The week between Christmas and New Year’s is the busiest skiing week of the year.

America’s skiing market is dominated by two major players: Vail and Alterra — both of which are thriving at the moment.

But this market is worth understanding not only for its unique supply & demand qualities, but for its fascinating behavioral economics, and its rapid transformation into a luxury market amidst a very uncertain future.

You’ll learn:

- What caused skiing demand to spike?

- Why is skiing more expensive than ever?

- How busy are ski resorts these days?

- Why are ski resorts like gyms?

- What are skiing’s biggest long-term threats? One is obvious…

- …But the other is not 🎟️

- How did the market reach the point where Vail and Alterra are the only major players? 🎟️

- How do Vail and Alterra’s strategies differ? 🎟️

- Why is competition so limited when skiing is more popular than ever? 🎟️

- Why is European skiing cheaper than American skiing? 🎟️

- How did seasonal passes come to dominate the market? 🎟️

- Why have only four new ski resorts been built in the last 23 years? 🎟️

- What does the future hold for the ski industry? 🎟️

Note: To read the full issue you’ll need the All-Access Pass. 🎟️

Table of Contents

Skiing demand is spiking…

In the past few years, America’s skiing obsession has reached new heights.

2022 was the busiest ski season on record, with 64 million ski resort visits. That’s up 6.6% over 2021.

Two influences seem to explain the surge:

- Post-pandemic “outdoor boom.” Since Covid ended, outdoor activities have seen a renaissance. Demand has climbed for stuff that gets people out of the house. Skiing is no exception.

- Social media. With pristine white snow and cozy mountain lodges, skiing is Insta-friendly social media gold.

It’s hard to quantify the extent to which Instagram and TikTok are driving more people to the slopes, but ski resorts have certainly been prioritizing influencer partnerships in its marketing efforts.

That’s great news for ski resorts – but not so much for skiers themselves. The industry cannot easily create supply. This isn’t like manufacturing iPhones or cars. Companies can’t just quickly spin up new ski resorts to meet the demand.

And all this extra demand means high ticket prices and long wait times.

…but threats loom large

Skiing is more expensive than ever

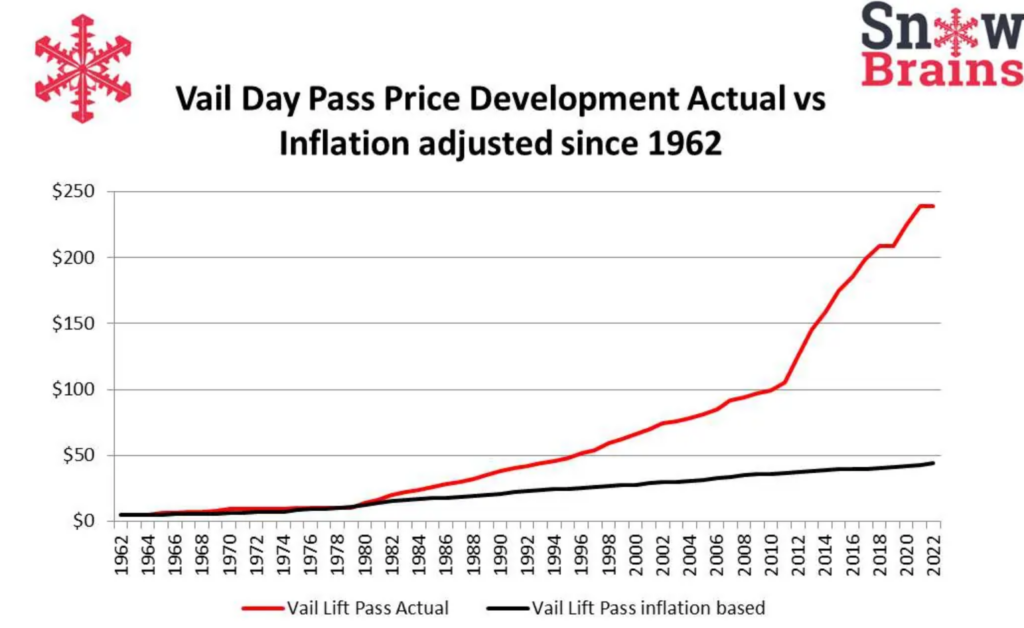

Even before the recent demand spike, the cost to go skiing in America was flying past inflation.

In 1962, a day pass at Vail Ski Resort was just $5. If that figure had climbed in line with inflation, it would be $44 today.

But last season, it cost $239.

Are these exorbitant prices simply an inevitable fact of skiing?

Well, not quite.

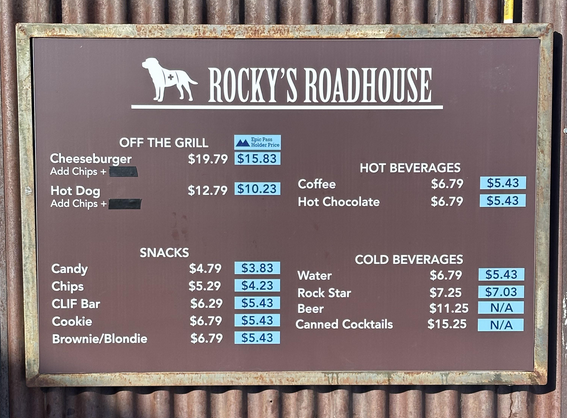

In Europe, despite having world-class facilities, not a single resort charges over $100 for a day pass.

But these high prices haven’t turned off American skiers.

In fact, the resorts are busier than ever.

Ski resorts are packed

As more people have been drawn to skiing, resorts have become incredibly crowded.

In one 2020 incident, dubbed the Vail lift line apocalypse, skiers had to wait over two hours to ride to the top of the mountain.

As you’d expect, this overcrowding has additional knock-on effects.

Parking has been getting scarce. And locals are complaining about housing shortages in ski towns wealthy residents snap up second homes and investors convert properties to short-term rentals.

In fact, housing shortages have gotten so bad that local workers often struggle to find a place to live when competing with deep-pocketed transplants.

As our friends at The Briefcase pointed out, this has prompted ski resort companies to invest tens of millions just to ensure their employees have housing.

Despite the problems associated with such big crowds, ski resorts have shown little interest in creating capacity limits, which could hamstring their revenue.

While ski resorts may limit the number of day passes they sell, most seasonal ski passes are sold in unlimited numbers. This means when fresh snow draws people to the mountain in droves, wait times for ski lifts can get outrageous.

But in the grand scheme of things, high prices and crowded mountains are just two minor annoyances resulting from skiing’s recent surge in popularity.

In contrast, skiing faces two long-term threats that could upend the industry as a whole.

One of them is obvious, the other not so much.

Skiing’s long-term threats

Climate change is already affecting resorts

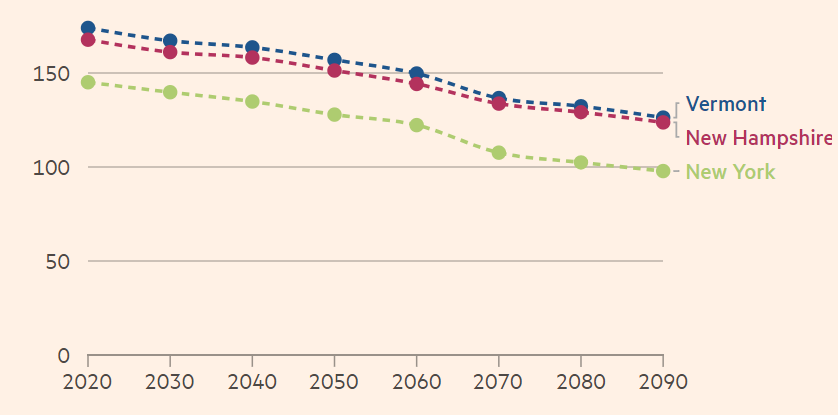

To state the obvious, skiing requires snow. And due to climate change, there’s been a whole lot less snow in recent years.

- Since 1973, global snowfall has declined 2.7%

- .Higher temperatures and a greater portion of rain compared to snow have started to shrink the actual ski season in which resorts generate their greatest revenue.

- While the traditional ski season starts around Thanksgiving, many resorts no longer open that early.

- By some estimates, the Western US snow season has shrunk by more than 30 days since 1982 (!)

- And in Europe, nearly half of Alpine ski resorts could go bankrupt if current trends continue.

While a shrinking season is the most existential climate threat to the ski industry, higher temperatures mean terrible snow quality. Skiers may put up with bad snow to get a few runs in, but they’re unlikely to continue to pay ultra-premium prices for it.

Resorts are investing huge sums in artificial snowmaking capacity, but let’s be clear: this is no panacea.

Making fake snow takes a ton of energy. And as temperatures rise, fake snow requires even more energy to produce, making the process increasingly uneconomical.

But there’s another looming problem. One that is quieter and rarely discussed…