Last week was big for Altea, our private community for alternative investors. Our second Art deal is closing, and Altea’s first tequila deal is going to the lawyers. Plus, two new deals for our members.

I’ve also started a running list of books I read and recommend based on my WC research. Suggestions are welcome.

Today, we’ve got:

Table of Contents

The AI nuclear option

From the excellent (for nerds like me) newsletter, the Transcript, which transcribes relevant bits from earnings calls.

An incredible quote jumped out at me from the recent round of earnings calls:

Kinder Morgan (KMI) Executive Chairman Rich Kinder:

“One recent survey showed a projected increase in electric demand to power data centers of 13% to 15% compounded annually through 2030. Put another way, data centers used about 2.5% of U.S. electricity in 2022 and are projected to use about 20% by 2030. AI demand alone is projected at about 15% of demand in 2030.”

This jives very closely to what Zuck said in his recent interview:

“I actually think before we hit [AGI], you’re going to run into energy constraints. I don’t think anyone’s built a gigawatt single training cluster yet. You run into these things that just end up being slower in the world.”

Likewise Sam Altman’s push toward a nuclear power revival.

The drumbeats around this are getting louder, but I’ve been consistently put off by how scammy uranium and nuclear investments always seem.

I’m considering a deep dive on specific ways to invest in this trend (similar to this piece on how climate change will affect real estate), but I can’t justify the 20 – 30 hours it would take to research write unless you guys are willing to pay for it.

If you want to see this happen, let me know what it would be worth to you.

I want to learn more about the AI nuclear trend

If enough people are willing to pay for this, I’ll write it. If I get loads of people committing to it, I’ll turn it into something bigger.

Chess makes me a better investor

I’m rediscovering chess in middle age, and it’s wonderful.

Most of my days are full on, and playing chess is a fantsatic exercise in mindfulness.

The game is often perceived simply as a game of strategy and intellect overshadowed by its apparent complexity and competitive nature. But, at its core, playing chess is a profound exercise in mindfulness, offering a unique, engaging way to practice being present and fully engaged with the moment.

Chess demands complete focus on the current state of the game, requiring players to observe, plan, and react based on the unfolding position of pieces on the board. Through this intense focus, players naturally practice mindfulness by anchoring their attention to the present moment, setting aside distractions from the past or concerns about the future.

And that mindfulness has all sorts of benefits as both an investor and entrepreneur:

- Better decisionmaking

- Better stress and emotional regulation

- Improved concentration and focus

- Patience and longterm perspective

- Adaptability to change

- Resistence to overtrading

- Resilience in the face of loss

I’m still pretty awful, but connect with me if you fancy a game.

In the meantime, if you want to improve your game, here’s a couple books you may want to check out:

Introducing Books from the WC

Yes, those are my initials, and yes, I know what they mean, but I’m owning it.

Curated from among hundreds of books I’ve read over the last several decades, these are the best.

Most are non-fiction, but you’ll also find works of fiction sprinkled in. They tell an important story, give essential historical context, or present a compelling or necessary vision of the future.

They’re all books that will make you a better investor, give you essential context for our world, and possibly help you become a better human.

You can view them all here.

Here’s a closer look at one recommendation. The Diamond Age by Neal Stephenson.

I actually found reading this book exceptionally hard work, but perhaps that’s because I slogged through it while deployed with NATO during the Libyan uprising. Nonetheless, the vision of the future presented here, specifically around AI as a tutor for our children, is compelling and thought-provoking.

If you enjoy it, I encourage you to check out Snow Crash as well. It is a look at what would happen if America (and the world) split up into corporate city states. Which isn’t, like, an impossible outcome.

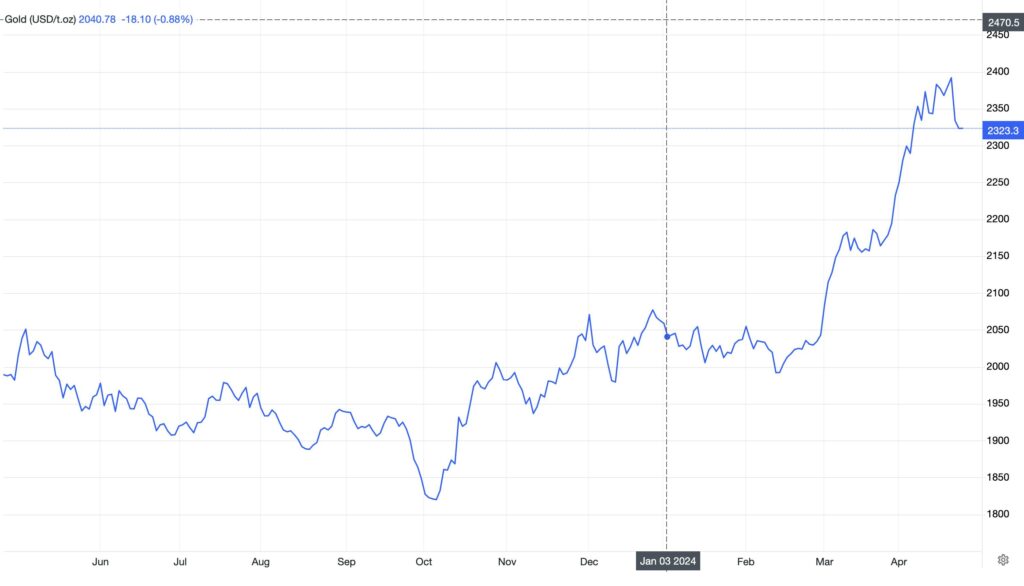

Why is gold mooning?

It’s been a heck of a year for gold.

And gold shills like Peter Schiff have delighted in the new all-time highs.

#Gold closed the week above $2,390, its highest weekly close ever. This is also the second highest daily close ever. Overnight gold traded at a new all-time record high above $2,416. #Bitcoin is down 6% on the week, trading at just 26.8 ounces of gold, 28% below it's record high.

— Peter Schiff (@PeterSchiff) April 19, 2024

But what’s the real reason gold is up 20% YoY?