Welcome to Startups Insider.

New here? Read up on our previous issues to get the most from this post.

June 22, 2022 | ±5 minutes

CONTENTS:

- An overview of Relic – a UK fractional investment platform

- The history and development of the company

- The products and services they provide

Let’s check them out!

Table of Contents

Introduction

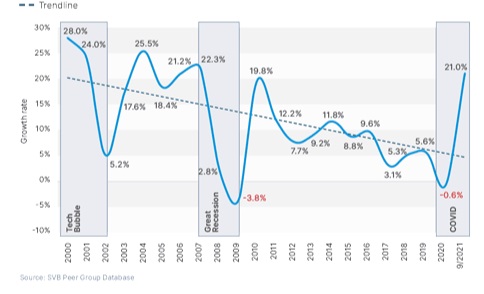

Fractionalization isn’t a new concept. The idea of forming “syndicates” to participate in all sorts of investment opportunities (think horse racing and property) and sharing the upfront costs has been around for centuries.

However, it’s only in the past decade that technology started catching up.

The internet has made us more connected than ever – well, at least virtually. The advance in tech has allowed fractionalization to really take off.

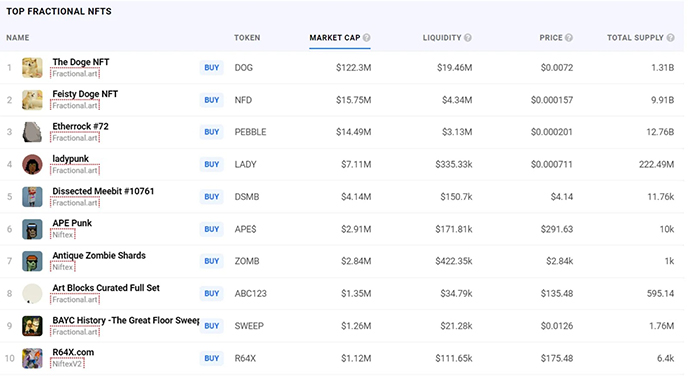

We only need to look at the Fractional NFT market to catch a glimpse of the direction this investment model is heading.

Fractionalization is such an exciting model because it’s just so accessible. Whether you’re a high-capital investor or a student looking to jumpstart their portfolio – fractional assets are within reach.

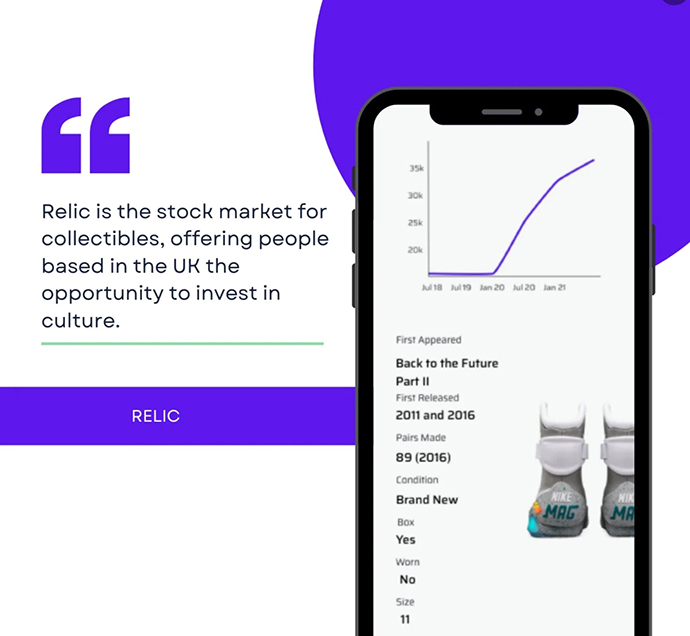

An easy way to invest in collectibles

With that in mind, today we’re taking a closer look at a UK company that’s geared towards the new generation of investors, combining a mobile-first platform with fractionalized alternative assets.

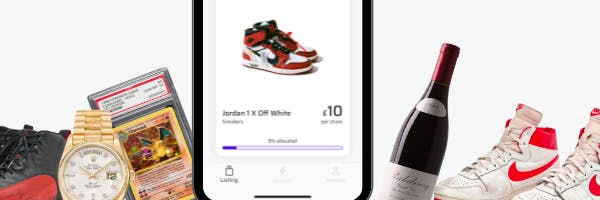

The list of markets they dabble in is enticing – sneakers, sports trading cards, video games, NFTs, and plenty more.

You can find Relic on:

- Official Website

- iOS app (to join Relic BETA via TestFlight)

- Google Play Store app

- Discord

The need for innovation

Just before the pandemic, Australia was dealing with another disaster of its own – the horrific 2019–20 bushfire season. Over 30 people lost their lives, 2700 lost their homes, and the air quality in nearly every state reached dangerously low levels.

In late 2020, a number of charitable events were run to help raise funds for those who lost their homes. At this time, Relic’s founder Josh Shrive participated in an auction for buying rare bottles of vintage liquor, with proceeds supporting bushfire victims.

The auction made Shrive realize that people loved vintage alcohol not just for getting drunk – turns out wine and whiskey were some of the most profitable investment opportunities out there.

At the same time, Shrive was already all across crypto and equities as an investment class but was shocked at the lack of innovation in this space.

Relic’s mobile-first investment model

After consulting hundreds of potential clients, an important decision was made.

The fractional business model was seeing some serious support. There was a lot of potential for a fractional wine business, but with a twist – it would be built mobile-first.

However, Josh Shrive then had a random encounter with our very own Wyatt Cavalier. Their shared interest in alternative investments led to a conversation that changed Shrive’s perspective – sure, vintage wines are a viable alternative asset, but there’s so much more out there.

Armed with advice from potential customers and confidence in the fractional mobile-first investment model, Relic was born.

Bringing the UK up to speed

The United States is rife with fractional investment opportunities. Much of this accessibility came on the back of Obama’s JOBS Act which made it easier for small businesses to begin crowdfunding.

However, the United Kingdom lagged a few steps behind.

The avenues for UK residents to access unique and exciting alternative investments – such as sneakers, vintage watches, and liquor – were relatively limited. Exposure to these opportunities was mostly international, which can incur forex fees and tighten profit margins even further.

Pair that with the very sparse fractionalization market, and there was a perfect opportunity for Relic.

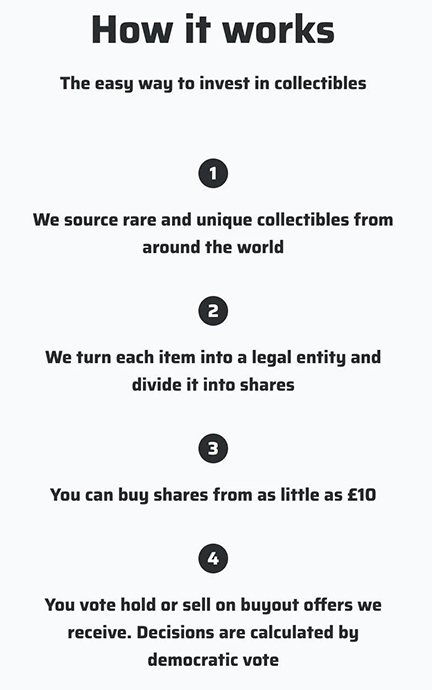

They are one of the few UK-based companies to support fractional investments in a broad range of collectibles. The investment platform takes charge when it comes to all the nitty-gritty of buying alternative assets. This includes authentication, storage, insurance, and other logistical exercises investors may not actually consider.

And best of all for UK investors – Relic supports GBP. This is a pretty huge deal. Investors don’t have to worry about gas fees, exchange fees, international transfer wait times, and compatible deposit/withdrawal methods. It’s just so much more convenient.

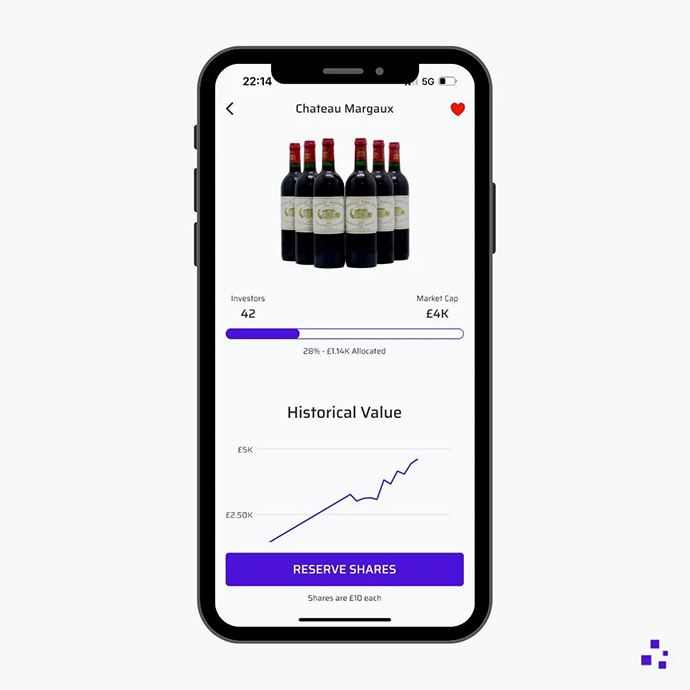

Relic’s mobile platform comes with a lengthy informer on every asset put up for sale. Customers can still learn all about the deep world of collectibles, even if they have no desire to invest.

How Relic works

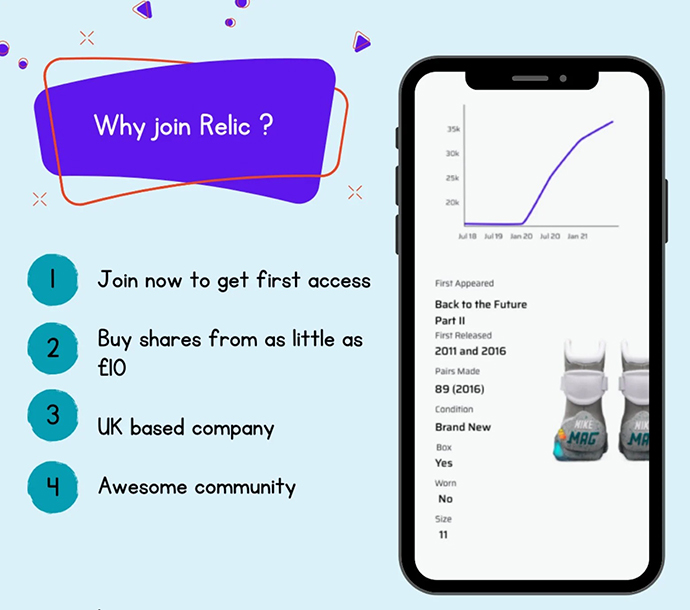

Relic aims to become the UK stock market for collectibles, making investing in and owning collectibles easy and accessible for everyone. Interested users can get start buying shares from as little as £10. There are no hidden fees or commissions – what you see is what you get.

The company is yet to release their finished product, with the mobile app currently available on iOS Testflight for Apple users, and on certain Android devices via the Play Store.

After the beta ends, the waitlist will be restored and new users will only be able to gradually access the investment opportunity as Relic scales up operations. Early adopters will have priority access to the first round of collectibles on offer, as well as contribute to how the product is built.

BETA & Even BETA

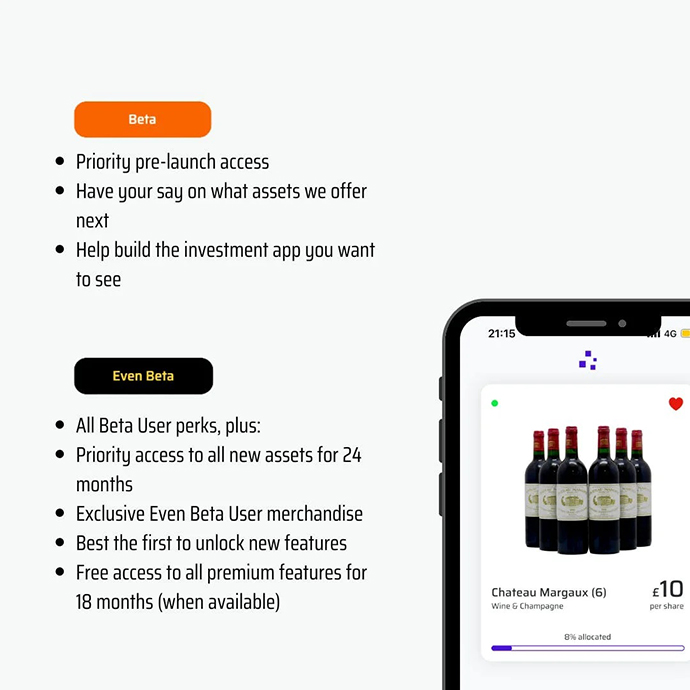

You can be among the first to try a brand new way of investing by signing up for Relic BETA. Your membership would come with exclusive early access and benefits, among which is priority pre-launch access. Luckily, if you want to become a Beta User, the only criteria is to be a UK-based app user.

And then there’s Even BETA. This is the next step up from the BETA membership, and as such, it’s a bit more exclusive. To unlock it, you’d need to be a BETA user first, and in addition to that, you’d have to:

- Reserve 1+ shares in an upcoming asset

- Purchase 1+ shares on launch day”

This, of course, comes with even beta (sorry about that) perks, which they’ve listed below:

Wrapping up

The immediate future is exciting for Relic, as they prepare to move their product from beta to the real deal in the coming year. They’ve done the market research and are ready to execute their plan.

While the official app launch will be Relic’s biggest short-term priority, there are major updates in the works for down the line.

Josh Shrive and the team have realized a omnipresent issue with fractionalizing alternative assets – the boundary between owning a digital and physical product. When you consider that investors tend to buy collectibles for reasons other than just making a profit, this is a substantial barrier.

The team can’t reveal too much at the moment, but bridging the gap between physical and digital ownership is shaping to be one of their key goals for the future.

“In this equity/crypto downmarket, everyone should be looking to get collectibles into their portfolio. There is something much deeper and emotional that somebody gets by investing in what they love.” – Josh Shrive, Founder

That’s it for today’s issue, we hope you enjoyed it.

Are there any topics that you’d like us to go over, or a particular opportunity you want us to analyze? Just get in touch – we read every single email.

Cheers,

Stefan