Welcome to our Sports Cards Insider newsletter – FREE VERSION. Today we have a deep dive into a pair of baseball card assets IPO’ing on Collectable:

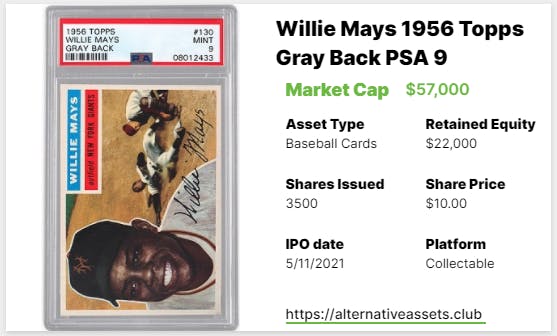

- Willie Mays 1956 Topps Gray Back PSA 9 – Tuesday, May 11th, 8 PM EST

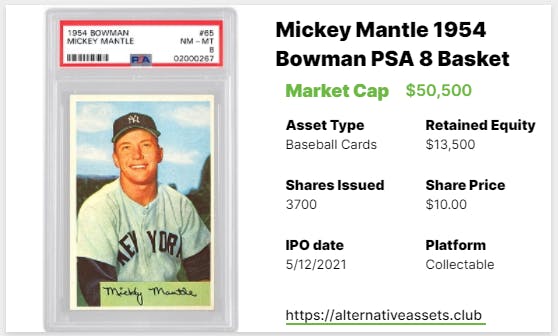

- Mickey Mantle 1954 Bowman PSA 8 Basket (3) – Wednesday, May 12th, 8 PM EST

Follow me on Twitter for my latest insights and analysis.

Table of Contents

What is the Willie Mays 1956 Topps Gray Back PSA 9?

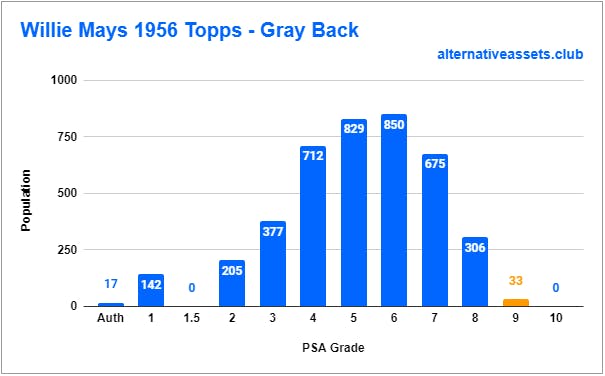

This is a 1956 Topps Willie Mays card with a gray back graded PSA 9. The 1956 Topps set had two different printers – one with a white back and one with a gray back. For this Mays card, the white backs are scarcer and more valuable — there are over 4,000 gray backs in the PSA population and only 388 white backs. There are 33 gray backs graded PSA 9 with none higher.

It IPOs on Collectable on Tuesday, May 11th at 8 PM for $57,000. The consignor is retaining $25,000 in equity, leaving $32,000 in available shares.

Add IPO to calendar

Cultural Relevance

We’ve covered Mays a couple of times, with the first write-up here. He’s the greatest center fielder to play the game, arguably one of the 2 or 3 best players of all-time and recently celebrated his 90th birthday. Happy birthday Willie! In 1956, the year of this card, Mays had a “down” year (he was still excellent, compiling 7.6 bWAR and was an All-Star) but it was the only year between 1954-1966 that he didn’t finish in the top-6 in MVP voting. and the Giants were awful, finishing 67-87, their worst record between 1946-1984.

Inferred Value – $40K+

[Detailed Valuation for Insiders Only]

Category Strength

The Sports Cards category had a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

There has been a bit of a flight to vintage quality in the sports card market as of late, and Mays certainly fits that category. As he’s the oldest living Hall of Famer, he gets coverage every birthday and retains a fairly high profile. The value may stay flat or decline in the short run but I’d expect his cards to remain steady over the long haul.

Asset Liquidity

This will have a roughly 60-90 day lockup period then will trade daily.

Platform Risk

Intangibles

The retained equity (43.8%) gives the consignor near-total control here. While I believe Mays cards will continue to be a great store of value, there’s nothing particularly unique about this season or this card compared to others, though it does help that there are none graded higher (for now).

What is the Mickey Mantle 1954 Bowman PSA 8 Basket?

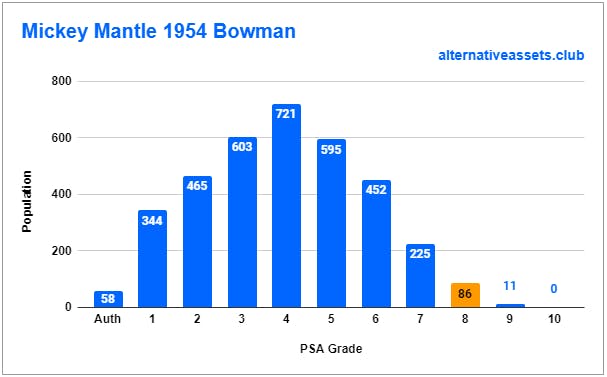

This is a set of 3 Mickey Mantle 1954 Bowman cards graded PSA 8. Of the 3,559 cards in PSA’s database, 86 have been graded as PSA 8s, with 11 PSA 9s and none higher.

It IPOs on Collectable on Wednesday, May 12th at 8 PM EST for $50,500. The consignor is retaining $13,500 in equity, leaving $37,000 in shares.

Add IPO to calendar

Cultural Relevance

We’ve also covered Mantle quite a bit – the most extensive write-up is here. One of the greatest center fielders ever (not up to May’s level) and arguably the most talented baseball player ever, Mantle is prized by collectors with some of his cards being among the most valuable and coveted in the industry.

In 1954, Mantle was already an excellent player but he didn’t become a transcendent superstar until the next year (between 1955-1962 he finished in the top-5 in MVP voting 7 times, winning three) and it was the only year between 1948-1958 that the Yankees did not win the American League pennant.

Inferred Value – $30K-60K

[Detailed Valuation for Insiders Only]

Category Strength

The Sports Cards category had a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

As with Mays cards, I’d expect in the long run for Mantle cards to continue to appreciate but for a card that is not particularly unique (and is not the highest graded variant) there’s no reason this will outperform other Mantle cards or the market in general.

Asset Liquidity

This will have a roughly 60-90 day lockup period then will trade daily.

Platform Risk

Intangibles

While the retained equity on this one isn’t as high (26.7%) it’s still a factor. And similar to the Mays card, there’s nothing particularly special about this card – it’s not his rookie card, it’s not particularly rare and it’s not from a memorable season.