Hello and welcome to Alts Cafe

This is your weekly quick-fire analysis on all things Alts investing.

TLDR:

- Inflation slowed and rate hikes are paused for now.

- Canada, San Francisco, South Korea, and commercial real estate are all in trouble. But there’s some new investment coming to the Sun Belt.

- Binance continues to implode.

- SPACs are hot again.

Like these posts? Please give us a shout on your socials, we’d appreciate it.

Wyatt

Table of Contents

Macro View

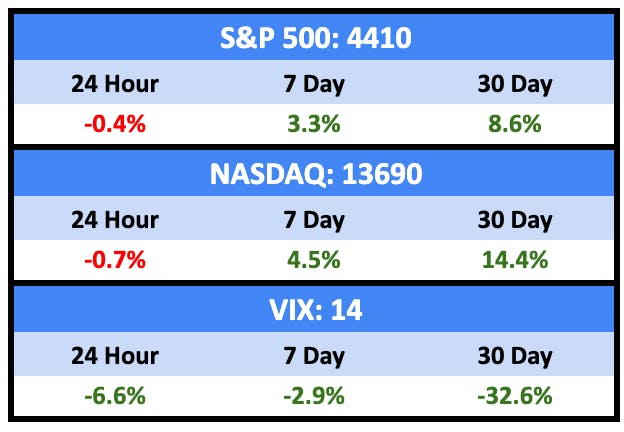

Both the S&P 500 and NASDAQ hit 14 month highs last week.

Bullish News

- US inflation slowed to 4.0%.

- The Fed is pausing rate hikes for now. Two more small hikes likely by the end of 2023.

- PE investors say 2024 will be better than 2023.

- China is unleashing a stimulus plan.

- US import prices fell in May, which helped keep inflation down.

- US retail sales unexpectedly rose in May by 0.3%.

Bearish News

- Defaults in the $1.4tn US junk loan market have climbed sharply this year. There were 18 debt defaults in the US loan market between January 1 and the end of May totalling $21bn — greater in number and total value than for the whole of 2021 and 2022 combined.

- The ECB hiked rates 25bps to 3.5%, the highest it’s been in 25 years.

- Both Australia and New Zealand are facing recessions.

- Just 34% of chief financial officers rated current economic conditions as good or very good, down from 40% in the first quarter.

What are we doing?

ALTS 1 fund news:

We’re still checking out an investment in the Deathcare space 👀

Real Estate

Bullish News

- A family office is creating a fund to help wealthy Brazilians invest in Sun Belt real estate.

Bearish News

- Canada’s real estate market is a mess.

- America’s hat has a mortgage extension time bomb to worry about.

- The US housing market is short more than 300,000 homes in price points middle-income buyers can afford.

- Wildfires in CA and hurricanes in FL have been getting a lot of attention, but watch out for tornados.

- Borrowing costs for commercial real estate have hit 7%.

- Six in seven CRE investors is bearish on the rest of 2023. Time to go long?

- All CRE may be in trouble — not just offices.

- South Korea’s real estate lending market could collapse.

- The owners of one of the biggest shopping centers in SF walked away after 20 years, in the face of declining sales, occupancy and foot traffic.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

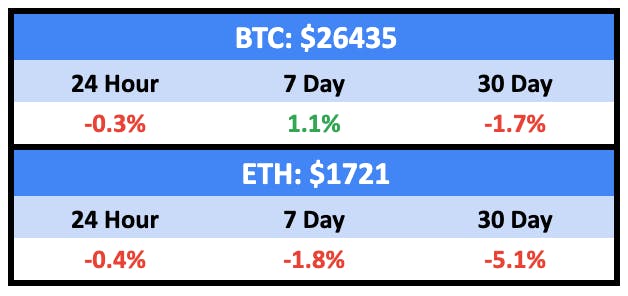

Pretty meh week for crypto as it digests lots of regulatory fallout.

Investors are holding their breath.

While NFTs (and possibly their owners) continue to self harm.

Bullish News

- Crypto ownership doubles in UK before new rules kick in.

- Bankrupt crypto exchange Bittrex was given the green light to allow customer withdrawals last week.

- Crypto investors are prioritising security over returns.

- BlackRock has filed for a bitcoin ETF. It’ll be custodied with Coinbase, which seems like a terrible idea.

Bearish News

- Nigeria is kicking Binance out. Will be more difficult for all those princes to get their money out now, presumably.

- Binance is being cut off from the US banking system.

- Coinbase is sad too.

- The SEC has added 50 altcoins worth perhaps $100 billion to its list of securities.

- Crypto platforms Delio and Haru Invest have suspended investor withdrawals.

- Noted memecoin enthusiast gets angry someone else is making money off a scam coin, suspends it.

- North Korean hackers stole over $100 million from Atomic Wallet users.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Startups

Bullish News

- SoftBank is firing more of its Vision Fund team; nature is healing.

- Visa is acquiring Brazilian fintech Pismo for around $1 billion.

- Aiming to skirt US crypto regulations, A16z is opening a London office.

- Keeping pace with AI startup valuations, Salesforce has doubled the size of its AI fund to $500 million.

- The EU could break up Google’s adtech biz in Europe, which would open the market for new entrants.

- More and more SPACs jump on the IPO train.

Bearish News

- CareRev is firing 30% of its staff.

- GrubHub is eliminating 400 jobs; around 15% of its staff. Didn’t know GrubHub was still a thing tbh.

- Meanwhile, Uber Eats is bailing on Italy and Israel.

- Even space tech companies are feeling the pinch.

- Tiger Capital missed its fundraise target by 55%.

- Desperate to be internationally relevant, Britain wants to be a global home for AI regulation.

- The creator economy never really materialised.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our very clever friends at CityVest. If you click on the Percent ad, we make a buck.

- We hold BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- We are investigating an opportunity in the Deathcare space for our fund, and will say more as soon as there’s something to share.