Hi everyone,

As you can probably tell, international investing is a big part of who we are here at Alts.

From our recent investor trip to Mexico, to deep dives on Rwanda and the Philippines, to an Alts team that’s spread around the globe; we believe that some of the most under-discussed opportunities are in other countries.

Today’s issue is about the intersection of international investing and private credit.

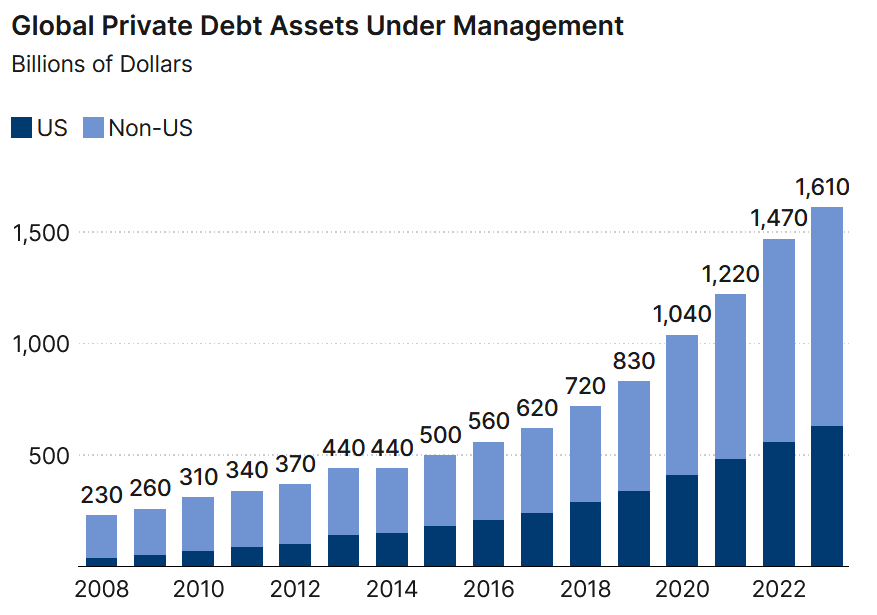

The United States pioneered this asset class, and most of the discussion is focused on the US. But a majority of the world’s private credit assets are actually invested outside the US!

There are three reasons a geographically diversified private credit mix could be an especially productive strategy right now.

In this issue we explore these reasons, and analyze three regions (LATAM, Asia, and Europe) using real examples from Percent.

Let’s go 👇

Note: This is Part 4 in our Private Credit series. For a refresher, here’s Part 1, Part 2, and Part 3. This free issue is sponsored by our friends at Percent. As always we think you’ll find it informative and fair.

Table of Contents

Private credit: It’s time to shine ☀️

It’s a golden moment. The market is opening up to ordinary, retail investors for the first time ever.

Percent is the only platform exclusively dedicated to private credit.

One of the draws of private credit is the flexibility and freedom with which investors can lend (compared to banks).

As a result, there are fewer cross-border hurdles, and more capacity to diversify a private credit portfolio geographically.

- Get as much as 20% APY and more (That’s high)

- Investment minimums as low as $500 (That’s low)

- Alts readers can earn up to a $500 bonus with their first investment (Neat)

See all Private Credit Deals →

Three trends with international private credit

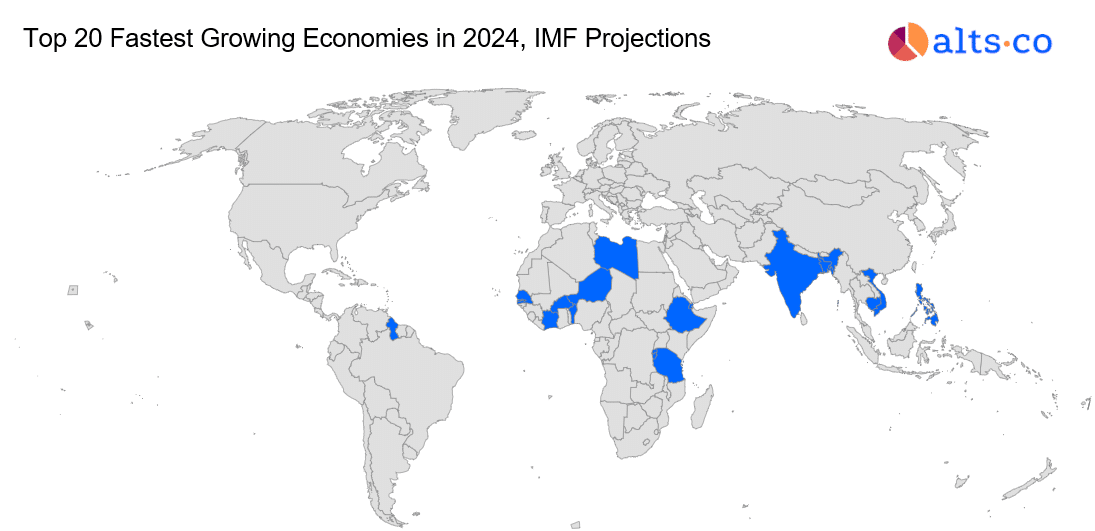

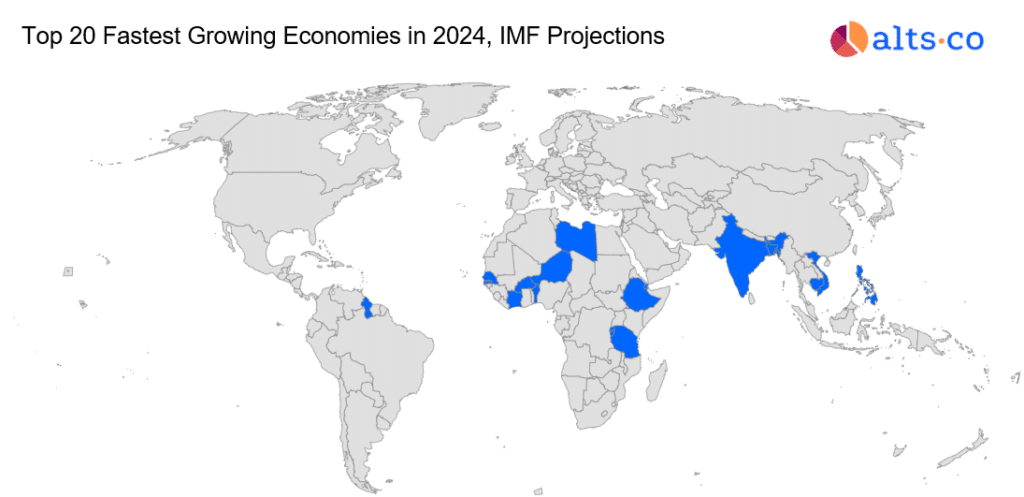

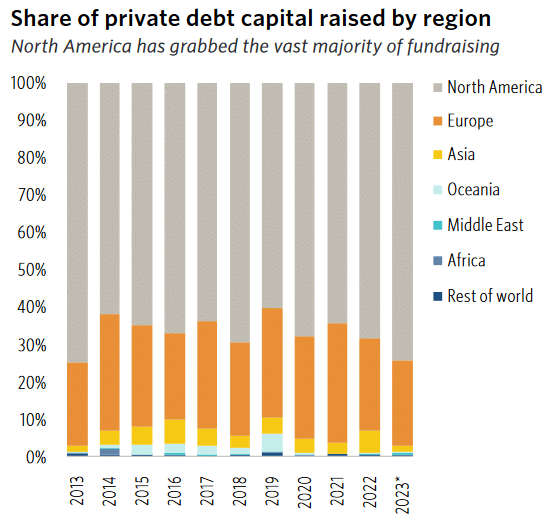

As we mentioned, a majority of the world’s private credit assets are actually invested outside the US:

There are three trends that may accelerate international private credit performance over the next few years.

Trend 1: The fastest-growing economies are abroad

As countries get wealthier, their economic growth tends to slow down.

This isn’t a universal law or anything, but it’s a useful rule of thumb that accurately describes the experience of industrialized nations like the US, EU, and Japan.

For instance, while the US registered a respectable 2.5% GDP growth in 2023, that still pales in comparison to places like Ethiopia, India, or Panama, which all experienced 6%+ growth.

The fastest-growing economies tend to be in international emerging markets.

This is a decades-long trend that’s seen the US share of the global economy fall from 40% in 1960 to around 24% today.

But a fast-growing economy also means more businesses pursuing more financing. And those businesses are often willing to pay higher yields to access it.

Trend 2: International banking standards are tightening

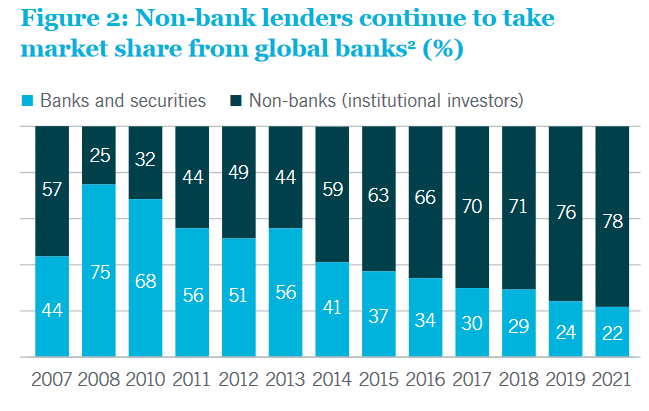

An under-appreciated factor in the rise of private credit is the tightening of banking regulation.

After the 2008 crisis, regulators started to crack down on big banks, including implementing stricter capital and leverage ratios.

This decreased the amount of lending banks were able to support.

But that didn’t change the fact that people still need financing! To get it, they turned to private credit.

Today, just 33% of all lending in the United States is done by banks — a much lower standard than countries like Germany or Greece (around 70% and 90%, respectively)

But here’s the thing: The rest of the world could be set to fall in line with the US.

The latest update to an internationally agreed-upon set of global banking standards (ominously known as the Basel III Endgame) is slowly being phased in, with a target compliance date of July 2025.

As regulatory standards around the world start to tighten, we expect bank share of lending in international markets to continue to decline. And this means a corresponding opportunity for private credit growth.

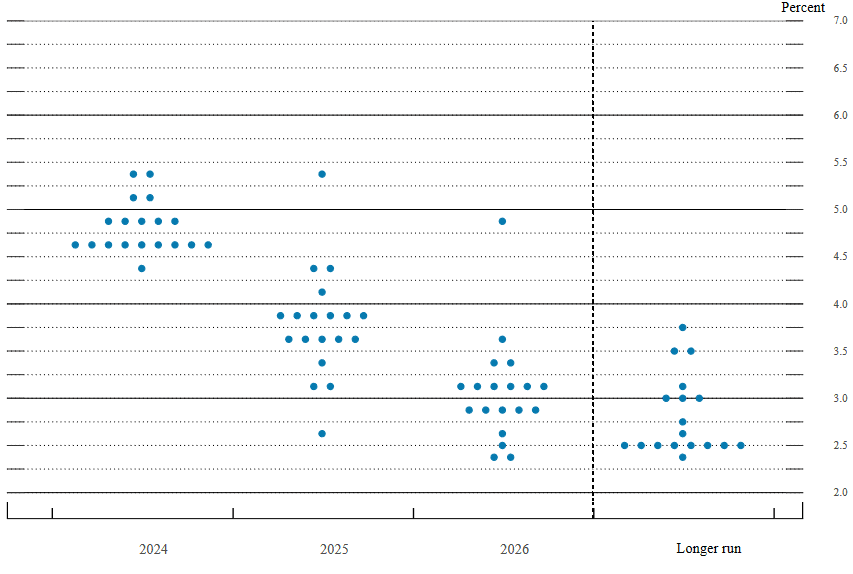

Trend 3: US rate cuts would help foreign markets

Finally, (somewhat anticipated) interest rate cuts from the Fed this year could help international markets flourish.

When the Fed raises interest rates (as it has over the past few years), money tends to flow into the US.

This usually causes central banks in other countries to raise their own rates to stay competitive — regardless of domestic economic conditions.

But when the US lowers interest rates, that dynamic reverses, as international central banks tend lower rates too.

Lower rates generally support economic growth and increase asset prices — both of which contribute to a stronger lending environment.

Putting it all together, the fact that the Fed itself is predicting three rate cuts this year is good news for international markets, which will be less constrained by high US rates.

Regional breakdown

So far, we’ve painted a general picture of why international private credit is worth paying attention to right now, and why too much American home bias could be a mistake.

Now, it’s time to get specific. What does the private credit scene look like internationally – and in which regions is the market seeing the strongest development?

Latin America (LATAM)

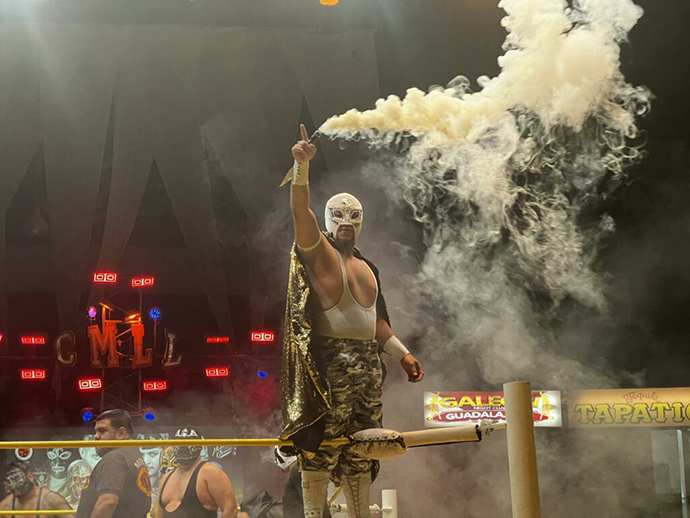

Full disclosure – we’re definitely biased in favor of Latin America.

Alts wrapped up our first investor trip to Mexico last month, and we left enormously excited about the potential of investing in LATAM.

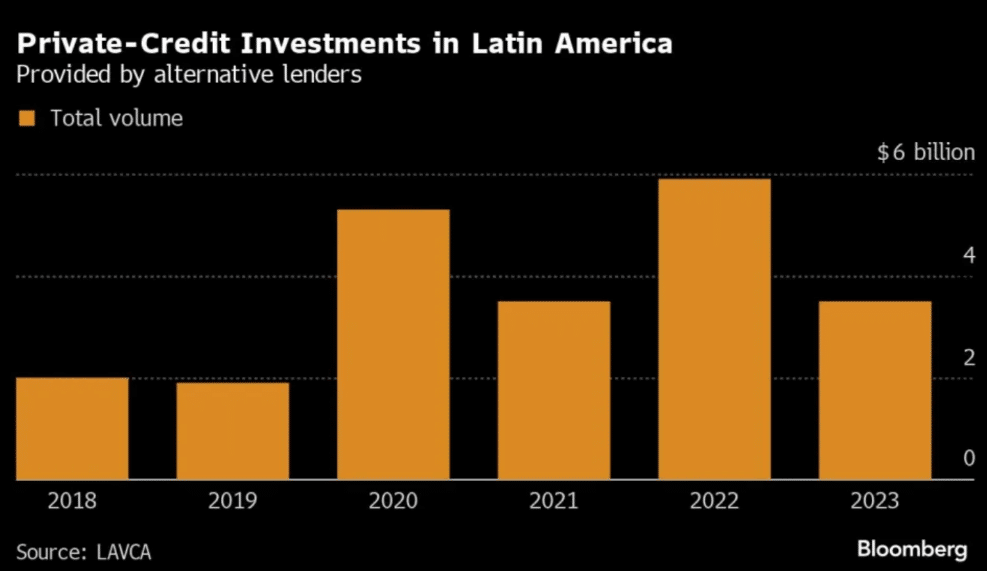

But hard data also backs up the idea that private credit in this region is starting to accelerate.

There was just ~$2 billion worth of direct lending in the region in 2018, but that grew to nearly $6 billion in 2022.

That number scaled back a bit in 2023. But we expect another pickup this based on recent activity:

- In Brazil private market investment has skyrocketed, punctuated by a recent $100m deal by American PE firm Ares Management. 🇧🇷

- Last year, former Credit Suisse bankers launched a $600m fund specifically focused on direct lending in Latin America & the Caribbean (ArtCap Strategies).

- The largest asset manager in LATAM, Vinci Partners, has invested heavily in this space, acquiring two major private credit firms.

Why is private credit so big in LATAM?

Easy: An enormous unbanked population.

As a result, non-bank entities have stepped in to provide consumer debt, like credit cards and personal loans.

And all that consumer debt provides a source of raw material for the creation of asset-backed loans for private credit investors.

Summary: Direct lending in LATAM is becoming a big opportunity.

Asia

Asia is host to three of the world’s five biggest economies (China, Japan, and India). It accounts for nearly 2/3 of all global GDP growth.

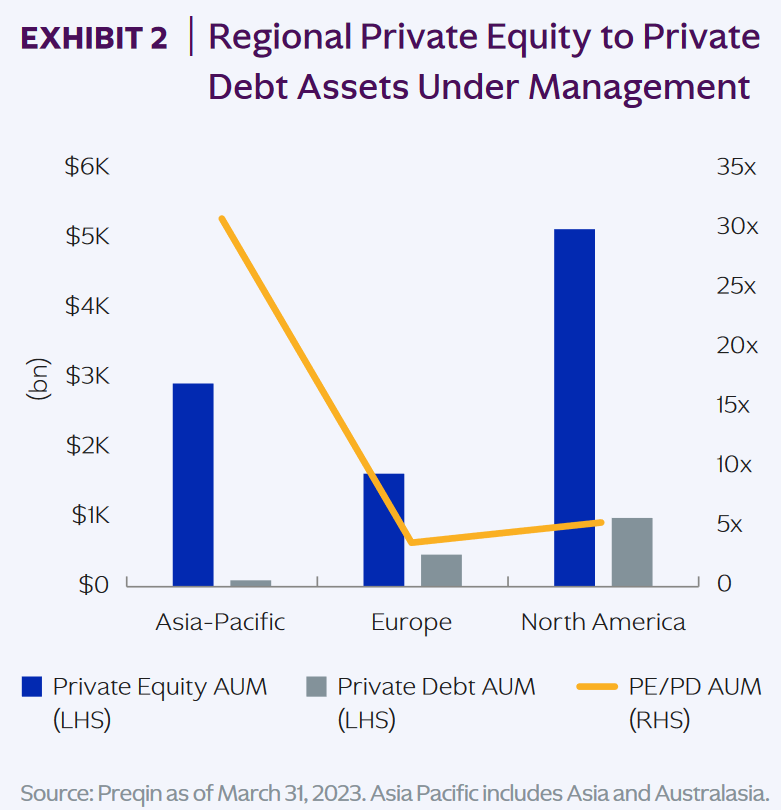

That economic might means that even though private credit might be huge in Asia on a nominal basis, it still lags the rest of the world on a relative basis.

For example, in 2022, Asian private credit funds raised an estimated $10.2 billion – significantly greater than a region like LATAM, but still less than 5% of global private credit fundraising.

As a result, we think that private credit is still massively underutilized in Asia.

In fact, 79% percent of credit in Asia is still extended by banks, compared with just 33% in the US. That means there’s a ton of market share for private credit to capture.

One area in particular we expect to see growth in is specialized corporate lending.

Between 2018 and 2023, private equity AUM in Asia tripled to nearly $3 trillion. Private credit has long been a key partner for the PE industry, providing more flexible lending solutions than banks can.

Despite that relationship, private credit in Asia hasn’t kept pace with private equity, resulting in a shortfall of debt investment relative to other regions.

As developing financial markets in Asia mature, we anticipate seeing private credit playing a greater role in supporting PE (similar to Europe and America).

Summary: Private credit is seriously underutilized in Asia, especially to support private equity.

Europe

While direct lending in Europe might not be as thrilling as emerging markets in Asia or LATAM, the region is worth reviewing as a case study of a maturing private credit market.

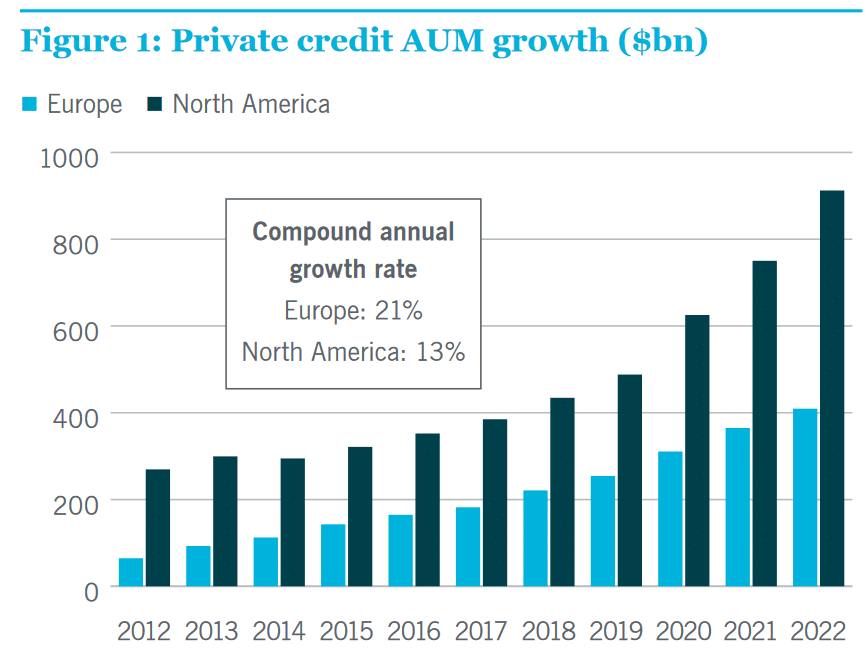

As we’ve discussed, the US really helped launch this asset class, and North America remains at the forefront of global fundraising.

While Europe hasn’t quite caught up yet, the market there has been growing at a much quicker rate, registering a CAGR of 21% in AUM between 2012-2022 (compared with just 13% in North America).

Average yields, meanwhile, are roughly comparable with those in the US (around 9-10%) – not exactly a surprise given similar economic development and regulatory standards.

Curiously, European officials have been developing mechanisms to enable more retail investors to participate in private credit, similar to BDCs in the United States.

These include the LTAF structure in the UK and the ELTIF structure in the EU. Regulators have only recently approved the current form of each, so investor participation remains to be seen.

Summary: Valuable diversification, but a maturing market with comparatively fewer exciting opportunities.

Comparing US and international private credit

Given the size and scale of the domestic market, we’d expect US-focused investments to make up a sizable portion of most private credit portfolios, if not an outright majority.

But as we’ve seen, there are a few reasons to think that international markets could be primed for strong performance in the next few years.

Therefore, geographic diversification is worth considering for serious investors – especially given the variation in the development of regional private credit markets.

To round out our understanding of international private credit, we’ll now analyze real examples of private credit deals, courtesy of Percent.

Percent is an online investment platform that enables accredited investors to access the space.

In addition to offering passive investment products, they also feature a host of individual deals you can invest in.

To date, over $1 billion has been invested in these deals, generating a historical weighted yield of more than 13%.

In addition to US-based deals, Percent also offers exposure to international borrowers:

Deal 1: ePesos Payroll Advances

The first deal we’re going to look at is an asset-backed loan secured by a collection of payroll advances from borrower ePesos.

Payroll advances involve fronting an employee a portion of their wages for a fee. Then, after a set period of time, the lender is repaid when those wages materialize.

As such, this is a type of consumer lending – so it’s probably not surprising to find out that ePesos is a financing firm based in Mexico, considering the consumer debt opportunities we discussed in LATAM.

This was also a (relatively) small deal size, with the raise topping out at $480k.

That makes sense, since consumer debt tends to target smaller nominal amounts – the average underlying payroll advance was just $383.

Finally, we’ll note that the underlying advances are made in pesos, even though the actual investor payments are made in dollars.

That introduces currency depreciation risk, which is one unique aspect of international financing. But the offering documents indicate that this was managed through a mix of hedging and over-collateralization.

The ePesos deal closed in late 2022 and has since been fully repaid.

Deal 2: The Smarter Merchant Business Financing

Next, we’re looking at another asset-backed loan, this time secured with corporate financing.

In this deal, NYC-based The Smarter Merchant (TSM) provided small- and medium-sized businesses in the US with working capital financing based on their anticipated revenue.

In comparison with the ePesos deal, this offering was significantly larger, at more than $2.5 million.

Given the scale of corporate financing and the maturity of the US private credit market, it’s not surprising to see higher ticket figures for domestic deals.

One thing to note is that the US-based deal actually carried a higher yield than the Mexico-based one – 17% compared with 12.25%.

Naively, we might assume that investments in emerging markets naturally carry a higher interest rate to compensate for the generally increased risk in such countries.

But the details really matter. In this scenario, the ePesos deal arguably had greater security than the TSM one, since:

- ePesos received small-ticket repayment directly from employers paying expected wages,

- while TSM received high-ticket repayment from businesses based on uncertain revenue streams.

This fact highlights that we can’t assume an international deal is necessarily higher risk than a domestic one – nor should we assume we’ll inevitably earn higher returns outside the US.

In any case, this deal closed early last year and has since been fully repaid.

That’s it for today!

See you next time,

Brian

Disclosures from Alts

- This issue was sponsored by Percent

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Percent. Percent has agreed to offer an unconstrained look at its business, offerings, and operations. Percent is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.