AltFin Australia $1 billion | Consultation on “Cryptoassets” FCA

This edition I focus on alternative finance trends and insights in the UK, the largest alternative finance industry in Europe. But there is also an article on the Australian market where the AltFin industry is already distributing over $1 billion to customers.

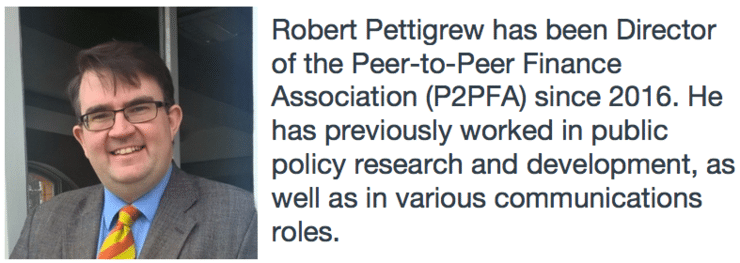

Our expert this week on the status of Alternative Finance in the UK is Robert Pettigrew.

Further news this week:

- Australia’s ‘diverse’ alternative finance industry tops $1bn

- UK Financial Conduct Authority Issues Consultation on “Cryptoassets” Seeking to Provide Clarity on Regulatory Approach

- UK Fintech Investment hits new highs as industry matures

- British Business Bank Small Business Finance Markets report 2019

- Trade body Peer-to-Peer Finance Association said this type of lending is becoming ‘increasingly significant’ for businesses and consumers.

- ECWT case study with : Charlotte Aschim – TotalCTRL

Table of Contents

Australia’s ‘diverse’ alternative finance industry tops $1bn

Australia’s alternative finance industry has topped US$1bn for the first time, driven by the “diverse” nature of the market. The digital finance revenues jumped by 88 per cent in 2017 to US$1.15bn in Australia, placing it just ahead of South Korea in the Asia Pacific region, which rocketed three times to US$1.13bn over the same period.

These findings are part of KPMG’s 3rd Asia Pacific Alternative Finance Industry Report, released by the accountants in December.

KPMG partner Ian Pollari said:

“The Australian alternative finance market has now grown to over US$1B, capturing 32 per cent of the Asia Pacific market share, excluding China, and becoming the second largest market in Asia Pacific. Having grown by 88 per cent against the previous year, the Australian industry is highly diverse and leads the region in terms of product innovation and research and development.”

Business lending largest industry

The largest three elements of Australia’s mixed alternative finance market consist of balance sheet business lending worth US$574m, peer-to-peer consumer lending accounting for US$256m, and invoice trading coming in at US$142.7m.

Some industry executives say the release of the Royal Commission on banking report about the cut-throat sales culture at the expense of consumers at many of Australia’s biggest banks, will provide a further opportunity for the alternative finance industry.

Mark Jones, chief executive of peer-to-peer lending firm SocietyOne, said:

“We’ve noticed an uptick in the number of consumers willing to consider banking alternatives in the aftermath of the Royal Commission, which has been a strong contributor to our own growing lending volume. Trust is critically important in financial services, and we believe the fintech industry is growing so strongly because of its focus on delivering a better, and more transparent, outcome for the customer.”

Jones speaks on a panel about what the Royal Commission’s findings mean for consumers and small businesses at the AltFi Australasia Summit, at Sydney’s Dolthouse on 15 April.

UK Financial Conduct Authority Issues Consultation on “Cryptoassets” Seeking to Provide Clarity on Regulatory Approach

The UK Financial Conduct Authority (FCA) issued a consultation on the emerging “cryptoasset” sector of finance. The UK is well known for its thoughtful regulatory approach when it comes to innovative new financial services and the final outcome will be watched with interest around the globe. The cryptoasset consultation is also part of the UK Cryptoasset Taskforce’s recommendation that the FCA provides additional guidance on the regulatory perimeter.

Christopher Woolard, Executive Director of Strategy and Competition at the FCA said

“This is a small but growing market and we want both industry and consumers to be clear what is regulated, and what isn’t. This is vital if consumers are to know what protections they’ll benefit from and in ensuring we have a market functioning as it should.”

In a release, the FCA said the numbers regarding crypto remain relatively small but more consumers are investing in these digital assets.

Today, within the UK there are less than 15 cryptocurrency exchanges in operation out of a global total of about 231. Out of these exchanges in the UK, only 4 produce daily trading volume in excess of $30 million with aggregate daily trading volume of just $200 million for the group.

2,000 exchange and utility tokens

There are currently over 2,000 exchange and utility tokens in the market reports the agency. The FCA notes that in 2018 initial coin offerings (ICOs) saw a significant reduction in capital raised in compared to 2017. Global ICO funding was $65 million in November 2018, compared to over $823 million in November 2017.

The FCA estimates that there are 56 projects in the UK that have used ICOs, accounting for less than 5% of projects globally.

78% scams

The FCA has previously issued warnings regarding the risk to consumers affiliated with investing in cryptoassets. About 78% of ICOs in 2017 were labeled scams. Yet the agency continues to pursue an important policy of ensuring competition in financial services – IE challenges to traditional finance – while providing sufficient investor protection.

The FCA states that publishing guidance should “reduce legal uncertainty and assist firms to develop legitimate cryptoasset activities and business models.” The intent is to “improve participation in the cryptoasset market and competition in the interest of consumers.”

Overall, the UK’s regulatory approach has been lauded around the world for fostering a robust Fintech ecosystem. Digital assets may be the most challenging project associated with the regulator’s portfolio of regulatory objectives.

UK fintech Investment hits new highs as industry matures

Cash pumped into UK fintech firms rose by 18 per cent to $3.3bn in 2018 as private equity investment soared by 57 per cent to $1.6bn, while venture capital dipped to $1.7bn as the UK fintech sector entered a new stage of growth ahead of its peers in Europe, according to a report from industry body Innovate Finance.

$36.6bn VC investments globally in 2018

The UK kept its position as a world leader, ranked third globally in VC investment behind China and the US. Global VC investment in fintech in 2018 reached a record $36.6bn across 2,304 deals, a 148 per cent increase year on year. Within Europe, the UK continues to dominate followed by Germany ($716m and 48 deals) and Switzerland ($328m and 40 deals).

Revolut’s $250m fundraise ranked among the top ten largest global VC deals of 2018. Monzo, EToro, Liberis and BitFury were also among the UK’s top five deals, each raising over $80m.

Challenger banks

Last year challenger banks took the lion’s share of VC investment at 27 per cent of the total, followed by personal finance and wealth management (19 per cent), alternative lending and Financing (18 per cent) and blockchain and bigital Currencies (10 per cent).

Recent fund raises at N26 and Oaknorth have carried on this trend into 2019. London-based neo-bank Oaknorth is Europe’s most valuable fintech thanks to a Softbank led funding round last week totalling a massive $440m, pushing its valuation to $2.8bn. A few weeks back N26 raised $300m, suggesting a $2.7bn valuation.

50% external investments in UK

The UK remains a competitive investment destination with 50 per cent of investment flowing in from overseas, largely from North America (25 per cent) and Europe (18 per cent).

Charlotte Crosswell, CEO of Innovate Finance, said that it is “encouraging” to see that investment continues to grow in the UK fintech sector, reaffirming its position as a leading global financial and technology centre.

“The UK has a unique position across financial services, technological innovation, regulators and government which all play a crucial role in this impressive growth journey. However, we should not be complacent as new challenges lie ahead; we must focus on growing our talent and capital pipeline across the UK, to ensure sustainable and inclusive growth in the future.”

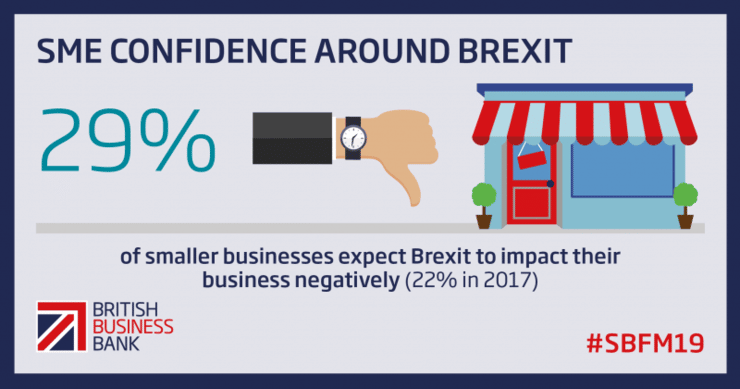

British Business Bank Small Business Finance Markets report 2019

The British Business Bank published their annual SME finance report. Two broad themes provide the background to this year’s report:

First, there is evidence that small businesses, due to the current period of uncertainty, are either using external finance to put in place contingency plans or reducing their finance requirements as they delay longer term investment and expansion decisions.

Awareness and use of alternatives to traditional finance is rising

The second theme is declining demand for finance although, encouragingly, awareness and use of alternatives to traditional finance is rising.

Key findings in report:

- An increasing number of smaller businesses – 29%, up from 22% in 2017 – expect the UK leaving the European Union to have a negative effect on their business; a similar proportion (34%) expect it to be more difficult to access finance post-departure.

- Gross bank lending remained stable in nominal terms, with the gross lending closely matching repayments over 2018.

- Equity finance, asset finance and market-based lending have grown by 4%, 3% and 18% respectively.

- Just 36% of smaller businesses now use external finance compared to 44% in 2012 and over 7 in 10 firms say they would rather forgo growth than take on external finance.

- Awareness of alternatives to traditional finance has continued to grow, with 52% of small businesses aware of peer to peer lending, 70% aware of crowdfunding platforms and 69% aware of Venture Capital (up from 47%, 60% and 62% respectively in the previous year).

- Almost half (48%) of equity deals are in London despite it accounting for only around 20% of high growth firms, but clusters of high-growth and high-tech firms are continuing to develop across the UK.

Trade body Peer-to-Peer Finance Association said this type of lending is becoming ‘increasingly significant’ for businesses and consumers.

Peer-to-peer cumulative lending jumped by almost half to £9.5bn last year as this loans market “continues to mature”, according to trade body data.

288,000 business borrowers and individuals

Loans originated by these firms lifted by 44 per cent in 2018, split between more than 288,000 business borrowers and individuals, said the Peer-to-Peer Finance Association. Loans to businesses totaled £5.5bn, with the remainder accounted for by consumer loans. More than £800m of new lending was originated by these firms in the final three months of last year. Businesses accounted for £527m of these loans, while £282m of this lending went to consumers.

Peer-to-Peer Finance Association director Robert Pettigrew said: “There was marked growth in levels of new lending facilitated by association members during the last three months of 2018, as the contribution of peer-to-peer lending platforms to UK businesses and consumers has become increasingly significant.”

The data is drawn from the loanbooks of the trade body’s eight members – CrowdProperty, Crowdstacker, Folk2Folk, Funding Circle, ThinCats, Landbay, Lending Works and Zopa.

Market leader Funding Circle holds the largest loanbook, coming in at £4.6bn at the end of 2018. The smallest loanbook of the group belongs to CrowdProperty, totalling just over £27,000 at the end of last year.

The Peer-to-Peer Finance Association was established in 2011 as a representative and self-regulatory body for debt-based peer-to-peer lending.

ECWT AltFin case : Charlotte Aschim – TotalCTRL

Charlotte Aschim, Co-founder and CEO of TotalCTRL is a hardworking Norwegian tech nerd, entrepreneur and experienced engineer. Charlotte has a Master’s degree in Land Management from the Norwegian University of Life Sciences (UMB). She has a demonstrated history of working in the construction industry. Charlotte´s magic idea started to grow in 2017 based on her and her co-founder and COO Ingrid Østbys own experiences dealing with food waste when working in grocery stores. Charlotte gradually became a food waste expert, skilled in ArcGIS, Computer-Aided Design (CAD), AutoCAD Civil 3D, GPS Navigation, and 3D Modeling. In five years Charlotte wants her technology to be used all over the world and she hopes that in 20 years “our children get to grow up in a world completely without any food waste.”

The start-up was launched on funding from Innovation Norway and they closed their first formal investment round in January 2018 and they have continued to rapidly raise funding throughout the year.

TotalCtrl won also the GreenTech Challenge Oslo 2018.

TotalCTRL was one of the six start-ups to pitch for venture capitalists and investors the 3rd of November 2018 in the US, in the 1st ever event focusing on female lead cleantech and sustainability companies. The event was organized by organized by the leading Bay Area non-profit Women in Cleantech and Sustainability and hosted by Google.

What makes TotalCTRL unique, compared to their competitors, is that their technology is based on automatic data harvesting, which seamlessly integrates into existing infrastructures. They replace the manual work with technology. For the grocery industry and consumers our 0-waste technology is a game-changer, which provides multi-level automated tracking of inventory based on expiration dates. Everything is connected. By letting the consumer plan, buy and use smarter, the grocery retailers will do the same. TotalCTRL Consumer will reduce the money retailers waste, literally, in the garbage in the form of foods. In time, the technology will be usable throughout the entire value chain – from producer to consumer.

Alternative Finance – funding raised

The start-up was launched on funding from Innovation Norway and they closed their first formal investment round in January 2018 and they have continued to rapidly raise funding throughout the year.

TotalCtrl won also the GreenTech Challenge Oslo 2018.

Expert of the week : Robert Pettigrew (UK)

What is the current status of Alternative Finance?

The alternative finance market in the United Kingdom is relatively strong, and continues to gain momentum as it grows. In terms of marketplace lending, the UK market is the third largest globally, and accounts for around 77 per cent of volumes in the European Union. Peer-to-peer lending comprises the largest part of the UK alternative finance market and is estimated to have facilitated lending of around £15 billion.

There are lots of advantages of a limited company. The eight member platforms who comprise to the Peer-to-Peer Finance Association (P2PFA) have enabled lending of around £5.5 billion to businesses and more than £4 billion to consumers with more than 150,000 investors funding loans to nearly fifty thousand businesses and a quarter of a million consumers. During 2018, these same platforms facilitated new lending of around £3 billion.

Regulation

The regulatory environment in the UK was introduced in 2014, and revisions are being considered as part of a post-implementation review. The regime has enabled the development of a number of different business models for peer-to-peer lending platforms to reflect the various markets which are served. Platforms who belong to the P2PFA commit to the organisation’s Operating Principles which set out standards of transparency and business practice, and its eight members account for around two-thirds of the volume of the UK market.

Institutional investors

Another feature of the development of the UK market has been increased interest among institutional investors: around 40 per cent of the funding for peer-to-peer platform-facilitated lending in 2017 was provided from institutional sources and the acceleration from this source has also taken place in equity-based crowdfunding.

Can you give us an inspiring case from your country?

The establishment of the Peer-to-Peer Finance Association (P2PFA) in 2011 by the three big platforms in the UK market was a bold statement that platforms in this innovative, disruptive sector would commit to clear standards, and, by embracing self-regulation, underscore that market confidence needed to be created and maintained. The P2PFA argued, from its outset, the case for statutory regulation of the sector which was introduced from 2014.

The P2PFA’s Operating Principles provide a series of requirements to which all P2PFA platforms must commit which go beyond those required by the statutory regime. Another feature of developments in the UK market is the increasing interest shown by institutional investors. Whilst a large number of market players continue to commit to their retail investment proposition, the facilitation of loans funded by institutional investors such as banks, mutual funds, pension funds, hedge funds and asset managers has become an important part of the alternative finance market.

Of some significance is the support provided to some platforms by the Government-backed British Business Bank: the Cambridge Centre for Alternative Finance’s most recent report found that the amount of investment from institutional sources through peer-to-peer lending platforms was forty per cent in 2017 (an increase from twenty-eight per cent in 2016). The P2PFA’s Operating Principles require that platforms treat all investors equally and do not operate in a way which disadvantages retail investors.

Finally, the approach adopted by the Financial Conduct Authority, as regulator, has enabled platforms to continue to reflect the different markets which they serve. Delivering effective innovation and competition in established financial service markets in such a way as to attract investors and borrowers has inspired quite a variety in the different business models which platforms have adopted some of which have changed reasonably frequently the better to serve the requirements of various customers.

By adopting a principles-based regulatory framework, the sector has been able to focus on meeting and maintaining fundamental standards, whilst retaining the flexibility to adjust their models to reflect the needs of the different segments served.

What are the biggest obstacles for growth?

Levels of interest among potential investors in alternative finance are very strong: and, through the introduction of the Innovative Finance Individual Savings Account (ISA) a tax-incentivised savings product which makes use of investment in alternative finance products there has been growing awareness.

There has been a long term decline in demand amongst UK businesses for external finance. The British Business Bank has published a ‘Business Finance Guide’ to improve awareness amongst small businesses of the options available to them, and has convened a Finance Hub for interested parties to do what they can to raise the profile of avenues which businesses can explore.

Around a third of small businesses have made use of external finance (a broadly consistent figure since 2014), albeit that non-bank finance has grown rapidly in the UK. However, when surveyed, around three-quarters of small businesses in the UK would prefer slower growth to avoid borrowing.

The British Business Bank has found that attitudes to equity finance correlate strongly with turnover growth: equity investment is catching up with levels in the United States, but there is a strong cluster effect around the UK’s leading universities.