This week, we bring you

- Toys R Us Pioneers AI-Generated Film

- Streamers Slash Original Content

- AmEx’s Reservation Dominance Strategy

- Manufacturers Pay for Ransomware Attacks

- Record Labels Sue AI Startups

- Uber and Nvidia Back Self-Driving Startup

- 3 Stocks To Consider

Thanks for reading.

Wyatt

Table of Contents

Toys R Us Pioneers AI-Generated Film

Toys R Us Studios partnered with Native Foreign to create the first brand film using OpenAI’s text-to-video tool Sora, which is currently only available to alpha testers.

The one-minute video, produced in just a few weeks, tells the story of how founder Charles Lazarus created the iconic toy retailer and its mascot, Geoffrey the Giraffe. By embracing generative AI, Toys R Us demonstrates the beginning of AI-generated film in marketing.

Streamers Slash Original Content

Major US streaming services are cutting back on original TV shows in 2023, with the total number of original seasons falling by 19% across 8 major platforms.

As competition intensifies and margins tighten, the financial challenges of producing content in the streaming arena are becoming more apparent, leading to a shift in strategy for many players.

AmEx’s Reservation Dominance Strategy

American Express is making bold moves to dominate the online reservation space.

With the acquisition of Tock for $400 million, following their 2019 purchase of Resy, AmEx aims to persuade restaurants to prioritize their cardholders.

As restaurant spending by AmEx members surpassed $100 billion last year and U.S. restaurant sales are projected to hit $1 trillion by 2024, the company sees significant growth potential.

Manufacturers Pay for Ransomware Attacks

A new study from Sophos Ltd reveals that two-thirds of manufacturing and production organizations reported ransomware attacks in the first half of 2024, a 41% increase since 2020.

On average, 44% of computers in manufacturing were impacted, with malicious emails being the most common attack vector. The cost of recovery has also risen sharply, with the mean cost reaching $1.67 million in 2024 compared to $1.08 million in 2023.

Record Labels Sue AI Startups

The world’s biggest record labels are suing AI music startups Suno and Udio, alleging they unlawfully trained their AI models on copyrighted recordings.

The labels, represented by the RIAA, seek damages up to $150,000 per infringed work, potentially amounting to billions. While the music industry sees promise in AI, it aims to protect artists’ rights and ensure responsible deployment of the technology.

Uber and Nvidia Back Self-Driving Startup

Toronto-based autonomous vehicle startup Waabi has raised an impressive $275M CAD in a Series B round led by Uber and Khosla Ventures, bringing its total funding to $375M.

The company’s ambitious AI-powered self-driving technology has attracted notable investors like Nvidia and Porsche, as it aims to revolutionize transportation and logistics through partnerships with Uber Freight and others.

As countries like Dubai begin to embrace autonomous vehicles on public roads, Waabi is well-positioned to capitalize on the growing demand for this transformative technology.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Aussie-focussed market news that gives a solid non-US perspective on global finance.

Weekly strategies to build multi-generational wealth simply and safely.

Daily trading ideas, strategies, and alerts from trading veteran Jeff Bishop.

Stock ideas

Here are three of my favorites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

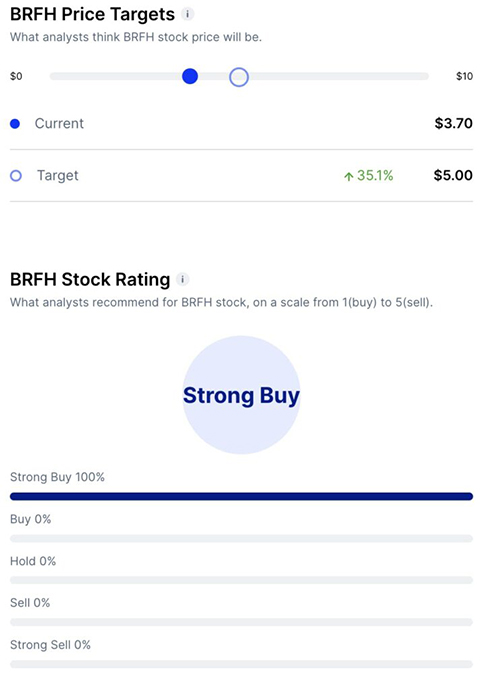

Barfresh Food Group ($BRFH)

Bull Case:

- Market Share Gains: Barfresh captured ~10% market share in school meals, 6% in the past year.

- Profitable Growth: Management guides for record revenues and profitability in 2024, with a path to $20M+ EBITDA in 3-5 years.

- Expanding Distribution: Barfresh is winning new school districts, increasing sales, and launching products.

Bear Case:

- Execution Risk: Past operational issues like losing a key bottler in 2022 caused revenues to plummet.

- Regulatory Changes: Changes to USDA requirements or ending free lunches in key states could significantly hurt sales.

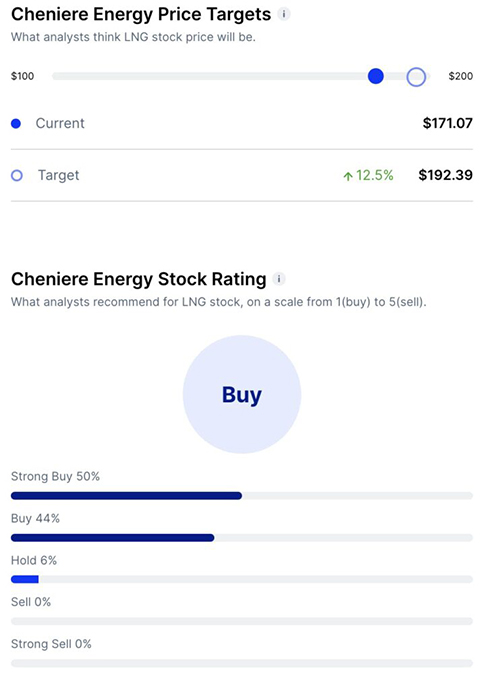

Cheniere Energy ($LNG)

Bull Case:

- LNG export surge: US LNG export capacity will increase by 4 bcf/d over the next 18 months, reaching 20.4 bcf/d by mid-2027.

- Shale gas decline: US dry gas production likely peaked in December 2023 and shale gas fields appear to be entering early stages of decline.

- AI gas demand: The proliferation of AI and data centers could require an additional 7 bcf/d of natural gas supply by 2030.

Bear Case:

- High inventories: Despite the bullish long-term outlook, current US natural gas inventories are nearly 600 bcf above seasonal averages.

- Weather volatility: Periods of mild weather could lead to price volatility.

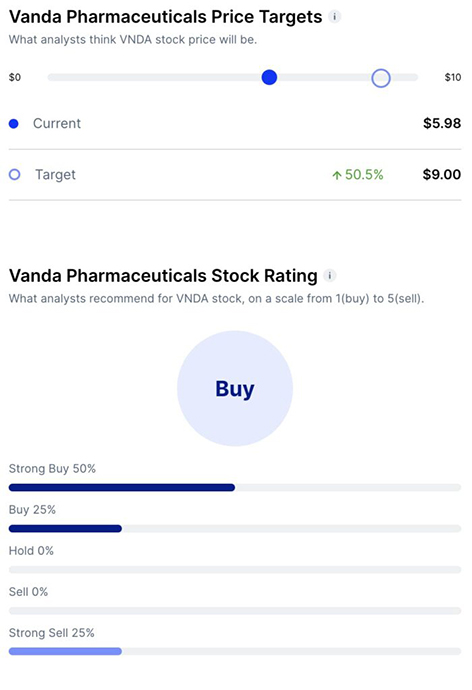

Vanda Pharmaceuticals ($VNDA)

Bull Case:

- Strong cash position: Vanda’s $5.40/share in net cash and securities suggests the market may be undervaluing the company’s potential.

- Acquisition interest: Two unsolicited takeover bids from Future Pak and Cycle Group Holdings indicate interest in Vanda’s portfolio.

- Upcoming milestones: Several of Vanda’s drugs are recently approved, nearing commercialization, or awaiting regulatory decisions.

Bear Case:

- Management concerns: Co-founder/CEO Polymeropoulos, a 3+% owner who employs family, hasn’t engaged bidders, raising concerns about alignment with shareholder interests.

- Lack of strategic focus: Vanda’s drug portfolio spans various indications without a clear, cohesive strategy.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.