We all know what happens when a company goes public (IPO’s). The stock gets listed on an exchange, it becomes available to be publicly traded, and shareholders watch in real-time as their shares rise in value (hopefully).

But what happens when a company doesn’t go public? The company still has a valuation, which means each share still has a value. But these shares aren’t liquid. There’s no easy way to understand their true price, or to sell them.

Or is there?

Today we’re looking at the world of pre-IPO secondaries.

As companies delay going public, demand from shareholders and employees to “cash out” has hit critical mass. This has created secondary markets where startup shares can be traded.

Today’s issue was authored by long-time Alts community member Jack Richardson.

Since 2020 he’s been a broker in the secondary private markets. As the founder of Hamia Group, Jack has transacted in companies like Palantir, Robinhood, Scopely and Kraken.

This is a complex world, and this issue gets into some tricky financial topics. But don’t worry — Jack breaks this stuff down into layman’s terms.

Let’s go 👇

Table of Contents

How to invest in pre-IPO startups

This issue has perfect timing.

In the past, shares of hot startups have only been available to well-connected VCs, private equity firms, and hedge funds. Access was out of reach for everyone else.

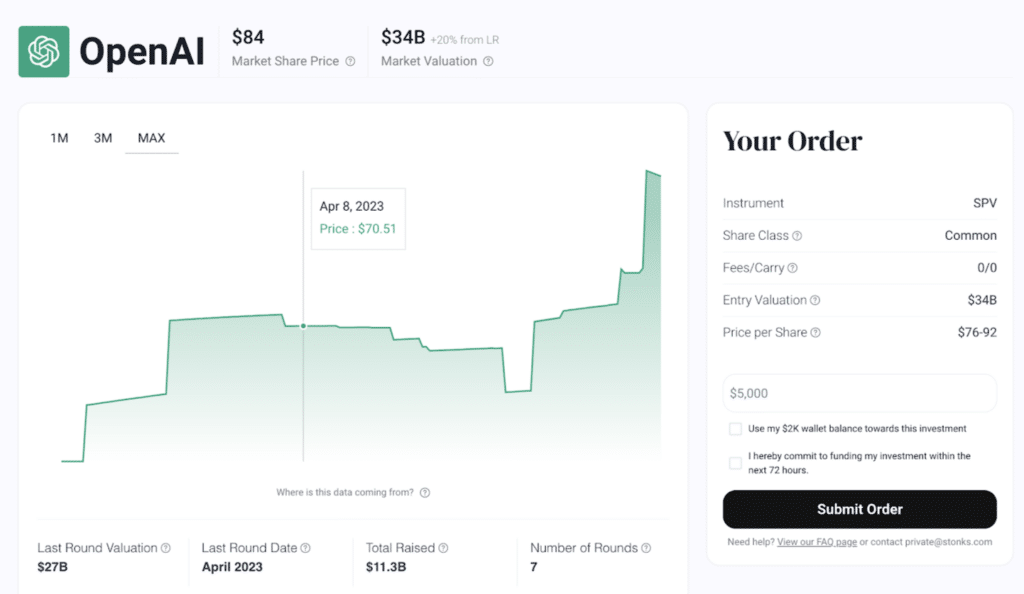

But just last week, the company formerly known as Stonks rebranded to Sandhill Markets — and they’re letting everyday folks invest in shares of pre-IPO companies for the very first time.

They’ve grown up and launched a platform for pre-IPO secondaries that gives you access to 20 of the world’s best high-growth startups.

You can now invest in these startups before they IPO:

- $5k minimum investment

- No management fees or transaction fees

- Unlimited investments

- Future liquidity through Sandhill’s Secondaries Market (coming in 2024)

Interestingly, there are no management or transaction fees. Sandhill is doing a subscription model. Membership costs $149/month.

Are you an accredited investor? Start here.

A short history of pre-IPO secondary markets

First, let’s talk about why it’s called a “secondary” to begin with:

- When you buy shares in a primary sale, proceeds go to the company.

- But when you buy them in a secondary sale, proceeds go to the seller.

The first secondary transactions were done in the 1980s, but the market really picked up during the 90s dotcom bubble, as distressed companies liquidated their positions to hungry buyers looking for the discount of a lifetime.

At the time, there were lots of failed dotcom startups that were worth zero. But some survivors had real businesses, customers, and actual cash flow. These companies weren’t worth anywhere near their valuations during the top of the hype cycle, but they were still worth something.

Companies with strong balance sheets saw this as an opportunity to buy these distressed startups for pennies on the dollar. (Hey, it’s better than zero!)

What problem do secondaries solve?

You may have heard that companies are taking longer to go public.

This can be great for companies (who don’t have to answer to public markets), but it can create a huge problem for employees.

See, when employees join a startup, they’re often granted ESOPs (employee stock options). Employees expect (or hope) the company goes public someday, so those stock options convert into actual shares they can sell.

But what they may not realize when they join, is that many startups have an expiration date for exercising their options, — which is often just 10 years!

If the company doesn’t go public within that time, and if employees can’t exercise their options before the 10-year window closes, the options expire worthless! (Yes, for real.)

This creates a nightmare scenario for early employees.

Secondaries solve this problem — and a whole lot more. They open up a new market so employees can sell their shares before they expire.

As the average time it takes for startups to go public has gotten longer, secondaries have been used to facilitate the exercise of options, and coverage of tax obligations.

Types of secondaries

There are two types of secondary transactions: GP-led and LP-led.

GP-led

A GP is a manager of a venture fund. They get paid through management fees, carried interest, and distributions from the fund.

In a GP-led transaction, shares in the fund are sold off (or a percentage of the shares).

These trades tend to be enormous. Perhaps a big investor decides they can’t wait any longer for a liquidity event (i.e., for the company to go public or for a sale), and wants to sell their position ASAP.

For example, the gigantic hedge fund Tiger Global recently attempted to sell fund positions through secondaries.

LP-led transactions

In LP-led transactions, a limited partner (i.e., an investor in the fund) wants to sell their portion of ownership.

To make this happen, the fund itself does not sell any shares. Instead, the makeup of unitholders in the fund changes.

Tender Offer

When a company has lots of employee interest to sell shares, they coordinate a tender offer. This means they match the shares with a buyer (or multiple buyers) at a specific price and terms the company has agreed to.

Direct Secondary

A direct secondary transaction occurs when shareholders directly sell their stock to another person or entity.

This is what you probably think of when you think about secondaries. One party sells to another using a Stock Transfer Agreement.

Forward Contract

Forward contracts are complex (often 10+ page long) derivative contracts, where the seller receives the cash today and promises to deliver the shares to the buyer as soon as they are free of transfer restrictions, usually post-IPO lockup.

These contracts are problematic. For those curious, this article explains why.

What are the benefits of secondaries?

Employees can sell

The benefit for employees is that it allows them to sell their stock options before an exit.

For startup employees, having a piece of paper showing the value of their employee stock options isn’t all that meaningful.

You know what is meaningful? Turning those options into actual dollars.

Secondaries allow employees to turn their “paper gains” into cold, hard cash. This can have a hugely positive impact on their lives.

And yes, this makes many employees rich. But it’s also a smart thing to do regardless, because having a ton of unexercised stock options means your wealth is highly concentrated in one company.

As a general rule, you don’t want most of your net worth tied up in a single entity (be it a house, a rare baseball card, or even a company). You want to diversify.

Secondary liquidity lets startup employees do exactly that.

Investors can buy more

The benefit for investors is that it allows them to buy more company shares.

Because they have a board seat and relationship with the founders, VCs often have unique insight into a company, which may give them a high conviction that the business will perform extremely well in the future.

But unless the company is raising a new financing round, there’s no way for the VCs to increase their stake. And founders may not want to raise a round, because most of the time raising a round means their shares get diluted.

Secondaries can be a great way for VCs to increase their stake, because secondaries typically use common stock, which won’t cause dilution.

In a nutshell, it’s a founder-friendly way to buy more of the business.

Companies can hire better

Secondary liquidity is a cost saver for startups, because it helps them retain and attract talent.

Startups make up for below-market wages with the promise of ESOP upside. But that upside only matters if the options can be converted into cash.

Employees feel comfortable with these lower salaries and higher stock options, as long as the company provides a liquidity facility (like going public, getting bought, or creating secondaries).

Without a liquidity mechanism, older employees have no reason to stick around any longer, and the company will have trouble attracting new top talent (who are wise to how this all works).

Better price discovery for the market

There’s a concept in finance known as the bid/ask spread (often just referred to as the spread.)

The spread refers to the difference between what a seller is asking for, and what a buyer is actually willing to pay. A “tight spread” means both sides acknowledge the asset’s true value. A “wide spread” means there is disagreement about what the asset is worth.

The more data points there are, the more consensus there is on pricing, which causes the price to settle into a nice, tight range.

But when there’s a lack of activity, there’s a lack of consensus on price. Neither sellers nor buyers are confident that they’re getting a good deal, because neither side can back their opinion up with data.

Secondary markets give both sides the data and confidence they need to transact. It creates more activity and, in theory, decreases the spread; meaning more accurate prices (which is good for everyone.)

And it’s good for the startup ecosystem as well! When funds have all their cash tied up in positions, they can’t write checks to promising new companies. But when funds sell their positions, they release capital to their investors, and can fund a whole new batch of companies.

And round and round we go. ♻️

What are the problems with secondaries?

Problems for employees

Bad optics

It may sound ridiculous, but some employees are afraid to sell their stock options through secondaries, because they fear it looks bad.

They think selling implies you don’t believe in the company’s growth prospects, or that they aren’t as committed.

This isn’t necessarily true, of course! As an employee, you may believe that the company will do great in the future, but know that you can put the cash into investments that will do even better for you.

I guess some employees don’t see it this way. Ah well. 🤷

Tax nightmares

Okay, let’s talk about taxes. This can be a huge problem.

Remember, employees need to exercise their options before they expire, which creates a tax bill. This is fine in theory, because the money they make from selling should far exceed any tax bill.

But sometimes the paper value of stock options grows so high that the only way they can afford the tax bill is to actually sell the shares those options become!

Bolt provides an example of the risk employees take when they exercise options. The company actually loaned their employees money so they could exercise stock options. Many employees took them up on this offer.

But then the worst thing imaginable happened: The market turned south, Bolt couldn’t get more funding, and the shares were no longer worth what the employees paid to exercise. This meant all these employees essentially overpaid in taxes.

On top of that, now they had a loan to pay back, increasing their losses further!

Oh, and to make things even worse, Bolt later fired employees who had taken out these loans; cutting off their salary and hurting their ability to repay.

Brutal.

Problems for investors

Existing investors set a company’s valuation by negotiating what’s known as a priced round.

The downside of secondary transactions for investors is that they may have to “re-mark” their book (i.e., revalue their shares) based on a new outsider’s valuation.

When this revaluation is higher than it was before, great! But if it’s lower, it creates pressure to update the NAV — something VCs are hesitant to do.

Secondary trades are long-only in principle. There aren’t really any tools to “short” these companies. This makes hedge funds uncomfortable, as they cannot manage their private book like their public book.

Caplight seems intent on changing this. Today, they’re a secondaries exchange, but soon they’ll use their data to offer derivatives.

These can then be used to make leveraged bets, or short (bet against) private companies, allowing hedge funds to apply similar strategies to what they do with their public portfolio companies.

Problems for companies

Less visibility into ownership

One reason private companies like to stay private is there’s a clear understanding of who owns what.

Founders and the board often either block a secondary transaction outright, or exercise their Right of First Refusal (ROFR), which allows a select group of investors to purchase the stock instead of the proposed buyer to maintain this control.

A secondary transaction where a new entity buys shares removes visibility into who the ultimate beneficiary is.

Some companies, particularly those tied to defense, need to understand who is behind the entity. Otherwise, foreign governments or bad actors (spies, money launderers, etc.) could get access to shareholder updates and trade secrets.

It makes hiring more difficult

Wait, hang on. Didn’t we just say that secondaries make hiring easier?

Well, yes, it does. But it’s complicated. Here’s why.

We know that venture-backed startups pay less in salary than large companies, and that they offset this by offering stock options.

Stock options have something known as the strike price, which is the exact, fixed price at which an employee can exercise options and convert them into shares. The lower the strike price, the more valuable the options, because the employee can capture more upside when they convert.

For tax purposes, companies must be able to justify that they are issuing options at a price roughly equal to market value.

So if there’s a large secondary offering, it could reset the market value and force the company to redo the 409a. This creates a new strike price which is higher than the current strike price.

This means there is less upside for new employees, and makes hiring top talent more difficult.

Secondary volume (and valuations) have fallen

Preferred stock commands a premium over common stock, because in the event of a sale, preferred stock gives investors the first right to proceeds.

This is less important when markets are rising and companies exit successfully, because enough upside is captured that both preferred and common shareholders get returns.

Where it becomes problematic is if markets are falling, or the business falters and sells for a lower valuation than at which money was previously raised.

When this happens, it can mean that the pool of cash that common shareholders split is significantly reduced, because the preferred shareholders recoup their full investment first.

Because of this huge benefit, preferred stock generally trades at a premium compared to common stock. This premium has shrunk as liquidity has become more common.

When DST purchased secondary common stock in Facebook, it paid 35% less than it should have, based on the $10 billion preferred stock price at the time.

Pre-covid, this discount was starting to shrink down to the 10-20% range. But after covid, demand exploded. Common shares began trading at 150% of the most recent priced round.

This was incredible considering these secondary rounds already had some rather, uhh, ambitious valuations driven by low interest rates.

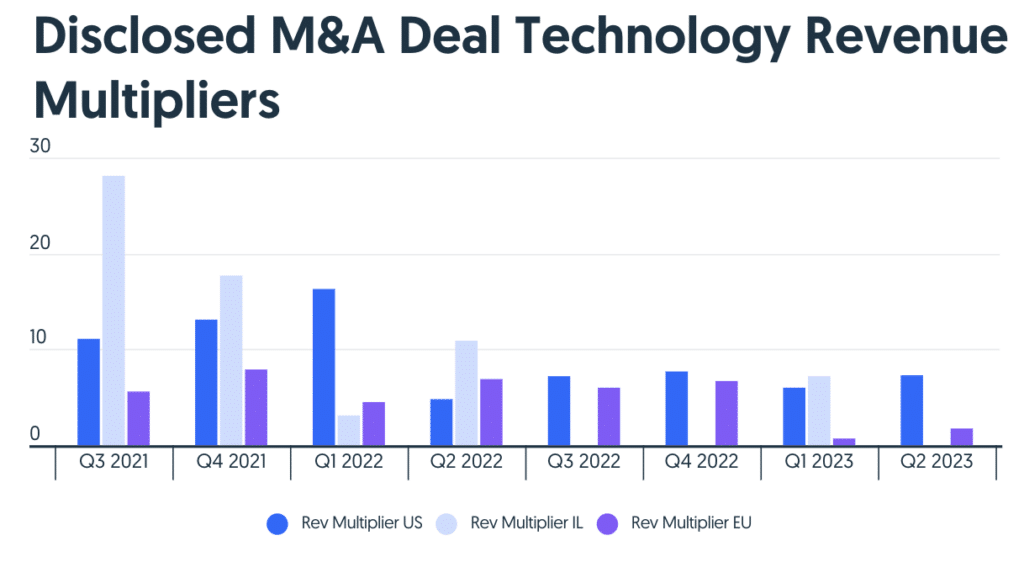

Today, common stock trades at significant discounts to those elevated 2021 valuations (heck, even preferred stock usually does too). We’re talking 30% markdowns in blue chip companies, and as much as 80% markdowns in companies with difficult paths to profitability (if there is a buyer at all.)

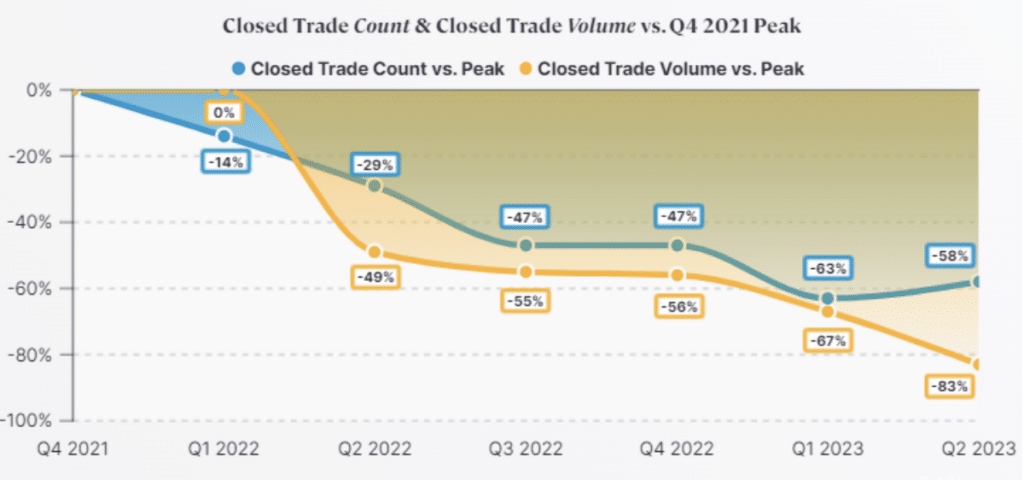

Caplight highlights the significant slowdown in activity in the secondary market since the boom. The number of closed transactions is down by 58% from the 2021 highs as of Q2 2023, and the actual volume of shares transacted has decreased even more, by 83%, over the same period.

Ultimately volume will pick back up. The question is, at what valuation?

For now, it seems sellers will need to meet buyer appetites. Boards can value their companies’ secondary offerings however they’d like.

But if buyers aren’t biting, well, they have no other choice but to come down in price.

Secondaries in global markets aren’t as developed

I have a tech recruiter friend who shared an interesting anecdote with me.

There was a study which asked startup employees in the US and Australia how much value they placed on each dollar of employee stock options.

In Australia, the answer was 35 cents. In the US? 85 cents.

A possible reason for this difference is that Australian startups have far less liquidity than US startups, making realizing value from an option grant much more difficult to envision.

Europe is following the US’s lead, but slowly.

Some EU companies still require documents to be physically mailed in order to complete a transaction, regardless of where the counterparties live. Ugh.

Software is being used to automate and clean up processes. But we haven’t seen a real shift yet.

Secondary startups to watch

This stuff is becoming a very big deal.

In 2023, the secondary market is expected to grow to $135b+. And it’s easy to understand why so many companies want to secure their piece of the pie by creating “picks and shovels” businesses.

Large LP secondary sales still require a brokerage and a discreet intermediary. High-finance stuff.

But recently, we’ve seen a range of platforms and choices to facilitate smaller transactions under $10m.

Brokers

Brokers, operating individually or as small firms, utilize a network of contacts from across the globe to cross transactions, which are then cleared via a broker-dealer to ensure compliance. This model depends heavily on relationships, networking, and trusting second-hand information.

Wall Street banks have set up desks to specifically play in this space. Leading players are Forge Global and Rainmaker Securities.

Platforms / aggregators

Forge and Manhattan Venture Partners are leaders here, doing both brokerage and SPVs to generate revenue from the full investor journey.

SPV providers

An SPV (Special Purpose Vehicle) allows a bunch of investors to pool their capital together and make a single investment. (Note: This is what we used for our own fundraising — if you’d like to join the round, it’s closing in one week.)

SPVs can be used by asset managers to buy secondaries, but the offering generally includes fees and “carry,” which vary based on how difficult it is to source the shares.

Sandhill Markets is sort of a hybrid platform/SPV provider, with a twist.

Sandhill has lowered the investment minimums significantly and have waived fees and carry. Instead, they have a modest membership fee that users pay monthly to access the platform.

It’s the same model that has been used for a decade, just at much lower entry points ($5k vs $25k)

And by making secondaries more accessible, they’re creating more transparency. It’s an example of a tech company disrupting finance in a niche where participants have traditionally held an advantage by being discreet and non-transparent.

The promise of liquidity in the future is fascinating too, and is a real possibility given the smaller initial investment sizes they are offering.

Sandhill calls itself the “Robinhood of the Private Markets” — which makes sense from a waived fees perspective. Robinhood helped reduce fees and open up access to the public markets, and Sandhill is doing the same for pre-IPO Secondaries.

$5k minimums, with 0% management fees, 0% transaction fees, and 0% carry for members.

Their model is fresh and bold. If Sandhill generates traction, it is very possible that other platforms will be forced to adjust their fee structures and offerings to keep up.

We’ll be watching Sandhill Markets very closely. Review the deals closing soon.

Exchanges

There’s a range of offerings seeking to bring public market qualities to the private space; including transparency, updated pricing, and tighter bid-ask spreads.

Notice and Augment are newer entrants, and Zanbato was founded in 2010.

Lending products

These allow employees who believe in the upside of their companies, and equity, to retain their shares but receive a loan that allows them to realize some wealth, possibly to pay a tax bill.

These are non-recourse loans generally and Liquid Stock is a pioneer in the space.

Liquidise

Unlike some of the previously mentioned offerings, Liquidise does not aim to monetize the market by making marginal improvements; they seek to fundamentally reshape the market by taking the best of the DEX’s (Decentralized exchange) like Uniswap and applying the Automated Market Maker (AMM) functionality and liquidity pools to traditional markets.

Every other model discussed in this article is a CEX (Centralized Exchange) where there is a bid-ask spread that needs to be manually closed by a centralized intermediary.

Usually, the potential downside of a DEX is the lack of KYC/AML processes. But I believe these are front and center in the Liquidise model.

Closing thoughts

Secondaries kill multiple birds with one stone, but the biggest problem they solve is for employees.

Remember that startup salaries tend to be modest. Startup employees rely on the value of their shares to make it all worth it. Without secondaries, many of those shares would expire worthless, and startup employees would be totally screwed.

So it’s terrific to see the ecosystem evolve, and new secondary markets take shape. But is right now a good time to be buying secondaries?

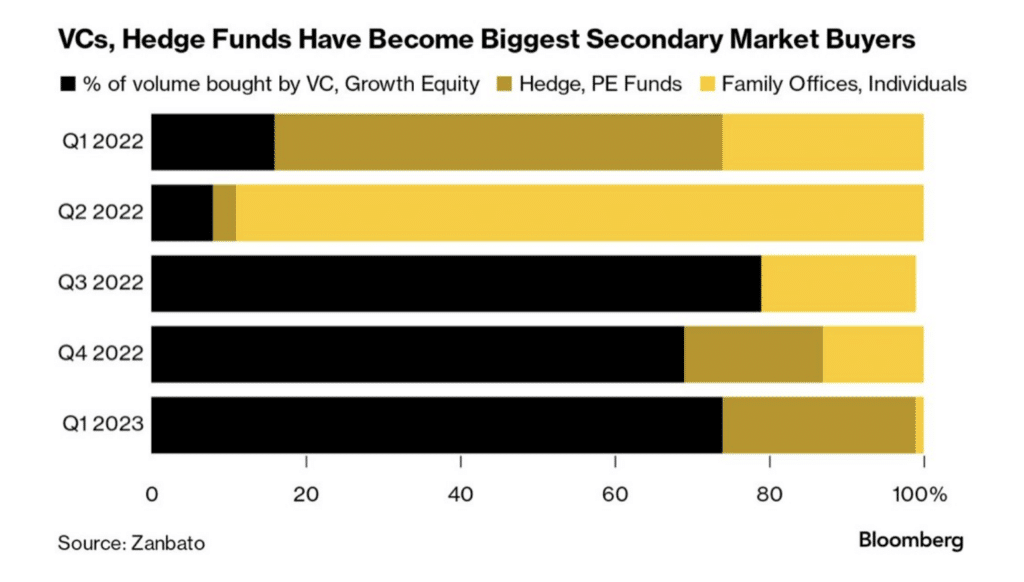

Well, if you think of VCs and private equity as “smart,” then the “smart money” is buying up more and more late-stage pre-IPO secondaries. Crossover funds certainly think this is a good time. They are definitely here to stay and are all fighting for access.

So on one hand, yes, buy when others are fearful.

But we’re also in a situation where many founders struggled to extend their runway to the end of 2023. So the next few months may be volatile, especially with early-stage companies.

The upcoming Instacart and Klayvio IPOs will be really interesting. If these go well, we may get a flurry of IPO activity in Q1 2024, and IPO activity drives up pricing in secondaries, as investors can smell a quick turnaround and flock to whatever pre-IPO shares are available.

That said, the election in late 2024 may also slow things down again quickly. If we don’t get a flurry in early 2024, then 2025+ is likely the next time we see real strength in the growth stage markets.

If you’re okay with that timeline and can do good DD on the company today, then yes — there are some great opportunities right now at the right price.

In the meantime, it’s exciting to see new startups move the space forward. They’re providing access, adding liquidity & better pricing, and even creating derivatives.

Most importantly, they’re creating transparency in a market that has traditionally been secretive as heck.

Further reading

- Industry Ventures put together a comprehensive deep dive on the origins of secondaries and where they predict it will grow to in 2030.

- Did Stripe wait too long to go public?

- Two weeks ago, the SEC released new rules requiring private fund advisers “…to distribute a fairness opinion or valuation opinion” in connection with secondary transactions.

- Employee stock options are a tricky topic — especially when it comes to taxes. This Holloway Guide is chock full of help.

Disclosures

- This issue was sponsored by our friends at Sandhill Markets

- Our ALTS 1 Fund has no investments in any companies mentioned in this issue

- This issue contains an affiliate link to Holloway Guides