This is a special deal for us. Through Altea, we’re a pilot program user of Acquire’s Invest I.Q. Platform, and I’ve had the good fortune to work closely with CEO Brian Harstine and his team.

Brian is raising an Angel Bridge Round to close out the MVP / Pilot phase of the platform before engaging with VC for a seed round later this summer.

This small bridge round is valued at the same as the founders’ equity investments — $10 million

Acquire’s seed raise, which Brian aims to kick off in a few months, will be at a $15 million to $20 million valuation.

You can invest directly here, or if you want t0 learn more:

Let’s get to it.

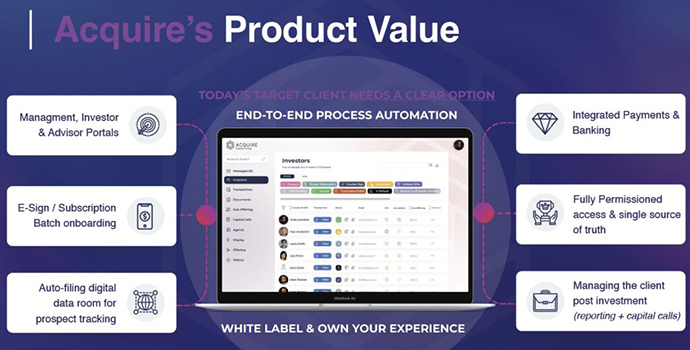

Acquire’s mission is to simplify and automate private market investments for issuers and investors through its Invest I.Q. Platform.

Table of Contents

Deal Basics

Investment Type: SAFE

Investment Stage: Pre-seed bridge angel round

Raising: $350k allocation to Altea

Valuation: $10m on a 20% discount to SAFE note

Deadline: June 30, 2024

View the deck: here

View the SAFE Document here

We’ll host a Q&A session with Brian on June 6th. RSVP here.

Or if you’re ready now, invest here.

Deal Overview

Acquire aims to revolutionize the private market investment landscape by streamlining and automating operational processes through its Invest I.Q. Platform. Founded in 2020, the company leverages advanced technology, including blockchain, to enhance efficiency and reduce costs for private market issuers, asset managers, family offices, funds, and administrators.

Highlights from my Q&A with Brian and Lisa

What is Acquire, and what are they doing?

Making the GP experience delightful

Why Acquire Beats Other Investor Platforms

How does Invest IQ change the investment landscape?

How does Acquire streamline the investment process?

Acquire’s white-label experience feels modern.

Is Acquire trying to do too much at once?

What’s the opportunity

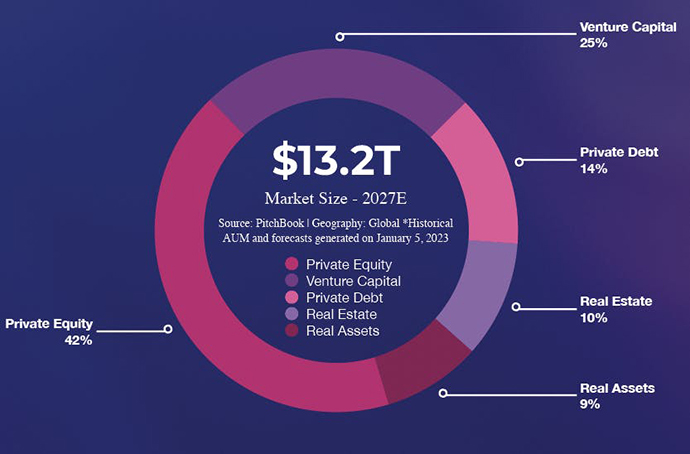

Acquire addresses the fragmented and inefficient private investment funds market, which manages over $13 trillion in assets under management (AUM).

More than 6,400 funds were incorporated last year, with an expected 67% growth in new funds in 2024. They will collectively raise $1.8 trillion in new capital.

Private market operations are plagued by disparate processes, multiple systems, and complex regulatory requirements, leading to inefficiencies and costs estimated at $207 billion annually.

Acquire’s I.Q. Platform offers a comprehensive solution to these challenges by automating customer acquisition, onboarding, document management, funding, and lifecycle processes.

Via its blockchain backbone, the platform ensures secure and scalable transaction settlements.

The strategic focus on private market issuers, coupled with the advanced technological infrastructure, presents a transformative opportunity for investors seeking to capitalize on the evolution of private market operations.

Deal Economics

The team is raising a small Angel Bridge Round to fill in the missing pieces before a VC-facing seed round in a few months. Specifically:

- Reach $250,000 ARR

- Hire team infrastructure for Sales, Customer, and Client support

- Finalize key features for the V2.0 to open Acquire up to new sales targets and further differentiate against competitors

Market Size

As they say, there’s a lot of money in money:

- Global Private Investment Funds: $13.2 trillion AUM (2023 estimate)

- U.S. Private Markets: 6400+ funds with a projected 67% growth in new funds in 2024, raising $1.8 trillion in new capital

- Estimated $207 billion in operational costs annually for fund operators and institutions

Growth Potential

The private investment funds market represents significant growth potential, driven by the increasing complexity of investment operations, regulatory pressures, and the demand for more efficient, scalable solutions. Acquire’s ability to automate and streamline processes positions it well to capture market share in a transitioning industry.

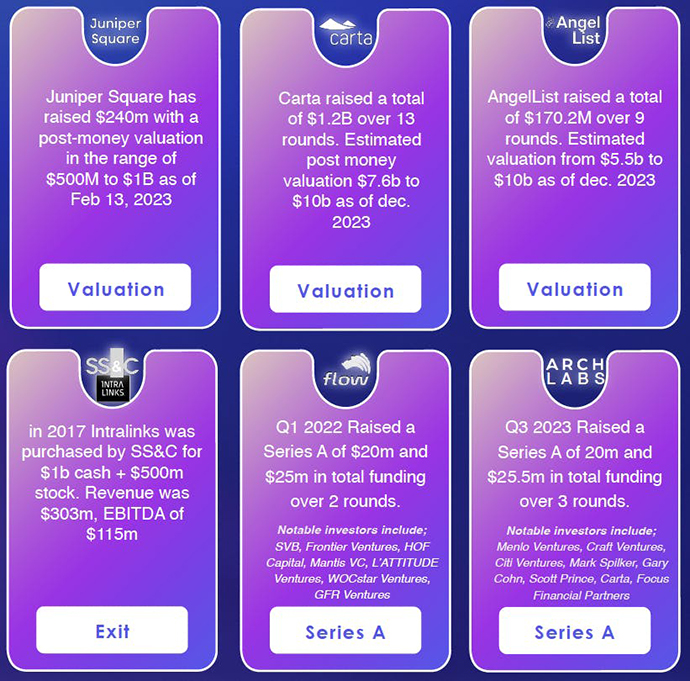

Valuation

Valuation for similar companies in the sector ranges significantly, but it’s clear that Acquire has the potential to wedge off a big slice of this pie.

What I like about the opportunity

Strong Market Potential:

The private investment funds market is substantial, with an estimated $13.2 trillion in assets under management (AUM). This presents a significant opportunity for growth. The U.S. private markets alone saw the formation of over 6400 funds last year, with a projected 67% growth in new funds expected in 2024. The demand for efficient and automated solutions in this expanding market creates a fertile ground for Acquire’s solutions.

Innovative Technology:

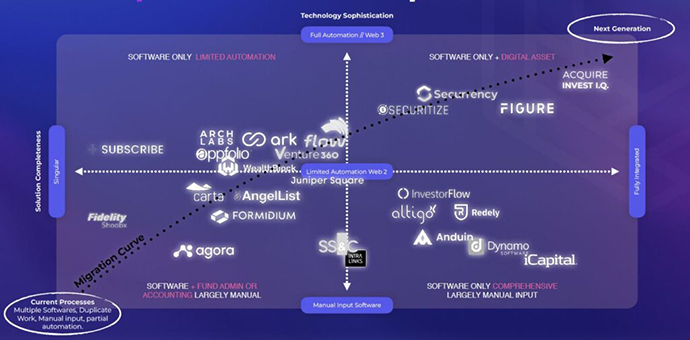

Acquire’sInvest I.Q. Platform leverages cutting-edge technology, including blockchain, to streamline and automate investment operational processes. This advanced technology not only enhances security and efficiency but also positions Acquire as a leader in WealthTech innovation. The company’s focus on reducing complexity and improving the investment lifecycle through automation offers a competitive advantage.

Comprehensive Solution:

Unlike many competitors that offer fragmented solutions, Acquire delivers a comprehensive, end-to-end platform that addresses multiple pain points in the private investment process. Its all-in-one solution reduces the need for multiple software, integrates seamlessly across operations, and scales efficiently. This translates to significant cost savings, enhanced operational efficiency, and a better user experience for fund managers and investors.

Experienced Leadership Team:

The company is led by seasoned professionals with deep expertise in fintech and investment management. Founder and CEO Brian Harstine and President Lisa Price bring a strong vision and strategic direction. Their combined experience and commitment to improving the private market investment landscape provide confidence in the company’s ability to navigate complexities and drive growth.

Strategic Market Timing:

The private market investment sector is currently undergoing significant transitions driven by regulatory shifts, technological advancements, and evolving investor expectations. Acquire is well-positioned to capitalize on these systemic changes. The increased demand for secure, efficient, and automated investment processes aligns perfectly with the capabilities of the Invest I.Q. Platform, presenting a timely investment opportunity.

The Risks

Competitors

Juniper Square

Competitive Position: Strong in the real estate investment management space

Strengths: Noted for its investor management and comprehensive reporting tools tailored for real estate firms.

Weaknesses: Limited diversification beyond real estate and relatively high pricing. Juniper also uses more offline manual input for much of the same data that Acquire automates.

Strategic Focus: Emphasizes efficiency in investor onboarding and reporting accuracy to enhance operational effectiveness.

Market Penetration: High within the real estate sector, established a significant presence among real estate investment firms.

Technology Integration: Robust traditional technology infrastructure, though it lacks some of the more innovative elements like blockchain that newer platforms might offer.

Carta

Competitive Position: Dominant in startup equity management and cap table services.

Strengths: Extensive user base with strong brand recognition and offers integrated services across equity management.

Weaknesses: Limited focus on comprehensive fund management, higher costs for advanced feature access. It relies heavily on human input for its system to function and further relies heavily on the fund admin service. Perceived lack of innovation.

Strategic Focus: Simplifies equity management, offers comprehensive valuation services and provides essential tools for startups.

Market Penetration: Wide among startups and private companies, Carta is a well-recognized name in the cap table management space.

Technology Integration: Streamlined and user-friendly, but less geared towards addressing the complexities of fund operations compared to its competitors.

AngelList

Competitive Position: Leader in startup fundraising, including syndicates and rolling funds.

Strengths: Large network of startups and investors, innovative investment models such as syndicates and rolling funds.

Weaknesses: Primarily focused on early-stage startups with less emphasis on operational automation for established funds. Expensive and relies on manual input. It doesn’t tackle connecting data processes.

Strategic Focus: Democratizes venture investing through flexibility and innovative funding structures.

Market Penetration: Extensive within the community of startups and investors, leveraging a large and active user base.

Technology Integration: Strong in facilitating investment transactions and networking, although focused more on early-stage investments than comprehensive operational solutions.

Intralinks

Competitive Position: Trusted entity in secure data sharing and collaboration for financial transactions, especially in due diligence for M&A activities. It’s used it a lot because everyone else uses it.

Strengths: Reputation for secure data handling and extensive use in M&A activities.

Weaknesses: High cost, focusing primarily on secure data sharing rather than holistic investment operations. Seen as stagnant and ripe for disruption.

Strategic Focus: Ensures data security and facilitates due diligence and secure transaction processes in complex financial operations.

Market Penetration: High within the M&A sector, particularly favored for its security features and reliability.

Technology Integration: Advanced in data security and secure transaction handling, though not as focused on automation and operational efficiencies outside of M&A processes.

How Acquire can differentiate itself

To effectively compete and stand out in the rapidly evolving fintech landscape, Acquire will focus on several strategic initiatives:

- Leverage blockchain technology for enhanced security and automation; future-proof fund offerings.

- Use modern infrastructure to enable advanced automation by connecting silos of manual processes.

- Offer a comprehensive solution to reduce the necessity of multiple software applications.

- Present a strong customer-centric approach to enhance user engagement.

- Stay ahead of regulatory demands.

- Focus initially on overpriced, low-hanging fruit.

- Ensure the platform’s scalability to manage multiple offerings efficiently.

If it does this, Acquire can position itself strongly against established players, capturing market share through innovation, efficiency, and superior user experience.

Other Concerns

There are a few risks outside Acquire’s control.

Economic Downturns

The private market and alternative investments are highly sensitive to economic cycles. An economic downturn in the U.S. could reduce investor appetite and reduce capital allocation to private funds. During recessions, investors typically gravitate towards more liquid and lower-risk investments, impacting the demand for software solutions tailored to private investments.

Interest Rates

The U.S. has been experiencing fluctuating interest rates. Higher interest rates generally decrease the attractiveness of riskier investments, such as private equity, venture capital, and other alternative investments. These environments often lead to reduced fundraising activities and capital deployment in the private markets.

Regulatory Changes

The private market investment landscape in the U.S. is tightly regulated and subject to frequent changes. Shifts in regulatory policies can increase compliance costs and create operational complexities for private funds.

Inflation

High inflation rates can erode investors’ purchasing power and increase operational costs for private funds. Inflationary pressures may also lead to increased fees and costs associated with investment operations and fund management services.

FAQs

What does Acquire do?

Acquire is a fintech company that aims to simplify, automate, and enhance private market investments for issuers and investors. Its primary product, the Invest I.Q. Platform incorporates advanced technology such as blockchain to streamline investment operations.

What is the Invest I.Q. Platform?

It is a technology solution designed to streamline and automate private market investment operations for issuers and investors.

What are the primary benefits of the platform?

The platform reduces complexity, improves investment cycle times, enhances investor engagement, ensures compliance, and offers scalable solutions.

How does the Invest I.Q. Platform enhance efficiency?

The Invest I.Q. Platform automates key processes such as customer acquisition, onboarding, document management, funding, and lifecycle management. This reduces manual tasks, minimizes errors, and improves cycle times for investment processes.

How does Acquire generate revenue?

Revenue will be generated through a subscription-based SaaS model, targeting private market issuers and investors. Pricing will be based on service levels.

What market size and growth potential exist for Acquire?

The global market for private investment funds is estimated at $13.2 trillion AUM, and it has significant growth potential due to increasing operational complexity and demand for efficient solutions.

Can you provide details about the team’s experience?

The leadership team includes Founder and CEO Brian Harstine and President Lisa Price, who have extensive experience in fintech and investment management. They are complemented by a skilled team of developers, project managers, and advisors who bring a wealth of knowledge and expertise to the company.

How does Acquire ensure compliance with regulatory changes?

The Invest I.Q. Platform is designed with programmatic compliance tools that are continuously updated to reflect the latest regulatory requirements. This helps fund managers and issuers adhere to regulations without the burden of manual compliance management.

What measures are in place to protect investor data and transactions?

Acquire employs advanced blockchain technology to ensure secure transaction settlements and robust data protection. Additionally, the platform incorporates state-of-the-art security protocols to safeguard client and investor information from cyber threats.

Like what you hear?

That’s it for today.

We’ll host a Q&A session with Brian on June 6th. RSVP here.

Or if you’re ready now, invest here.