Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

Last time, we featured selfmade, a visionary brand pioneering psychodermatology.

This month, we’re looking at a company making parents’ lives easier by taking the hassle out of travelling with little ones.

It’s got a super low minimum investment — just $250.

If you want to see investment opportunities specifically for accredited investors and qualified purchasers, please let me know.

Let’s get to the Big Deal 🚀

👶🏾 BabyQuip

BabyQuip is the leading international service delivering baby gear to traveling families in over 1,200 locations across the US, Canada, Mexico, the Caribbean, Australia, New Zealand, and Europe.

👔 Deal overview

- Investment type: Equity – Preferred shares

- Valuation: $29.73m

- Raising: $2.3 million

- Minimum Investment: $250

- Alts member perks: 20% off rentals using code ALTS

- Campaign closes: December 11, 2023

- Check it out:

Dive into their super slick video to learn more.

And you can listen to CEO Fran Maier on the Kingscrowd podcast.

📖 TLDR of why I like it

The persistent vibe I get from BabyQuip is competence. Fran Maier and her team are a safe pair of hands, and that’s reassuring at times like this.

Words like “competence” and “safe pair of hands” aren’t sexy in the tech world, but they are exactly what I want during an economic climate that’s anything but certain.

They’re solving a real need in a thoughtful way, and the addressable market is literally anyone who has a baby now or will reproduce at some point in the future.

⚙️ What’s the investment?

This is an equity investment in BabyQuip capped at a valuation of $29.73 million. You’ll receive preferred shares.

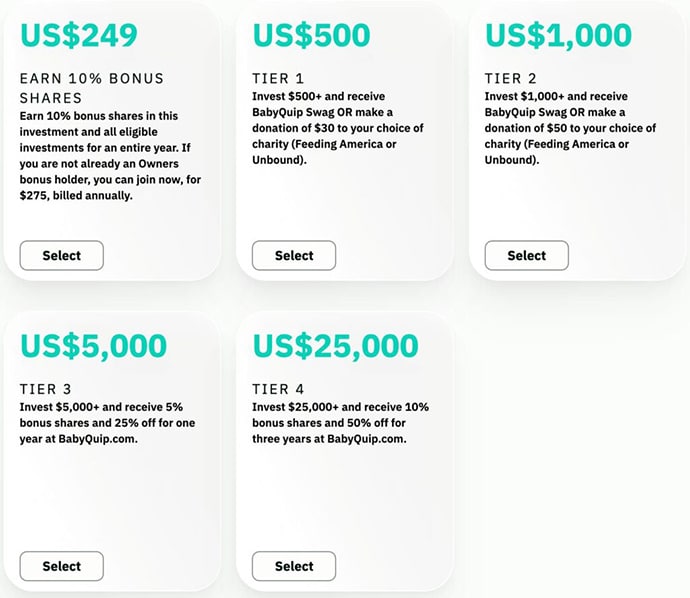

Like a lot of crowdfunding campaigns, several potential perks come along with your investment.

📈 What’s the Big Deal?

🚩 The Problem BabyQuip is Solving

Have you ever gone on holiday with a baby? Or two babies? It’s a nightmare. I’ve done it, and getting from baggage claim to the hotel is a mission.

Me: Stacked suitcases on top of the buggy, carrying one rucksack over each shoulder, pulling a suitcase behind me with one hand while directing the buggy with the other. Car seat balanced on top of the wobbly suitcases. Swearing a lot.

My wife: Carrying an infant in one arm, a toddler in the other, shouting at the oldest one to stop peeing in the water feature. Exhausted.

It’s not fun.

Travelling with small children is hard.

💡 The BabyQuip Solution

BabyQuip’s strapline is “Pack Light. Travel Happy.”

It’s a good one, and it captures what they do well.

Founded in 2016, BabyQuip offers a rental service specializing in baby gear to ease the challenges families face when traveling with young children.

The company provides an array of clean, high-quality items, ranging from smart bassinets to double strollers and toys. Through a network of local Quality Providers, BabyQuip serves over 1,200 locations in the US, Canada, Mexico, the Caribbean, Australia, New Zealand, Europe, and other regions.

💵 How does BabyQuip makes money

BabyQuip has recruited nearly 2,000 local Quality Providers (QP) across its 1,200+ locations. Each of those providers owns a variety of baby gear, from cribs to strollers to toys, that they make available to the platform.

They are not lending extra gear they have, they are building a business on the platform.When an order comes in through the app, the QP delivers the items to the family upon arrival and collects them at the time of departure.

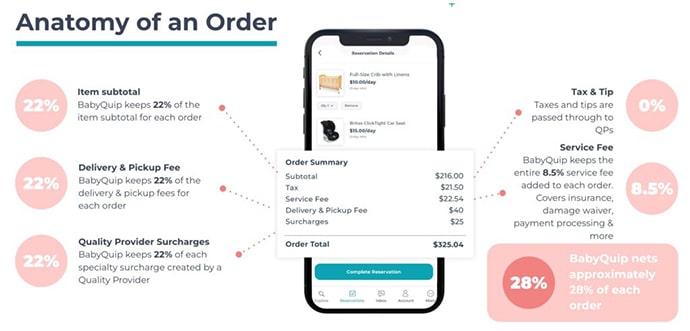

The QPs are trained during on-board and periodically on the company’s standards for cleanliness and safety. They keep about 70% of the revenue while BabyQuip banks the rest (the take rate).

Both the take rate and margin per order have increased steadily over the last several quarters.

Is an efficient model from a cash flow perspective, and it lets BabyQuip scale quickly without having to purchase thousands of baby crips, car seats, and buggies.

Should the company continue to scale significantly, it may make sense in time to vertically integrate in order to keep an eye on customer experience.

💼 Opportunity size

It’s a big opportunity.

30 million families in America and a similar number in Europe not to mention the other 7 billion + people on earth.

“U.S. family travel is a massive market, and 77.5 million families spend up to $150 billion per year on travel-related services.”

The problem BabyQuip is solving is both painful and universal.

📈 Growth potential

BabyQuip is the dominant brand in the US, but there’s a lot of opportunity to both capture more of that market and expand into new ones.

While the company’s 60k orders in 2022 were an impressive doubling over 2021, that still implies 29,940,000 American families haven’t used BabyQuip yet.

Further, CEO Fran Maier has her eyes set on Europe and Central America with a focus on Mexico and Costa Rica through 2024, and there are a number of new product offerings in the works.

BabyQuip launched a party rental category in April 2023 and plans to roll out PartyQuip after a successful beta test.

Other obvious expansion areas include both pets and seniors.

🚜 Traction

As mentioned above, orders doubled from 2021 to 2022, and BabyQuip is on pace to improve on that in 2023.

Q2 2023 was a record quarter for the business, 31% higher in GMV than the same quarter in 2022, with $4.4M in Gross marketplace volume (GMV) on 23,000 orders. First half performance is exceptional, with $7.5MM in GMV booked through the platform (up 39% vs.PY).

The company is on track for GMV around $17 million for the year.

BabyQuip is also well-regarded by its users with an NPS of 95, which is exceptional. This is reflected in the number of repeat orders, which is around 50% on a dollar basis.

The company is also doing a good job getting in front of partners. These relationships include:

- Hotels: Destination by Hyatt, Curator

- Vacation rental companies: HostAway, Guesty, OwnersRez

- Baby and family companies: Sitter City, Babylist

As well as a number of small property managers, vacation rental hosts, influences, and bloggers.

Many of those feed into a healthy customer acquisition strategy.

💰 Valuation

BabyQuip is raising at a $30m valuation (more or less), which is:

- 1.76x GMV (1x to 2x is typical)

- 6.25x gross margin (9x – 13x is typical)

So that gives us a range of:

- $17m – $34m from a GMV pov

- $43m – $62m as a multiple of gross margin

Based on this, $30m seems fair.

There are a lot of factors to consider when valuing a marketplace, and please make sure you DYOR.

🤔 The risks

Three main risks for me.

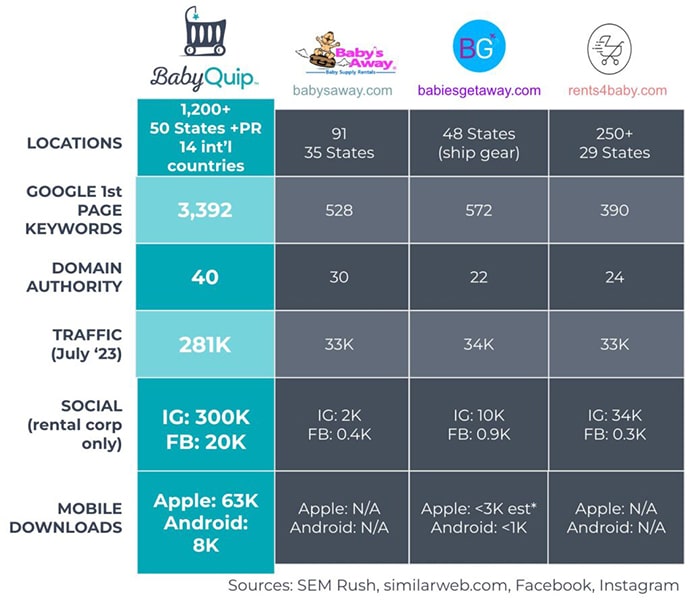

Competition

From BabyQuip’s pitch deck, you can see it’s already a fairly crowded market.

And this only includes the primary US competition. Babonbo.com, a BabyQuip copycat, has expanded into Europe, and Clouds of Goods is big in the “everything rental” space in the US.

BabyQuip is winning in the US, but its success has inspired competitors both at home and abroad.

A key differentiator for BabyQuip is its liability insurance. This is an expensive ($360k per year) moat that smaller companies can’t compete with. The insurance makes it far easier to recruit and retain high quality QPs

Slowing growth

As impressive as 30% YoY growth is, I’d probably hope to see that number a bit higher for a company at this stage of its growth.

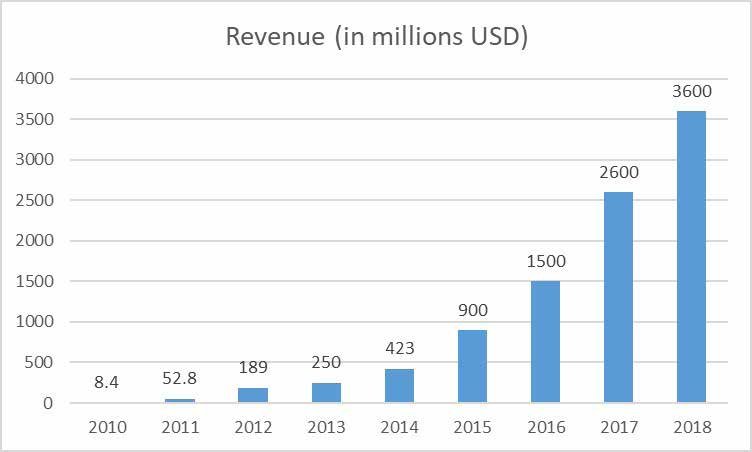

For reference, here’s the early growth rate of another marketplace you’ve probably heard of – AirBnB.

AirBnB is obviously a tough comparison, and I don’t think anyone realistically expects BabyQuip to match the company’s success (though hopefully they’re trying to partner).

But I would like to see BabyQuip’s growth curve steepen with this round of investment.

Too much expansion

And now to completely contradict myself…

There’s so much opportunity and green space for BabyQuip to slide into, there’s a real risk of spreading too thin too quickly.

Back to AirBnB’s example, Brian Chesky spent nine years saturating the market with their primary offering before offering their first major product expansion (Trips). There are still over 29 million addressable American families who have never tried BabyQuip. Better to nail that than worry too much about introducing new products.

💰 How to invest

BabyQuip’s funding round is open now, and you can invest with a minimum of $250.

Request a warm intro to CEO Fran Maier

That’s it for this week.

If you have a deal you think we should share with our 95k members, please get in touch.

See you on the beaches

Disclosures

- Participation in Big Deals is a competitive process. Investment sponsors, founders, etc submit their deal, and we choose the best of the best.

- BabyQuip compensated us for publishing this report.