Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

Table of Contents

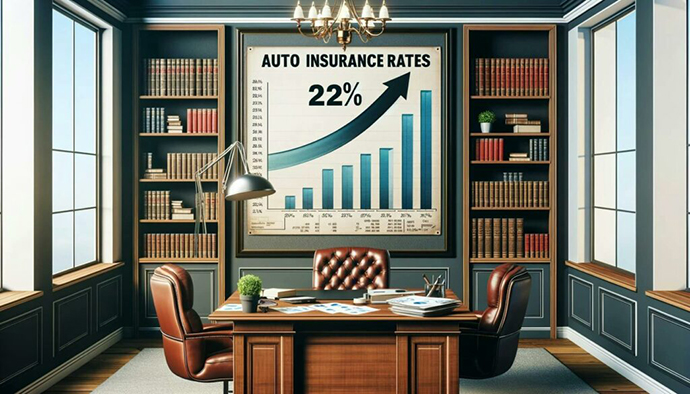

The American Car Insurance Crisis

via A Wealth of Common Sense

Auto insurance rates have surged by 22% over the past 12 months, far outpacing the overall inflation rate of 3.5%.

The increase in auto insurance rates is driven by several factors: rising vehicle costs, more complex and costly repairs, deteriorating driver behavior, and the impacts of climate change.

These elements collectively inflate costs for both insurers and consumers, complicating efforts to curb escalating expenses.

Will this slow down anytime soon?

Goldman Bets Big on Luxury and Beauty

Goldman Sachs is doubling down on the luxury and beauty sectors, moving Cosmo Roe, their former head of consumer technology, to lead their global luxury and beauty initiatives.

Roe, with involvement in deals such as Amazon’s acquisition of Whole Foods, Tom Ford’s sale to Estée Lauder, and Creed’s acquisition by Kering, is optimistic about the sector’s potential for growth and innovation in M&A.

What does this mean for the industry? More from Short Squeez.

California’s Shrinking Share of the US Tech Industry

California, previously a leader in tech employment, has seen its share of US tech jobs drop to a decade low.

Since August 2022, the state has lost tens of thousands of tech jobs, adding only 6,000 since the pandemic began. This comes in stark contrast to the 570,000 tech jobs gained elsewhere in the country.

This shift has significantly impacted California’s economy, housing market, and public finances, demonstrating the consequences of the state’s inability to adapt to changing times.

Get the full analysis from Apricitas Economics

The Boldest Scam In Crowdfunding?

Wigl, a startup that raised over $13 million from retail investors for its wireless power technology, has been exposed as a sophisticated scam.

A detailed review of Wigl’s SEC filings exposed severe mismanagement, showing that less than 5% of the raised capital ended up in the company’s bank accounts. The analysis also revealed substantial losses due to risky investments and inappropriate use of investor funds by the CEO for personal expenses.

Biotech Finally Bounces Back

The biotech sector is experiencing a resurgence in 2024, with venture funding and IPO filings significantly higher than last year. US and European biotechs raised $6.8 billion in the first quarter alone, outpacing the most active quarter of 2023 by $1 billion.

This growth is driven by increased M&A activity, de-risked clinical trial data, and a clearer path to FDA approval. While the focus remains on later-stage deals, the trend of large initial financing rounds is expected to continue, albeit at a slower pace compared to the overall investment trend.

Samsung Reclaims Its Smartphone Crown

In Q1 2024, Samsung reclaimed the title of the world’s top smartphone seller from Apple, shipping 60 million units—20% more than its rival.

This shift occurs as Apple experiences a nearly 10% year-over-year decline due to diminishing demand in China, where consumers increasingly favor local brands like Transsion and Xiaomi.

Further compounded by the lack of groundbreaking features in recent iPhone releases, Apple now faces a significant challenge in maintaining its market dominance.

The Financial Statements That You Should Pay More Attention To

James Li from the Wharton Business School conducted a study on the financial statements of 3,156 open-ended and 56 closed-end actively managed US equity funds from 1995 to 2018, investigating whether these statements provide additional insights beyond traditional metrics like expense ratios and past performance.

Li discovered that certain accounting measures—dividend income, interest income, unrealized gains/losses, and cash holdings—can significantly enhance predictions of future fund performance.

By incorporating these measures into a machine learning algorithm, he improved the alpha of his fund selection by 1% per year over a model that relied solely on standard metrics.

Joachim Klement’s full breakdown is fascinating.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

The latest news, tools, and step-by-step tutorials of all the latest in AI.

The most important tech news and insights. Join 80,000+ early adopters staying ahead of the curve, for free.

Free daily hot stock trading ideas, and market insights from a 20-year trading veteran.

Stock ideas

Here are three of my favourites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

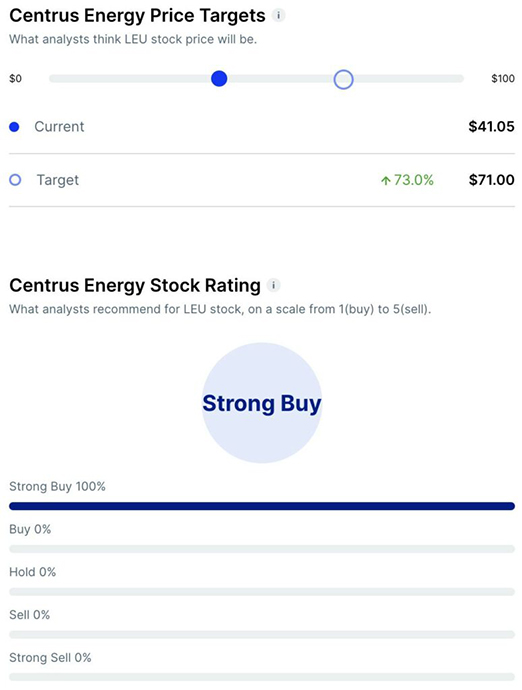

Centrus Energy ($LEU)

Bull Case:

- Government Support: Centrus Energy received $700 million in government funding for HALEU production, positioning it as the sole domestic producer.

- Rising Nuclear Energy Demand: The company is well-positioned to benefit from the anticipated surge in nuclear energy demand.

- Attractive Valuation: With an EV/EBITDA of 8 and a market cap of $684 million at $43.70 per share, Centrus Energy presents a compelling investment opportunity.

Bear Case:

- Speculative Nature: The position in Centrus Energy is considered speculative.

- Previous Divestment: The firm Pernas Research had previously divested from Centrus Energy due to its reliance on Russia.

- Government Support: Heavy reliance on government support may raise concerns about its long-term sustainability.

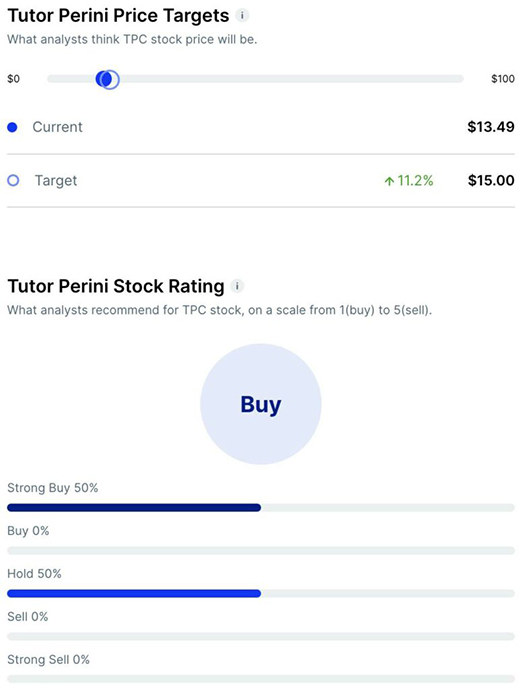

Tutor Perini ($TPC)

Bull Case:

- Infrastructure Spending: Tutor Perini is well-positioned to benefit from the $1.2 trillion federal infrastructure law.

- Strong Pipeline: Ongoing new business wins have rebuilt Tutor Perini’s sales pipeline.

- Legal Settlements: Successful legal action to collect past-due work could generate over $500 million in incremental cash flow.

Bear Case:

- Undervalued Shares: Tutor Perini’s shares are trading at a 20% discount to tangible book value, suggesting skepticism about its future profitability.

- Covid-19 Impact: The pandemic caused delays in larger Civil contracts, weighing on profitability.

- Uncertain Earnings: While Tutor Perini has the potential to generate normalized EPS over $3 as the Civil segment recovers, the timeline and certainty remain unclear.

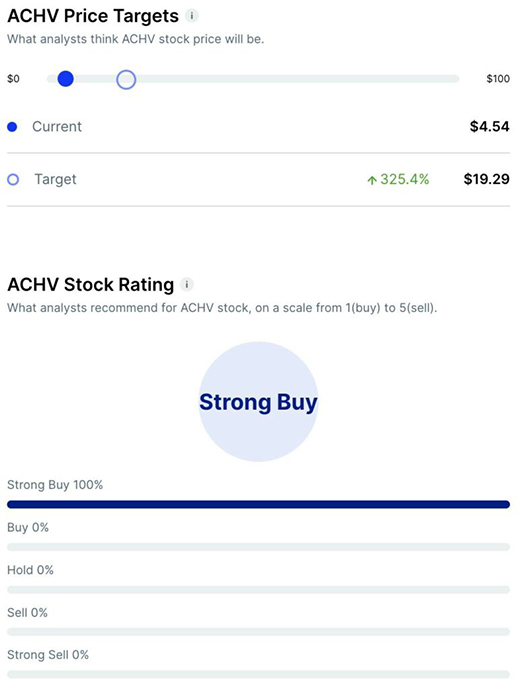

Achieve Life Sciences ($ACHV)

Bull Case:

- Efficacy: Cytisinicline shows 4-6x higher quit rates vs placebo in trials, positioning it for market share gains if approved.

- Safety: Cytisinicline showed excellent tolerability vs Chantix, potentially expanding the market.

- Acquisition Potential: ACHV could be acquired by big pharma around their 2025 NDA filing, potentially at $20-40/share.

Bear Case:

- Capitalization Struggles: Dilutive fundraising and SVB issues highlight risks around ACHV’s financial position.

- Regulatory Uncertainty: The FDA request for more safety data could pressure the stock.

- Binary Risk: If their drug is not approved or the company is not acquired, the stock could decline massively.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.