We just wrapped up our inaugural investor field trip to Mexico, where 15 Alts community members and speakers went on a unique adventure into the heart of Tequila country.

This was a life-changing trip for all of us. We arrived as Mexico noobs; eager to learn about everything from hot LATAM startups, to mezcal production, to the nuances of mortgage financing.

We left as tequila experts; ready to deploy capital and possibly even co-invest together on an Alts vacation rental in Puerto Vallarta (!)

Deals were made, brain cells grew, some brain cells died (blame tequila and Lucha Libre) and lifelong friendships were forged. In today’s issue I’ll tell you all about it.

Investor retreats like this are a huge part of why we started Altea.

What is Altea?

Altea is our new private community for accredited investors.

This is where we share the best alternative investing deals from around the globe. It’s where opportunities are found, discussed and vetted. It’s where the magic happens.

We also host fireside chats with expert speakers. In fact, next week we’re hosting an event with Miguel Ortiz, founder of the tequila investment company House of Rare.

Altea is a natural evolution for us, and the future of our company. There’s nothing else like it.

If you’re accredited, this is for you. Apply here.

Table of Contents

We gathered in the heart of Mexico

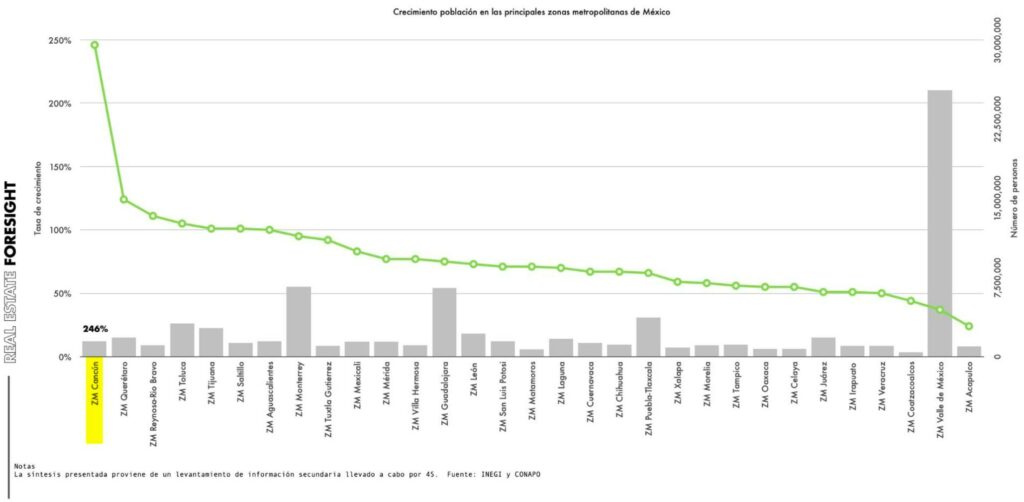

Our trip began in Guadalajara, a rapidly-developing metro area of 5 million, and Mexico’s 2nd largest city.

Guadalajara is the capital city of the state of Jalisco, where the town of Tequila is located, and where the vast majority of the world’s tequila is produced.

But this trip was about more than just Tequila.

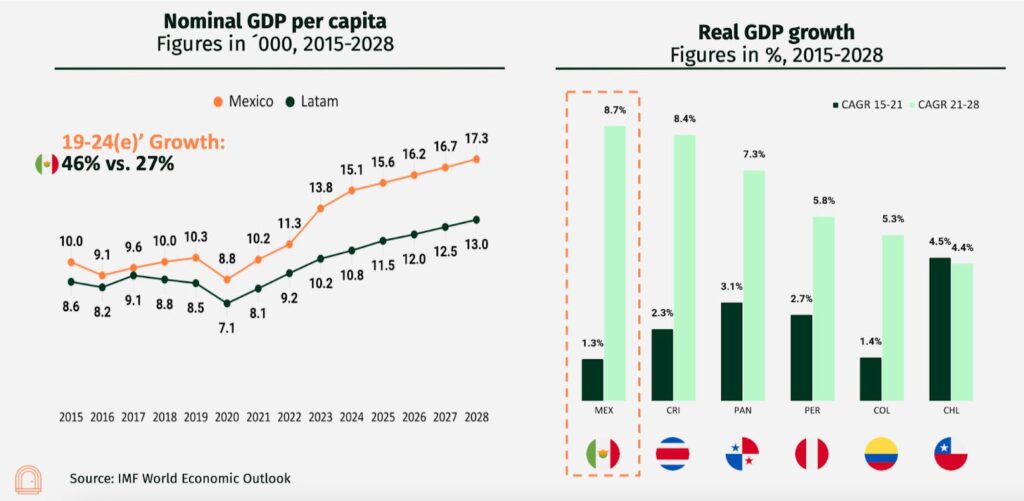

Mexico is the world’s tenth most populated country, and it’s experiencing rapid middle-class growth, high GDP growth, and a reduction in inequality.

At heart, our trip was about understanding investment angles related to the rise of Mexico’s middle-class:

- What problems are Mexican founders working on?

- What does the Mexican startup landscape look like?

- What problems still need to be solved?

- Which cities are best suited for which investments?

- How does investing in Mexico compare to investing in the rest of LATAM?

The ABCs of investing in LATAM

Our first speaker of the week was Luis Enriquez Arias, cofounder and managing partner of Bridge LATAM (and all-around wonderful guy).

A mathematician and economist from ITAM, in 2016, Luis successfully raised one of Mexico’s very first Series A rounds for Cultura Colectiva — a huge LATAM digital media company, with more than 30m monthly active users.

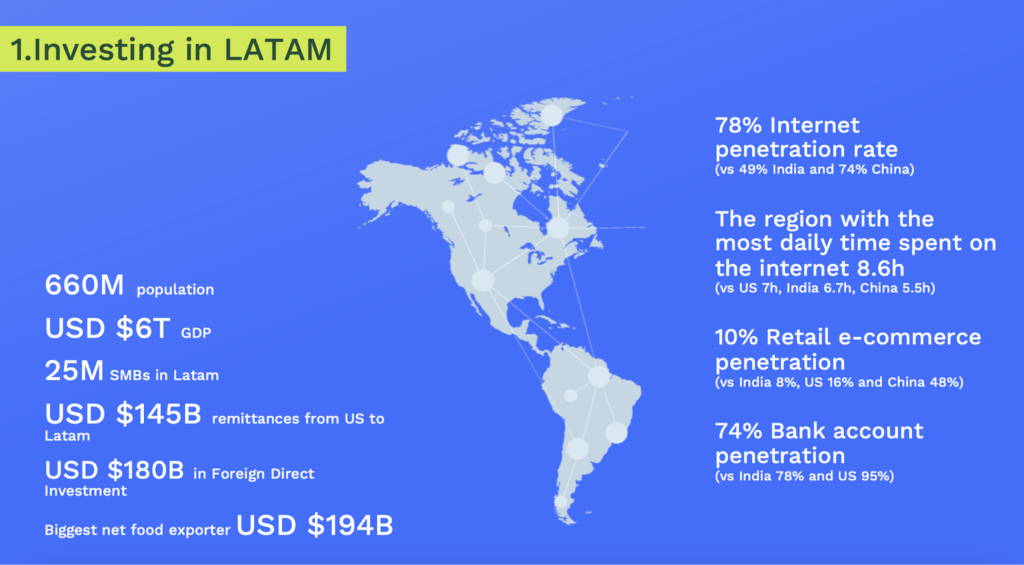

With Bridge LATAM, Luis invests in startups across the Latin America; an enormous, 670 million person market that has terrific internet infrastructure (78% internet penetration) and yet is massively underserved by existing technology firms.

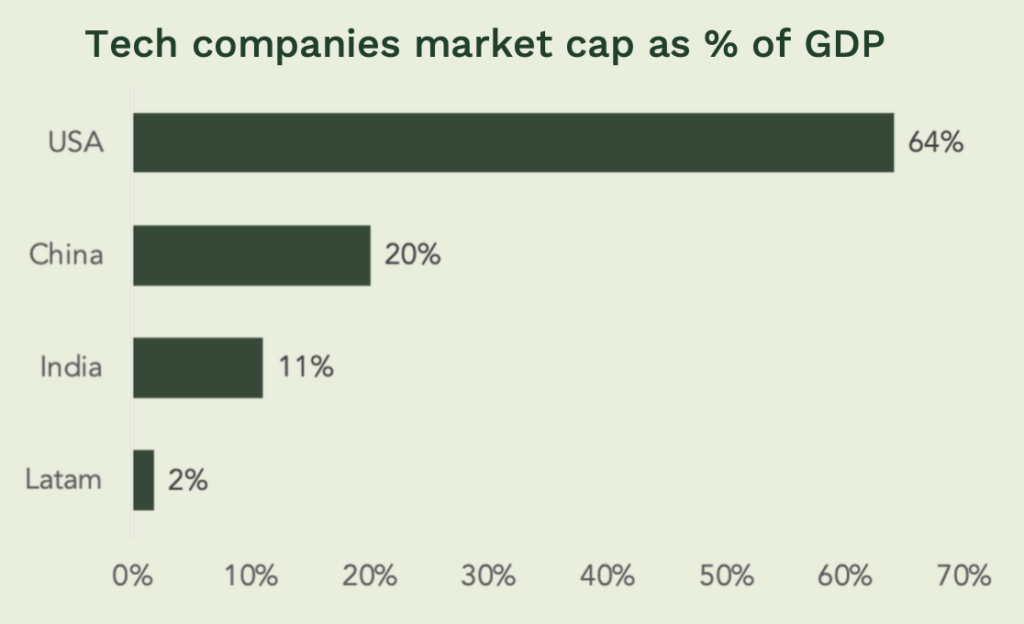

To illustrate this point: Tech companies in LATAM make up just 2% of GDP. (In the US it’s 32x higher.)

The amount of venture capital deployed falls short in LATAM compared to India and Southeast Asia.

Measured as a percentage of GDP, LATAM startups receive 1/3rd as much investment as SE Asian startups, and 1/7th as much as Indian startups. Luis believes Mexican venture capital has a 20x upside from where we are today.

Bridge LATAM began their first fund solely investing the partners’ personal capital.

After 2 years, they understood that there was a huge advantage to investing as a founder’s fund, so they made the decision to raise from external investors. Fund II was oversubscribed, providing USD $15m to invest in early-stage startups.

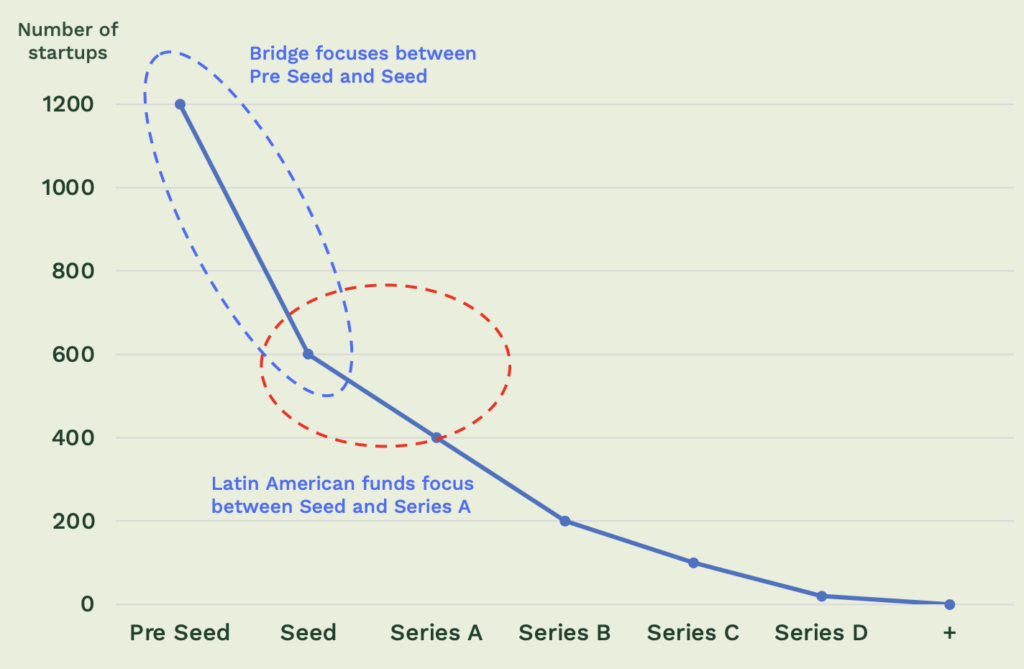

Critically, Bridge LATAM firm only invests in pre-seed and seed rounds.

Why?

Because unicorn exits in LATAM are still extremely rare.

See, the LATAM VC ecosystem is still lacking big exits. There are only 26 unicorns across LATAM, so you can’t just “copy & paste” the US model.

Investing in seed/pre-seed and exiting at series B and C is a better LATAM investing strategy.

That said, big LATAM exits certainly do happen.

What LATAM startups you should know about?

Rappi

Rappi is Latin America’s first “delivery SuperApp.”

Groceries, shopping, restaurants, fast food, pharmacies and supermarkets. You can also book flights, classes, and send cash. It’s like a LATAM version of WeChat.

The company has committed to a delivery time of just 10 mins, which they’re achieving by building out a web of dark store locations.

Founded in 2015, Rappi is headquartered in Bogotá, Colombia. It then expanded to Mexico, where it has 33 million downloads — the highest penetration in Latin America.

The company is still privately-owned, profitable, and has no plans to go public soon.

Nubank

Nubank (known as Nu in Mexico), is a Brazilian neobank headquartered in São Paulo. It’s largest fintech bank in Latin America, with over 80m users.

At its IPO in 2021, Nubank was valued at $45 billion, and has significantly expanded its presence since. It’s now the fifth-largest issuer of credit cards in Mexico, with a 29% market share .

Mercado Libre

Mercado Libre (literally, “free market”), is the leading e-commerce company in Latin America, operating in every single LATAM country (and half of the Caribbean)

Founded in Argentina back in 1999, Mercado Libre is no longer a startup, but an online auctions juggernaut, with $13 billion in revenue in 2023.

It has become the region’s most popular ecommerce site, and is among Time magazine’s list of 100 most influential companies.

We’ve already seen a wave of experienced entrepreneurs create mega-exits across the region.

Mexico will start experiencing this phenomenon in 2024, as early employees of the LATAM unicorns will undoubtedly launch & fund new startups.

Where do LATAM’s best startup opportunities lie?

All aspects of life are ripe for innovative products & services.

But there are a few areas which Bridge LATAM is particularly interested in.

Nearshoring

In contrast with offshoring, which seeks to take advantage of lower production costs in another country (no matter how far away the country is), nearshoring is the practice of moving offshore operations to a nearby country, to take advantage of cheaper delivery, more favorable time zones, closer cultural ties, and lower import taxes.

While this movement began well before Covid, disrupted supply chains during the pandemic kicked nearshoring into high gear.

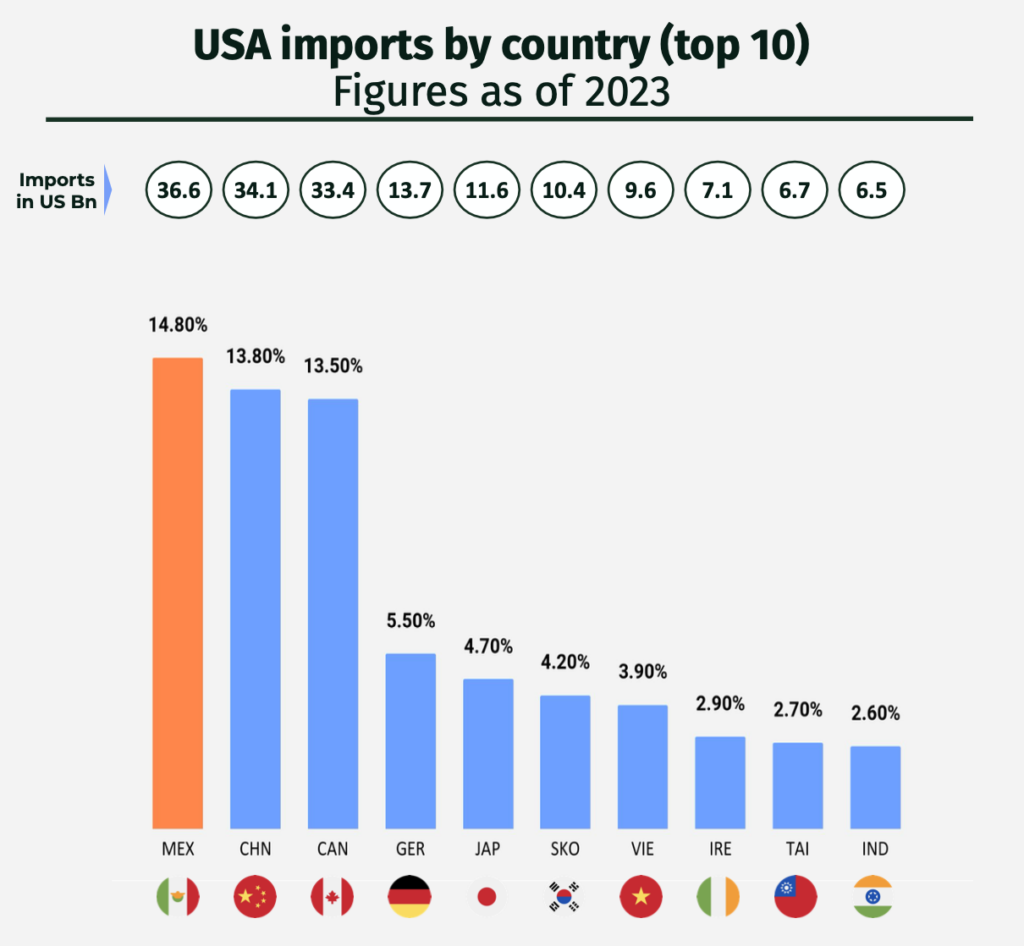

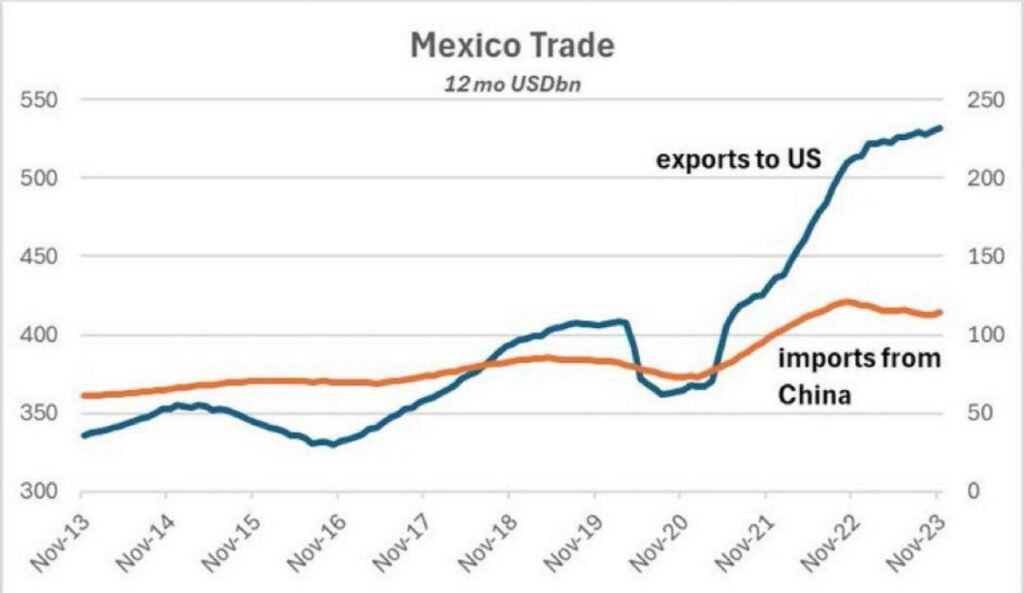

The global reconfiguration of supply chains presents a $64 billion opportunity for Latin America, with Mexico capturing $35b+ of this.

The passage of NAFTA (North American Free Trade Agreement) eliminated tariffs on imported Mexican goods, and significantly boosted Mexico’s exports to the US.

Tariffs that President Trump introduced on trade with China have led to Chinese companies avoid taxes by shifting their final assembly to Mexico:

Yes, lots of Mexican production is essentially Chinese goods with a “Mexican rubber stamp.” (A fact confirmed by the speakers)

But exports to the US have risen far more than imports from China. So while rubber-stamping goods to avoid taxes plays a part, it’s not black & white.

Healthcare

Healthcare spending per capita in Latin American and Caribbean nations (as well as the share of population above 65) is expected to double by 2050.

Tons of great private sector investment opportunities here.

Proptech and financial access

Real Estate represents over 30% of average family’s equity, but just 1% of investment in the whole region.

In Mexico and Peru, less than 60% of the population have a bank account and B2B financing has huge potential in the region

Proptech and financial access combine to solve a tremendously large problem: banking the unbanked.

Banking the unbanked

If there’s one thing I’ve learned in my travels, it’s that so much of the developing world simply doesn’t have access to even moderately complex debt products.

This is a well-known problem throughout Africa and parts of Southeast Asia. I saw this in the Philippines, where just 15% of citizens have a bank account.

LATAM is no exception. Crypto helps a little, but crypto can’t buy you a car, or get you into a new home.

Alternative credit for first-time homeowners

To learn more, we invited a founder to the event named Cristian Villamizar.

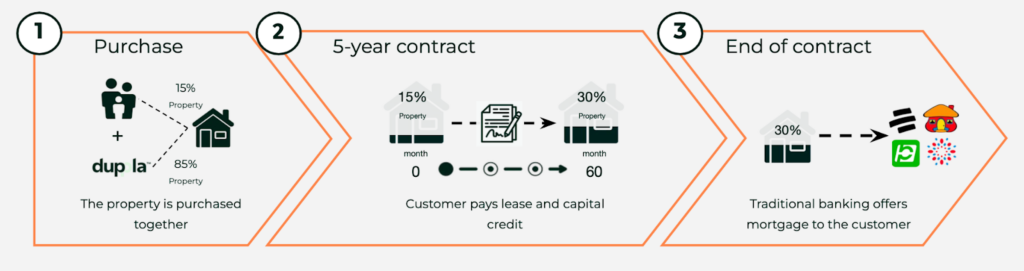

Cristian is the founder of Duppla, a startup solving homeownership by introducing a rent-to-own model (similar to Divvy and Landis in the US, and Hope Housing in Australia.)

At the same time, they are set to become LATAM’s largest supplier of residential real estate to institutional investors.

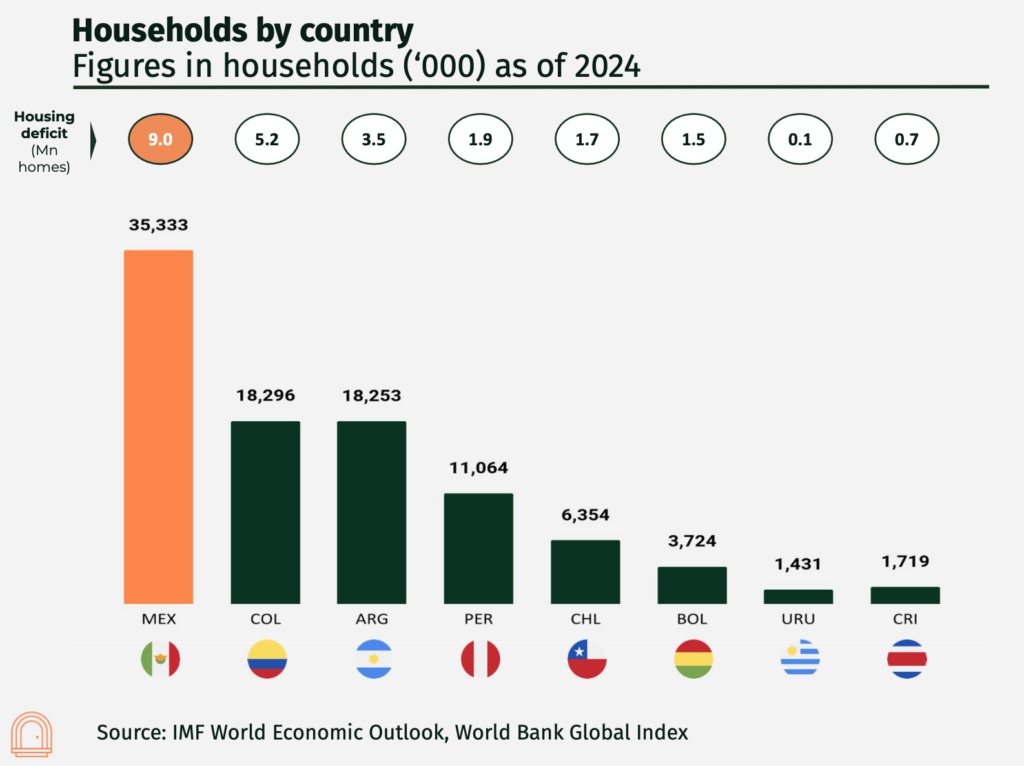

Mexico is the largest housing market in LATAM, and it suffers the biggest housing deficit (9 million homes).

Unlike in the US where the problems are mostly regulation and NIMBYism, in LATAM the biggest obstacle is simply access to credit.

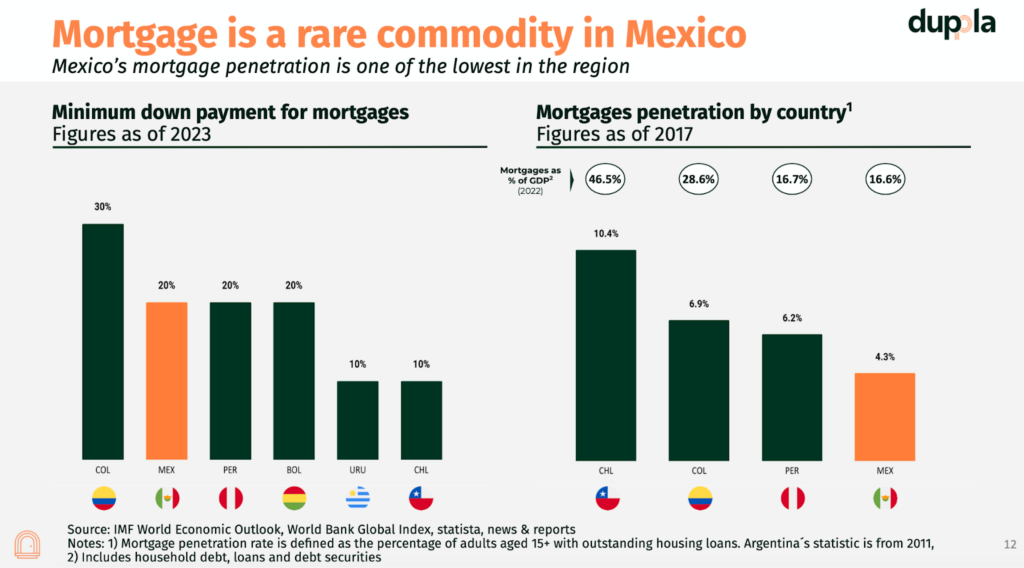

See, mortgages are a rare commodity in Mexico. In fact, Mexico’s mortgage penetration is one of the lowest in the region.

- Requirements are inflexible. Banks demand job/income stability and high credit scores. This means that “informal workers” (which make up an enormous part of Mexico’s economy — estimated around 29.4% of GDP) have trouble getting credit.

- Credit scores are borderline-non existent. Only 18.3% of Mexicans has good credit history, greatly restricting people’s access to loans from Infonavit (Mexico’s national housing fund). The problem cannot be fixed with government programs alone.

- Down payments are very high. In Mexico, a 20% down payment is a standard, intractable requirement. (In Colombia it’s 30%!) Families must save for 10-12 years.

Interestingly, things aren’t much better on the supply side. Historically, residential housing has been a poor investment in Mexico:

- Yields are very low. Rental yields and debt rates have a significant gap. Mexico’s rental yields are typically around 5 – 6%. When financing costs ~7%, it’s difficult to make money.

- It’s cheaper to rent than buy. Since property owners can’t really make money in the real estate market, they often don’t bother trying. (It’s common for Mexicans to buy a place in a cheap area, rent a place an expensive big city, and invest leftover cash in other markets.)

- Multi-family housing isn’t profitable for developers. Insufficient cap rates mean a lack of available entry-level housing for sale. Apartments are simply not being developed at the necessary scale. Developers will take decades to catch up. Institutions deploy very little capital into real estate.

The solution: Duppla’s “rent-to-own model.”

The model allows investors and families to buy an apartment together.

- Lower down payments. Duppla offers 15% down payments vs up to 30% for traditional banks

- A new credit bureau. They mitigate the risks of lending to informal employees, and help citizens establish and improve their credit history

- Apartments (finally) become a good investment. On the institutional side, the value prop is clear. Investors get a 10% cap rate, vs 5.5% with traditional multifam investments.

Cristian is from Bogotá, where the company was founded. They’re off to a great start there:

- 59 units

- $3.3m in assets under management (avg of $56k/unit)

- 273 applications

- 329 brokers

But he has plans to expand operations to Mexico next. After all, the Mexican market has the ideal conditions for the rent-to-own model to be successful: a favorable economic environment, a broken mortgage market, a lack of substitutes, and a large institutional investment market (with very little RE exposure!)

They plan to open the Mexican market in Q4 2024, replicating the success story they’ve had in Colombia

Colombia is sort of a testing ground for Mexico. Companies find product-market-fit in Colombia, then move to Mexico to really expand.

– Cristian Villamizar, co-founder of Duppla

There are differences between Mexico and Colombia. As I mentioned above, down payments are downright absurd in Colombia, which helps on the demand side.

But mortgage financing is a problem throughout LATAM. There is no shortage of opportunity.

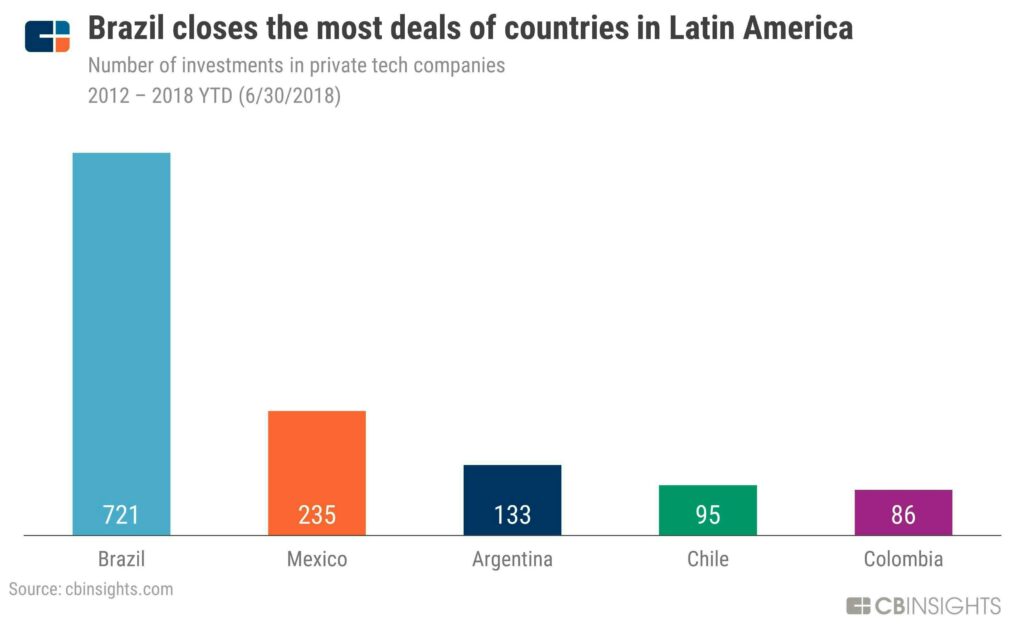

What about Brazil?

With 214 million people, it’s tempting to think Brazil would be a more attractive country to enter before Mexico.

But we heard time & time again how Brazil is a totally different beast. It has a different language than the rest of LATAM, a more developed VC ecosystem (4x higher VC investment as Mexico) and markets there tend to be about ~5 years ahead.

Startups founded in Brazil tend to stay there, and grow there. The level of crossover is less than you’d expect.

Alternative credit for Mexico’s Uber drivers

Homes are the biggest purchase most citizens will ever make. But a similar dynamic is playing out in the automobile industry — specifically with Uber drivers.

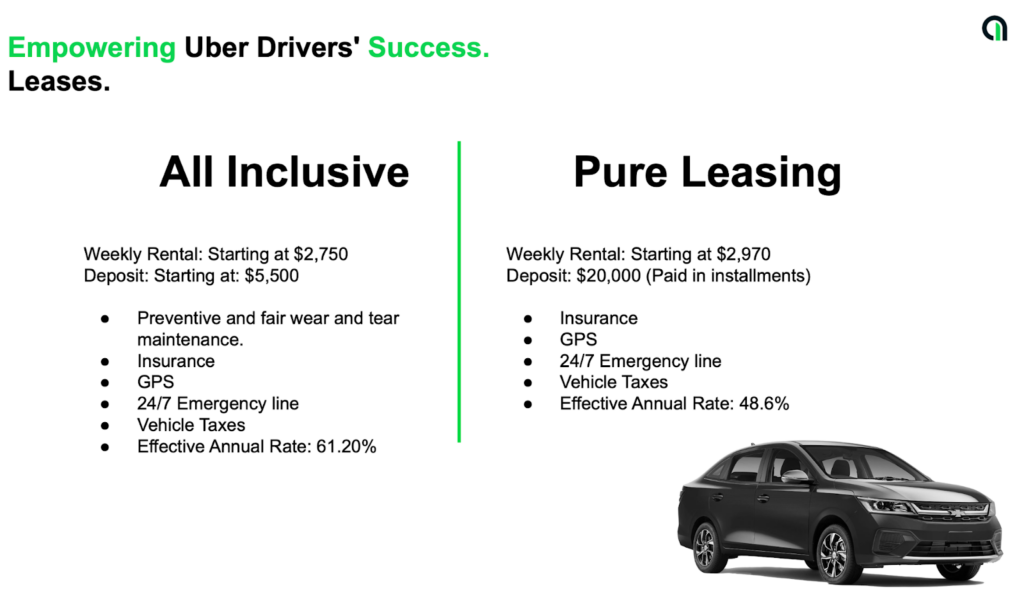

Javier Serrano is the GM of Asaak, a Guadalajara-based financing company which has applied the rent-to-buy model to automobiles.

It’s the same story: Citizens want to become Uber drivers to supplement their income, but they can’t get credit because the infrastructure isn’t in place.

Asaak is their trustworthy partner, providing car leases and helping unlock drivers’ income potential.

How Asaak works:

- Applicants start the signup process using their gig platform credentials. (Asaak is one of the few companies able to utilize Uber’s SSO database)

- The platform analyzes drivers’ income and work history to verify financial trustworthiness and create a credit profile

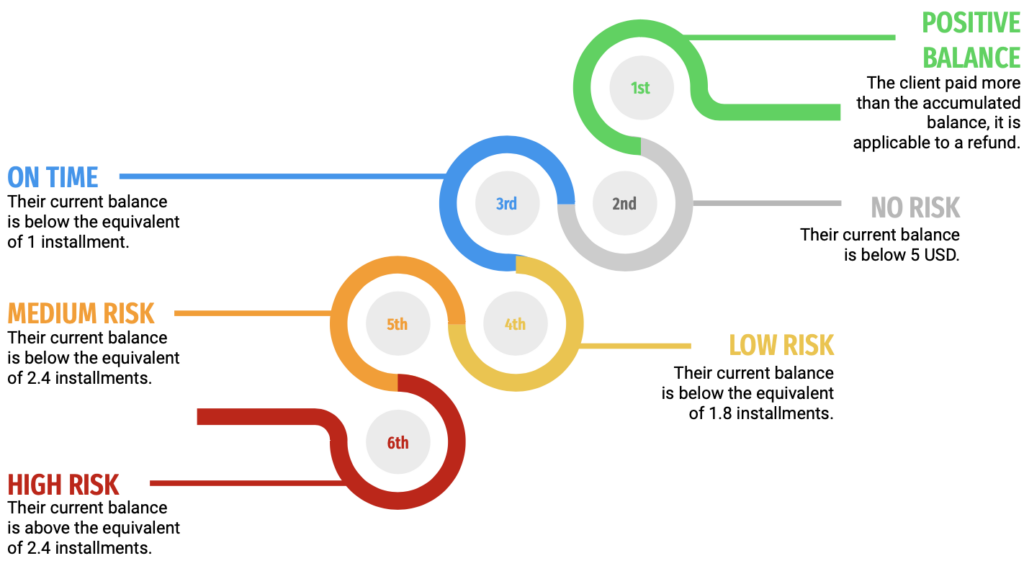

- Asaak employs strategic risk management to ensure repayments are collected

Interestingly, Asaak actually started as a Ugandan fintech company — one of the very few African tech companies to expand to LATAM.

- Founded in 2016

- USD $2.1m run rate

- 97% on-time collection rate

- 100% vehicle recovery rate

Mexican real estate

You cannot have a Mexican investing discussion without talking real estate.

In the old days, the term “investing in Mexico” conjured up images of Cancún timeshare presentations. People didn’t think outside the box.

But in recent years, the real estate industry in Mexico has experienced an unprecedented boom. Today there are a wide variety of excellent RE opportunities nationwide.

To make sense of it all, we invited Pablo Errejón to break things down for us, city by city.

Guadalajara

Pablo is based in & bullish on Guadalajara.

Economic diversity

As Mexico’s second-largest city, Guadalajara has a diverse and robust economy. It’s a hub for tech innovation, along with electronics, manufacturing, and services.

Known as the Silicon Valley of Mexico, Guadalajara has a thriving technology sector & entrepreneurial community, fostering a culture of innovation and collaboration.

Industrial growth

But the real story in Guadalajara is industrial growth.

More industrial space is getting scooped up than ever — mainly from logistics companies like Amazon and UPS.

If you invest in industrial RE, Guadalajara is the place to be (along with Monterrey)

Industrial real estate in Guadalajara has low risk, tons of demand, and great tenants. For individual investors I would say this is the best real estate opportunity in Mexico. – Pablo Errejón

2023 Stats

- 1.9% vacancy rate (!)

- Class A inventory in 2023 increased 12.6%, reaching 4.7 million m2

- The list price for rent at the end of 2023 closed at $6.38 per m2, ($63/sq ft) up $0.77 YoY.

- New demand is for large speculative projects:150,000 sq feet & up.

Monterrey

Monterrey’s proximity to the US makes it an even bigger industrial RE market.

As Mexico’s 3rd major city, Monterrey is renowned as a major economic and industrial center, with a strong focus on manufacturing, technology, and business.

Industrial growth

Monterrey has consolidated itself as the largest industrial market in Mexico, offering well-developed infrastructure, modern transportation networks, communication systems, and a robust industrial base.

Its proximity to the US border makes it an especially appealing choice for investors with cross-border interests.

2023 Stats

- 1.2% vacancy rate (!)

- 180 million sq ft were added to the inventory — the highest ever.

- The list price for rent at the end of 2023 closed at $6.47 per m2, ($64/sq ft) up $0.77 YoY.

- Automotive industry is the main driver

Cancún

Cancún really needs to be on your radar.

Far from being just a resort town, Cancún is rapidly growing into its own proper city.

Population growth

During Covid, Mexicans flocked to Cancún. It’s one of the tourist cities with the highest economic growth in Mexico.

The state of Quintana Roo, which includes Cancún, Playa del Carmen, Cozumel, Isla Mujeres, and millennial hotspot Tulum, is number one in the country for demographic growth.

Infrastructure

The Mexican government is pouring money into Cancún infrastructure. Constant road development, new hospitals, and one of the biggest shopping centers in Mexico.

This infra investment is best illustrated by Tren Maya, a 1,500 km intercity railway that will traverse the Yucatán Peninsula.

The gateway to Riviera Maya

Situated on the northeastern tip of the Yucatán Peninsula in Mexico, Cancún is unexpectedly close to major North American cities.

Riviera Maya has natural beauty, stunning beaches (thanks, Chicxulub!), archaeological sites, turquoise waters, vibrant coral reefs, and a tropical climate.

Puerto Vallarta

Great location & weather

Located along the Pacific Coastline, Puerto Vallarta is a pacific coast gem, just a 4 hour drive from Guadalajara.

Puerto Vallarta enjoys warm, sunny weather year-round, with average temperatures ranging from the mid-80s in winter to the mid-90s in summer.

It’s an amazing city, and a great place to invest. It’s so large that we have all sorts of tourism now…high income, snowbirds. Americans are taking over, and they’re often better citizens than Mexicans! For individual investors, after I would say residential in Puerto Vallarta is the second-best real estate opportunity in Mexico (after Guadalajara industrial) Cancún has a larger hotel lobby, and thus more risk of anti-Airbnb legislation. The demand for long-term rentals in Puerto Vallarta is huge. And it’s not overpriced like Los Cabos.

– Pablo Errejón

Big international airport

Every day, over 17,000 passengers arrive, most from Canada and the US.

I personally believe that the coast of the state of Nayarit is going to see tons of development in the next 10 years. The area north of San Pancho I think has a lot of upside… And there is talk (maybe even plans) of an international airport going in up there.

– Mark Godley, Alts community member and Puerto Vallarta real estate investor

Mexican arbitrage

Under-developed markets create opportunities for arbitrage, which two of our speakers are taking advantage of.

Biotech arbitrage

Martha Laura Lopez is the former Regional Director at Mexican Association of PE & VC Funds (AMEXCAP), and currently serves as Mexico’s Operational Partner for Zentynel.

Zentynel is a Chile-based deeptech VC fund investing in high-growth biotech companies across LATAM.

Top portfolio companies include:

- AUTEM Therapeutics, a Brazilian-based company who has developed a safe, non-invasive treatment for advanced cancer patients. It applies electromagnetic frequencies to improve the results of standard oncology treatment.

- MulitplAI, an Argentinian firm using AI, low-cost genomic sequencing, and remote medicine to detect cardiovascular diseases anywhere in the world.

- Harmony, who is disrupting the infant nutrition industry by replacing cow’s milk with healthy, ethical and sustainable solutions.

So where are the arbitrage opportunities here?

They’re related to talent cost, innovation cost, and valuations:

Large talent pool

LATAM (and especially in Mexico) graduates more engineers per capita than the US. UNAM is Mexico’s largest and most important university. UDEM (Universidad de Monterrey) is also well-renowned.

Students are increasingly shifting away from companies like IBM and HP, and migrating towards startups.

Cheaper innovation cycles

Deeptech R&D is labor-intensive, and it’s not exactly conducive to remote work. It takes lots of time & physical space to bring a drug to market.

LATAM biotech startup employees cost much less than they do in developed markets. We’re talking 10-15x lower. And the quality of engineering is the same.

The cost of laboratories and infrastructure is lower too. This means biotech startups are able to validate locally, get traction, and expand to the US when they’re ready.

Attractive early-stage valuations

Because of the lower VC activity, Zentynel can find these high quality companies at lower valuations, help them grow, then capitalize extra well when they take their drugs to the US & Europe.

It’s a win-win for everyone (and a bit fascinating that we don’t hear about more biotech firms setting up shop in LATAM.)

Cross-border arbitrage

Another fascinating speaker who joined was Alan Burke, co-founder of Condor Trading, LLC.

In the aughts, when High Frequency Trading Firms (HFTs) became dominant in the US, Alan discovered that Mexico had both a local market and an International market, called the SIC.

SIC was created to facilitate the listing of US equities and ETFs in the Mexican markets. The shares traded in Mexico are 100% fungible with their US counterparts. The only difference being that the shares listed in Mexico are traded in Mexican Pesos.

The local market was deeply liquid, but the international market (SIC) market was largely illiquid since it was still emerging.

SIC was created to allow local pension funds to trade foreign equities without the money leaving Mexico.

When you have the same equities traded in different currencies, you have a natural arbitrage opportunity.

How does this cross-border arbitrage work?

In its simplest form, let’s pretend we have a stock called $XYZ which is trading on US markets at $10/share.

- Now, let’s say this same stock is trading at 110 pesos/share on Mexican markets

- But there’s an exchange rate of 10 pesos to the dollar

- This means that the value of XYZ-Mexico in USD is actually $11 — a full dollar higher than it “should” be.

In this case, an arbitrageur can sell the shares in Mexico (for $11 each), buy them in the USA (for $10 each) and process a conversion which moves the shares from the US to Mexico (and allows them to pocket the difference)

Arbitrage firms like Alan’s repeat this until the markets are back in line, trading at $10 in both markets.

We launched an arbitrage trading strategy to monitor for price discrepancies. With strategic broker partners, we could execute the US, Mexico and FX trades and instruct for a conversion from US to Mexico, or vice-versa. Competing directly with HFT firms on speed is not a viable strategy. Our focus on smarter technology has and will continue to help us grow more. We approach the arbitrage trade with a combination of “smart trading” and low latency.

– Alan Burke, Condor Trading

Alan’s strategy has returned 70% – 300% annual returns on deposited capital since he began trading.

Naturally, such attractive returns have attracted interest from the HFT world, and volumes began to increase (making their job tougher).

But only ~10% of the 3,000 products listed on the SIC are trading on a daily basis. So there is plenty of room for growth.

Wealth embedded in the forests

One of the most fascinating speakers of the week was Fatima Montiel, founder of Eco Forest.

Fatima has had an interesting career. Her first company was called Sr Tonillo (“Mr. Screw”) 🔩 which she sold to a manufacturer. She later became the President of COPARMEX Young Entrepreneurs Alliance.

Fatima’s current company, Eco Forest, connects landowners in Mexico with the global market for carbon credits.

They effectively empower Mexican landowners to profit off their land not by developing it, but by not developing it for 100 years.

What I find fascinating about the carbon credits market is how poorly understood it is. And that’s because it’s complicated! But it’s also necessary to fight the climate crisis.

Mexico certainly has it’s fair share of forests. According to the UN, 33% or about 65 million hectares of Mexico is forested. Of this 53% is classified as primary forest, the most biodiverse and carbon-dense form of forest.

So how does selling carbon credits work?

The complete process is too involved for this issue. But suffice to say that:

- There’s quite a bit more to it than just leaving the forest alone. To generate credits, landowners are required to maintain the forest, by implementing sustainable forestry practices that contribute to carbon sequestration.

- Landowners rely on companies like Eco Forest to handle verification, certification, legal paperwork, monitoring and reporting.

It used to be tough to “put a price” on a forest. But the global carbon market changes the value equation.

At its core, Fatima’s business is all about cultivating trusting relationships with rural communities who want to understand this value.

A journey into Tequila country

After three days in Guadalajara, we set off 40 kms northwest towards the agave fields and timeless distilleries of Tequila.

Tequila itself is a gorgeous town, with character oozing from its cobblestone streets. It’s an odd mix of quaint architecture and industrial-grade tequila production, with 20 registered distilleries in a town of just 40,000 people

The Jose Curevo company sort of put the town on the map in the 1940s when, along with Sauza, it established (and began to dominate) the tequila industry.

To this day, the Cuervo family owns much of the town’s real estate, including Fábrica La Rojeña (their gigantic distillery), the lovely Hotel Solar de las Animas (where we stayed) and the Cholula Restaurant.

Our first stop was Cascahuin, a 4th generation distillery which began producing tequila in 1904, and whose current distillery was built in 1955.

After that, we visited Arette (one of my favorites) which is adjacent to Cuervo, but a world away in terms of flavor.

Then we went across the street to the cellar which holds the actual barrels we bought for our ALTS 1 Fund through our friend Miguel at House of Rare.

We’ve written about tequila investing and production since buying our barrels. But there were a few things that surprised me after experiencing this world up close & personal:

Tequila white-labeling

It seems like every celebrity has their own tequila brand. (Clooney was first, now even Kendall Jenner has one.)

But what people don’t realize is how much white-labeling is happening. The 3,000+ Tequila brands on the market come from just 150 registered distilleries.

Even many of the premium brands are really just white-labeled tequila in disguise. It’s not necessarily a bad thing, one isn’t necessarily better than the other. It’s just fascinating.

And for all the bandwagon-jumping, there is plenty of legitimacy in the market. For example, mezcal brand La Leyenda has owned their land for generations, and have just recently decided to create a new “end-to-end” brand from scratch.

A relatively simple process..

Making premium tequila isn’t as involved as I expected.

Plants are harvested by hand (even Cuervo does this). The piñas are baked in giant ovens for a few days, then crushed into pulp, cleaned with water, and fermented in giant tanks.

There are no additives (err, at least with premium stuff). Yeast isn’t even added — instead, companies rely on spontaneous fermentation using naturally occurring airborne yeasts.

Then it’s left to sit in oak barrels for up to 4 years.

..with a complex taste

Boy, tequila starts to get interesting after a few years.

At 4 years, extra añejo tequila becomes sweeter; exuding notes of oak, caramel, and toffee.

At 7 years, it’s more akin to a fine cognac than anything resembling tequila. A lip-smacking infusion of enchanting nuts and chocolate.

And the 35-year old mezcal we tried? Well, that tasted like nothing else I’ve ever had in my life. Full of decades’ worth of complex, deep, earthy delights.

Where to next?

This was truly the trip of a lifetime. But it won’t be the last one.

A special thanks to everyone who joined our inaugural trip, to all the speakers who made it work, and to Miguel Ortiz for helping organize such a great experience.

Where should we go next? We’re tossing around a few ideas, including:

- Vietnam, which has many similar developing nation qualities as Mexico 🇻🇳

- A music-investing themed trip to Nashville 🎸

- A whiskey-themed investing journey to Japan 🇯🇵

One thing’s for sure: If you want to join our next trip, apply to Altea.

We’ll keep you posted!

That’s all for today.

If you’d like an introduction to any of the speakers from our trip, reply back.

And to invest in tequila barrels yourself, go with House of Rare. Get in touch and I’ll introduce you to our good friend Miguel. 🤝

Hasta luego!

Disclosures

- We hold six tequila barrels through House of Rare in our ALTS 1 Fund.

- House of Rare did not sponsor this issue. However, they are an Alts affiliate. If you purchase a barrel through House of Rare, you save $500, and we get $500. Win-win.

- We are not officially affiliated with any other company mentioned in this issue.