Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite.

Quick links:

On Monday, Jim thanked the “incompetent knuckleheads at SVB” for hastening a downturn that never seems to arrive, and “making the stock market more attractive as we near the end of rate hikes.”

The day after his comments, the market immediately tanked (of course). And echoing Jamie Dimon’s comments that “ the crisis isn’t over yet ,” Jim acknowledged we should be worried about liquidity, credit, and defaults.

(Hang on, last week, didn’t he downgrade this whole thing from a “banking crisis” to a “jam?” I digress…)

Table of Contents

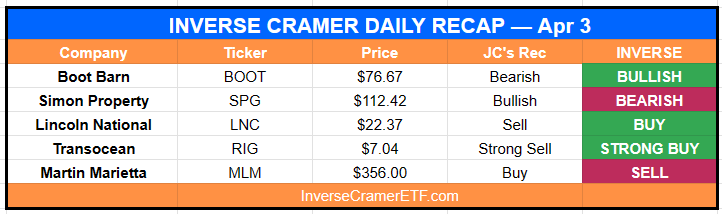

Monday Apr 3

I think it has gotten too cheap. I’ve seen the stock shrink and it doesn’t make sense to me – On Boot Barn ($BOOT)

He is money. I’m not going to abandon my liking of them. – On David Simon of Simon Property Group ($SPG)

I prefer Halliburton. I think it’s cheaper, better, and safer – On Transocean ($RIG)

I don’t think it has much going for it from the demand side other than China. I think there was an incredible moment for the refiners, but that moment has now come and gone. – On oil companies

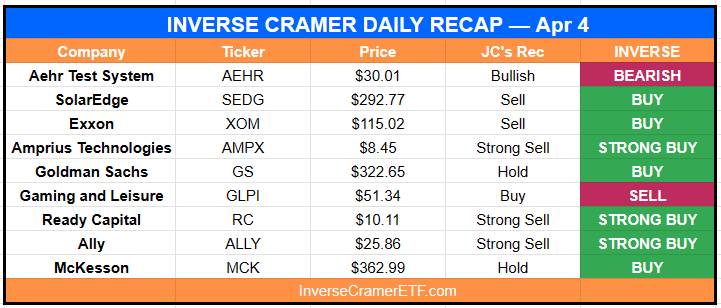

Tuesday Apr 4

Fun moment Tuesday when Susan from California asked what to do about PayPal.

See, a while back Jim recommended PayPal. But now it’s down big, and he says it won’t recover for 5 years.

Susan wants to sell, but he tells her not to sell yet because “they can do better.” But then he goes on to talk about how PayPal is screwed because of Apple, Square, and BNPL movement…

Madness

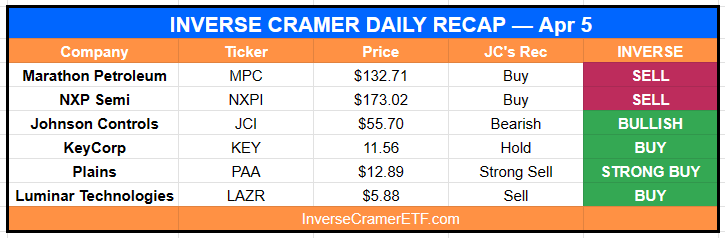

Wednesday Apr 5

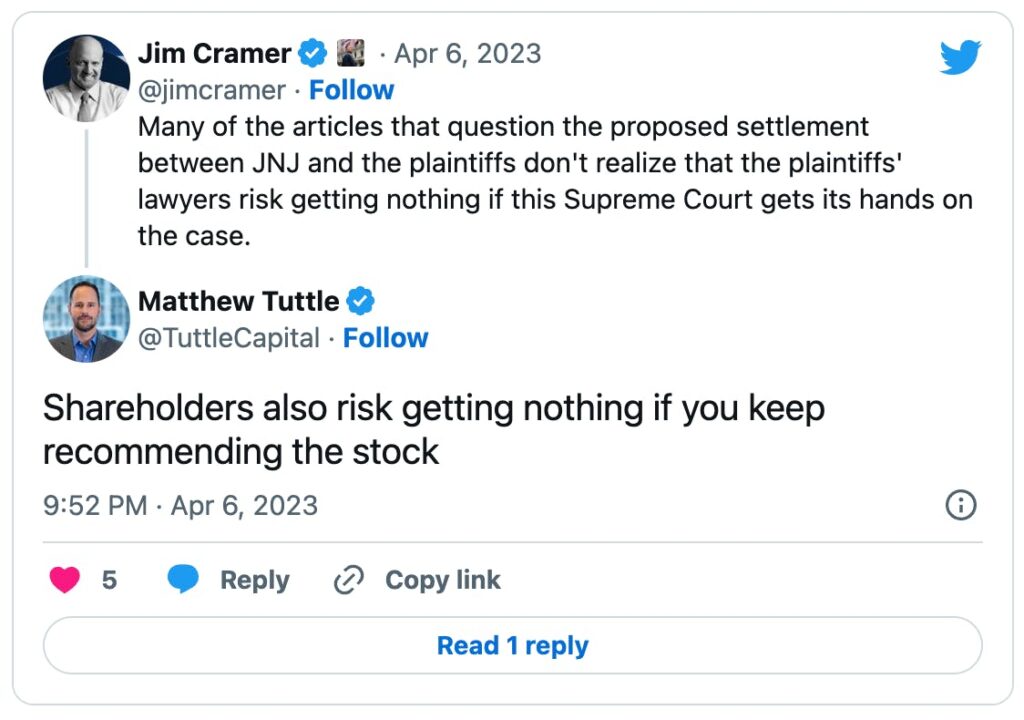

Jim spent most of Wednesday talking about the Johnson & Johnson asbestos lawsuit.

For those who don’t know, JNJ has been in legal hot water after it was revealed their baby powder tested positive for traces of asbestos.

This has been a headache for Cramer. See, last March he recommended the stock for his Charitable Trust, because he thought there was no way JNJ could be permanently impaired by these claims.

We had visions of $200 dancing in our heads! – On Johnson & Johnson

On Wednesday, Johnson & Johnson announced a nearly $9 billion settlement to settle the lawsuits.

This was decent news for Cramer, because as he put it, “the existential threat has been taken off the table“.

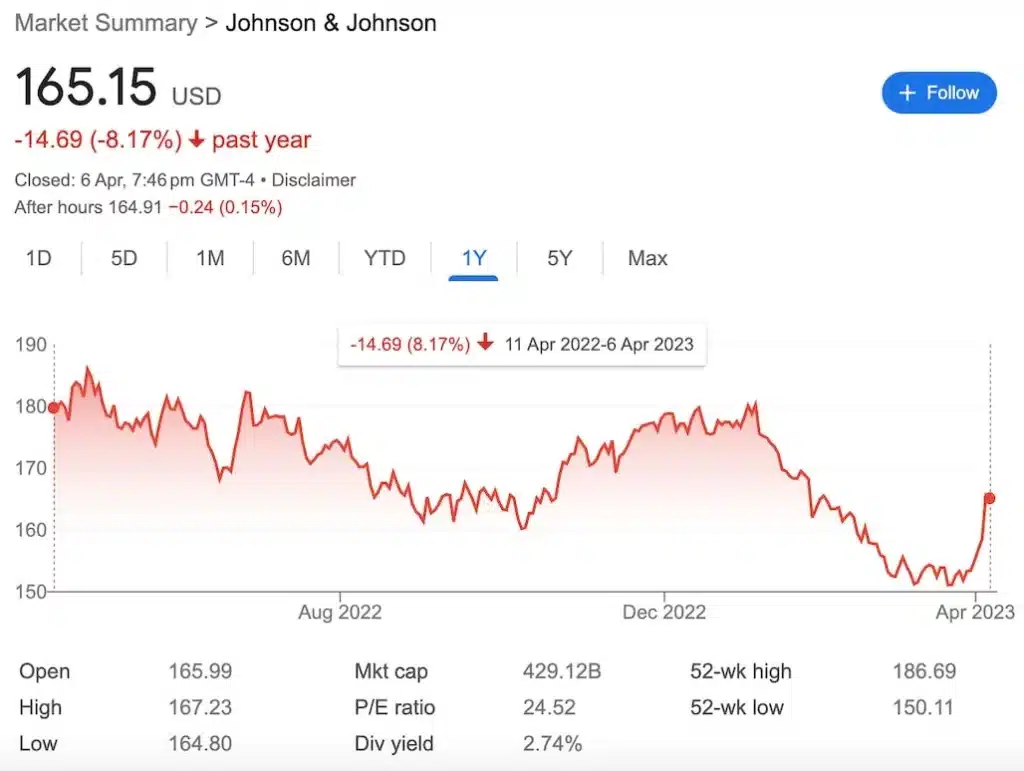

The stock jumped on the news as well (though it’s still down 8.17% from Cramer’s top-tick call last March)

Thursday Apr 6

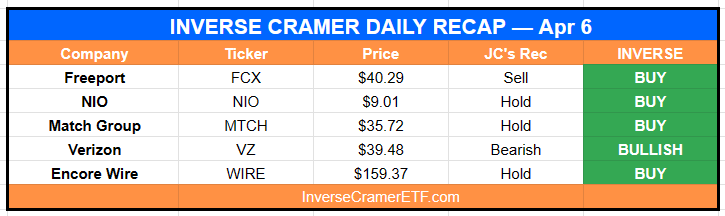

I think you can hold it. What’s happening with some of these stocks in China is the government runs them. I think the Chinese are doing that now. I want you to hold on to it for when the government runs it, then you can sell. – On Tesla competitor NIO ($NIO)

It’s being crushed by T-Mobile. What a beatdown. This is not the level to sell, it’s got a good 6% yield. But they’ve not demonstrated to me any real growth. They’ve gotta start doing that or maybe we need a couple of changes! – On Verizon ($VZ)

Friday Apr 7

Cramer was off for Good Friday

“We like Coinbase to $475!”

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) April 6, 2023

Now hates it at $60, oops pic.twitter.com/3OB4hARcRI

Cramer Classic

Olive branch

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by Tuttle Capital

- I am long $SPG, $MTCH and $NIO

- We have no ALTS 1 investments in any companies mentioned in this issue