If you’re looking for an investment with panache, it’s hard to beat film financing.

Investing in movies has enormous red-carpet appeal, with the added hope that the project takes off, there’s a big Hollywood premiere, and you’re a part of it all.

But while investing in films is sexy and compelling, the chances of success aren’t great, and the economics often leave something to be desired.

So today, we’re going to look at film finance strategies that may be more promising — ones that can pay off even if the movie is a flop.

I previously worked for a wealth management firm with an entertainment hedge fund practice. While I was never in a decision-making role within the hedge fund, I picked up a few important things about how this world works.

These are the strategies I saw employed during my time there.

Let’s go 👇

Note: Some of this issue is free. The All-Access Pass is your ticket to read the whole thing.

Table of Contents

The problems with film investing

Traditionally, investors access this space by providing filmmakers with cash in return for an equity stake in their project.

Under this model, returns are closely linked to box office performance.

Here’s the problem — box office performance is notoriously unpredictable, and the cards are usually stacked against individual investors:

- 97% of independent films don’t earn a profit. Like with venture capital, you need to take a lot of shots on goal to score a winning project.

- Film investment agreements often (but not always!) include provisions entitling distributors to earn fees and recoup marketing expenses before investors see a dime.

- “Hollywood accounting” can be used to figure out a way to make a film look less successful than it really is when it comes time to repay investors.

Film finance can still be lucrative! But these pitfalls mean the naïve strategy of tossing money at a random indie project and hoping for the best won’t work very well.

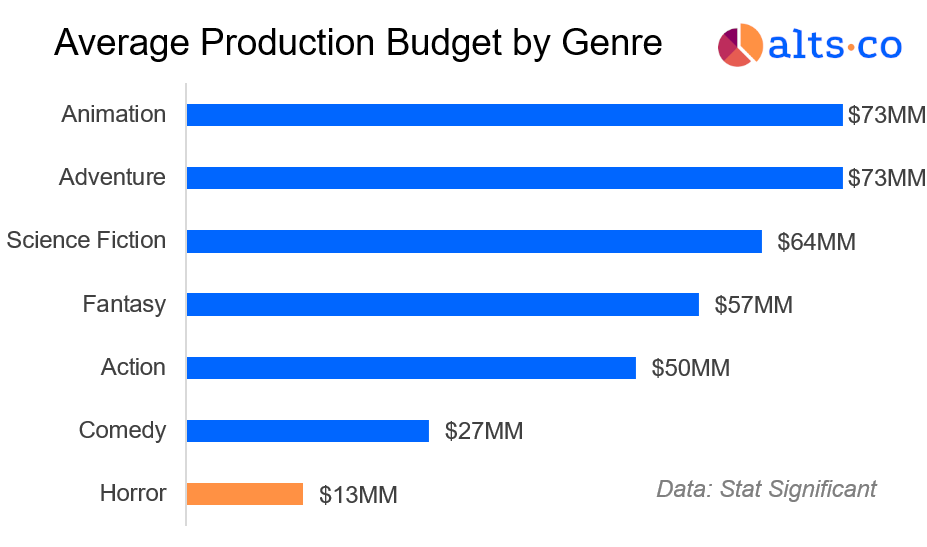

First, you need to understand is that not all genres are equally promising.

Horror films are scary lucrative 🧟♂️

When you think of the most profitable movies, your might think of big-name superhero/sci-fi stuff.

While movies like Avatar and Avengers: Endgame take the cake when it comes to top-line performance (each grossed over $2.5 billion), they’re not necessarily the best projects from an ROI perspective.

Here’s why: while these movies definitely make a lot of money, they’re also incredibly expensive to produce.

Endgame, for instance, had a production budget of $400m. Meanwhile, Avatar apparently cost slightly less than that (although some reports indicate a figure over half a billion.)

As investors, we don’t necessarily care about how much money a film makes overall. Instead, we care about how much it earns per production dollar spent.

When it comes to slim budgets producing high earnings, there’s one genre in particular that stands out – horror.

Low costs, high earnings

As Wyatt wrote about last August, horror films are a goldmine.

Standout films like Paranormal Activity (2007) and The Blair Witch Project (1999) boasted production budgets of just $450k and $600k, respectively.

Despite shoestring expenses, both have cleared at least $200m worldwide and spawned a slew of sequels.

Even horror movies that are less culturally memorable can still perform incredibly well.

The Gallows (2015) cleared $40m on a $100k budget, although you’d probably be hard-pressed to find people who remember it today.

Considering these economics, it’s unsurprising that some Hollywood studios have dedicated themselves almost exclusively to horror — including Blumhouse Productions.

Blumhouse has been involved with many of the biggest horror films of the past few decades, including Paranormal Activity, Insidious, The Purge, Split, Get Out, M3GAN, and Five Nights at Freddy’s.

And their strategy of backing low-budget horror flicks has resulted in some impressive figures, including a 997% median return on investment (!) which is leaps and bounds above major studios.

How does horror get away with being produced so cheaply?

One big reason is that horror movies don’t need to actually be “good” to satisfy audiences — they just need to be scary.

Case Study: Gone Girl vs Annabelle

In 2014, two movies went head-to-head at the box office, and provided a perfect case study for understanding how horror movies differ from other genres:

- Gone Girl, the psychological thriller directed by David Fincher featuring Ben Affleck, Rosamund Pike, and Neil Patrick Harris, and

- Annabelle, a low-budget horror movie with basically no big stars, and a director whose last film (The Butterfly Effect 2) was described as “an abominable, pointless sequel.”

Gone Girl received rave reviews from critics (87% on Rotten Tomatoes) and is still culturally relevant today. Annabelle, meanwhile, got poor reviews (28%) and was quickly forgotten.

Critically speaking, Gone Girl was clearly the better movie. But which one was the better investment?

You guessed it. Gone Girl cost $61m to produce, and grossed $367m (6x return). Annabelle cost $6.5m, and grossed $256m (for a 39x return!).

So despite having one-tenth of the production budget, Annabelle was vastly more profitable for investors.

See, while bad reviews are associated with negative ROI in genres like action, drama, and comedy, the same isn’t true for horror.

This means horror studios don’t need big-name directors, A-list actors, or expensive locations.

Instead, they just need to terrify the viewer — which isn’t very expensive to do.

This isn’t to say that all horror movies are good investments — they can easily flop like any other film.

But if you’re going around investing money in cheap indie flips, nothing seems to have a better chance of success than horror.

What are the best alternatives to equity financing?

Just because you invested in a horror film doesn’t mean you’re safe. You’re still dependent on the film getting financial success.

You need to move beyond equity investing to get returns that aren’t dependent on a film’s commercial success.

One completely different strategy (which is rarely discussed) is buying film project cashflows.

The two most popular types of cashflows you can invest in are Tax Credits and Negative Pickups.

Go a layer deeper…

But the second half of this issue has some really valuable info we can’t just give you for free.

Read on to learn about the alternative alternatives:

- How do film tax credits work?

- Which states offer the most generous tax credits?

- What are negative pickups?

- How do you make money with film receivables?

- How do you invest in private credit for films?

- What about investing in film studio space?

- What are the most serious film investing platforms?

- What are some under-discussed film finance opportunities for startups?

- What has the “smart money” been investing in lately?