Welcome to the WC, wherein you find yourself trapped in my mind for eight to ten minutes weekly.

Today I dive waaaaay down the Chinese rabbit hole. If you’re worried about China in one way or another — and you should be — come down the rabbit hole with me.

Today, we’ve got:

- Get stuck in with Euro 2024

- Apple killed the app star

- What’s happening in China?

Let’s go.

Table of Contents

Get stuck in with Euro 2024

And win some swag (more below).

Euro 2024 could be a turning point for football (soccer) in America.

The Euro 2020 tournament saw a 32% viewership increase in the USA over Euro 2016, with 87 million people tuning in. The final between England and Italy clocked nearly 10 million viewers in the States. The NBA finals that year averaged fewer than six million.

And it’s not just on TV. “When EURO 2024 tickets originally went on sale, no other nation’s fans outside of Europe requested more tickets than the United States.”

Three reasons I expect Euro 2024 to be even more popular than Euro 2020:

- Sports betting is now legal in the US.

- Messi

- America, Canada, and Mexico are hosting the 2026 World Cup.

This is to say that Alts is hosting a fantasy league for the tournament, and you should join. The winners will get some swag, and everyone else will learn something.

Would you like to know more?

The Numbers Game: Why Everything You Know About Soccer Is Wrong: David Sally & Chris Anderson. This book delves into the hidden analytics behind football (soccer), helping readers understand the sport in a more profound way. Given Euro 2024’s potential in changing how soccer is perceived in America, this analytical perspective could be particularly enlightening for fans and investors alike.

The Club: How the English Premier League Became the Wildest, Richest, Most Disruptive Force in Sports: Jonathan Clegg and Joshua Robinson. This book explores the immense economic growth and globalization of the English Premier League, offering insights into how and why soccer is gaining traction in places like the USA, as evidenced by the expected popularity of Euro 2024.

Soccernomics: Why European Men and American Women Win and Billionaire Owners Are Destined to Lose: Simon Kuper and Stefan Szymanski. This book combines economics and soccer, shedding light on why certain trends occur in the sport. With soccer’s growing popularity in the US, understanding these economic aspects can be crucial for fans and investors.

Apple killed the app star

In which we learn, yet again, about platform risk.

This week, Apple hosted what many say was it’s most important worldwide developer conference in possibly a decade. The company announced a variety of new technologies that will be baked into its iOS 18 operating system, launching in beta this summer.

Lots of great stuff for users. Lots of angst for app developers.

Because the narrative is that the update will make a number of popular apps obsolete.

At least in iOS. Some of the stuff Apple is “killing” has thriving business on Windows or Android, etc, so it won’t be a death blow.

So what’s dead (or at least endangered)? From most at risk to probably ok:

Bezel, iPhone mirroring

These apps have always been awful, and now it’s native there’s no need for them at all. Also, they’re all 100% locked into the Apple ecosystem due to the nature of what the apps do.

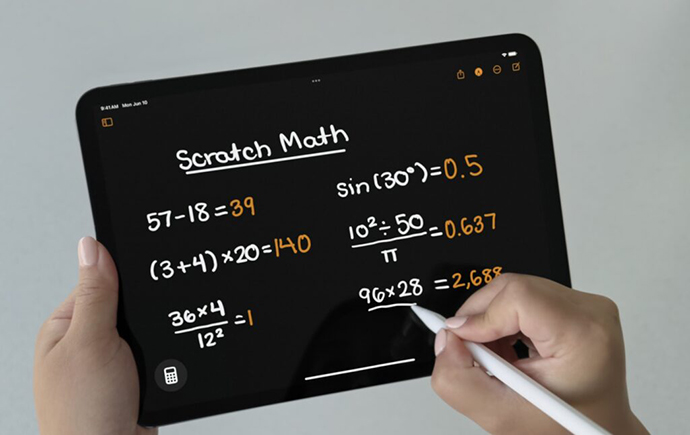

Every calculator app

This is obviously better than anything available now, except highly specialized calculator apps for specific functions.

AllTrails, the hiking app

There are some network effects around users’ social graphs, and the majority of users will be on Android or Google, but this is bad.

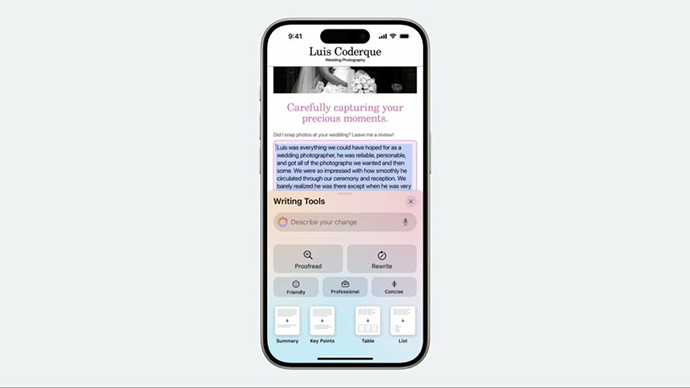

Grammarly, the writing app

This is used so much at the enterprise level that I don’t see this having a massive impact, but Grammarly is also in trouble from OpenAI. They’re fighting a two-front war and should probably look for an acquirer.

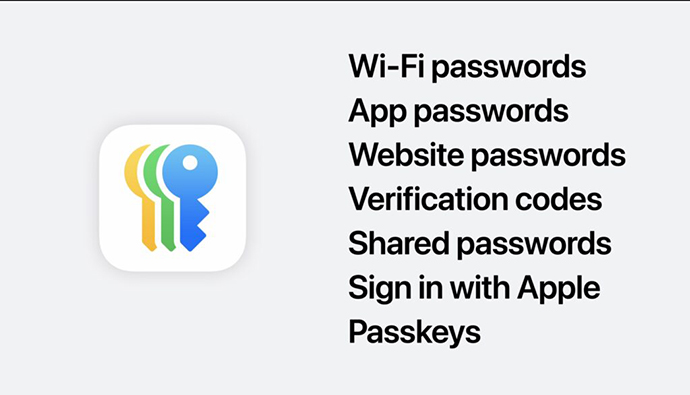

1Password, the password app.

There are many enterprise users here, and most of those won’t be in the Apple ecosystem. Plus, there are doubts that Apple can replicate all the service level functionality requirements of an enterprise SAAS app.

There’s a lot to like with these announcements, and it does feel like Apple is trying again, having bombed with the Vision Pro launch. Its integration with ChatGPT, in particular, could be game-changing if the two companies can improve the latency and reliability.

Would you like to know more?

Platform Revolution: How Networked Markets Are Transforming the Economy and How to Make Them Work for You: Geoffrey G. Parker, Marshall W. Van Alstyne, and Sangeet Paul Choudary. This book explores the complexities of platform business models that companies like Apple leverage. It delves into the implications for developers and users, providing a broader understanding of platform economics which is essential in understanding the risks and opportunities posed by platform updates.

What’s happening in China?

China is complex, insular, and opaque at the best of times, and it becomes far worse when the economy is in trouble. This makes it very difficult for outsiders to invest there with confidence.

Jonathan Sine recently wrote an excellent, though very long, piece on Local Government Financing Vehicles (LGFVs). These LGFVs comprise nearly 60% of the country’s GDP and are immensely important.

If you want to know what’s happening in China, I encourage you to read the entire article.

If you want the gist, I read it, so you don’t have to. I also paint a few pictures of China’s future below.

Overview

China’s Local Government Financing Vehicles (LGFVs) have been a crucial mechanism for funding infrastructure projects and local development since the 1990s.

Key Points

- Definition and Role of LGFVs:

- LGFVs are state-owned enterprises created by local governments to finance infrastructure projects.

- They operate outside standard government budget constraints, leveraging land and other assets to secure loans primarily from banks.

- Wuhu City in Anhui province pioneered the first LGFV in 1998, laying the foundation for widespread adoption.

- Financial Situation:

- LGFVs’ aggregated assets and liabilities are vast, equating to significant portions of China’s GDP.

- Financial health is precarious, with many LGFVs unable to cover interest payments from operating earnings. They often rely on new debt issuance to remain solvent.

- The borrowing cost averages around 5%, while returns on assets hover around 1%.

- Debt Expansion and Risks:

- LGFV debt has grown substantially, estimated at 60% of China’s GDP.

- The financial opacity and potential underestimation of total LGFV debt pose a challenge to accurate risk assessment.

- New debt is typically used to refinance existing obligations rather than for new productive investments, leading to a debt spiral.

- Historical Context:

- Central government reforms in the 1990s aimed at fiscal re-centralization inadvertently fueled LGFVs’ rise by restricting direct local government borrowing while increasing local spending responsibilities.

- The 2008 financial crisis and the subsequent stimulus further accelerated LGFV debt accumulation as Beijing leveraged these vehicles for countercyclical spending.

- Political Economy and Central-Local Dynamics:

- LGFVs have been tools for local officials motivated by career incentives tied to economic performance and growth targets.

- The intergovernmental financing structure, marked by delayed and inefficient fund transfers, exacerbated local fiscal pressures and reliance on LGFVs.

- Current Challenges and Regulatory Efforts:

- The central government has made several attempts to regulate and bring LGFV debt under control, with limited success.

- Recent efforts include transitioning off-balance-sheet LGFV debt to on-budget bonds and categorizing LGFV functions to manage financial exposure better.

Impact on Investment

- Domestic and Foreign Investment:

- Uncertainty surrounding LGFV debt stability creates substantial risks for investors.

- Potential policy shifts and government actions could lead to volatility, impacting both local and foreign investment sentiment.

- China’s Economic Future:

- The transition away from land-finance-centric LGFV models signals a move towards more sustainable and diversified economic strategies.

- The resolution of LGFV debt could lead to temporary economic slowdowns but would likely foster long-term financial stability.

Ok, summary over, back to me.

So what does this all mean? I’ve broken it into three scenarios based on how I see things potentially playing out. I’m not a China expert, so please take these with several grains of salt.

Best Case (20%)

A smooth transition to a sustainable financing model would bolster investor confidence and preserve economic growth, contributing to long-term stability.

Effective Debt Management:

- The Chinese government successfully implements comprehensive reforms that bring LGFV debt under control without triggering widespread defaults.

- Local governments transition smoothly from reliance on off-balance-sheet financing to more transparent, on-budget mechanisms.

Economic Stability:

- Economic growth remains steady as Beijing’s focus on “high-quality development” yields results.

- Infrastructure and public goods investments continue but with better funding management and efficiency.

Regulatory Success:

- Stricter regulations and monitoring by central authorities mitigate risks associated with LGFVs.

- Effective audits and classification of LGFV functions help local governments rationalize their debt and reduce financial misallocation.

Investor Confidence:

- Foreign and domestic investors gain confidence in the Chinese market due to improved financial transparency and stability.

- Bond and capital markets strengthen, facilitating better financing conditions for local governments and enterprises.

Assumptions:

- Effective and timely implementation of comprehensive reforms.

- Successful management of local government debt without triggering defaults.

- Maintenance of economic stability and continued investment in priority areas.

- Central government’s capacity to enforce regulations and monitor compliance efficiently.

Factors Considered:

- Historical precedent suggests that while China has successfully navigated economic reforms before, the complexity and sheer size of LGFV debt present significant challenges.

- The central government has demonstrated a strong capacity for monitoring and controlling economic levers, but local compliance can vary.

Most likely case (60%)

Gradual adjustments and mixed outcomes would present challenges but avoid major crises. Investors remain cautious yet engaged.

Gradual Adjustment:

- The transition from off-balance-sheet to on-budget financing is gradual, with some disruption but no major systemic crises.

- Local governments continue to use LGFVs but under stricter oversight and with enhanced accountability.

Mixed Economic Outcomes:

- Economic growth may slow down temporarily as local governments adjust to new financing mechanisms and deal with legacy debt.

- Investments in high-priority areas continue, but some infrastructure projects may face cuts or delays.

Regulatory Push-Pull:

- The central government alternates between tightening control and providing support to ensure stability.

- Local governments employ creative compliance to balance meeting development goals with adhering to new regulations.

Moderate Investor Response:

- Investor sentiment remains cautious but stable, with selective investment in regions and sectors perceived as lower risk.

- Credit conditions improve but are subject to periodic fluctuations based on policy changes and economic indicators.

Assumptions:

- Gradual implementation of reforms with some disruptions.

- Mixed economic outcomes with temporary slowdowns but no systemic crises.

- Continuing regulatory adjustments as local governments balance compliance with development needs.

- Moderate investor caution with stable engagement in the Chinese market.

Factors Considered:

- Historical patterns indicate that gradual, iterative reform processes are common in China.

- Central and local government dynamics often involve push-pull interactions, with periodic policy adjustments.

- Previous debt management efforts (e.g., banking sector reforms) have taken time but generally avoided systemic crises.

Worst case (20%)

A financial crisis and economic downturn would create substantial risks for both the Chinese economy and global investors, with severe disruptions in public services and infrastructure.

Debt Crisis:

- Failed reforms lead to a wave of defaults among LGFVs, causing a financial crisis that affects banks and other lenders.

- Local governments struggle to refinance debt, leading to severe cuts in public services and infrastructure investments.

Economic Downturn:

- Economic growth stalls or contracts as liquidity dries up and investments plummet.

- The broader economy suffers from decreased spending, high unemployment, and reduced consumer confidence.

Regulatory Failures:

- Central government measures fail to address the root causes of LGFV debt, leading to persistent financial instability.

- Widespread corruption and inefficiencies exacerbate financial mismanagement at local levels.

Investor Panic:

- Panic among foreign and domestic investors leads to capital flight and soaring borrowing costs.

- Bond markets collapse, further restricting local governments’ access to financing and deepening the economic crisis.

Assumptions:

- Major policy failures leading to a wave of LGFV defaults.

- A financial crisis that spreads to banks and other lenders.

- Economic downturn with significant negative impacts on growth and employment.

- Investor panic, capital flight, and collapse of bond markets.

Factors Considered:

- While China’s financial system has been resilient in past crises, the scale of LGFV debt poses unprecedented risks.

- Potential policy missteps or unforeseen economic shocks could exacerbate existing vulnerabilities.

- Global and domestic investor sentiment can shift rapidly in response to perceived risks.

Would you like to know more?

The China Model: Political Meritocracy and the Limits of Democracy: Daniel A. Bell. This book provides an insight into China’s unique political system and governance model, which helps comprehend the complexities behind Local Government Financing Vehicles (LGFVs) and financial management practices in China.

Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise: Carl E. Walter and Fraser J. T. Howie. This book delves into the intricacies of China’s financial system and the vulnerabilities that underpin its economic miracle, offering context for understanding the financial risks associated with LGFVs.

China’s Guaranteed Bubble: How Implicit Government Support Has Propagated Financial Crises: Louis Viñuales. This book explores the systemic risks within China’s financial system, exacerbated by implicit government guarantees, which are crucial to grasping the stability and future of LGFVs.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- Our friends at Webstreet sponsored this issue.