When you hear the term ‘commercial real estate,’ you probably envision office buildings.

As you may know, the office building market is in a pickle. But ugly headlines make it easy to forget how broad the commercial real estate (CRE) market is.

If you dig deeper, you’ll find the commercial real estate market isn’t all doom and gloom. Some areas of the market are not only resilient, but thriving.

There at least four bright spots in commercial real estate, and today we’re looking at each one.

You’ll learn where the best opportunities lie, and how you can invest right now.

This issue was written by Alts contributor Alvin Yam. Alvin founded Paraiba Wealth Management, a registered independent investment advisor (RIA).

Let’s go 👇

Note: Half of this issue is free. To read the hidden sections, get the All-Access Pass. 🎟️

Table of Contents

Invest where people live, shop & eat 🛍

As you’ll see in this issue, grocery-anchored commercial properties are shining bright.

“Grocery-anchored” means the property has a grocery store as the primary tenant.

The thesis is simple:

- Grocery stores sell perishable food that everyone needs

- They’re located close where people live

- Remote work means people spend more time in their suburban neighborhoods

- Longer commute times mean retail shopping is shifting from downtown centers.

First National Realty Partners offers accredited investors the opportunity to invest in grocery-anchored real estate.

Invest where people live, shop, and eat.

Check out First National Realty Partners.

Yes, office buildings are still in trouble

Okay, first let’s address the elephant in the room.

It’s been two years since the pandemic ended, but the impacts on office buildings are still being felt.

Office buildings in major cities are still dealing with record high vacancies as remote/hybrid work becomes the norm.

Kevin O’Leary (aka “Mister Wonderful” from Shark Tank) believes the commercial real estate sector is on the brink of collapse.

And Morgan Stanley analysts predict a peak-to-trough CRE price decline of up to 40%, meaning it’d be worse than the 2008 crisis.

The industry’s modus operandi continues to be a strategy of “extend and pretend,” where landlords beg negotiate with lenders to extend their repayments.

So basically, we’ll keep seeing more praying and delaying instead of restructuring or writing down the amounts owed.

There’s a giant skeleton in the closet of the regional banks…every piece of real estate is worth less when interest rates go up…

– Real estate mogul Barry Sternlicht, talking about CRE loans

Note: This is part of the thesis behind $SKRE — the first ETF that allows you to short regional banks. $SKRE is from Tuttle Capital, creators of the original Inverse Cramer ETF.

👨👩👦 Bright spot #1: Multifamily housing

Strong demand, rising rents.

In strong markets with steady cash flows, multifamily properties can be a relatively low-risk investment, even for beginners.

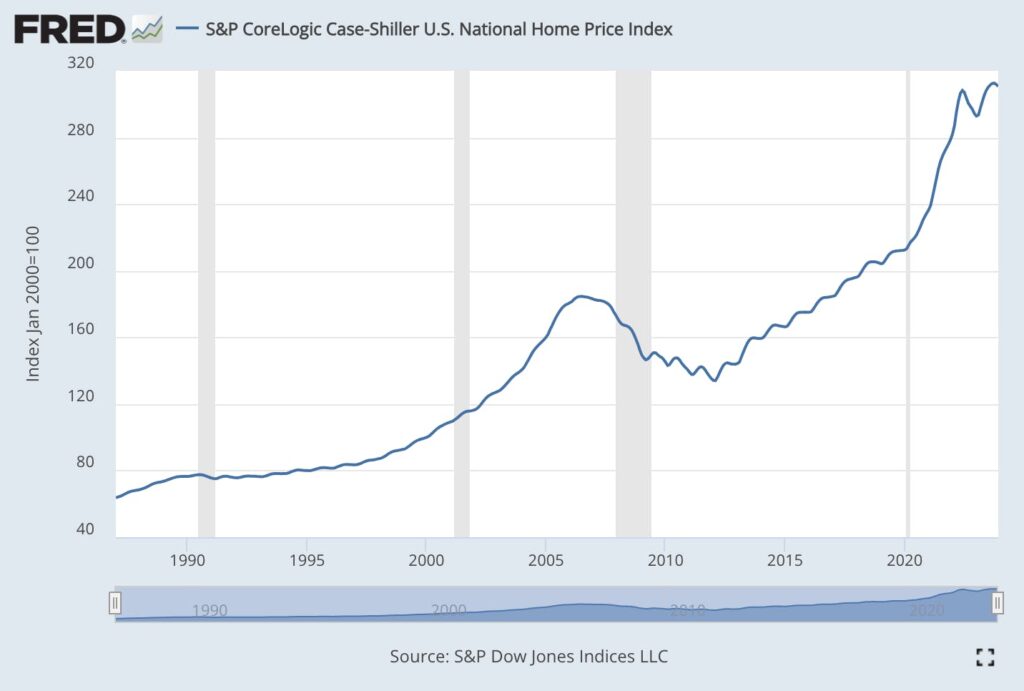

Over the last two years, home prices have surged 20 – 30% per year in some parts of the country (and 75% overall in the last 8 years).

Inventory shortages (due to under-building after the 2008 crash), low interest rates, and high demand during the pandemic have fueled the absurdly high growth.

Yes, these are single-family home prices, not apartment prices. But the unaffordability of houses means demand for rental apartments has stayed strong, and shows no signs of slowing.

According to the National Multifamily Housing Council, the US will need to build 4.3 million new apartments by 2035 to meet demand for rental housing.

This is actually doable. Last year the US built 461,000 apartments, and is currently building more than it has in fifty years.

But this is just to keep up with demand, not get ahead of it.

Remote work and rising home prices are keeping occupancy rates high and supporting rents to steadily increase across the country. With the relentless rise of home prices, it’s no wonder many younger workers have opted for apartment leases rather than buying.

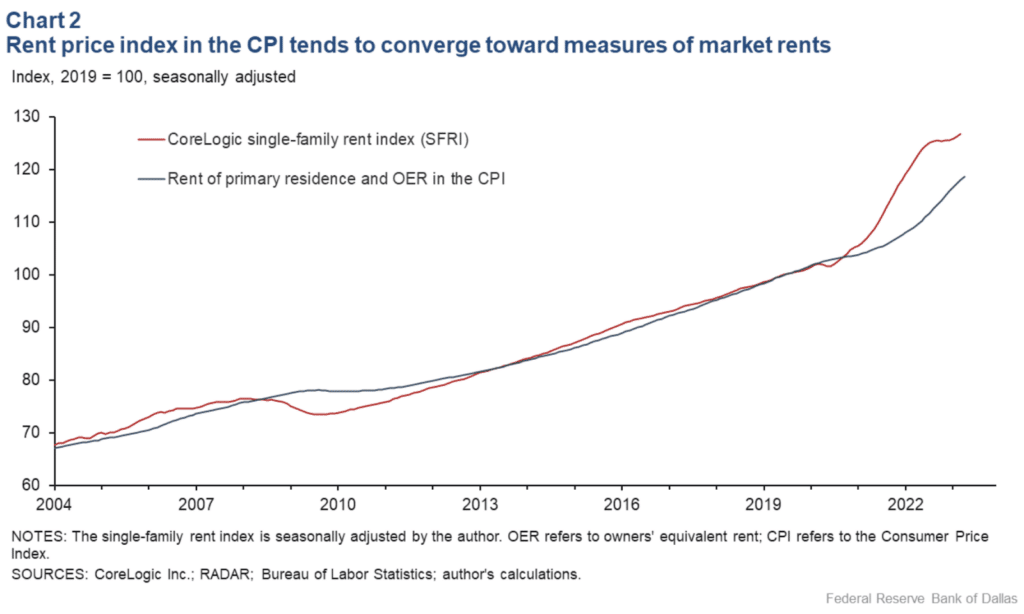

Naturally, rental rates have steadily increased, and are well above inflation.

Millennials have been flocking to urban areas, and by 2030 are expected to make up 47% of the renter population, up from 35% in 2015.

Across the US, effective rents on new leases rose about 8-10% annually over the past two years.

With rents climbing, multifam properties have delivered annual total returns in the low-to-mid teens.

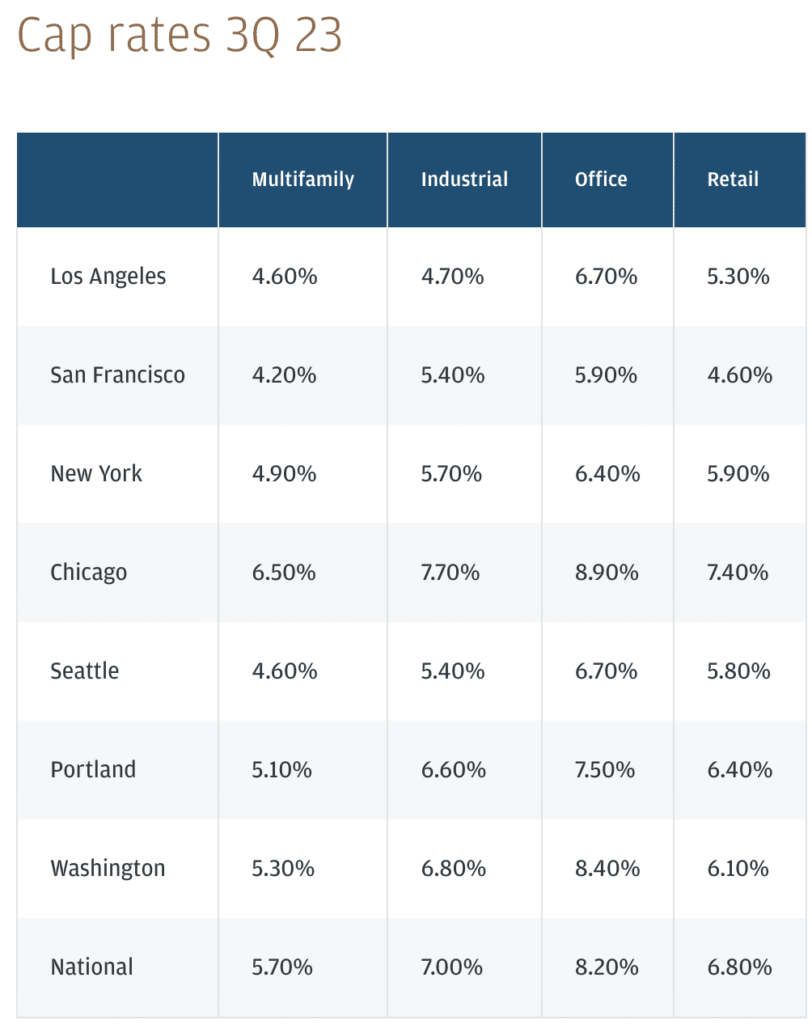

Cap rates for multifamily properties are averaging around 5.7% nationally.

As such, institutional capital continues to pour into the space ($117 billion worth in 2023!)

Investor demand for this sector has been due to multifamily assets offering a stable income stream versus other commercial sectors, which have been more sensitive to economic cycles.

Where are the best opportunities in US multifam housing?

Here are the most promising areas:

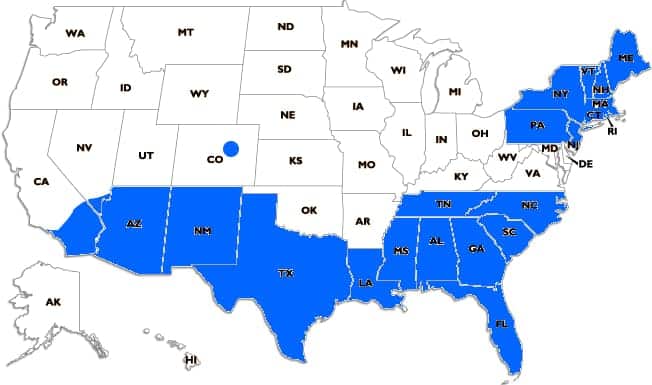

Sunbelt

Job growth, affordability, population booms, booming economies, and warm weather attract residents to the Sunbelt in droves.

The best opportunities are in cities across the Southeast, including Austin, Dallas, Houston, Charlotte, and Nashville.

Austin especially stands out here, as a hub for a young, tech-employed population willing to pay for modern amenities.

Miami

Has international appeal, vibrant nightlife, and an influx of new residents.

According to the report by the Miami Association of Realtors, Miami-Dade County ranked first in the nation for foreign buyer residential real estate (22% of the total)

Northeast

It may seem counterintuitive, because the northeast is actually losing population. But this region has large populations, strong public transport networks, and limited space.

NYC, Boston, and Philadelphia are classic urban centers with high living costs and limited single-family housing options.

Denver

Not in the sunbelt, but a fast-growing city with a strong job market and limited housing options.

How to invest in multifamily right now

The consolidation play

In the world of multifamily housing, consolidation is a strategy where an operator buys and combines multiple smaller properties into one larger portfolio.

This works best in markets with many small property owners, which gives you cost savings, market influence, and better cost efficiency.

Markets with the best potential for consolidation are those with high fragmentation:

- LA: Massive city with numerous smaller, older multifamily properties. Developers in Koreatown used this strategy over the past decade.

- Chicago: Diverse neighborhoods with opportunities to combine smaller buildings such as the Wicker Park area.

- Boston: Historic city with tons of old buildings and plenty of potential for consolidation efficiency gains.

The upgrade play

In markets with newer housing stock (like those found in the sun belt) a value-add strategy of upgrading older properties has led to higher rents for properties.

- Older Class B and C properties in Denver rent for much less than newer units. Operators who renovate amenities like pools, gyms, and communal spaces could potentially command similar rents as newer buildings.

- Older coastal properties in Miami, especially those with rents below the market average, could potentially command increased rents after renovations.

📦 Bright spot #2: Warehouses and DCs

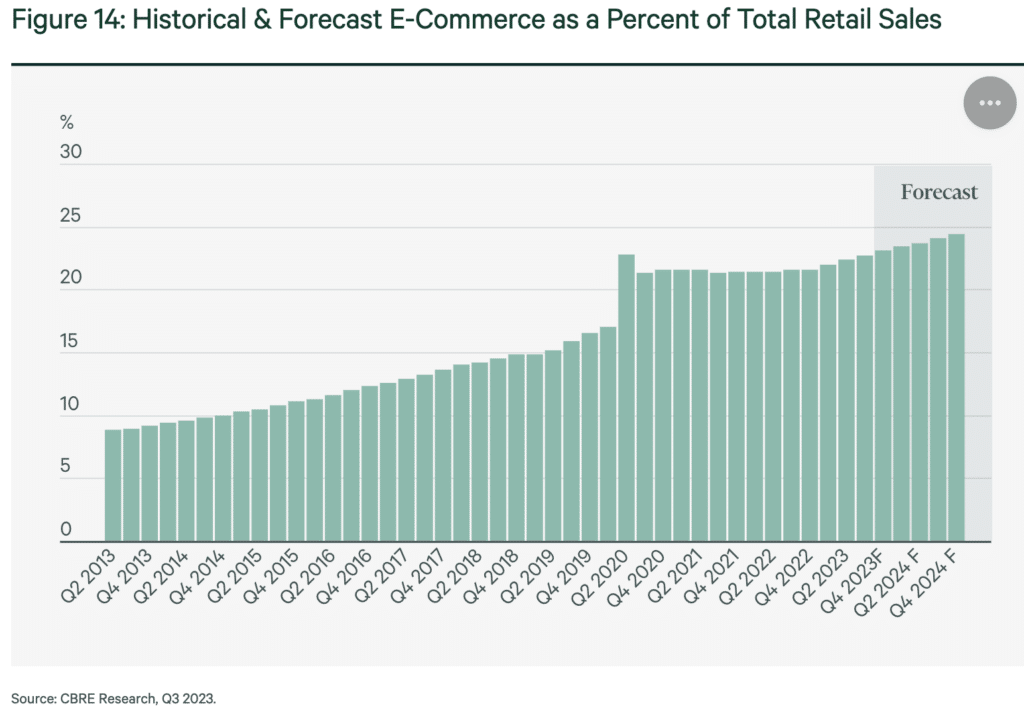

Ecommerce continues to grow.

Amazon’s revenue is at $576 billion. Shopify is at $7.1 billion and growing 26% YoY, with 4.6 million merchants.

Warehouses are critical for the ecommerce supply chain. Logistics companies like UPS and FedEx rely on expanding their network of distribution centers (DCs) to keep things flowing nicely.

Warehouse space absorption accelerated during the pandemic, and is still flying high.

After years of lagging behind other property sectors, industrial real estate is now one of the tightest CRE markets, with landlords commanding premium rents due to the scarcity.

Sure, it’s not as tight as the astounding 1.9% vacancy rate we saw in Guadalajara last month, but demand for industrial space has outpaced new construction, leading to vacancy rates and increasing rents across major markets.

With retailers ramping up fulfillment capabilities and robust projected demand for ecommerce, more warehouse space will be needed.

But industrial space is easy to build, and warehouse/distribution center performance is losing steam.

Going forward, signs point to a more stabilized industrial market. The industry expects the national vacancy rate to likely remain slightly below its 20-year average of 7.3%.

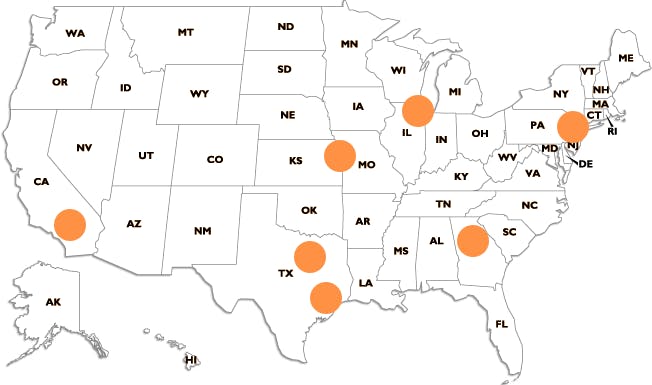

Where are the best opportunities in US industrial real estate?

To maximize efficiency, industrial properties are often strategically located near railroad lines.

Direct rail means easy shipping between facilities, ports, and major distribution channels.

Here are some promising areas in this space with close proximity to railway lines:

Southern California’s Inland Empire

Sure, “nobody rides the train in LA.” But you better believe freight does.

Riverside, San Bernardino, and Redlands are prime rail-connected locations near major ports.

Los Angeles is a critical gateway for international trade, particularly with Pacific Rim countries, making it a strategic location for warehouse and distribution centers.

The Inland Empire has low industrial vacancy rates, and limited space for new development due to limited available land and strict zoning regulations.

Furthermore, as we talked about in The Economics of High Speed Rail, the Brightline West project aims to establish a high-speed rail connection between Victorville, CA and Las Vegas. This rail connectivity between SoCal and Las Vegas has the potential to increase demand for industrial and commercial real estate expansion along the corridor as well.

Atlanta

Atlanta is a major rail hub serving the Southeast.

Connectivity to key networks like Norfolk Southern and CSX are driving new warehouse construction.

Dallas and Houston

Dallas-Fort Worth and Houston have surprisingly extensive rail networks.

Transporting goods, access to large consumer bases, and business-friendly environments make these Texas markets attractive.

Chicago

Chicago has excellent rail infrastructure. And the centralized location with national reach has led to rapid development and industrial occupancy in IL, IN, and WI as well.

Northern New Jersey

Northern New Jersey is close to the Port of New York and New Jersey, with numerous rail-accessible facilities in high-demand industrial submarkets.

Just like in SoCal, high prices are driven by limited space and tough zoning.

Kansas City

Situated at the crossroads of major interstate highways and with great access to rail lines, Kansas City is a strategic location for distribution centers and serves the central US market.

How to invest in industrial right now

Typically, this is a space for large institutional players.

For example, in 2022, CRG raised $300m for its US Logistics Fund II, which aims to deliver $1.5 billion of warehouse and distribution facilities in key logistics markets. They focus on coastal cities with high barriers to entry and Sun Belt locations with high population growth.

Don’t let institutional capital scare you off. If you want to invest on a smaller scale:

- Invest in existing facilities. Upgrade older warehouses with automation, energy efficiency features, or amenities like truck parking to attract premium tenants.

- Direct ownership. Buy a small warehouse yourself. Be prepared for the complexities of property management and maintenance.

- Crowdfunding. Pool your money and invest in specific warehouse projects. Lower barrier to entry, higher risk.

- Private equity funds are usually focused on larger portfolio deals.

🗄️ Bright spot #3: Data centers

The real heroes (and winners) of the AI boom.

Chat GPT and Midjourney get all the headlines. But the AI revolution all hinges on massive investment into data centers.

Data centers are nothing less than the backbone of the entire AI explosion. They power the intense computational processes required for training neural networks.

We are seeing unprecedented demand for data capacity. Storage is expected to grow from 10.1 zettabytes (a zettabyte is a trillion gigabytes!) to 21 zettabytes in 2027, a five-year CAGR of 18.5%.

As data consumption grows, so does the need for robust data centers. OpenAI, Anthropic, Microsoft, and Google have been relentlessly expanding their data center footprints to meet demand.

Where are the best opportunities in US data centers?

The key factors here are connectivity, access to power, and rail access (again).

Wait. Why does rail matter for data centers?

Because of a very important, yet little-known fact about America’s infrastructure…