Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite 🙃

Table of Contents

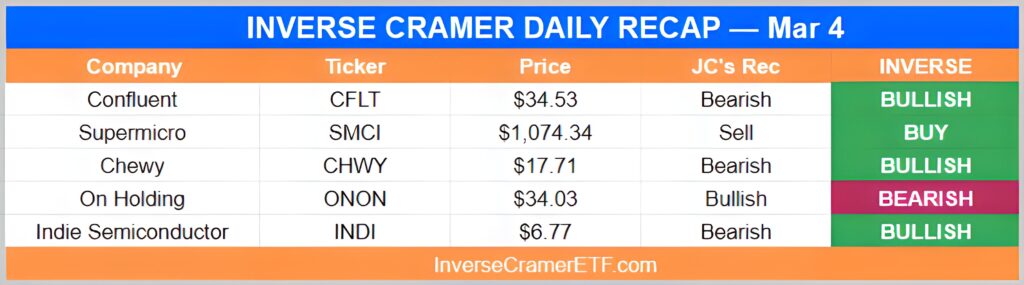

Monday, Mar 4

You’ve got to get them a couple of quarters because they have some issues involving their financial. On Mad Money, we don’t back companies with financials that are not pristine. So, we’re gonna hold off there.

-On Confluent ($CFLT)

It’s gotten too high for me. We had the company on, I loved it, but since then it tripled. I have to pull back on this one. This one is too sizzling.

-On Supermicro ($SMCI)

Stay interested in On Holding. We’ve got an interesting piece out today. It’s doing well for a very long time. I’m sticking with my view.

-On On Holding ($ONON)

The Indie Semi is too late in auto. I’m not interested, frankly, in self-driving. It doesn’t have the sport yet.

-On Indie Semiconductor ($INDI)

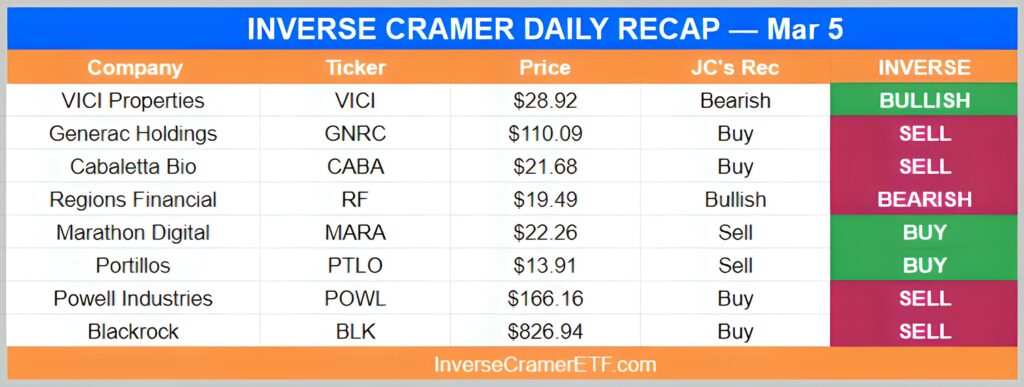

Tuesday, Mar 5

I wasnt a big fan of VICI. The last acquisition they made was a bowling alley deal and I’m not sure I like it. It’s a little too dicey.

-On VICI Properties ($VICI)

As long as the interest is low or lower, Generac is fine with me because the grid is awful. It turns out to be a finance play because you borrow so much money to get Generac.

-On Generac Holdings ($GNRC)

Just go buy the Bitcoin ETF. That’s what you do. Don’t fool around, own the pure.

-On Marathon Digital ($MARA)

I’ve lost faith in this management. They should be delivering better. The insiders are selling all all all. That company is overvalued. They need better earnings.

-On Portillos ($PTLO)

It’s going higher. Blackrock is the distinguishing event. It is the great financial repository for our nation, and you should own it. It is still inexpensive, great call by you.

-On Blackrock ($BLK)

🚨BREAKING🚨@jimcramer HAS SAID THAT THERE ARE MANY SIGNS THAT #Bitcoin HAS TOPPED

— Not Jim Cramer (@cramercoin) March 5, 2024

WE ARE GOING TO INFINITY pic.twitter.com/7i3wnLzFDF

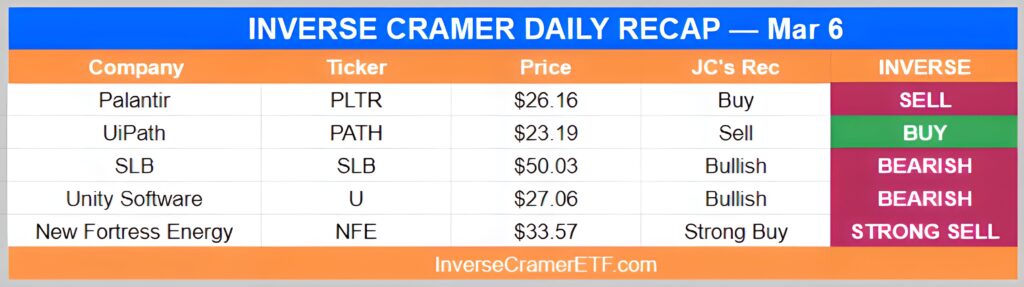

Wednesday, Mar 6

If robotic process stocks finally make money, I’ll talk positively.

-On UiPath ($PATH)

I want you to buy it (Buy, Buy, Buy). Someone always gonna trifle Wes Eden’s brilliance, don’t count me as one of those people. I wanna buy Wes Edens and that’s New Fortress Energy.

-On New Fortress Energy ($NFE)

Top tier trolling lmao pic.twitter.com/4e2KqQvzUz

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 6, 2024

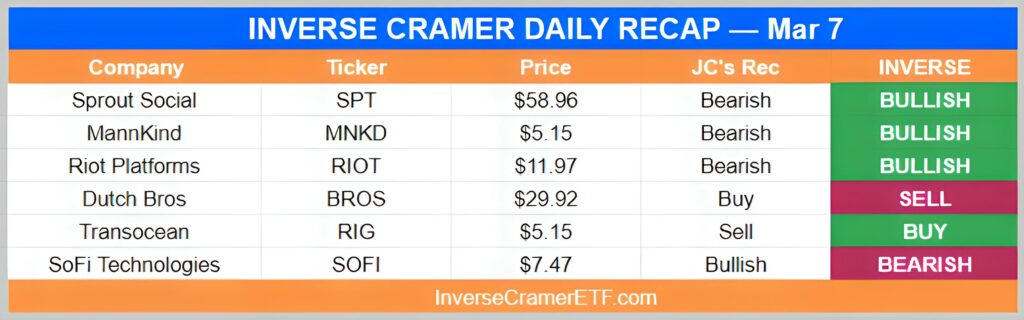

Thursday, Mar 7

I have to look at that company honestly because that’s in a hotspot. But the stock is not making money, that’s why I’ve said no. But doesn’t mean I have to be closed-minded because they are supposed to have an earning breakout. Let me do more work.

-On Sprout Social ($SPT)

MannKind has been hanging out there forever. Probably starting to look like it’s gonna have an earnings breakout, but I’m one of those people who’s jaundiced about it. Gotta wait and see if they’ll come up with something. I just can’t go in and say, you know what looking better. I’m not gonna go there.

-On MannKind ($MNKD)

If I want a Bitcoin miner, I’d rather just own Bitcoin or the Ethereum ETF. Either one of those rather than Riot Platforms.

-On Riot Platforms ($RIOT)

They had a big offering and the price held. The stock didn’t break down, maybe it’s finally turning. They over-expanded. I was upset they did that because it’s such a good brand. They seem to be getting more religion, they’re slowing things down. That’s gonna make it a stock to own.

-On Dutch Bros ($BROS)

What happened is the stock ran and they did this one-to-quarter convertible senior note and it crushed the stock. I don’t blame the people wanting to have that money at that price. but that’s what it hurt it, sir. I still believe.

-On SoFi Technologies ($SOFI)

This is insane

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 8, 2024

Nvidia is up 40% in just 15 days

To put that into perspective they have added an entire Tesla AND Starbucks in market cap

2 weeks pic.twitter.com/9p6eQGRiVk

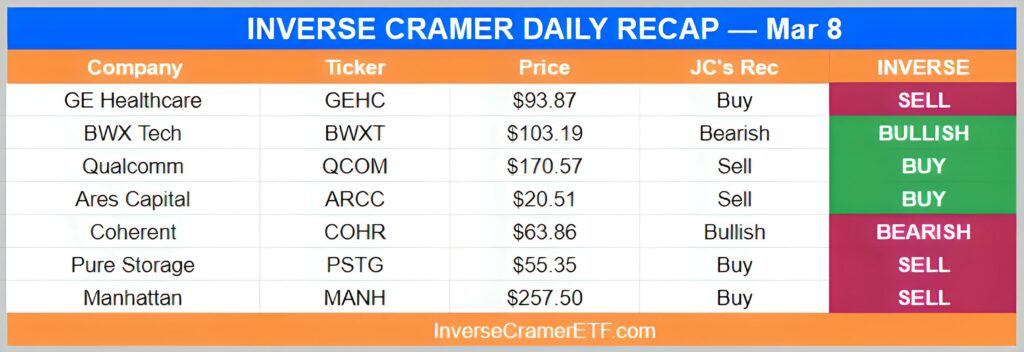

Friday, Mar 8

You want a stock that goes higher? That’s GE Healthcare.

-On GE Healthcare ($GEHC)

I have no idea what they really own. I can’t get behind them because I could be surprised.

-On Ares Capital ($ARCC)

Turns out they are the storage winners. It took a while for the turn around but they are a winner.

-On Pure Storage ($PSTG)

It is a very very good company. You described it better than I possibly can. It’s a winner. I congratulate you.

-On Manhattan ($MANH)

Cramer Classic

Bitcoin hits all time highs within 30 minutes of Jim calling Saylor lucky

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 5, 2024

You literally cannot make this up😂 https://t.co/stqQCLqb3F

Weekend Bonus

"Crypto is going to change the financial industry forever"

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 6, 2024

Crypto: pic.twitter.com/Anzu6NEQpI

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue has no external sponsors

- Neither the author nor the ALTS 1 Fund has no holdings in any companies mentioned in this issue

- This issue contains affiliate links to TradingView. If you sign up we get a few bucks.