READ TIME: ±6 minutes

Hello and welcome to Alts Cafe for August 1, 2022.

This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What’s the equity market doing?

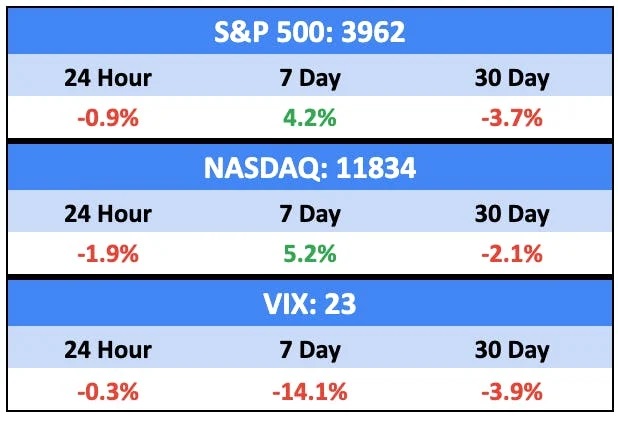

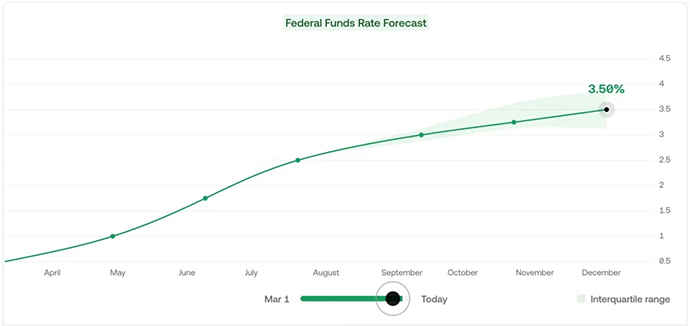

Weird week on the markets, as investors reacted positively to a 75bp rate hike, and the official data shows two straight quarters of economic decline (what we used to call a recession).

The markets predict another 50bp to 75bp rate hike during the September Fed meeting as well.

What are we doing?

Fractional Alts picks:

No changes here for now.

ALTS 1 fund news:

We’ve started to dollar cost average into both Bitcoin and Ethereum.

Crypto

Here’s what you need to know:

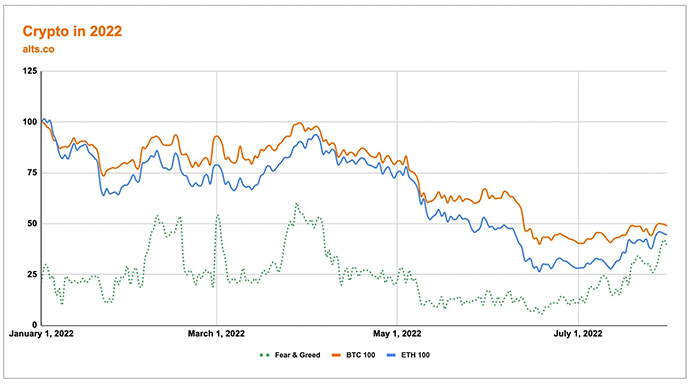

Crypto has followed equities up (or is it the other way around?) with a tidy gain over the last week, though the markets were predictably choppy over the weekend.

The Crypto fear and greed index pipped up three points (10%) to 33 over the week.

We analyzed the fear and greed index’s movements alongside Bitcoin, and there are some significant opportunities for momentum trading here.

The correlation between the index and BTC’s movement one day and seven days out was .59 and .58, respectively. That is, if the F&G index goes up today, BTC will probably go up tomorrow (and next week).

Bullish News

- July closed up 17%, which was the best month since October 2021.

- Several businesses in a small town in Honduras have started accepting BTC as payment in a bid to attract more tourists. They’re calling it Bitcoin Valley.

- Two football (soccer) clubs in South America used cryptocurrency to pay for the transfer of a player.

- Bitcoin adoption is gaining ground in El Salvador, according to its finance minister, though the country’s holdings are still down over 50%.

- Sticking with South America, Brazilian bank Santander will offer crypto trading soon.

Bearish News

- Thailand’s equivalent of America’s SEC is looking to roll out stricter crypto regulations.

- Babel finance, which lost $280m prop trading Terra, has suspended client withdrawals.

- CoinFlex has laid off at least half its workforce, while trying to cut costs.

What to do with that info:

We’ve begun to DCA into both BTC and ETH. This is also a disclosure that we own positions in those two assets.

Real Estate

Here’s what you need to know:

The always-excellent real estate newsletter Briefcase published a counterpoint to my doom and gloom, and it’s worth sharing here. I’m pasting it in with some minor edits for space, and I’ve removed the images and charts.

They reckon this housing…event…will be nothing like 2008 for the following reasons:

Reason 1 – Loose Lending

Mortgage fraud, speculation, and irresponsible mortgage lending were the primary drivers of the last housing crash. Since then, lending restrictions have become stricter, and rising interest rates are reducing buyer demand and speculation.

Reason 2 – Foreclosure Rates

Even before the pandemic, foreclosure rates were at historical lows. This means that tighter lending practices are helping homeowners avoid buying homes with mortgages they can’t afford.

Reason 3 – Demand

Buyer demand is strong. Even with higher interest rates, buyer demand will remain robust as housing prices come back down to reality. Further, the pain felt by rising rates will be cushioned because anyone who can no longer afford a mortgage will have Millennials and Gen-Z lining up to make purchases as household formation heats up.

Reason 4 – Equity

Homeowners hold a record $28 trillion in home equity. This means that even with a drop in home prices, owners still have equity they could tap into should they need a personal economic stimulus. Further, the number of mortgaged residential properties with negative equity decreased by 5.3% in Q1 2022 year-over-year.

Reason 5 – Incomes

Incomes are stronger now than they were in 2006. According to recent data, household income as a percentage of home prices is at a historically stable level, especially compared to the early 2000s.

Reason 6 – Credit Scores

We are financially healthier than in the early 2000s. Now, I do have my own concerns about the traditional credit score method, however, it does give us a glimpse into our overall financial well-being.

Lastly, some news from last week:

- The annual rate of US residential price appreciation declined 2% for June. The biggest drop during 2007 – 2009 was 1.2%.

- Mortgage rates topped 6% in June but are back down to around 5%.

- The Fed increased rates 75bps.

- Housing inventory is up 22% over the last two months, but that’s still 54% lower than 2017.

- Mortgage applications continued to decline.

- China’s property sector is a mess.

If you’ve got the kind of bank account that’s above all this, consider investing in this gem, available for $175m. It’s sure to impress all your friends. (Can I be your friend?)

What to do with that info:

Invite me to your new house in the Hamptons. And keep watching these numbers.

NFTs

Here’s what you need to know:

If you’re looking for NFTs that are resistant/immune to crypto problems, metaverse and GameFi projects may be the best bet. They were the sectors least affected by the Terra collapse.

Do you have:

- A CryptoPunk?

- 30ETH to burn?

- A deep dark need to flex?

You can get a Tiffany’s necklace showing off your punk.

Volume continues to decline, hitting well under $20m most days last week.

Feels like a small cadre of dedicated collectors/investors are scooping up the biggest projects.

What to do with that info:

Get yourself a Tiffany’s necklace, obviously.

Startups

Here’s what you need to know:

TechCrunch ran a survey of big fintech investors that was very similar to one from 2021, and here’s the TL;DR:

“Woo hoo — everything is amazing and 2021 was a stellar year in the world of fintech.” And today, it’s more like: “We’re proceeding very, very cautiously — and you should too.”

But this guy is bullish on fintech. Former a16z partner Rex Salisbury has set up a solo fund, focussing on early companies in the space.

I don’t know if this is startups news or not, but a, well, startup is launching to help up your DALL-E 2 game. No more unpredictable images For $2 you’ll get exactly what you want…

What to do with that info:

Get on the DALL-E 2 waitlist and sharpen your prompt-writing skills. If you sell a prompt on the platform above, you keep 80% of the take.

Quick Hits

Sports Memorabilia

Indianapolis Colts owner paid over $6m for the belt awarded to Muhammad Ali after the 1974 Rumble in the Jungle fight. A second copy of the belt is available at Collectable now with a market cap of around $800k.

BREAKING—-Muhammad Ali’s

— Jim Irsay (@JimIrsay) July 24, 2022

championship belt from 1974 ‘Rumble in the Jungle’ when he employed his rope-a-dope and defeated George Foreman—-just added to @IrsayCollection Just in time for the Aug. 2 show at Chicago’s Navy Pier (and Sept. 9 at Indy). Proud to be the steward!🙏 pic.twitter.com/REJOGV1Cwq

Sports cards

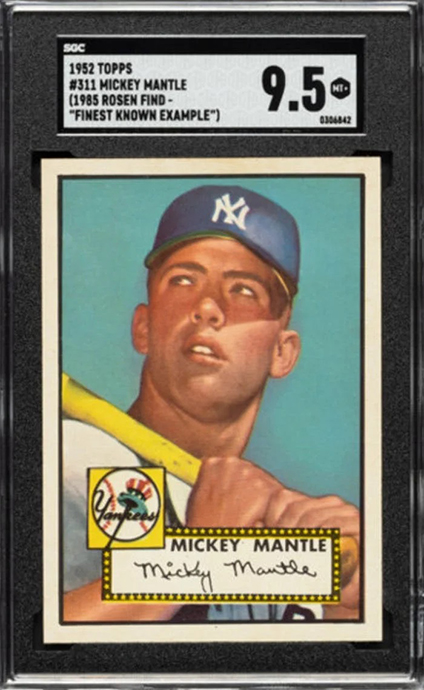

Heritage auctions have got their hands on an SGC 9.5 graded Mickey Mantle rookie card, and it’s expected to sell for well over $10m.

This is one of those items that defy recessions, logic, and the economy.

Wine

Jumping on the bandwagon, Forbes put out a guide to investing in wine last week.

It’s worth a look if you’re new to the space.

Despite a huge run up already in 2021 and 2022, Bordeaux and Champagne aren’t slowing down.

Bordeaux and Champagne currently have the best bid:offer ratios and an excess of bids, suggesting that interest is highest in these two regions. https://t.co/dWMt7JkDFe pic.twitter.com/k0l3dyD39m

— Liv-ex (@Livex) July 27, 2022

Broadly speaking, though, wine has been pretty flat in 2022 (unlike everything else, which has been terrible).

As the chart shows, fine wine has remained steady as other markets have tottered. However, although the leading indices have made gains, their pace has been much more subdued in Q2.

— Liv-ex (@Livex) July 24, 2022

Find out more: https://t.co/8eJwHOUQd1 pic.twitter.com/NCEwSosq23

That’s all for this week.

Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt