Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- How reverse stock market crashes happen

- Inside Africa’s Secret Rental Market

- How to Identify Tomorrow’s Billion-Dollar Startups Today

- Counterparty Risk Matters

- Three retailers that will boom or bust this Black Friday

Table of Contents

How reverse stock market crashes happen

All Reverse Market Crashes happen for roughly the same reason: Inflation and mismanagement of debt.

It could help you make or lose a lot of money, depending on where you stand.

Graham Stephen goes into some detail.

Inside Africa’s Secret Rental Market

via Tech Safari

Africa’s secret rental market is an offline and informal accommodation sector, which is not easily visible online. This market includes rentals that are not listed on platforms like Airbnb and Booking.com and are often managed through channels such as Facebook, Instagram, WhatsApp, and word of mouth.

Caleb lays out the business case for investing in a startup tackling this challenge.

How to Identify Tomorrow’s Billion-Dollar Startups Today

via Data Driven VC

To identify and promote champion companies early on, artificial intelligence and data-driven approaches have become indispensable — but humans still make the difference.

Andre shows you exactly how he spots winners.

Counterparty Risk Matters

via Capital Gains

Today, the US has about $2.3tr of physical currency outstanding, but over $21 trillion of “money” defined more broadly as checking and savings accounts, CDs, repurchase agreements, etc.

Counterparty risk almost never matters. But when it does, it REALLY does.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Stocks and Income

I write this every weekday. All the content you need to get your investing day started off right.

The New Money

The world’s biggest ideas, disruptive trends, most exciting early-stage companies, and groundbreaking entrepreneurs.

The Rundown AI

The latest news, tools, and step-by-step tutorials of all the latest in AI.

Stock ideas

In honor of Black Friday, let’s take a look at America’s biggest retailers.

Analysis provided by public.com.

Remember to always DYOR.

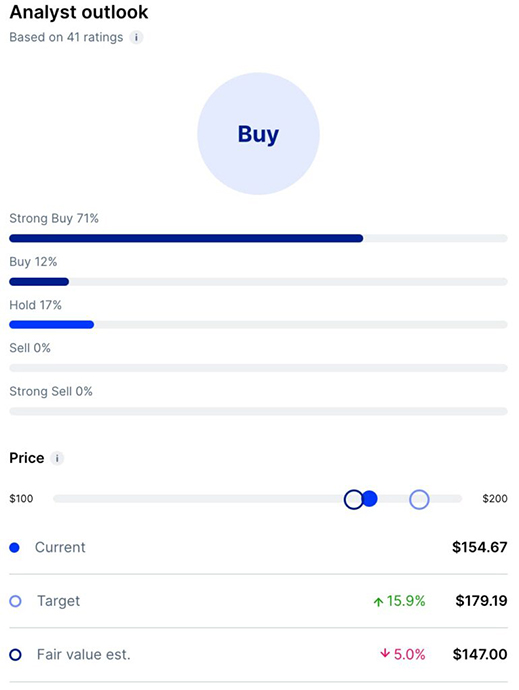

Walmart ($WMT)

Bull Case:

- Market Dominance: Walmart is a retail behemoth with a massive global presence. Its economies of scale allow for competitive pricing, drawing in a vast customer base.

- E-Commerce Growth: Walmart has been aggressively expanding its online presence, competing directly with the likes of Amazon. Its omnichannel approach (integrating online and offline shopping experiences) could be a major growth driver.

- Diverse Product Range: Walmart’s wide range of products, from groceries to electronics, makes it a one-stop shop, which can be particularly appealing in times of economic uncertainty.

Bear Case:

- Competitive Pressure: The retail space, particularly online, is fiercely competitive. Walmart faces challenges from e-commerce giants and niche retailers alike.

- Low Profit Margins: Operating in the discount retail segment means Walmart’s profit margins are inherently thin, making profitability highly sensitive to cost fluctuations.

- Global Economic Sensitivity: As a global retailer, Walmart is vulnerable to international market disruptions, currency fluctuations, and geopolitical tensions.

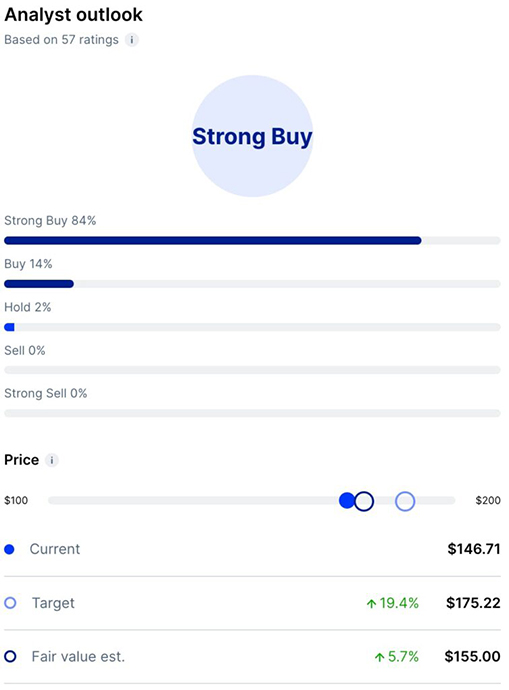

Amazon ($AMZN)

Bull Case:

- E-Commerce Leadership: Amazon is a leader in e-commerce with a continually expanding market share. Its platform’s convenience and efficiency have entrenched consumer loyalty.

- Diversification: Amazon’s diversification into cloud computing with AWS, digital streaming, and even potentially healthcare positions it well for future growth.

- Innovation Focus: Amazon’s commitment to innovation, from AI to logistics, keeps it at the forefront of technological advancements, potentially driving future growth.

Bear Case:

- Regulatory Risks: Increasing scrutiny from governments worldwide on issues like data privacy, antitrust concerns, and labor practices could lead to regulatory challenges.

- High Valuation: Amazon’s stock is often considered overvalued, which means it could be more sensitive to market corrections.

- Dependency on Consumer Spending: Economic downturns that impact consumer spending can directly affect Amazon’s core e-commerce business.

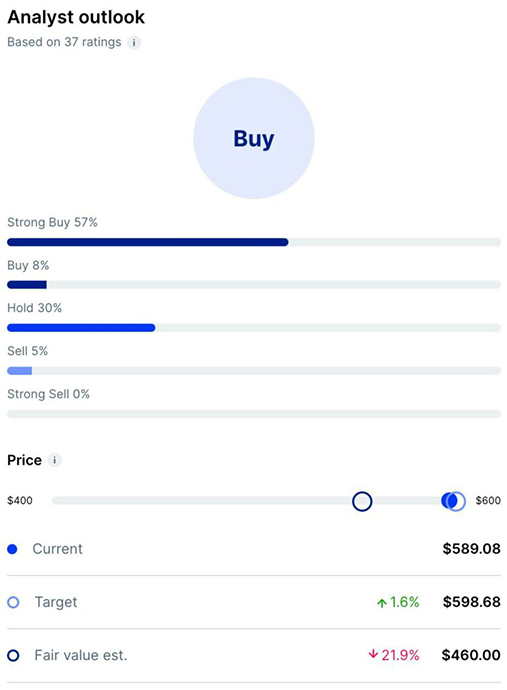

Costco ($COST)

Bull Case:

- Strong Membership Model: Costco’s membership model creates a loyal customer base and a steady revenue stream. This model also encourages larger basket sizes per shopping trip.

- Cost Leadership: Costco’s ability to offer products at lower prices due to its large-scale bulk purchasing and efficient operations attracts price-sensitive consumers.

- Consistent Performance: Costco has shown consistent financial performance with steady growth, making it a potentially safer bet in turbulent market conditions.

Bear Case:

- Limited Online Presence: Compared to competitors like Amazon and Walmart, Costco’s online presence and digital strategy are less developed, which could be a disadvantage in the growing e-commerce sector.

- Economic Sensitivity: Being a bulk seller, Costco might face challenges in economic downturns as consumers might reduce spending or switch to cheaper alternatives.

- Market Saturation: In its key markets, there is a risk of saturation, which could limit growth opportunities unless it successfully expands to new geographies or segments.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click through.

- This newsletter was brought to you thanks to our friends at Honeycomb Credit.

- I’m long AMZN.

- Nothing above is financial advice. DYOR, you filthy animal.