Welcome to your weekly distillation of all the best from Altea.

Two opportunities have crossed my desk that haven’t made it up on the platform yet:

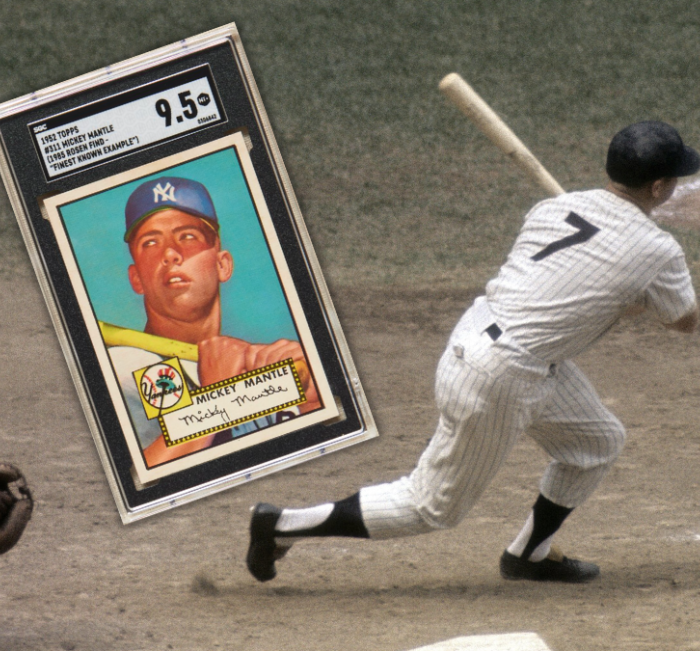

- ⚾ 1952 Topps Mickey Mantle rookie card graded PSA 8.5 – $2.8 million

- 🏈 PE investment in an NFL team (or teams) – minimum $10m but more realistically $20m

If either of those is of interest to you and you can write a check for at least $100k (and ideally bring in friends), please let me know.

Table of Contents

Platform Improvements and Updates

I’m building and testing out an AI-powered deal analysis tool and have used it on a few deals so far:

- Tortuga Growth Partners – Project TLX

- rethink INVESTING – 26 Evans Avenue North Mackay QLD 4740

- Vinpactico Wines – Winery Consolidation in BC, Canada

Feedback welcome!

New Deals

All three deals above are new to the platform plus the Mickey Mantle rookie card and NFL opportunities.

Make sure to let me know if you’re interested in any of the above.

Live Deals

Alts 1

- Minimum Investment: $20k

- Duration: 10 years (8 to go)

- Target IRR: 20%

- Investment Type: Reg D fund, alternative assets.

What’s the deal

This is our own fund, so please note the obvious bias.

Alts 1 represents a pioneering venture into the realm of alternative investments, seeking to capitalize on unconventional assets historically outperforming traditional market instruments. The fund, led by a team with a blend of military, financial, and technological expertise, positions itself as a dynamic entity agile enough to exploit market inefficiencies across a broad spectrum of alternative assets, including art, crypto, tequila, and more niche ventures like sports cards and distressed music rights.

Funding Status: $500k

What’s changed?

We did a Q&A this week. Have a watch if you’d like to learn more.

Altea Tequila SPV

- Investment size: $10k minimum

- Hold period: 3 – 5 years

- Potential IRR: 35% to 40%

- Fees: 2% management | 20% carry | nominal one-time subscription TBC

What’s the deal

Altea will acquire 50+ barrels of 100% agave tequila through this SPV to buy and hold for at least 3 years as the spirits age.

The barrels will be acquired, stored, and disposed of through our network of tequila brokers, private collectors, and exclusive brands in Jalisco, Mexico, over the course of 3 to 5 years.

Funding Status: $387k firm commits

What’s changed since last week

This will be up on the funding platform next week, and we need sign offs and wires by 17th May.

I’ll be in Tequila, Mexico, 20 – 21 May to personally supervise the barrelling and certification processes.

Frank Auerbach Bundle

One Frank Auerbach Charcoal

- Investment size: up to $560k

- Duration: 3 – 10 years

- Potential IRR: 15% to 20%

- Fees: 1.5% management | 20% carry

Through the same London art connection that brought us Art Bundle I, which was 25% oversubscribed and has returned 19% in three months, we have the opportunity to acquire a unique piece by legendary German/British artist Frank Auerbach.

What’s changed since last week:

Just waiting on one or two wires, and this should be done early next week.

Events

Events this week

Two events this last week, and they were both bangers, if I do say so myself.

Alts 1 represents a pioneering venture into the realm of alternative investments, seeking to capitalize on unconventional assets historically outperforming traditional market instruments. The fund, led by a team with a blend of military, financial, and technological expertise, positions itself as a dynamic entity agile enough to exploit market inefficiencies across a broad spectrum of alternative assets including art, crypto, tequila, and more niche ventures like sports cards and distressed music rights.

SignalRank is raising funds to invest in high-potential Series B companies using proprietary algorithms. It aims to transform investing in unicorns at Series B with a systematic approach.

Events next week

Dutch Mendenhall – CEO at RADD | Wednesday, May 8 at 10am EST (RSVP)

Join us for a chat with RADD CEO Dutch Mendenhall, who will be talking about the current state of the US residential real estate market while giving an overview of two deals currently on the Altea platform:

Investment Type: Real Estate

Raising: $5,000,000

Minimum Investment: $100,000

Projected returns: 31% IRR

Investment Type: Real Estate

Raising: $10,000,000

Minimum Investment: $100,000

Average Cap Rate: 10.35%

Projected returns: 15.2% IRR

Investor Field Trips

We should have a page put together for the Nashville trip soon. We’ve already locked in some killer guests and speakers.

Nashville

A music-themed investing adventure to Music City, USA.

- Est. dates: October 21 – 25

- Est. cost: $7,000 – $9,000

That’s it for this week.

Any questions, comments, or suggestions, please shout.

Cheers,

Wyatt, Stefan, and John