As we all know, the housing shortage is one of the most frustrating, evergreen problems of our time.

Nobody needs another dossier on why the market is so tough: Supply is low, interest rates are high, and construction is inefficient.

Prefabricated Housing (“prefab”) is hailed as a solution that can address the construction industry’s supply & efficiency challenges.

By manufacturing units in an offsite factory, prefab startups can automate production, reduce costs, and address labor inefficiencies. As you’d expect, prefab ventures are cropping up everywhere.

But these companies aren’t created equal. Investors should consider factors beyond automation: is the business rethinking how we build, or simply replicating the conventional (and often inefficient) way of building offsite?

While there is no ‘one-size-fits-all’ approach to construction, there are best practices that can be spotted to help investors conduct due diligence within this complex industry.

Today, we’ll explore 3 ways to evaluate a prefab business’ effectiveness. We’ll also show you how a startup called ZenniHome fares against this framework.

Note: This issue is sponsored by ZenniHome, and was co-written by Alts community members Erin Poeta and Richard Meacham: Two experts from modular interior construction startup DIRTT. As always we think you’ll find it informative and very fair.

Let’s go 👇

Table of Contents

1) Does the startup create multi-trade design and construction?

The first due diligence question is does the business support multi-trade design and construction, or is it simply moving an inefficient method of construction off site?

With multi-trade, you integrate multiple types of work (think carpentry, electrical, etc) to solve for real process efficiencies.

Multi-trade prefabrication requires designers and builders to think differently about the design and construction process.

How it works:

- Work is performed by multiple trades off-site

- These sub-assemblies are shipped to the site

- Finally, these are assembled together on-site; resulting in a much less waste

Take for instance a manufactured wall, fitted with all the structural, aesthetic, plumbing, and electrical components.

Multi-trade prefab can significantly minimize the process + material waste because everything is now integrated within the same shippable assembly.

This provides meaningful impacts to the schedule, critical path, and bottom line.

Does ZenniHome pass test #1?

✅ Yes.

Based on my read of the Process section of their website, ZenniHome passes this test with flying colors.

But multi-trade alone will only get you so far. You also need to consider how the project is being delivered and how the company goes to market.

2) Does the company facilitate collaboration early on?

The second due diligence question is: Does the company’s leadership understand how their system is affecting successful project delivery methods? (i.e., do they facilitate collaboration among all players early in the design process to minimize risk and process waste?)

A little history here. North America is an extremely litigious society, so construction ends up being mostly about risk management.

The big risks are:

- Building regulations (building codes, zoning laws, historical preservation efforts)

- Local culture and regional preferences

- Value of ‘property’ (as an asset or a sense of place)

- Unionization of workers

That said, the project delivery method – i.e., how a construction project is designed and built – can be devised to reduce risks and provide everyone more freedom to build beautifully.

Traditionally, the “design-bid-build” method was used. This 3-phase method often leads to the creation of multiple siloes causing fragmentation and waste.

But lately, something called Integrated Project Delivery (IPD) has been used.

IPD is a lean construction project delivery method that seeks involvement from all participants through all phases of design and construction

Key aspects:

- A multi-party contract

- Alignment of project team incentives and goals

- Early involvement where knowledge is shared openly

- Shared risks and outcomes

- The owner/client is part of the process (since they have a vested interest in outcomes)

Together, these aspects allow the various stakeholders to redirect focus from risk to project outcomes.

And since information is openly shared among all parties, a lot of process waste is reduced as well.

Does ZenniHome pass test #2?

✅ Getting there.

Based on my read, ZenniHome is working towards #2.

They seem to rely on the customer to find a contractor and navigate the zoning process (which is half the battle).

Per Kenna Hettinger from ZenniHome:

This is correct. The customer is responsible for finding a GC who then does the on-site work and applies for permits for the project. We understand that this is a huge process, though, so with our first 12 customers we have a dedicated team member with expertise in the home lending process to walk them through every step including helping them find a GC, coordinating with their GC for permits, navigating the loan process, etc. We are working to build relationships with cities and GCs so that this process is easier for future customers.

– Kenna Hettinger

3) Does the company have a local go-to-market approach?

The third due diligence question is: Has the business formed partnerships with local design-build teams (architects and general contractors) to innovate beyond local regulations?

While contracting as a multi-trade prefabricator under an IPD model reduces lots of waste, a local approach has proven to be an even better way to do business.

See, over in Japan, Sweden, and Germany (countries where prefab has successfully scaled!) the industry relies on regional ecosystems to reinforce this local way of building. But North America is only now just catching up.

Consider states like California, Texas, and New York. These states have the same population as some European countries. Each state would essentially be its own “ecosystem” working towards solving for how to best construct and deliver prefab buildings.

Given the huge geographic disparities in codes and culture, prefab manufacturers are likely better off creating regional and segment-specific teams.

It’s ironic that efficiency may not come from a one-size-fits-all approach. But North American regions are unique, and complex. And thus North American prefab startups should consider taking a more nuanced approach.

Does ZenniHome pass test #3?

✅ Yes. ZenniHome is taking a local, nuanced approach.

Again, per Hettinger:

Our largest and most impactful partnership is with the Navajo Nation. Our current factory is located on the Nation. We signed a 75-year lease…

From a 2011 report, the Nation is short more than 30,000 homes. We are continuing to have discussions with President Buu Nygren about how ZenniHome can support his mission to build 1,000 homes across the Nation. President Nygren has also announced $74m in grants from the Nation to ZenniHome. This is just the beginning of our partnership with the Navajo Nation.

Hettinger went on:

Additionally, we have a very strong relationship with the City of Mesa, AZ. This is where we installed our prototypes and where our first stacked multi-family project will be installed. We had the mayor and a city council member in attendance at that groundbreaking. We’ve also worked with the State of Utah to pass a bill creating a statewide certification process for factory built homes.

Before this, our homes would have had to go through the approval process for each individual city or local jurisdiction. Now we can get approved at the State level (like we have for AZ) making the process much faster to bring homes into Utah. This bill was passed and signed into law by the Governor just this year.

(Editor’s Note: Thanks to the efforts of ZenniHome and others, Utah is the #1 state in per capita residential construction.)

ZenniHome’s products

ZenniHome is transforming the housing market through its standardised units – the Citizen and the Denizen.

These are “base houses,” created with robotic precision along an assembly line using sustainably-sourced steel.

Once you’ve purchased a ZenniHome, it can be delivered and set up within days.

To me, the coolest feature is the Citizen’s transforming furniture, which is like something from a sci-fi movie. Feast your eyes on floating beds, fold-in wardrobes and office spaces that morph into guest rooms.

The team

There’s no other way to put it: ZenniHome’s leadership is first-class.

CEO Bob Worsley is a multi exit serial entrepreneur and former Arizona senator, who previously founded SkyMall (which he sold to Rupert Murdoch) and many other companies.

Their new COO, Dr. Michael Schmitt was previously at Tesla as director of operations at the Cybertruck Gigafactory.

He’s built multiple factories in 5 different countries, and is playing a central role to their vision of building homes like cars.

Investment opportunity

ZenniHome is raising money on WeFunder in one of the biggest campaigns in site history.

The team has already raised $11.5 million from over 2,000 investors.

Details

- The opportunity is a priced round valuing the company at $75m

- Each Series A Preferred stock you buy is valued at $7.114.

- ZenniHome has successfully raised in the past – $6m in 2021 and $7.5m in 2023.

- The minimum investment is only $250, and is for accredited and non-accredited investors.

ZenniHome plans to pump most of the raise into materials and labor for plant production. A small portion will go to senior hires and sales/marketing.

Traction

As discussed, the team has secured a grant from the Navajo Nation worth $24m to build ~24 new homes every single day.

On top of this, the IDS+A has invested $50m to purchase at least 200 ZenniHomes. These will be distributed to those most in need across the Navajo Nation.

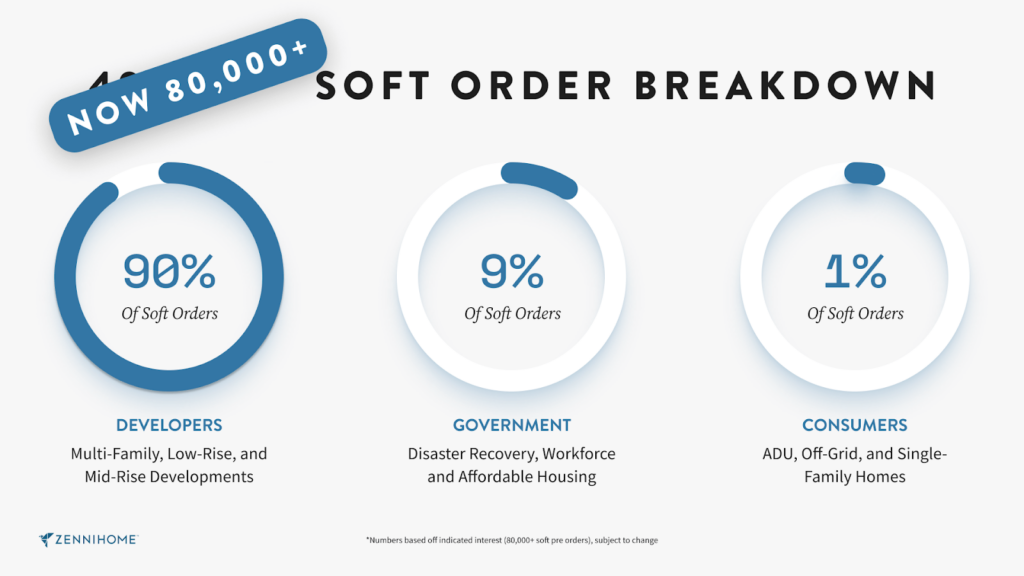

The team already has 1,200 units in the pipeline, with an additional 80,000 “soft orders” – a number that has doubled in the span of 12 months.

The installation process for several of these is underway – and you can follow along on Instagram.

Some units are already operational and if you’re an Arizona local you can even book a tour.

Revenue and projections

ZenniHomes are targeted toward smaller units (under 1,200 square feet), so their service addressable market is approximately $600b.

In 2023, ZenniHome’s revenue was $5.1m. They believe they can see $70m in revenue by the end of this year.

Most impressively, the team expects to hit profitability this year. Within five years, ZenniHome projects they’ll earn over $1b a year.

Current profit margins are a hefty 21-22%, but the new factory (which can create 10x more homes daily) will improve these figures to nearly 30%.

ZenniHome’s Wefunder round closes Apr 29.

That’s it for today!

See you next time.

Disclosures

- This issue was sponsored by ZenniHome

- This issue was co-authored by Erin Poeta and Richard Meacham from DIRTT. However, DIRTT is not a sponsor.

- There is no relationship between ZenniHome and DIRTT.

- Neither the authors, nor the ALTS 1 Fund holds any interest in ZenniHome

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of ZenniHome. ZenniHome has agreed to offer an unconstrained look at its business, offerings, and operations. ZenniHome is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.