Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- Egypt: An Unlikely Contender for Economic Success?

- Shein Eyes IPO: The Fast-Fashion Behemoth’s Next Big Step

- Surpassing Forecasts: NVIDIA’s Remarkable Q3 Growth

- Bangladesh’s Wage Protests: Sewing Uncertainty For Investors

- Stocks Worth Keeping An Eye On

Table of Contents

Egypt: An Unlikely Contender for Economic Success?

via Noahpinion

Noah Smith sheds light on an often-overlooked aspect of Egypt’s economy:

“Egypt’s GDP only plateaued during its period of chaos in 2011-14; in general, it’s been on a slow but steady upward trajectory.”

Are we underestimating Egypt’s potential as a rising economic player?With its strategic strengths and gradual economic stability, Egypt might just be gearing up for a remarkable turnaround.

Get the full story from Noahpinion.

Shein Eyes IPO: The Fast-Fashion Behemoth’s Next Big Step

via Chartr

Shein, once a disruptive force in fashion, is now eyeing an IPO in early 2024, with ambitions of a $90 billion valuation. This move could cement its position above giants like Lululemon and H&M. But what lies behind this rapid ascent?

“Shein puts the fast in fast fashion: dropping as many as 10,000 new items on its website every day.”

Amidst its staggering success, Shein also faces scrutiny over labor and environmental practices.

How will Shein’s IPO shape the future of fast fashion?

Surpassing Forecasts: NVIDIA’s Remarkable Q3 Growth

NVIDIA’s recent Q3 FY24 earnings showcase a tech giant in full stride.

Jensen Huang, NVIDIA’s CEO, underlines the dawn of the generative AI era, demanding new data center architectures. With a whopping 34% Q/Q revenue jump to $18.1 billion, NVIDIA’s foray into AI training and inference is paying off.

The demand surge continues to surpass expectations. Read More.

Bangladesh’s Wage Protests: Sewing Uncertainty For Fashion Investors

via The AverageJoe

“For weeks, thousands of Bangladesh workers making as little as $3 a day took to the streets.”

Rising wages in Bangladesh’s garment industry, a cornerstone of global apparel, pose financial risks for fashion investors. Protests have forced a 56% wage hike, yet workers demand more, straining the budgets of giants like H&M and Zara’s Inditex.

The competitive market, intensified by low-cost brands like Shein and Uniqlo, further complicates the investment outlook, potentially impacting stock performance and long-term profitability in this sector.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Free daily hot stock trading ideas, and market insights from a 20-year trading veteran.

Daily business news. From Wall Street to Silicon Valley.

Stay up to date on disruptive trends, the most exciting early stage companies, and groundbreaking entrepreneurs.

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com. Remember to always DYOR.

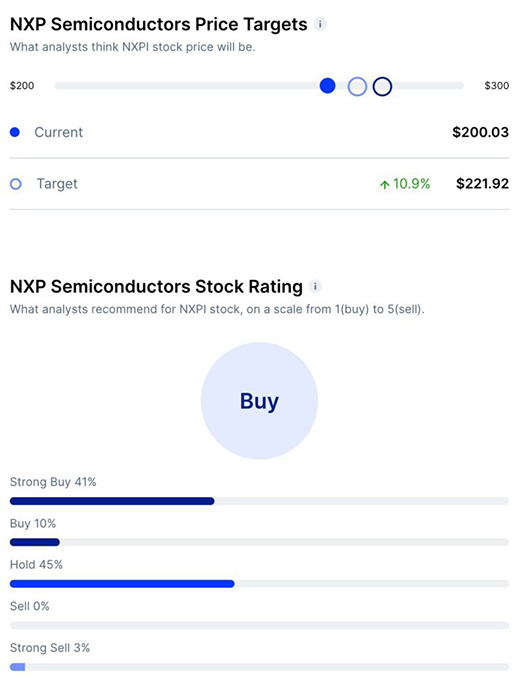

NXP Semiconductors ($NXPI)

Bull Case

- Strong Financial Performance: NXP Semiconductors has demonstrated resilience in its financial performance, surpassing 3Q23 sales and profit forecasts, particularly driven by its robust automotive business.

- Solid Market Position and Growth Potential: The company’s strategy focuses on market leadership across major sectors like automotive and IoT, supported by strong cash flow and a robust capital return policy.

Bear Case:

- Underperformance Compared to Peers: Year-to-date, NXPI shares have underperformed compared to peers, raising concerns about the company’s ability to deliver consistent returns to shareholders.

- Macroeconomic Challenges and Asian Sales Decline: The decline in the company’s Industrial & IoT sectors and Asian sales due to COVID-related slowdowns in China may pose challenges amidst the global economic slowdown

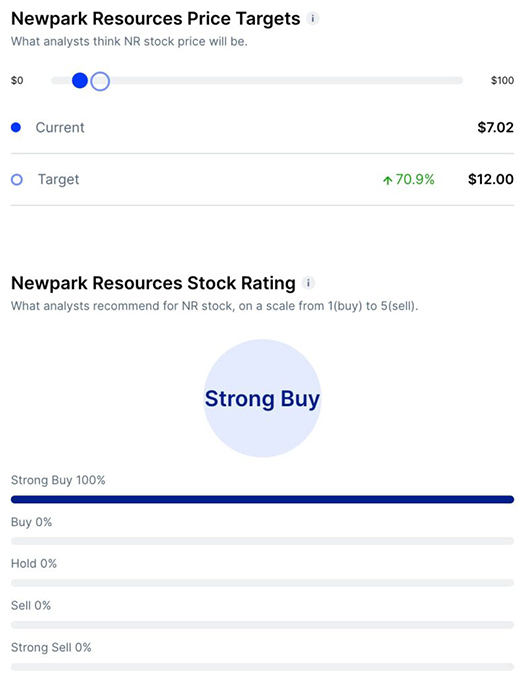

Newpark Resources ($NR)

Bull Case:

- Strategic Review and Potential Divestiture: Newpark Resources has initiated a strategic review for its Fluid Systems business, with options including selling the entire segment or winding down its working capital. This could unlock significant value.

- Valuation Upside: The Industrial Solutions business currently carries a modest valuation of 5 times its 2025E EBITDA, significantly below segment peers that are valued at 9-11x.

Bear Case:

- Market Perception: The market’s perception of Newpark Resources primarily as an oil and gas services company may contribute to the stock being mispriced.

- Cyclical and Capital-Intensive Segment: The potential divestiture of this segment may pose challenges and uncertainties for the company’s future performance.

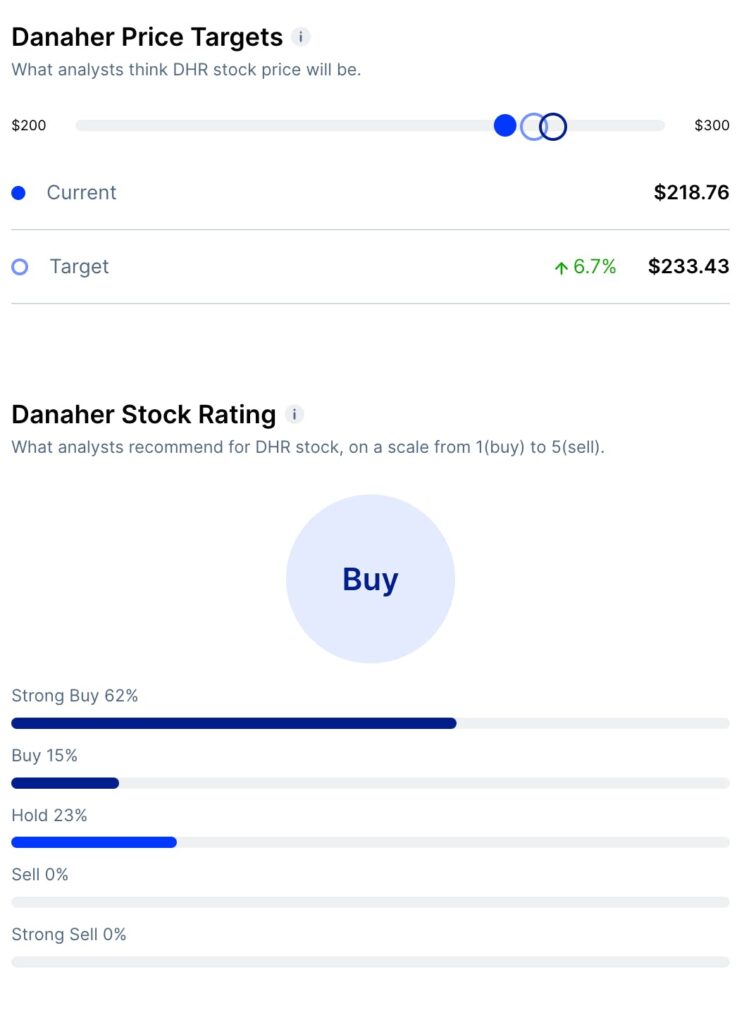

Danaher ($DHR)

Bull Case:

- Life Sciences Dominance: Danaher’s acquisitions, like GE’s Biopharma and Pall Corporation, give it a leading position in bioprocessing with a 35-40% market share.

- Attractive Valuation: Post-spin-off, Danaher trades at about 21x normalized earnings due to smart capital allocation and a focus as a pure-play life science entity.

Bear Case:

- Integration Delays: COVID-19 caused integration delays, and temporary industry challenges, such as reduced vaccine demand and CDMO inventory issues.

- Competition and Trends: Competition risks and the trend favoring focused companies over diversified ones could challenge Danaher’s long-term growth.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click through.

- This newsletter was brought to you thanks to our friends at Honeycomb Credit.

- Nothing above is financial advice. DYOR, you filthy animal.