Welcome to Sports Memorabilia Insider for Feb 15th, 2022 – FREE edition.

Each week we give you the scoop on undervalued, mispriced, and hidden gems in Alternative Investing.

Table of Contents

Sports Memorabilia in 2022

Another week, another flat performance for the sports memorabilia index as it remains unchanged for the fourth week in a row. The index has found a support level and the eventual breakout will be interesting to watch.

The index is down 4% for 2022 YTD.

Last Week

Fractional secondary markets

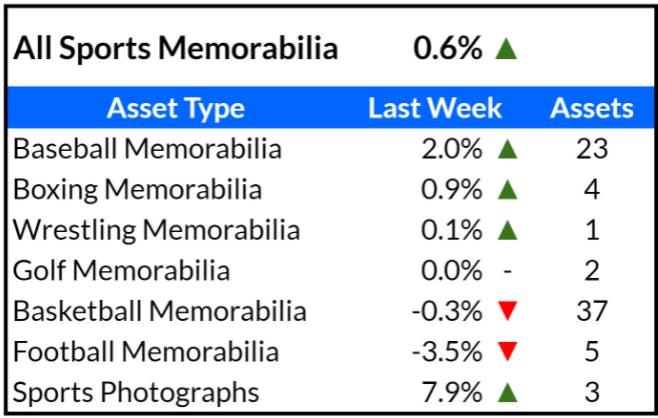

All sports memorabilia assets were up slightly more than a half percent for the week. The two titans of the index moved in opposite directions as baseball was up 2% for the week while basketball was slightly in the red with a .3% loss

Vintage game-used baseball memorabilia surged as the 1968 Willie Mays game-used bat gained 38.4% and the 1956 Ted Williams game-worn jersey was up 30.9%.

Early Jordan memorabilia on Rally got dunked on as both the 1992 game-worn Air Jordans and the 1985 shattered backboard jersey tumbled 30%.

Auctions

The Goldin Winter Elite Auction wrapped up on February 6 featuring offerings with fractional impact:

- Tom Brady NFL Debut Signed Full Ticket (PSA 7 ticket/PSA 9 Auto) – $175,200; strong result, perhaps partially impacted by Brady’s retirement; updating the value of Collectable’s Brady Debut Ticket (PSA 7) from $78,000 to $100,000

- 1971 Roberto Clemente World Series Game-Used Bat (PSA/DNA GU 10) – $102,000; updating value of two Clemente bats on fractional platforms; updating value of Collectable’s 1965-68 Clemente game-used bat (PSA/DNA GU 9) from $24,000 to $120,000; updating value of Rally’s 1959 Clemente game-used bat (PSA/DNA GU 10) from $103,000 to $140,000

- 1997-98 Michael Jordan Game-Used, Signed & Photo Matched Bulls Road Uniform – $600,000; continues a string of strong Jordan game-used auction results, including recent Lelands sale; updating value of Rally’s 1991 Jordan game-worn uniform from $60,000 to $500,000

- 1996-97 Michael Jordan Game-Used, Signed, and Inscribed Bulls Road Jersey – $216,000; updating the value of Collectable’s 1984-85 Jordan rookie game-worn and signed Bulls road jersey from $180,000 to $300,000

This week and next

Fractional Market IPOs

Busy week with two assets open for early access and three offerings debuting their general access IPO.

1967 Super Bowl I Full Ticket – PSA 5

- Market Cap: $24,000

- Retained Equity: $0

- Inferred Value: $17,550

- Drop: 2/13/2022 on Rally (fully funded as of 2/14)

- Our Opinion: [INSIDERS ONLY]

“Ruth Bows Out” Pulitzer Prize-Winning Type 1 Photo

- Market Cap: $49,500

- Retained Equity: $13,662 (27.6%)

- Inferred Value: $48,000

- Drop: 2/15/2022 on Collectable (early access)

- Our Opinion: [INSIDERS ONLY]

NBA 50 Greatest Lithograph – Dave Bing Collection

- Market Cap: $100,000

- Retained Equity: $0

- Inferred Value: $50,000

- Drop: 2/17/2022 on Collectable (early access)

- Our Opinion: [INSIDERS ONLY]

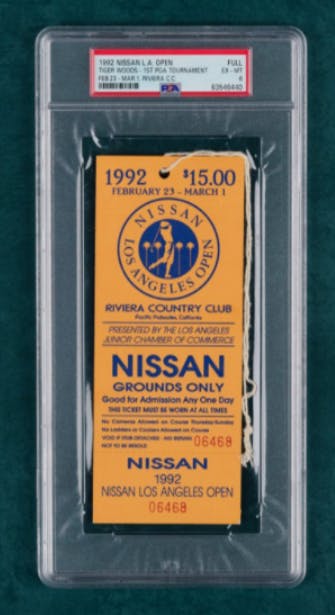

1992 Tiger Woods PGA Debut Full Ticket – PSA 6

- Market Cap: $70,000

- Retained Equity: $7,000 (10%)

- Inferred Value: $64,000

- Drop: 2/18/2022 on Rally

- Our Opinion: [INSIDERS ONLY]

Luka Doncic 2019 Game-Worn Signed Sneakers

- Market Cap: $82,000

- Retained Equity: $15,500

- Inferred Value: $52,000

- Drop: 2/20/2022 on Collectable (general access)

- Our Opinion: [INSIDERS ONLY]

Fractional Secondary Markets

Rally debuts four memorabilia assets for live trading, three of which feature Michael Jordan.

Note: Market cap data correct as of 2/14

1991 Michael Jordan Game-Worn Uniform

- Platform: Rally

- Market Cap: $65,000

- Inferred Value: $500,000

1992 Signed Michael Jordan Game-Worn Air Jordan 7’s

- Platform: Rally

- Market Cap: $29,400

- Inferred Value: $35,000

1994 Derek Jeter Game-Worn AAA Jersey (Signed)

- Platform: Rally

- Market Cap: $30,200

- Inferred Value: $27,000

1985 Jordan “Shattered Backboard” Jersey (Signed)

- Platform: Rally

- Market Cap: $140,000

- Inferred Value: $230,000

Auctions

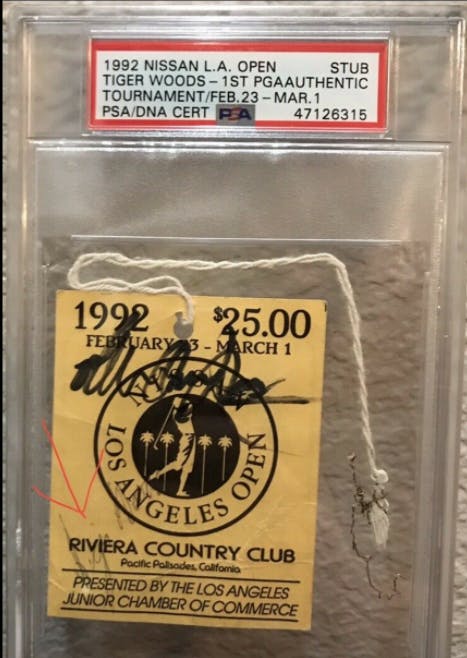

There is an interesting sister piece on eBay to the Rally Tiger Woods PGA debut ticket. Of the three such tickets in the PSA pop report, the authentic stub ticket is currently for sale for $85,000 and includes a 16-year old Tiger’s signature, which could be his first professionally signed item.

If you want to capitalize on the L.A. Rams Super Bowl victory, Goldin has four pairs of game-worn gloves from Van Jefferson, Super Bowl MVP Cooper Kupp, Von Miller, and Sony Michel up for auction.

A Brady debut ticket, identical to the $175,200 ticket noted above except for one grade higher on the auto, is also live on Goldin’s latest auction.