Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

Today is the 22nd anniversary of the attacks of September 11th 2001. No matter who you are, where you were, or how you feel about them, those attacks changed everyone’s lives profoundly. Please spare a thought for the 2,977 people who were murdered that day as well as all those who have perished since then.

What’s on deck today:

- It looks like the Fed may not hike rates again in 2023

- The smart money thinks CRE will turn around early 2024

- Seed funding is collapsing

- Introducing our new section covering PE and private credit

- Are NFTs dead?

If you’ve not already self-certified as an accredited investor (assuming you are one), make sure to do that if you want to get exclusive investment opportunities.

Wyatt

Table of Contents

Macro View

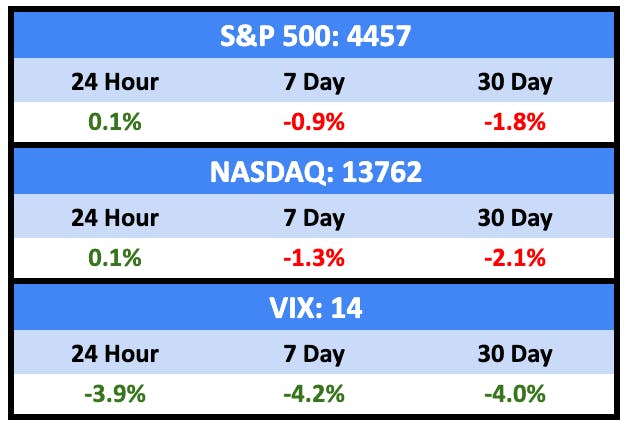

Great week for markets last week with prices up and volatility down.

Bullish News

- Consumer spending in July rose sharply over the month

- But real disposable income fell slightly

- And the gap between consumer spending and income drove a drop in the personal saving rate

- The Fed is looking to double its growth outlook.

Bearish News

- Markets are pricing in a nearly 44% chance of a rate hike at the Fed’s Nov. meeting, up from 28% a month ago.

- San Francisco is facing a $1 billion shortfall by 2026

Forecasts

📉

48%

Chance of Fed rate hike in 2023

📈

3.61%

📈

2.34%

What will the national average house price increase be in 2023?

As you’ll see below, Zillow expects house prices to rise 5.8% through the end of the year, which is quite different to what the market on Kalshi is predicting.

What are we doing?

ALTS 1 Fund news:

We’re considering exiting one of our art pieces. If you’re interested, please let me know.

Real Estate

Bullish News

- Barclays thinks there’s no risk of systemic financial crisis due to the collapse of China’s real estate market.

- But exports are down 14.5% YoY and imports were off 12.4%

- And oil demand may have peaked in 2023, though some disagree

- And Bloomberg released this hit piece condemning Chinese fund governance

- Zillow thinks home prices will rise 5.8% through the end of the year

- But home sales will be down 17% YoY

- There’s $205 billion waiting to invest in distressed CRE assets as soon as they hit bottom.

- And analysts think that’ll happen early 2024.

- China’s Country Garden stays alive…for now.

Bearish News

- US apartment rents in August were just 0.28% higher than August 2022 compared to 11% a year ago.

- Because the number of new units being built is at a 50-year high, with more than 460,000 being completed this year.

- But rents are holding strong in the suburbs.

- The typical age to buy a first home in the US has jumped to 36 years old, the oldest ever on record. That’s up from 33 in 2021.

- WeWork is trying to renegotiate all its leases to stay afloat, but it probably won’t be enough.

- The WSJ says regional banks have more exposure to commercial real estate than previously thought.

- One in eight SF home owners are selling for a loss, 4x the national rate.

- Goldman thinks remote working will stabilise around 20% to 25%, 10x the pre-Covid rate.

- Housing affordability is at its lowest point since 1984.

How to invest in real estate right now:

Wait until early 2024, apparently.

Startups

Bullish News

- It was a good week for Indian startups‘ fundraising despite a tough year.

- There’s now a startup to help other startups wind down much more quickly and easily, which should extend runways slightly.

- Global venture funding was $22 billion in August 2023, up around 19% MoM

- But that’s down 16% from the $26.2 billion invested in July 2022

- And seed stage investing is down nearly 50% YoY

- More than 25% of VC money has gone to AI companies in 2023.

- A dog food subscription box company is raising $354 million. How very 2013.

Bearish News

- Michael Kim of Cendana Capital (VC fund of funds investing in seed stage managers) predicts seed rounds will return to the $1.5m range.

- Arm, the British chipmaker, is set to IPO at a valuation around $52 billion, which is $18 billion less than Softbank targeted only a month ago.

- The recent surge in IPO chatter hasn’t helped the secondaries markets much.

- Rent the Runway is circling the drain.

- A variety of VC firms are trying to sell off portions of their portfolios.

- ChatGPT traffic fell for the third month running.

How to invest in startups right now:

Stay away from AI

PE & Private Credit

Bullish News

- Private credit firms have muscled in on $10 billion worth of debt refinancing.

- Two former Goldman Sachs partners have launched 5C, which describes itself as a credit-centric alternative investment firm.

- Private equity sports investment is on the rise. As leagues have eased ownership rules, dealmakers spy opportunities to gain outsized returns and cultural influence.

- Management fees are on the decline due to a more competitive fundraising environment.

- PE investment in European software companies is set to outpace 2022 numbers.

- September is off to a banging start with $36 billion of new bonds priced after Labor Day.

Bearish News

- Private debt fundraises in the real estate space hit a ten year low in the first half of 2023.

- Much of the brisk trade around PE in Q2 was down to GPs swapping stakes.

- US high-yield retail funds reported net outflows of $1.27 billion for the week to Aug. 23, as investors pulled assets from the funds for a fifth straight week.

- The FDIC is trying to flog $33 billion of private debt mostly tied to NY multifamily real estate.

- Debt defaults are set to rise.

How to invest in PE and Private Credit right now:

Wait, probably.

Crypto & NFTs

Here’s what you need to know:

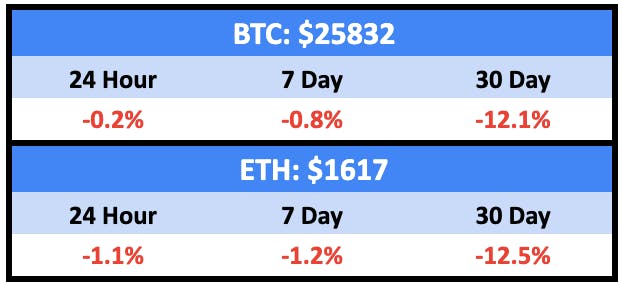

Crypto continues its slide

While sentiment is marking time until the BTC ETF announcement

And NFTs are just along for the ride

Bullish News

- Multi-billionaire Ricardo Salinas has 60% of his liquid net worth invested in crypto.

- JPMorgan is looking into blockchain-based digital deposit tokens.

- Justin Bieber is tokenising his recent song “Company.” NFT owners will get a 1% share of streaming royalties for around $56,000.

- Visa is teaming up with Solana and Circle to expand its stablecoin settlement capabilities.

- Coinbase has raised $57 million to launch a crypto lending service for institutional investors.

- Citizens of Turkey, Lebanon, and Cyprus have all resorted to Bitcoin as a safe haven to combat inflation and interest rates.

- Christie’s will auction off some Keith Haring NFTs.

- El Salvador is introducing Bitcoin education to its schools next year.

- You can now pay with crypto at the Colorado DMV.

- The London Stock Exchange is looking into blockchain-based markets.

- Former SEC chair Jay Clayton says the BTC ETF will be approved.

Bearish News

- NFT had their lowest trading volume in over two years last week.

- And decentralized exchange volumes have fallen to their lowest level since 2020

- And Google searches for “crypto” and “bitcoin” hit a multi-year low

- Ryan Salame, a top FTX executive who played a key role in the exchange’s political fundraising operations, could forfeit over $1.5 billion after pleading guilty.

- Genesis’ U.S.-focused spot crypto trading business will shut down later this month.

- North Korean hackers stole over $40 million from Stake.com, the crypto casino.

- Binance’s global product head quit. It’s unclear if anyone is still working there.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at JKBX and RADD.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.