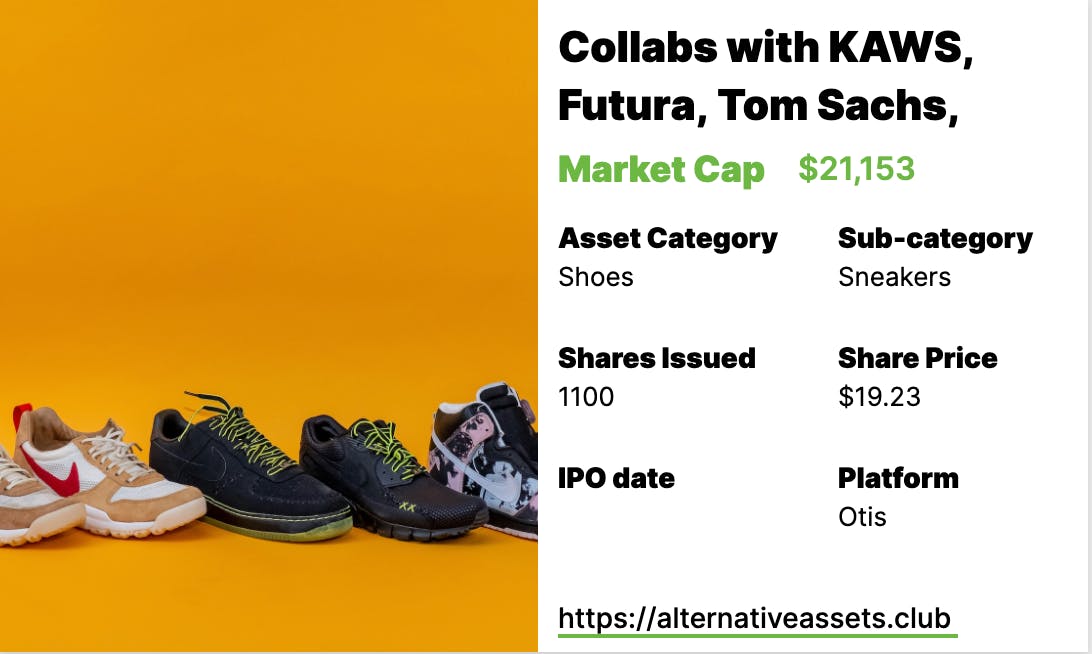

1985 Air Jordans 1s II, Nike x Artist Collection (Kaws, Futura, Tom Sachs), and Air Jordan 1 Modern Classics

Air Jordans 1s II, Nike x Artist Collection (Kaws, Futura, Tom Sachs), and Air Jordan 1 Modern Classics

1985 Air Jordan 1s II, Nike x Artist Collection, & Air Jordan 1 Modern Classics

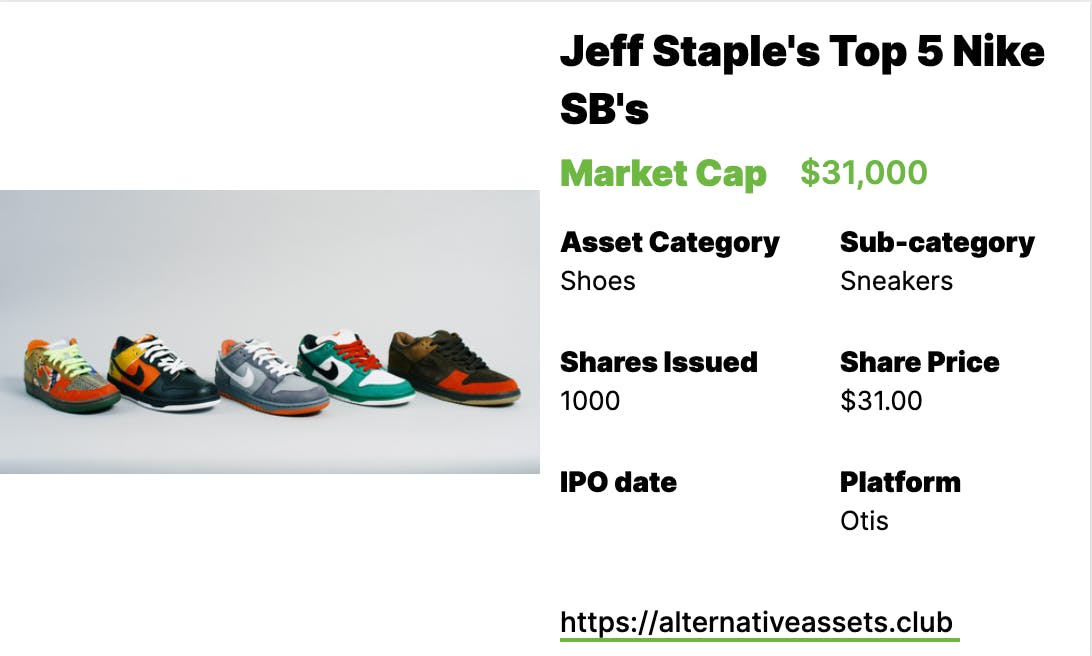

1985 Air Jordan 1s, Nike x Artist Collection, SB Dunks collection

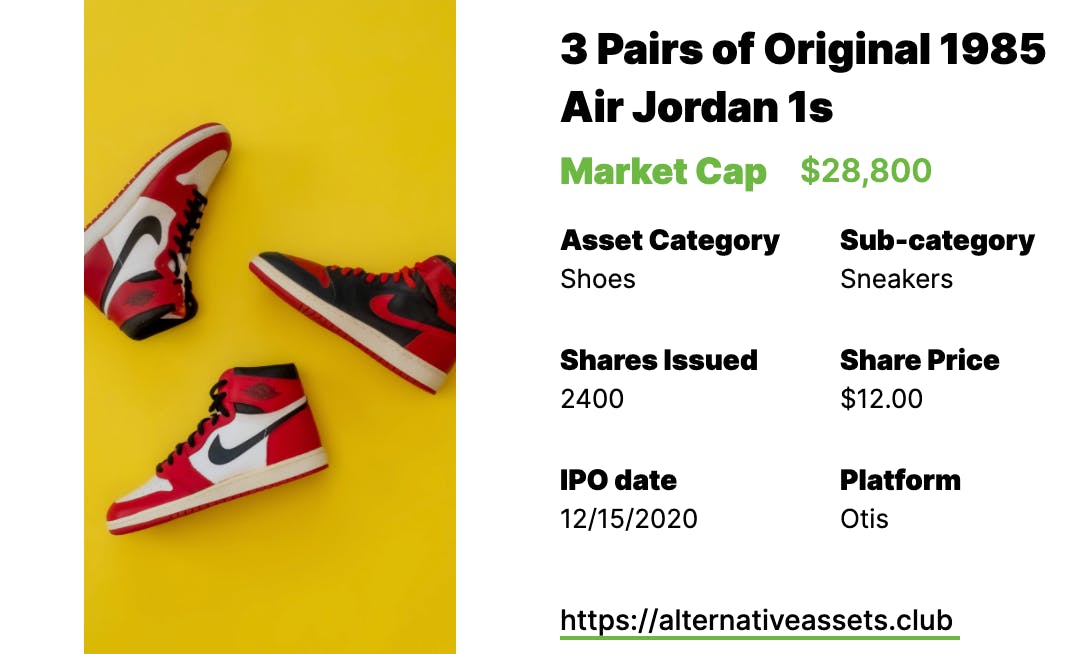

While there aren’t any sneakers IPO’ing at the minute, we’ll look at assets currently trading on Otis, the only fractional platform listing them.

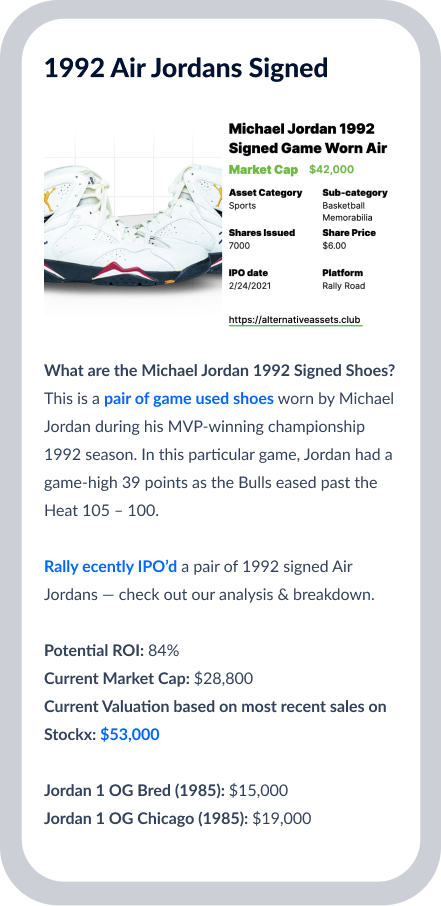

This week we dive into an asset class that we haven’t written about yet, but which has had steady, loud drumbeat for years: Sneakers ????

We create indices for eclectic modern alts. We’ve got a vinyl index, a whiskey index, and more. This helps us find the best buying opportunities for our alternative investment fund

We wrap everything up with a rich qualitative analysis. You’ll understand the pros & cons of investing in all sorts of alternative asset classes.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |