Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- The ETF That Lets You Buy Privately Held Companies

- How VC Has Changed Since The SVB Fallout

- Are Bear Market Funds Worthwhile?

- Crisis in the Chocolate Industry

- Walmart Doubles Down on Solar

- Have International Stocks Lost Their Luster?

- 3 Stocks To Consider

Table of Contents

Invest in SpaceX & OpenAI With This ETF (But There’s a Catch)

The Destiny Tech100 ETF ($DXYZ) debuted as the first US fund dedicated to holding private companies, allowing public market investors to gain exposure to firms like SpaceX, OpenAI, Axiom Space, and Boom Supersonic.

While the fund surged over 177% in its first two trading days, it comes with a steep 2.5% annual fee and may sometimes trade at a premium to the startups’ actual value.

Read more at The Average Joe.

How VC Has Changed In The Post-SVB Fallout

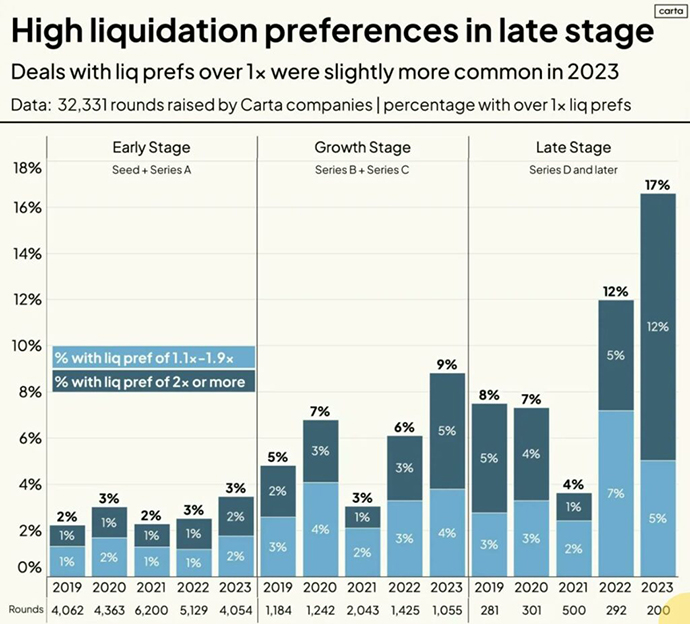

In the post-SVB landscape, the dynamics of liquidation preferences and venture debt are undergoing significant changes. An analysis by Carta revealed that while 95% of rounds maintained a liquidation preference of 1x or lower, a noticeable trend towards higher liquidation preferences has been recorded, particularly in later-stage and bridge rounds—a shift from the investor-friendly conditions of 2021.

Meanwhile, the demand for venture debt has surged, creating interesting tradeoffs for startups attempting to navigate these financing tools.

What’s liquidation preference?

Liquidation preference in venture capital ensures investors with preferred shares are paid out before common shareholders during a liquidation event. It can specify payment as a multiple of the investment and may include participation clauses affecting the distribution of proceeds among shareholders.

Funds Specifically For Bear Markets — Is This A Good Idea?

As investors seek safe havens in volatile markets, bear market funds are gaining popularity as a diversified asset class designed to withstand market downturns.

While these funds may mitigate losses during bear markets, they also come with higher volatility and fees, making them more suitable for strategic use rather than long-term investments.

Sweet Squeeze: Crisis in the Chocolate Industry

Chocolate prices are expected to skyrocket this year due to a catastrophic cocoa harvest in West Africa, where a plant virus has infected half a million acres.

The resulting supply squeeze has caused cocoa prices to double in just three months, hitting a record high of over $10,000 a ton.

How will major chocolate manufacturers like Hershey, Cadbury, and Lindt adapt? More from Stock Market Rundown

Walmart… The New King of Solar?

Walmart, the world’s largest retailer, is making a significant move into solar energy through a new partnership with Pivot Energy.

Dubbed ‘Project Gigaton’, the aim is to decarbonize Walmart’s operations by funding the development of 19 new solar energy projects in the U.S..

How big of an impact will this make?

Have International Stocks Lost Their Luster?

Despite the recent dominance of U.S. stocks, international stocks have, at times, outperformed, offering essential diversification for portfolios.

For example, in 2017, international emerging markets were the top-performing asset class, followed closely by stocks from developed international markets.

Given the current high valuations in the U.S. and the economic recovery underway in Europe and Asia, are international stocks on the verge of a comeback?

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Visual insights into business, tech, entertainment, and society.

5-minute reports on AI, Crypto, and more for those looking to start their own business.

Your one-stop shop for all things crypto.

Stock ideas

Here are three of my favourite stocks from this past week.

Analysis provided by public.com. Remember to always DYOR.

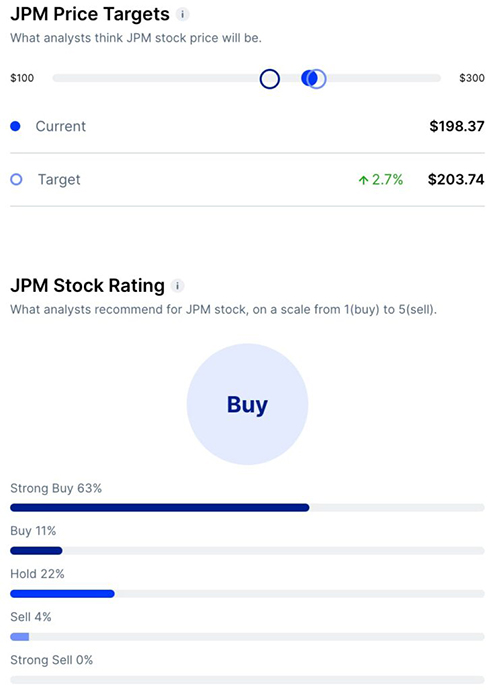

JPMorgan Chase & Co ($JPM)

Bull Case:

- Growth Potential: Strong investment banking revenue growth is projected for 2024, boosted by the Fed’s dovish pivot.

- Market Leadership: JPM is gaining market share through deposit growth and the First Republic acquisition.

- Valuation Upside: JPM trades at a discount to the S&P 500 despite strong fundamentals.

Bear Case:

- Persistent Discount: Valuation remains discounted compared to the broader market.

- Economic Risks: Unexpected market turmoil may negatively impact performance.

- Competitive Landscape: Intense competition and potential industry headwinds pose risks to the bullish thesis.

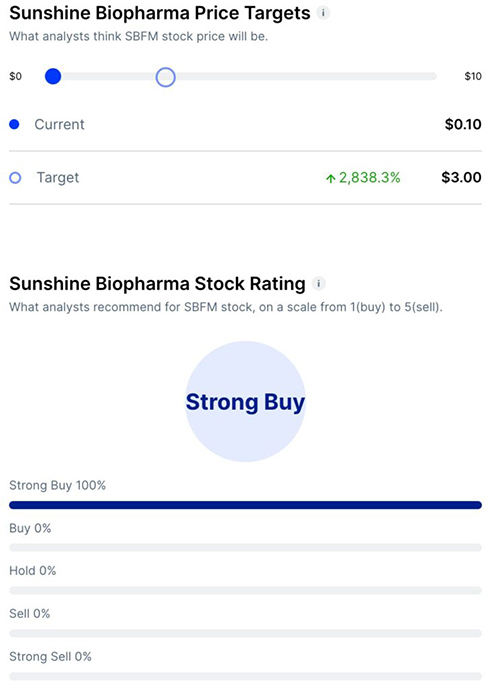

Sunshine Biopharma ($SBFM)

Bull Case:

- Rapid Revenue Growth: Q4 revenue grew 30.5%, and the company expects 2023 revenue of $24M.

- Undervalued: Despite $23M cash, $SBFM trades at a negative enterprise value.

- Insider Confidence: The CEO bought shares at $0.10 and the company repurchased 21.63M warrants at $0.145.

Bear Case:

- Convoluted Financing: The recent $10M raise with complex warrant terms caused the stock to drop.

- Drug Development Risks: mRNA molecule for liver cancer and protease inhibitor for SARS are still in early stages.

- Cash Burn: Current cash provides only a 2-year runway, any setbacks could mean dilutive financing.

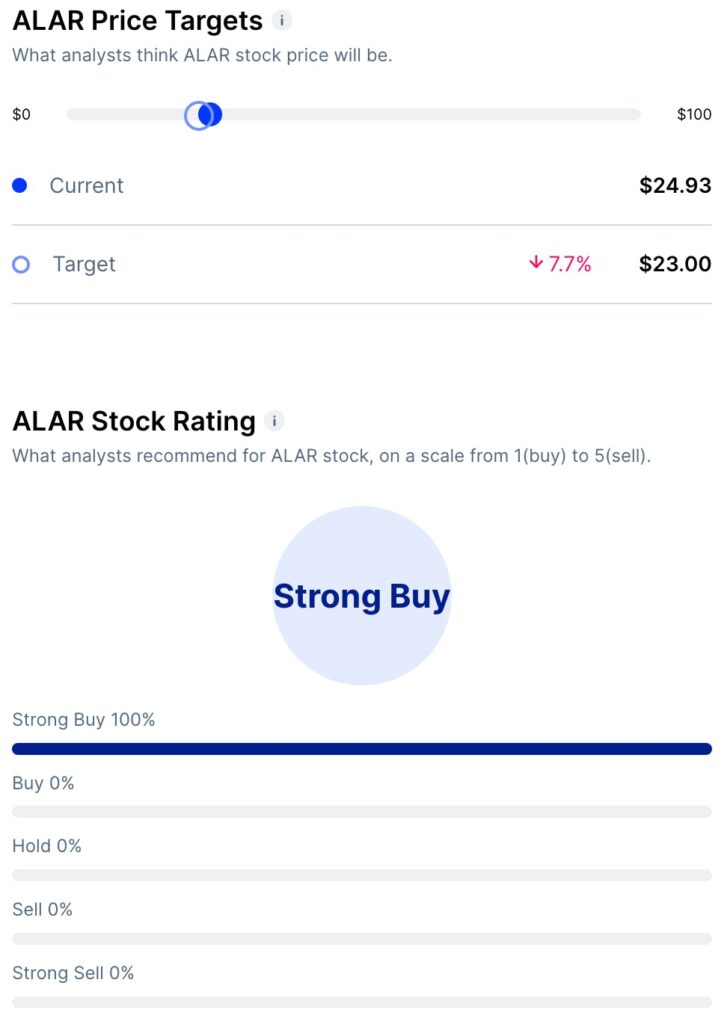

Alarum Technologies Ltd ($ALAR)

Bull Case:

- Strong Growth: Alarum achieved 75% YoY revenue growth, capturing market share in the expanding web scraping industry.

- Profitability: Alarum generated $3M profit in 2023 with 73% margins.

- Market Opportunity: The data scraping market is growing at a 28.9% CAGR.

Bear Case:

- Competition: Alarum faces competition from larger players like BrightData and Oxylabs.

- Regulatory Risks: Potential legal challenges could impact the business model.

- Valuation Concerns: The current valuation may be stretched compared to industry peers.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.