A controversial and overlooked alternative investment

Hi everyone,

Today we’re exploring Life Settlements: a controversial and overlooked area of alternative investing that you probably haven’t seen before.

As investors, we’re comfortable with betting on the future outcome of organizations. It’s easy to go “long” or “short” public companies

But in recent years, we’ve seen a steady rise in ways to bet on the future outcome of individuals.

For instance, it’s now possible to invest in the performance of athletes. And you can directly participate in the success of students through Income Share Agreements.

Life Settlements involve buying third-party life insurance policies before a policyholder’s death.

As you can imagine, this opens up a maze of ethical quandaries. But as you’ll see, “betting” on life and death may be less controversial than it seems — especially given the strong regulation in place. It actually benefits both investors and policyholders.

We’ll simplify this complex asset class by analyzing a very unique offering: the Life Settlement Access Fund, which is available through a company called UpMarket.

This fund has achieved an annualized return of 9.8% since inception, with little correlation to other markets.

Want to learn more about the Life Settlements market?

Join the webinar on Apr 11 at 1pm EST

Let’s go 👇

Note: This free issue is sponsored by our friends at UpMarket. As always we think you’ll find this issue extremely informative and fair.

Table of Contents

How life insurance works

Let’s say you’re the breadwinner for your family.

You provide the bulk of the household income to pay for the living expenses of your partner and children.

While it’s morbid to think about, there’s always the risk of an accident or illness resulting in your untimely death. If that occurs, you might be worried about how your family will be provided for.

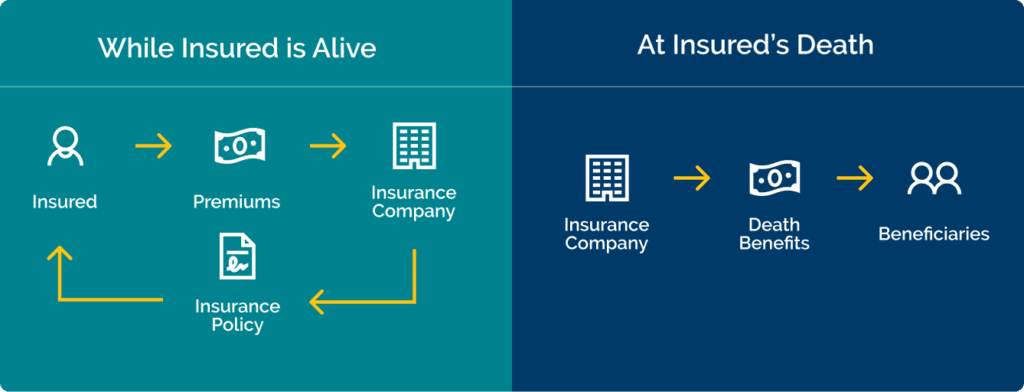

This is where life insurance comes into play. Life insurance involves paying premiums toward a policy that provides a cash benefit to named beneficiaries upon your death.

There are a whole bunch of different types of life insurance, but the main distinction you need to know is term life vs whole life:

- Term life insurance policies are only active for a specified period of time (say, 10 years). After that, the policy expires.

- Whole life lasts for your whole life.

The size of the cash payout (or death benefit) depends on the face value of the insurance policy, which also influences how expensive the premiums are.

While the death benefit of the average life insurance policy averages between $250k – $1 million, wealthier individuals can have benefits of $15 million or more.

Now, let’s say you’ve been paying into a life insurance policy for years, but you realize the tradeoff doesn’t make sense anymore.

Perhaps your children are now old enough to support themselves. Or perhaps you’re due to receive a large inheritance. Or maybe you get an unexpected illness and need immediate cash for medical expenses.

Remember, term life insurance expires on its own. But what about whole life?

Is it possible to “return” a whole life policy that you just don’t need anymore?

Surrendering your life insurance

The traditional way people deal with this is by swapping their existing life insurance in exchange for cash. This is known as surrendering your life insurance policy.

When you surrender your life insurance, you stop paying premiums and the insurance company pays you the surrender value of your policy.

This surrender value is lower than the death benefit value, and is influenced by:

- Total premiums paid

- Commissions paid (to insurance agents)

- Returns on the insurer’s investments

- Any agreed-upon fees or charges

So, you’re basically selling your policy back to the insurance company. But as any economist would tell you, limiting a sale to just one buyer probably won’t get you the best price.

Is it possible to sell your life insurance policy to someone other than the insurance company? And potentially for a price greater than the surrender value?

Today, that answer is a resounding yes. (And it wasn’t always this way!)

Want to learn more about the Life Settlements market?

Join the webinar on Apr 11 at 1pm EST

How “trading on your death” got started

It’s odd to think of a life insurance policy on yourself as something you can trade, but in the US this idea is well-established in case law.

In fact, a 1911 Supreme Court case on this very topic established that “[s]o far as reasonable safety permits, it is desirable to give to life policies the ordinary characteristics of property.”

And this “reasonable safety” clause is paramount – if someone holds life insurance on you, they literally benefit from your death, leading to obvious incentives for abuse.

For this reason, you can’t take out a life insurance policy on someone else. This is called stranger-owned life insurance and is generally illegal.

But in contrast, it’s perfectly legal to sell an existing policy on yourself, to a third party in the form of a life settlement.

Just had lunch with a guy that invests in life insurance settlements. Fascinating!

— Chris Koerner (@mhp_guy) April 3, 2024

He bought 4 policies for $2.2m from 94 – 97 year olds that total $7.1m in death benefits.

He pays the premiums until the holders "mature." The longer they live, the less he makes.

It's a win for… pic.twitter.com/giqkix20TN

For years, there wasn’t really a market for this stuff. Even if you knew you could theoretically sell a life insurance policy, who would buy it?

That all changed as a result of the AIDS crisis in the 80s and 90s.

As the tragic epidemic swept through the LGBTQ community, many young and previously healthy people were faced with significantly shortened lifespans (and costly medical bills).

This kickstarted the idea of trading life insurance policies for cash, known at the time as the viatical settlement business. (Critically, it also showcased the exploitation that can take place in the absence of suitable regulations.

From this infamous beginning, the life settlement market was born.

Today, most of the activity is in policies for aging seniors, rather than terminally ill patients.

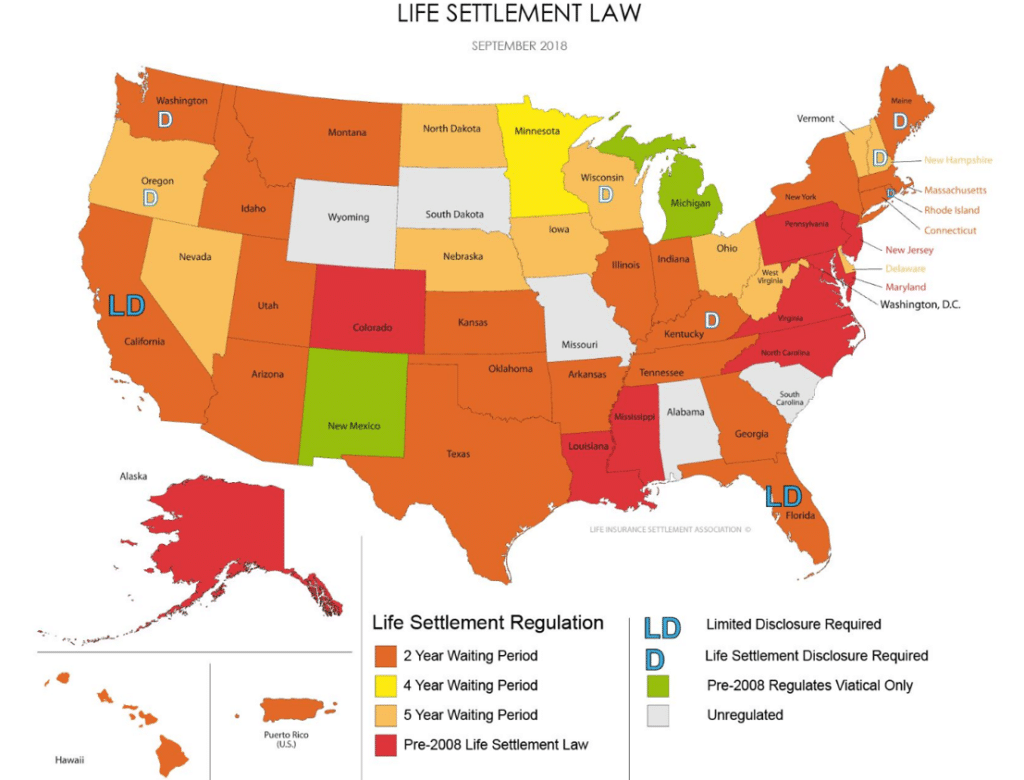

In addition, laws have slowly been established to protect the insured party.

How are life settlement prices determined?

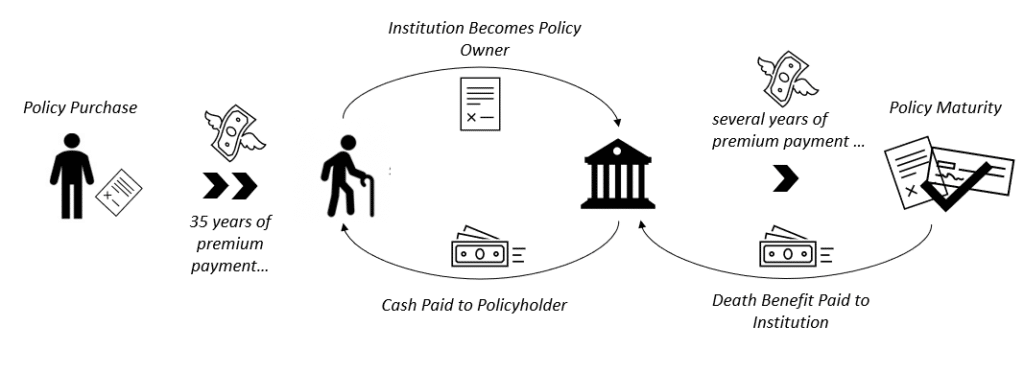

The minute an investor buys someone else’s life insurance policy, two things happen:

- The investor becomes responsible for paying future premiums, and

- The investor becomes the beneficiary of the account.

However, unlike the surrender value, the price an investor pays for a life settlement isn’t dictated by the insurance company.

Instead, the pricing is based on treating the policy like an investment. It includes factors like:

- The total value of the death benefit (cash payout)

- The remaining life expectancy for the insured

- Total expected remaining premiums to be paid

- The investor’s target return

- And macro factors like interest rates, inflation, competing investments, etc.

When an investor buys a policy, what do they do with it?

Buy and hold

The most basic strategy is to buy and hold the policy until the individual passes away. (Sorry, there’s just no nice or easy way to say that…)

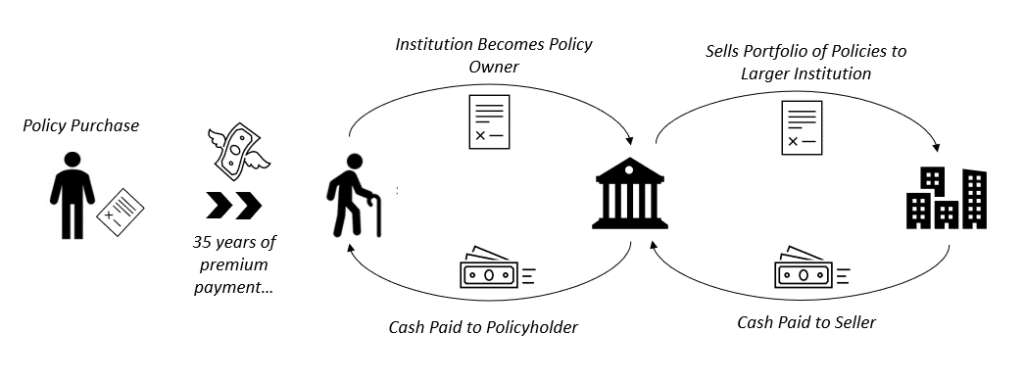

Buy and sell

But there’s also a growing market for such claims, meaning that the original investor might be able to buy and sell the policy instead.

For policyholders, the creation of a market for individual life insurance claims has been enormously valuable.

Investor competition for these policies tends to drive their prices up. In 2022, American consumers who sold their policies received life settlement prices 5x higher than their associated surrender values, resulting in an overall surplus of $638 million.

As you’d expect, investors aren’t paying for these policies out of the goodness of their hearts.

Life settlement investing can be immensely lucrative — especially if you can assemble a team skilled at blending medical and actuarial practices to better predict the life expectancy of policyholders.

To best understand what the market looks like for investors, we’ll analyze the Life Settlement Access Fund.

How to invest in in Life Settlements

UpMarket is an alternative investments platform with lots of cool opportunities, including in secondaries, real estate, and private equity.

But by far one of the most intriguing offerings on the platform is the Life Settlement Access Fund, which offers exposure to exactly the type of strategy we’ve described so far.

This is an “access” fund because it feeds into the underlying Life Securities Sarl fund, which is based in Luxembourg and more institutionally focused.

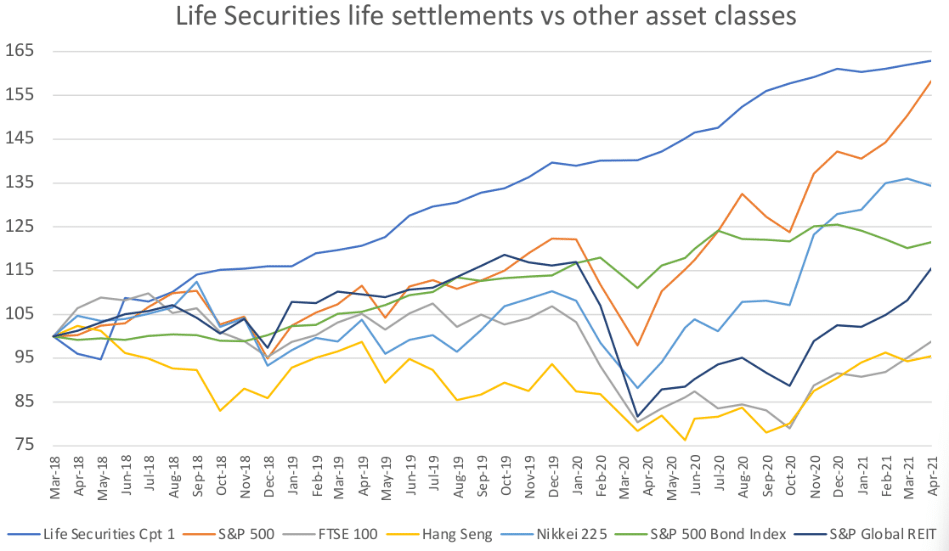

Given the numbers, it’s no surprise that institutions are interested – the fund has generated annualized returns of 9.8% since inception in 2018, all without a single down quarter.

That data helps highlight the three key benefits of investing in life settlements right now:

High return potential

Life settlements investing is still a relatively nascent market.

In 2022, an estimated $4.5 billion in face value of life insurance policies changed hands, a fraction of the estimated $187 billion in policies that might qualify for investment.

As it stands, there’s not a ton of competition for investors to buy these policies.

Even though 80% of seniors own life insurance, only about 50% of policyholders are even aware that you can sell life insurance for cash.

There’s a lot of outperformance to harvest in this market, including:

- Superior identification of people who might be open to selling their policies

- Better analytics in determining which policies are the best investment.

Like all markets, some of this outperformance might fade as life settlements investing matures.

But right now, there’s a lot of alpha left for early adopters.

Low volatility

In financial markets, it’s not uncommon to see major jumps or falls in a short time span.

Consider the 2020 Covid-induced crashes, which saw global markets fall some 30%+ in the span of a month.

But life settlements are different — weak (or strong) performance is generated by people living longer (or shorter) than expected. It’d be very strange for life expectancies to rise or fall 30% in a short time span!

Stuff like medical innovations or major pandemics can definitely have an impact (Covid reduced global life expectancy by about 1.6 years in 2020/2021) but it’s hard to see how the volatility of earnings from life settlements could ever approach traditional investments.

Low correlation to traditional markets

Finally, life settlements have effectively zero correlation to broader financial markets.

It’s pretty easy to see why. While factors like fluctuating interest rates or inflation might influence traditional financial assets, they’re not really going to impact how long people live.

In fact, we’re reminded of litigation finance in the way that life settlements are structurally uncorrelated to typical investments.

What makes this fund special?

We’ve spent a lot of time discussing the exciting possibilities of the life settlement investing market, but why should you get exposure through this fund? What’s so special about it?

As it turns out, the answer all has to do with research and due diligence.

The Life Securities team is one of the few on the market with their own in-house medical underwriters.

While most funds use third-party teams to provide the life expectancy estimates that power policy selection, Life Securities actually has their own doctors to inform those estimates (even including specialists like oncologists).

In addition, the fund uses its own proprietary analysis system to track each policy, fine-tuned in collaboration with some of the industry’s leading institutional players.

Finally, Life Securities uses an independent external evaluator to calculate the value of each individual policy quarterly.

That level of detail helps inform the team whether they should hold a policy till maturity or sell it to another investor – both strategies that the fund employs to generate returns.

And while past performance is no guarantee, this level of focus seems to be working – Life Securities has never incurred a loss on a policy since inception.

Investment details

This week’s webinar will go dig deep into all aspects of life settlement investing, and why this fund is a great fit for investors looking to get exposure to this unique alternative investment.

Portfolio composition

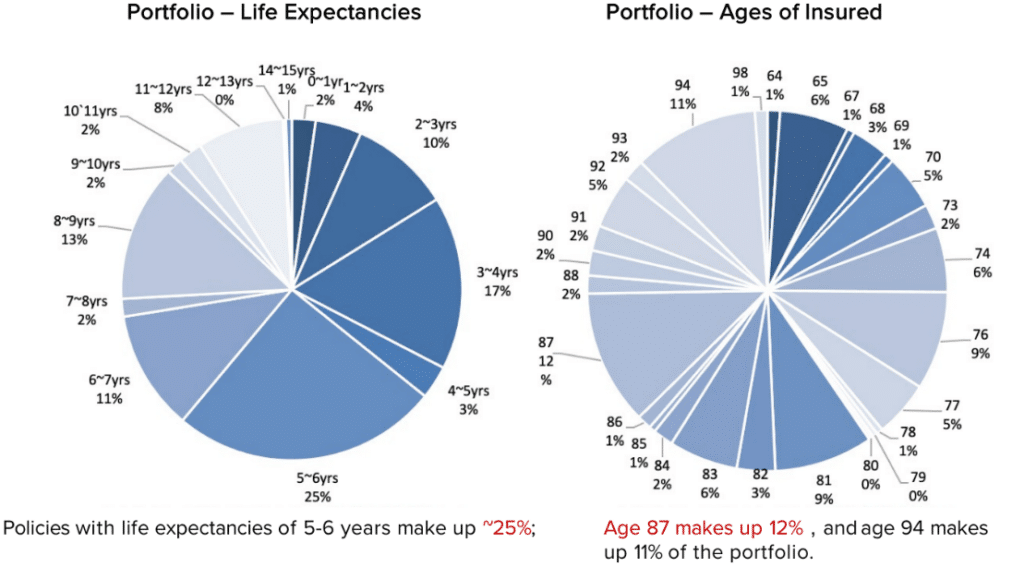

As of Q4 2024, the fund was strongly diversified between the ages and life expectancies of the insured individuals.

Naturally, the ages here are going to skew older. But it’s also important to ensure that you have a steady stream of earnings from these policies over time, rather than lumping payoffs in just a few years.

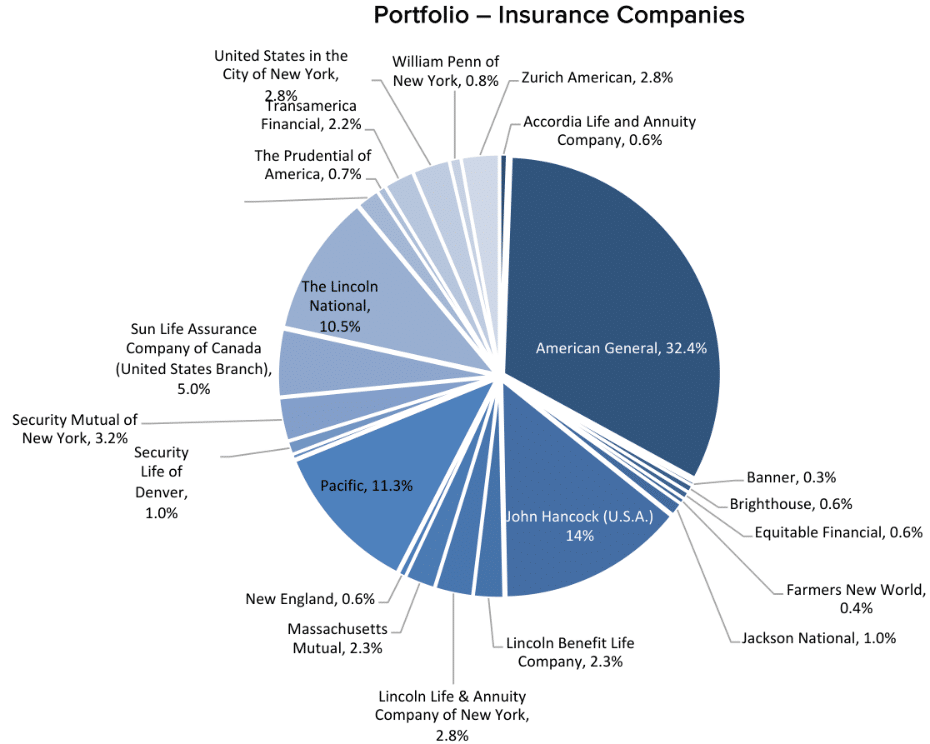

Critically, the fund is also diversified between insurance companies.

Ultimately, it’s the insurance companies that need to pay off the death benefit of these policies, so ensuring they’re a good credit risk is highly relevant.

Life Securities only purchases policies from insurance companies with ratings of A- or higher.

Investment terms

- Investment minimum: $100K, with $10K incremental

- Subscription/redemption: Monthly subscription with 90-day notice quarterly redemptions

- Fund fee: 1.5% subscription fee upfront, 2% annual management fee, 15% performance fee

- Qualification: US Accredited investors only

- Next close date: April 20th, 2024

- Investment lock-up: 2-year minimum

- Availability: Through UpMarket

Purchasing criteria

Finally, here’s what Life Securities outlines as their criteria for purchasing an individual insurance policy, which feeds through to bottom-line fund performance:

- Target return: Greater than 10% IRR

- Min. probability of profit: 95%

- Min. profit to loss ratio: 3:1

- Min. carrier investment grade: A-

Disclosures from Alts

- This issue was sponsored by UpMarket

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of UpMarket and the Life Settlement Fund. UpMarket has agreed to offer an unconstrained look at its business, offerings, and operations. UpMarket is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.

Disclosures from UpMarket