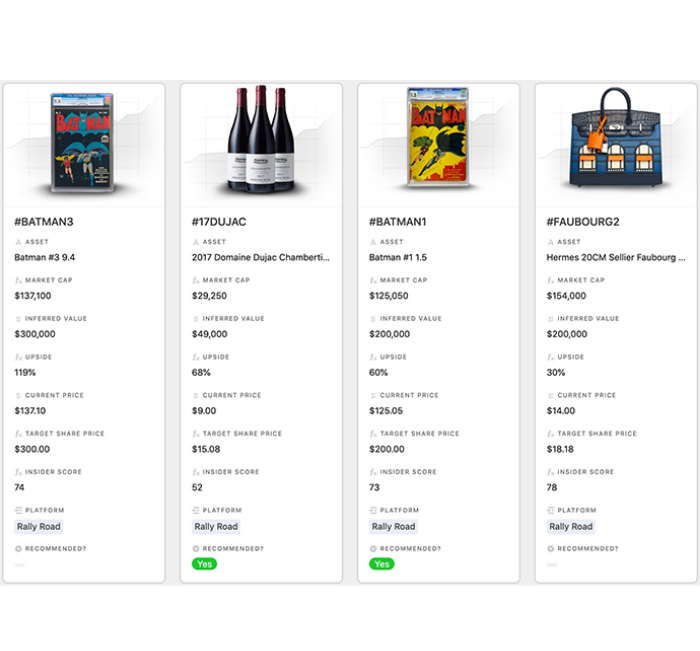

Overview of our current Alts portfolio

Welcome to the Fractional Trading & Index Update for 10th January 2022. This is the world’s first index that tracks the performance of all IPOs across Rally, Collectable, and Otis since inception, and gives individual results for each platform.